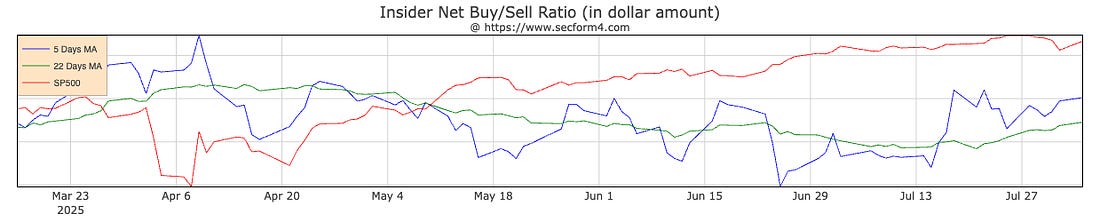

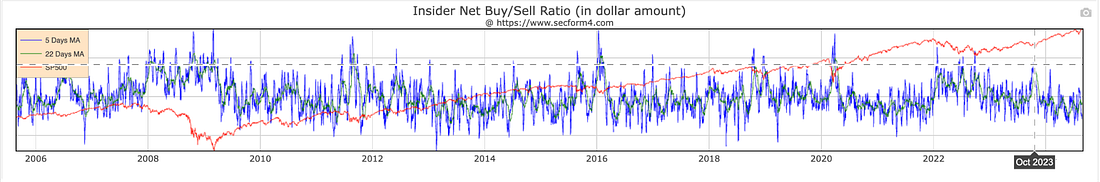

I want to say hello to many new subscribers and readers. I was very fortunate to join The Compound with Josh Brown yesterday. And some new faces have joined us. If you’re new… welcome. This is the Capital Wave Report - the market publication of The Money Printer Substack. Me and the Money Printer - which is a bit more off the wall - comes out later in the day… today’s subject will be… the No. 1 Financial Headline of 2025. But… this letter is designed to sniff out liquidity and credit events, track insider buying activity, and avoid sharp downturns. It comes out every morning around 8:15. Think of it as a Morning Surf report providing up-to-the-minute conditions… This letter has allowed us to stay safely ahead of the things most people in the media can’t see… and we’ve successfully stayed out in front of the COVID crash, the GILT Crisis, the SVB Crisis, the Nikkei crash… and the trade slump in April. What we’re looking for… is this pattern. It can save and make you a lot of money… As I said yesterday, the story of the world is told through the markets… Good morning: Last Wednesday, I led an education session on Tesla stock trading, walking through the mathematics behind the Fed-driven selloff. All of a sudden, the Russell 2000 took a serious bath - reminding us that it only takes one simple policy statement to unwind countless positions and send retail and institutions into a tizzy. Selling pressure in the Russell 2000 accelerated - with lots of stocks dropping more than 5% in a very short period (measured over a few days with specific coefficients) - and a lack of buying pressure to match… implying little rotation at the time. Our Russell 2000 signal turned Red on Thursday morning. And we remain under pressure despite yesterday’s little pop. The Russell has since pushed back to 220 and will now look to retest its 20-day EMA. (It’s technically Yellow, but the MFI is just 41.5). Meanwhile, the S&P 500 is dancing back above its 20-day EMA… all while insider buying-to-selling in total dollars didn’t breakout. The blue line below - the most important in all of finance - is the five-day moving average of buying to selling in dollars. The higher it goes, the more bullish it is. You’ll notice that it peaked out around April 8, right when President Trump called off Liberation Day. This had followed the previous week’s decision by the Fed to reduce its Quantitative Tightening pace from $25 billion per month to $5 billion. At the same time, it continued to conduct a large number of rollovers on existing liabilities. Anyway… the insiders bought the bottom… just like they have at the bottom of every major crisis dating back to 2008. See those spikes? They all aligned with a massive policy accommodation by a central bank to stabilize the system… What’s The Outlook Here?The Federal Reserve is tilting dovish after soft U.S. jobs data. Rate‑cut odds for September have surged toward 90%, setting the stage for short-term stability in equities and bonds over the next few weeks... I feel as though this market could simply go sideways until we get meaningful data in the coming weeks. All a lead-up to Jackson Hole event... However, the narrative’s starting to get bearish again. I’m not doing anything until I see some direction here on our signals. I wouldn’t short the S&P 500 until… The FNGD breaks above its 20-day and 50-day moving average… just saying… That’s where it’s clear that deleveraging is happening… and that’s where the worst of it comes… and fast… I know a lot of people watch the VIX. That said, Evercore has now warned of a 7% to 15% correction. They cited… wait for it… stretched VALUATIONS… This always makes me snicker. That sort of drawdown would likely come from a drain of liquidity from the system, deleveraging, or interest rates rising and impacting collateral quality. And a 15% move down will likely be met with some sort of accommodative policy… That means… BRRRRRRRRR. I don’t pay attention to valuations at the S&P 500 level very much anymore… I just pay attention to how much freaking capital is sloshing around… and the Repo market… and whether or not some bank in Japan is about to blow up… any day now. And what incentives are created by a financial system where:

That’s where we are. It’s Not the Economy… It’s LiquidityMorgan Stanley and Deutsche Bank have made similar bearish warnings… suggesting that the economic picture is looking worse. Therefore, the stock market will go down because, apparently, we still operate in a world where people genuinely believe that the stock market is forward-looking on the economy. But, as I’ve explained, the markets are front-running liquidity conditions and expectations… If we go back to COVID, we have to recall the comedy of Mo Amer.  If everyone is home… and the economy is closed… why was the stock market going up? he questioned. The man turned my 17 years of academic focus, trying to understand how the system works… and turned it into a hilarious five-minute bit. Remember, if the outcomes are money printing and accommodation (right before the bottom completely falls out), then that’s what the system is DESIGNED TO DO. As I’ve said… I have a framework that shapes my worldview. It combines and draws upon the work of many terrific academics and market pundits who think a lot differently. And I put all of that together into a presentation I did a few months ago… It’s called “The Wave Speech.” It’s about an hour long.  It doesn’t sell anything. It doesn’t even pitch this letter… It’s just a simple story that deviates from the traditional CFA or MBA narrative… and trust me, I’ve read all the CFA books and I took all the MBA finance classes... Nothing against them… I just think that there are a lot of powerful tools that aren’t incorporated in those educations. My presentation just shows you how we got here, and how my love languages transformed into Liquidity, Momentum, Insider Buying, and Policy Changes. And I promise you… Once you see what I see… (and there are a lot of other wild things that you can’t unsee, like deviation band reversions), you’ll see markets differently… So, take some time and check it out. Because it shapes what this letter is all about… Speaking of which… let’s get to the market preview…... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "The Narrative Shift Begins..."

Post a Comment