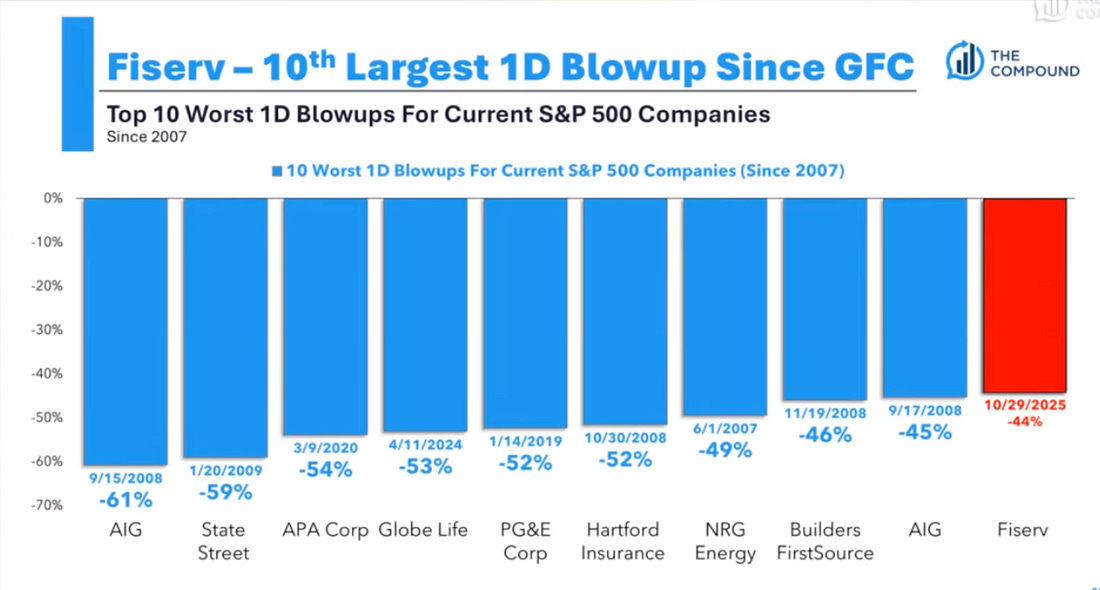

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. What Mamdani's Win Means... And Things I Think I ThinkWith more than 50% of the votes so far, Zohran Mamdani takes power in New York.Dear Fellow Traveler: Zohran Mamdani’s victory as NYC mayor tells us nothing about socialism’s rise and everything about my advancing age. That’s my hot take… But since his election sets the tone for Wall Street over the next four years, I can’t ignore it entirely. Yesterday, at the Compound, Josh Brown had listed his speaker name as “Comrade Josh,” an obvious nod to the socialist’s ascension to Gracie Mansion. A few joked that the city was now the People’s Republic of New York. That moniker recalls the People’s Republic of Evanston, a nickname moderates, libertarians, and even Democrats use to describe Northwestern University's home. As I’ve said - time and time again - the roots of today’s society… a media that is hyper political and inept… a society embracing unproven candidates with wide-eyed illiberal tendencies… and irrational behavior that demonizes independent thought were all hallmarks of my time in Evanston in the early 2000s. A number of the “involved” people I went to school with have grown up and are in positions of power. It’s not shocking to see the endgame of my illiberal college years expand to the real world. Here’s what everyone is missing… New York’s affordability crisis isn’t a failure of capitalism or a problem that uber-progressive policies can solve. It’s the predictable result of the city’s role as a financial chokepoint for Federal Reserve money printing. Until you understand that, everything else is just political theater. Which is why I worry about Mamdani the way I worry about the sun coming up… I don’t. What are his plans and probable outcomes? Mamdani will implement his affordability agenda and discover that universal childcare and fare-free buses don’t address housing costs driven by asset inflation. Will it work? Is it even feasible? I don’t know… I don’t live there anymore… If it doesn’t work, by year three, he’ll likely either blame “sabotage” by financial interests or quietly abandon the most expensive promises. The productive class will continue migrating to lower-tax states, and the city’s budget crisis will deepen. The real winner here? JPMorgan and the other primary dealers, who will keep surfing the liquidity waves regardless of who sits in Gracie Mansion. Again… I don’t live there, so I didn’t vote… But the reason why these people voted as they did does catch my attention… The reality is that so many of the things that his voters used to justify his ascension are misguided. They aren’t rooted in the failures of the free market… Is New York really overpriced and unfair because of capitalism? Depends on the reader’s interpretation of capitalism. I’ve argued that capitalism died in 2008… so Mamdani’s supporters don’t even know what has hit them… They don’t study economics. But most economists today don’t even understand the impact of shadow markets on asset prices. The city is fundamentally overpriced because it serves as the financial chokepoint for capital injections from a centralized bank in Washington. Just like… I don’t know… Washington, Brussels, London, Tokyo, and so many others like it… You can view that impact on the QE side (direct operations) or the never-ending expansion of liquidity and leverage that has embodied the post-COVID world. Doesn’t matter. Loose policies fuel inflation in asset and goods prices. CPI might show inflation at 3%, but the Chapwood Index (which tracks goods and services in New York City) showed double-digit price growth from 2017 to 2024… New York City is the primary beneficiary (and victim) of the modern Cantillon Effect, in which money is printed, dealers receive it first, and it is then leveraged and flows into real assets like real estate, land, and equities. If you’re not part of that inner circle, you’re the one negatively impacted by the ongoing increase in living costs. New York City is notoriously bureaucratic. Opening a small restaurant often requires more than 30 permits… You need permits from the Department of Health, Buildings, Fire, Consumer Affairs, Sanitation, and more. Each of them has its own inspections and fees. Many restaurateurs spend a year navigating red tape before serving a single customer. It engages in heavy centralized planning… Every lane, bike path, and café barrier is dictated by the Department of Transportation and City Planning… the Landmarks Preservation Commission can veto renovations, window replacements, or even paint colors for thousands of buildings… It’s cartoonish bureaucracy… An almost parody of itself… I’d argue the most capitalistic thing about the city is how fast you can access cocaine. The drug trade is one of the few things that doesn’t seem to have a barrier to entry there… It’s far easier to show up and deal drugs in Manhattan than to operate a taxi. The focus has been on the goal of taxing billionaires to afford the promises… Here’s the thing… if I’m a billionaire in Manhattan…? I’m not leaving… and they’re already showing that they were willing to likely spend more against Mamdani in the election cycle than what he might have taxed them… If I’m able to take part in the modern financial apparatus that enriches me just for existing (and buying even more expensive real estate), why would I leave? The Fed is going to keep pumping money through this system. A 2% tax increase doesn’t do much to me if I’m generating massive gains off the repo markets and the Fed is always willing to backstop me. That’s the punchline most voters miss… the real subsidy lives upstream, not in City Hall. Why go to Miami? Manhattan IS the Mecca of Moral Hazard. The perception is that Miami is where the reckless Cowboys operate… But in Manhattan? They wear suits and go to charity events at museums… How swanky!!! The tax issue, however, isn’t really about the Billionaires. It’s the brain-drain at a very specific income level… The politically independent… worker bees. The wealthier people who actually PAY taxes… New York is one of the most heavily taxed cities in the world. If you make $1 million in New York City, you’re paying 42% in city, state, and Federal income taxes… I’m not even including the 10% sales tax, the massive property taxes, and all the other fees that this city extracts from its people… That doesn’t include healthcare, rent, etc That’s just off the bat (gross)… then adjusted through whatever mechanisms you have to protect capital. Now… I know… $580,000 in take-home pay is a lot of money. But in Miami, that take-home pay rises to $680,000 with a big drop in cost of living… And that’s the group that will see the squeeze higher in the coming years... I always argue something simple about prime working years… And this is what many people don’t understand. If you tax someone at 50%, which is what Mamdani’s increased taxes will do mathematically to more people… (I wrote an entire book about all this…) Add it all up… and you’re taxing a full one out of every two years of their lives. Taking one year of productivity and saying - “But you can keep next year’s…” I know it’s hard for some people to feel bad for a person making $1 million… But that’s where the tax money is… That’s who will get squeezed… And that’s who will ultimately leave… the ascending group in their prime years… making somewhere between $400,000 and $1.2 million per year… That said… the real issue remains the cost of living… Which isn’t caused by “GREED” so much as it is economic policy not even set there… Everyone in that town keeps barking that it’s a left-or-right issue, causing all the pain. LOOK UP… THE MONEY HELICOPTERS ARE DROPPING CASH INTO 383 Madison Avenue (home of JPMorgan)… Until you fix the U.S. currency and recognize the real source of asset appreciation and rising food costs, nothing changes. Just more decay and louder proclamations. I don’t plan to bring this up again unless somebody starts nagging me that I “have to care.” I’ve learned not to worry about things I can’t control. Yep… I’m old enough to have seen this movie before. The ending never changes. What else do I think? Thing I Think No. 2: Chinatown Was Good… But SlowIf you’ve followed, I’m watching a movie I’ve never seen before… each night of November… Then I’m writing a very short review in the form of a Haiku. Last Night’s Film? Chinatown My review… She “kissed” her own dad? Tonight’s Film is… Unforgiven Thing I Think No. 3: It’s What You Think It Is…I read across various political platforms to get a sense of where things lie… Well, I wasn't too shocked to learn that the recent U.S. bailout efforts in Argentina are benefiting a very specific group of people… Hedge funds… Can I tell you what I think? I’m soooo… sooo… shocked!!! Thing I Think No. 4: Wow… This is SeriousI yanked this chart off The Compound from yesterday’s broadcast… This is the worst one-day blowup for an S&P 500 company since 2007… Naturally, many of these implosions occurred during the 2008 Financial Crisis… Housing… insurance… banking… Globe Life was 2024… PG&E’s fire chaos in 2019… But here’s Fiserv… dropping 44% in a day… last Tuesday. What happened? Three things… Fiserv piled on hidden fees and forced customers into Clover replacements… Growth was overstated and unsustainable… And then clients revolted… This triggered a major credibility crisis. This is exactly what NOT to do… Oh well.. stay long Toast (TOST), I guess… Final Thing, I Think: Momentum is ToughWe’re back in Yellow territory on the S&P 500… The Fed’s doing what it needs to do to support regional banks… We’re in a low-volume environment, and we’re squeezing higher—as markets look for clarity and hope we’re just clearing the pipes… As I said… I wouldn’t be surprised if there were a lot of dip-buying from algorithms, since we weren't below the 50-day moving average… That’s been the case today… This market is ticking up a little today… And that’s the cuts that impact the shorts using options right now… If you missed my analysis on Michael Burry’s battle from last night… check this out. But see this morning’s analysis too… Shorting is incredibly hard… and betting against momentum is hard… The issue is that policy accommodation is the norm… Anyone who says that the Fed’s actions this week aren’t “Accomodative” to risk assets is stuck in the past… We’ll figure it out… Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "What Mamdani's Win Means... And Things I Think I Think"

Post a Comment