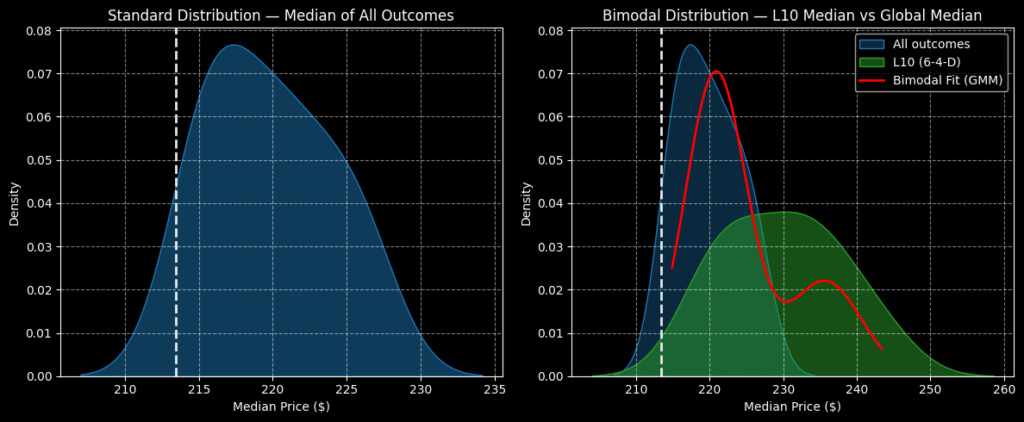

Today's editorial pick for you Advanced Micro (AMD) Stock Options Have Signaled a Decisively Bullish PathPosted On Dec 23, 2025 by Joshua Enomoto At the heart of any options-focused trade is uncertainty — specifically, the pursuit to whittle as much uncertainty down as possible. With Advanced Micro Devices (NASDAQ:AMD) scheduled to release its next earnings report in early February, the options market for the nearest expiration date is abuzz with activity. Basically, the latest orders in the derivatives market are signaling massive kinesis for AMD stock. Table of ContentsAccording to TipRanks' Expected Earnings Move, traders are anticipating a swing of 16.41% in either direction. Nominally, this translates to a $35.03 move relative to the current anchor price of $213.43, Friday's close. While this is good intel, the dispersion is very wide. In order to be a consistently successful options trader, you must have some way of narrowing down this vast range of outcomes. Generally, the first instinct might be to engage in an advanced options strategy such as a long iron condor. Under this approach, you would essentially combine two vertical spreads — a bullish spread and a bearish spread — to establish a profitability endzone in either direction. The idea is that you don't know where AMD stock may land, but you have conviction that the move is going to be strong. Because various expected move calculators are signaling for significant kinesis, you feel justified in paying a double premium to "attack" both a bull and bear profit zone. Unfortunately, because the market is anticipating greater-than-usual movement, the double premiums tied to a long iron condor strategy is likely to be expensive. I would argue that a more prudent approach is to narrow down the possibilities of where AMD stock may end up — and just consider buying one vertical spread instead of two. Whittling Down the Possible Outcomes for AMD StockAs I mentioned earlier, the options market is structured as a multiverse. If you look at any options chain, you'll notice that traders are literally pricing in the probability of alternate versions of reality. And while it's uncertain which version of reality will become the canonical timeline (so to speak), the heightened demand for specific strike prices tells us something. Because the risk of the proposed reality could come true, it's worth either speculating on it or hedging against it. Now, if you were purely depending on expected move calculators to trade AMD stock — especially around its earnings date — you're looking at a tough battle. Again, with such a wide expected dispersion, you don't know where AMD may end up. At this point, you're facing the prospect of either a big move higher or a big move lower. Part of the challenge is that expected move calculators are highly dependent on implied volatility (IV), which is a residual value from actual order flows that denote kinetic robustness. Colloquially, IV is like the "whoosh" that you hear from a passing car relative to where you are standing. Based on the crack of the wind and its duration, you can infer the velocity of the vehicle at that moment in time. What you cannot do is infer the end destination that the driver is heading toward. Maybe he's late to work. Maybe she's rushing to the hospital. Without greater context, it's impossible to make even an educated guess. Let's assume, though, that we did have additional, important context. If, for instance, we knew the time of day, in what direction the driver was heading and his usual habits, we can make reasonable inferences. At the very least, we can narrow down likely candidates — and just as importantly, eliminate unlikely ones. Leveraging Pattern Recognition to Trade Advanced MicroUltimately, what I'm proposing is to leverage pattern recognition to trade AMD stock. While this concept sounds reasonable and logical, one major problem exists: AMD, like any other security, represents a singular journey across time. How then should we go about finding these patterns? Let's consider an analogy. When you're in a relationship with someone, you obviously experience your partner as a singular entity. However, you also know what makes your partner tick — along with the triggers that elicit such acute behaviors. These behaviors are not a surprise to you because you have observed the underlying patterns for many years. Stocks are the same way. They have certain behavioral tendencies, and specific triggers can elicit certain types of exuberant price action. However, to identify these traits, we must run the security through multiple trials. If you took a single 10-week strand of AMD stock, the return during this period won't tell us much about the probability of performance of the other weeks in the dataset. However, if we stacked hundreds of rolling 10-week strands of AMD price data in a fixed-time distribution, the most frequent performance characteristics will result in a bulge in probability density.  This bulge represents risk geometry — the transitions not only of bulls getting more bullish but of bulls eventually becoming bearish. We want to know not just where AMD stock may end up over a fixed period of time but where buyers are most tempted to become sellers. Ordinarily, a 10-week distribution would see AMD stock land between $205 and $235, assuming an anchor price of $213.43, Friday's close. Further, price clustering would likely be predominant at $217, indicating a slight bullish bias. However, the current quantitative setup is a 6-4-D sequence; that is, in the past 10 weeks, AMD stock printed six up weeks but with an overall downward slope. This unusual setup typically yields a forward 10-week distribution that would likely land between $204 and $260. Moreover, price clustering would likely be predominant at around $230. A Bold Idea for the Aggressive SpeculatorWith AMD stock likely to converge around $230 over the next 10 weeks, a vertical spread targeting this price point may seem like the logical move. However, for the data-driven speculator, I'm a bigger fan of the 230/240 bull call spread expiring Feb. 20, 2026.  It's not just about the bigger reward, although that, of course, plays into the whole narrative. If AMD stock rises through the second-leg strike at expiration, the maximum payout would be over 217%. That's not something you can ignore. However, it's the probability decay that's really intriguing here. Between $230 and $240, probability density "only" declines by about 35.48%. From $240 to $250, the density drops by 83.27%, which is an exponential drop. By targeting $240, we can maximize our profit potential while also minimizing our opportunity cost. From a risk-reward standpoint, you really couldn't ask for a better setup. This is a PAID ADVERTISEMENT provided to the subscribers of StockEarnings Free Newsletter. Although we have sent you this email, StockEarnings does not specifically endorse this product nor is it responsible for the content of this advertisement. Furthermore, we make no guarantee or warranty about what is advertised above. Your privacy is very important to us, if you wish to be excluded from future notices, do not reply to this message. Instead, please click Unsubscribe. StockEarnings, Inc |

Subscribe to:

Post Comments (Atom)

0 Response to "Start forecasting for better outcomes with A.I"

Post a Comment