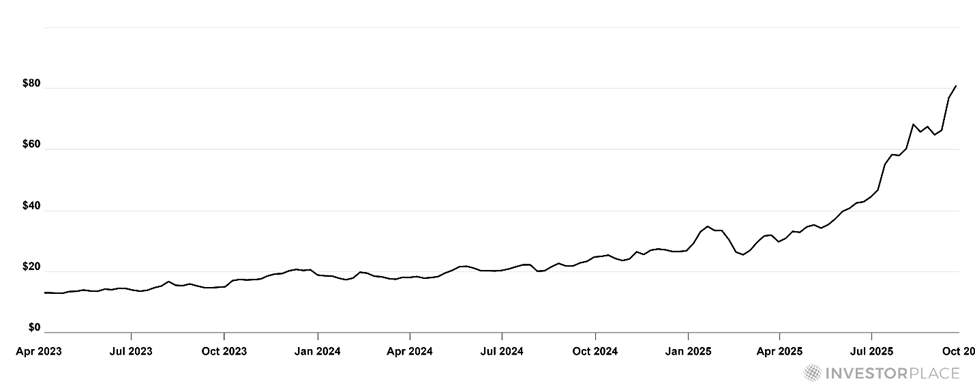

The $100 billion market warning… more calls that this is like 1998… how to ride a melt-up… take a look at this massive AI winner… small-caps have joined the party VIEW IN BROWSER $100 billion. That’s the value of the entire annual economic output of a handful of countries such as Kenya, Ukraine, Belarus, and Indonesia. It’s also what Nvidia just pledged to invest in OpenAI to build AI datacenters. Yesterday, Nvidia CEO Jensen Huang called it “the biggest AI infrastructure project in history.” Let’s go to our technology expert Luke Lango for more context. From Luke’s Daily Notes in Innovation Investor: Nvidia supplies the chips and capital, while OpenAI builds and trains the models. It’s effectively a “Manhattan Project for AI.” For context, $100 billion makes this the largest AI deal ever announced. Ten gigawatts of compute would exceed the combined AI capacity of Microsoft (MSFT), Amazon (AMZN), and Google. This is exponential. The logic is simple: Nvidia has the best hardware; OpenAI has the best software. Together, they anchor America’s AI dominance. The winners extend beyond them: $100 billion will flow into chips, cooling, networking, switches, and power — lifting the entire AI supply chain. So, this is hugely bullish for AI, right? Yes…and no. I’m on a Slack Channel with a handful of InvestorPlace’s leading analysts and market researchers I want to share with you the conversation that took place yesterday in the wake of this headline. I’ll leave out the names since none of these individuals realized I would be featuring their unedited thoughts today. Analyst 1: This is huge news for NVDA. Analyst 2: As the internet bubble peaked, companies started announcing big deals with each other. No cash changed hands, it was usually ad swaps. But each booked the ads as revenue and made their financials look better before adjustments. Is this similar? NVDA may not give OpenAI $100 billion in cash. That could be the MSRP of what they deliver. This isn't bad news but is the market starting to get frothy? Seeing other big deals where the cash is less than the headline could be a sign to watch for. Analyst 3: I had the same read. There are just constant money schemes every week… Feels like 2021, but instead of people buying JPEGs, it’s public and private institutions opening the floodgates… Analyst 2: Feels like 1998, with companies working together to announce big numbers that individual investors believe are true. NVDA has a 50%+ net margin, 70% gross margin. If this is $100b in chips, it costs them $0.30 on the dollar. If it's help with construction, they spend $1 in support to get orders for more than $1. It's like a retailer paying slotting fees at grocery stores. Yes, the Nvidia/OpenAI news is bullish. But it also may signal where we are in this cycle – perhaps the first clear glimpse of the ultimate market top, finally visible like a snowy mountain peak emerging from the clouds. Luke spoke to this in yesterday’s Daily Notes: Bubble signs are emerging… But bubbles can run long. The trick isn’t spotting the bubble, it’s spotting the pop. Right now, we see bubble signals, not pop signals. We believe this AI surge still has at least 12 months of explosive runway. That’s 12 months of opportunity, momentum, and gains across red-hot AI stocks. Stay long. Stay bullish. Stay ready. | Recommended Link | | | | Tim Cook was spotted in Kentucky with this little-known company’s CEO in what was deemed a scene “worth marveling over.” UBS also caught on and just upgraded this “overlooked AI play” to BUY. But here’s what matters most: If you get in before September 28th, you’ll collect a cash payout the very next day. Eric Fry says it’s time to sell Nvidia and bet on THIS stock instead. Since his July 23rd call, it’s delivered nearly 20X Nvidia’s gains. Get the ticker symbol and secure your Sep 28th payout before time runs out. Watch Eric’s time-sensitive video now. |  | | If we’re in the final melt-up, blow-off top, then where should we be looking for the biggest gains? Surprising no one, AI. Of course, this gives us a wide opportunity set. Let’s narrow down for one illustration… What do you get when you combine AI, rising geopolitical tension, and cutting-edge robotics? Military drones, massive sector growth, and enormous investment gains. As to that sector growth, according to The Business Research Company, the global market for defense drones was roughly $16 billion in 2024 and is projected to grow toward $23 billion by 2029. Some AI-focused forecasts put it closer to $50 billion by 2032 as autonomous capabilities expand. Leading drone stocks are already exploding in anticipation. Take Kratos Defense & Security Solutions (KTOS). Luke recommended KTOS to his Breakout Trader subscribers in May of 2023. As I write Tuesday morning, they’re up 435%.

But even after this explosive run-up, the KTOS trade could have plenty of juice thanks to an unusual phenomenon playing out in today’s market… Back to Luke: Something exceptionally rare is happening in D.C.; something that has only happened a few times before in our nation’s history… The U.S. government is buying equity stakes – in America’s AI supply chain… This is not business as usual. It’s industrial policy by way of Wall Street. And it could create massive upside opportunities for investors able to identify who’s next… After explaining more about what’s happening, Luke highlights the tie-in to KTOS. But it isn’t the only defense contractor that Luke believes the government might be eyeing: The DoD's Replicator initiative aims to field “thousands” of autonomous systems. Kratos (KTOS) is front-running with its Valkyrie combat drone. AeroVironment (AVAV) is delivering miniature munition Switchblades at scale. Either could see structured deals to accelerate production. Now, while military drones represent one striking application of intelligent machines, they’re just the tip of a much larger robotics revolution unfolding across a variety of industries. And if we’ve now begun the final melt-up, you want exposure to this corner of the market as it’s likely to bring some of the biggest moves. On that note, Luke – along with Louis Navellier and Eric Fry – have gone on record, making a huge prediction… The next trillion-dollar winner will be in Physical AI: the fusion of robotics and artificial intelligence. Here are their respective quick takes: From Louis: We’re at the beginning of an innovation revolution built on robotics, AI-powered factories, autonomous logistics and more. It’s arguably the most transformational thing to happen to our society since the Industrial Revolution. From Eric: Thanks to AI, robots are now stepping off the screen and into the real world – and taking over physical tasks once reserved for humans. This shift will reshape entire industries… It’s blindingly obvious that the world of the future will look little like the world today. From Luke: We’re in the middle of the most profound platform shift in human economic history. All the growth in today’s economy is happening inside the AI ecosystem. Everything else is just noise. Given the enormous opportunity in physical AI/robotics stocks, Luke, Louis, and Eric created a collaborative investment research package highlighting how investors should position their portfolios today. This Day Zero Portfolio holds the seven stocks they’ve identified as best-of-breed in AI-powered robotics. It provides targeted exposure to the next wave of AI exponential progress. I want to cover more ground in today’s Digest, but you can learn more about the portfolio right here. I’ve seen the holdings and there’s a lot of firepower. Here’s the collective bottom line of our experts: If Physical AI follows the same trajectory as cars (self-driving vehicles), PCs (AI PCs), and smartphones (personal assistants) – and we believe it will – we could be looking at $20 trillion or more in value creation. This isn’t just another boom. It’s a multiplier. That’s why we want to encourage you to consider our latest seven picks in robotics, if you haven’t yet. Finally, here’s one more reason to remain in today’s market despite the signs of froth Small caps have finally joined the party. And if history is right, that’s a ringing endorsement of additional gains to come. Back to Luke: Small caps are hot – and that is bullish. The Russell 2000 just hit a record close for the first time since 2021. Here are all 11 historical precedents going back to 1980 for what happens to the S&P 500 in the year after the Russell 2000 hits a record close for the first time in over a year. As you can see, the S&P 500 is higher a year later 10/11 times, with an overall average return of 13% and an average return in up years of 15%.

History says that this small-cap breakout is rarely a fluke. When they finally wake up after a long slumber, it usually signals that market breadth is expanding, and risk appetite is broadening. Translation – more gas in the tank for this bull. So, this small-cap price action isn’t just a technical milestone within this bull, it’s a green light for the overall market – for now. Be wise about how you invest… expect heightened volatility along the way… and remember what history suggests directly follows the boom… But if history rhymes, the next leg higher may have just begun. We’ll give Luke today’s send-off: We’re seeing bubble-like behavior, sure — but no signs of a pop yet. And until those pop signals appear, the boom rolls on. The Nvidia + OpenAI “Manhattan Project for AI” is the biggest deal in the industry’s history and proof that this AI Boom is only accelerating. The money, the momentum, and the opportunity are all still in front of us. That’s why we’re staying locked, loaded, and bullish on AI stocks. Have a good evening, Jeff Remsburg |

0 Response to "What the Nvidia/OpenAI Deal Really Means"

Post a Comment