Dear Reader,

50-year Wall Street legend Marc Chaikin, has come to be known for one thing in recent years...

Predicting the big moves in the stock market, using what he calls, "the most powerful stock cycle indicator I've ever seen, based on more than 100 years of data."

And just days ago, Chaikin went public with details on: The exact month the next big stock market crash is most likely to begin.

Will Marc Chaikin be right yet again, in predicting the next big market move?

I would NOT bet against him. He used this same cycle indicator in 2018 when he said stocks would fall on live TV...

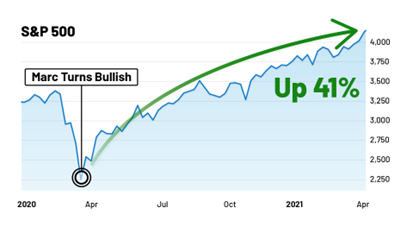

He used it in 2020 to help folks get back INTO stocks...

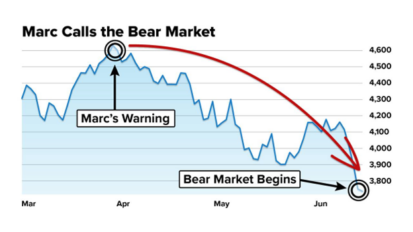

And in March of 2022 to predict a crash, when he wrote: "Millions of investors are about to be blindsided by a wave of stock crashes..."

And then again to predict huge bull markets in both 2023 and 2024...

And now, Marc Chaikin is using the exact same cycle indicator again to detail when he believes the next market crash will begin.

He says it's going to catch millions off-guard.

Which is why he recently produced a brand-new presentation detailing everything you need to know, including where to be invested now, and exactly when to the next crash is most likely to start.

Chaikin even reveals the name and symbol of one of his favorite investments to buy right now. To get the full story and access Chaikin's presentation for free on his website, click here...

Regards,

Vic Lederman

Editorial Director, Chaikin Analytics

3 Energy Stocks to Gain Exposure to the Carbon Capture Boom

Written by Leo Miller. Published 8/16/2025.

Key Points

- The carbon capture and sequestration (CCS) market is relatively small today, but analysts expect it to expand significantly over the coming years.

- CRC, OXY, and XOM are three stocks investing in CCS technology, allowing investors to gain exposure to this market.

- One firm projects a multi-trillion-dollar opportunity in the CCS market by 2050.

As groups seek to combat the significant rise in atmospheric carbon dioxide (CO₂) on Earth, the carbon capture and sequestration (CCS) market is set to become an increasingly large part of the economy. Fortune Business Insights values the global CCS market at approximately $4.5 billion in 2025.

By 2032, the research firm expects this figure to move to around $14.5 billion. That would be more than a tripling of the market in just seven years. It also equates to a strong compound annual growth rate (CAGR) of more than 18%.

Due to this, investors have a significant opportunity to reap the rewards of this expanding market. A key avenue to potentially achieve this is through investments in publicly traded stocks that are building out their CCS capabilities. Below, we’ll dive into three stocks that are doing just that, offering investors a way to gain exposure to the CCS market.

California Resources Eyes Hyperscale CCS Deals in Elk Hills

First up is California Resources (NYSE: CRC). The energy company primarily generates revenue by producing and selling oil and natural gas. However, the firm also has a first-of-its-kind project in California underway. Through its subsidiary Carbon TerraVault Holdings (CTV), the firm is pursuing the state’s first CCS project in Elk Hills, CA.

The project is also leading the nation. It is the first project in the United States that the Environmental Protection Agency has authorized to construct Class VI wells.

This is a significant milestone, as Class VI wells must meet strict requirements that show they can contain CO₂ underground for thousands of years. This demonstrates how California Resources is a CCS leader in the United States. The company expects to have the wells completed near the end of 2025 and to be able to start injecting CO₂ in early 2026.

Thus, this is not a far-flung opportunity for California Resources; CCS could become a revenue source soon. Adding to the intrigue is that California Resources hopes to announce a power generation and CCS deal with an artificial intelligence (AI) hyperscaler in 2025. This could be a significant positive catalyst for shares.

Buffett-Backed OXY Looks to Get STRATOS Plant Online in 2025

Next up is Occidental Petroleum (NYSE: OXY). Warren Buffett’s Berkshire Hathaway owns a significant stake in OXY, valued at approximately $13 billion as of March 31. Occidental is building a direct air capture (DAC) plant through its STRATOS project. The facility will pull CO₂ from the air and then store it underground. Importantly, STRATOS has also received Class VI well permits, and the site is on track to start capturing CO₂ in 2025.

When OXY captures and stores CO₂, it will receive carbon dioxide removal (CDR) credits. Other companies looking to reduce their CO₂ emissions artificially can then buy these credits. Near-term, the revenues STRATOS could bring to Occidental might not be needle-moving.

OXY generated more than $27 billion in sales over the last 12 months. However, the firm’s DAC strategy could become meaningful in the long term as it looks to build 100 DAC plants by 2035.

XOM Gets Carbon Capture Operations Underway, Sees $4 Trillion CCS Market

Last up is the most valuable energy stock in the United States, ExxonMobil (NYSE: XOM). Notably, Exxon’s CCS business is already operational.

The company is capturing and storing carbon for a third party using its CO₂ transport and storage network that Exxon calls "the world’s only large-scale system."

Exxon doesn’t say how much revenue it is generating from the project.

However, the firm previously stated that it sees the CCS market growing to a massive $4 trillion by 2050.

This highlights the massive potential opportunity for all three of these firms.

CRC, OXY, and XOM: Avenues for Carbon Capture Exposure

These three companies are making big moves to enter the CCS market. Thus, these names can expose investors to this market, which analysts expect to grow significantly over the coming years.

Still, it is essential to note that no names represent CCS pure plays. They all have other significant parts of their business that will likely exert extensive influence on the movement in their stock prices for years to come.

However, these businesses could significantly supplement their overall growth through CCS investments. This adds upside potential to these names in the long term, especially if their CCS growth manages to outpace that of the general CCS market.

This message is a sponsored message from Chaikin Analytics, a third-party advertiser of DividendStocks.com and MarketBeat.

This ad is sent on behalf of Chaikin Analytics, 201 King Of Prussia Rd., Suite 650, Radnor, PA 19087. If you would like to optout from receiving offers from Chaikin Analytics please click here.

If you have questions about your newsletter, feel free to contact our U.S. based support team at contact@marketbeat.com.

If you no longer wish to receive email from DividendStocks.com, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC.

345 N Reid Pl., Suite 620, Sioux Falls, S.D. 57103-7078. U.S.A..

0 Response to "The day and month stocks are most likely to crash next"

Post a Comment