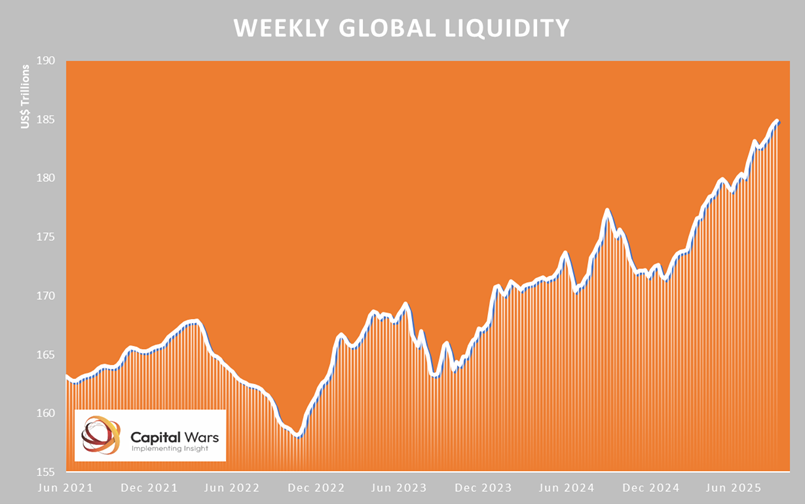

The Rally Isn’t About Rates. It's About Liquidity and Leverage...Another day, another journalist doesn't understand why markets are near all-time highs...Dear Fellow Traveler, Bloomberg just published 700 words about unprofitable tech stocks rallying 22% since July, and they think it’s about interest rates. Look at this liquidity chart. LOOK AT IT. Global liquidity is at $186 trillion. New all-time highs. That vertical line on the right? That’s not rate cuts. That’s coordinated global money printing. Bloomberg then says the 2021 rally happened because of “rock-bottom interest rates.” Nope… The 2021 rally happened because global liquidity expanded after central banks dropped trillions of dollars from the sky…. They printed a ton of money… even while the economy shut down… and the markets just went parabolic… It took a comedian to tell us what our financial media doesn’t understand…  The biggest monetary expansion in history. Rates were already at zero in 2020 - what changed was the printing. Now liquidity is expanding again. From $175 trillion to $186 trillion. And surprise - unprofitable tech is rallying again. “Experts” Can’t Read ChartsTed Mortonson from Baird calls this “speculative over-exuberance because the expected rate-cut cycle is leading to animal spirits.” No, Ted. Animal spirits are revived when there’s $15 trillion more liquidity sloshing around than last year. The rate cuts are the excuse, not the cause. Anthony Saglimbene thinks “AI is a unique secular tailwind.” The primary tailwind is liquidity going vertical. When liquidity expands, the junkiest assets rally hardest. Always have, always will. The Real StoryUnprofitable tech doesn’t rally on rate expectations. It rallies when:

That chart shows liquidity going parabolic. Everything else is narrative. Now, let’s get to the morning recap…... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "The Rally Isn’t About Rates. It's About Liquidity and Leverage..."

Post a Comment