Managing Editor’s Note: Jeff Brown believes we’re approaching a significant inflection point for artificial intelligence… AI systems are about to get faster, smarter, and better beyond anything we’ve seen so far. And he says now is the time to position yourself ahead of the prosperity boom that will follow this AI advancement. Jeff is sitting down tonight to discuss the oncoming economic boom… the future of artificial intelligence… and how you can play it. The event is kicking off at 8 p.m. ET. You can go here to automatically add your name to the guest list. The Top Commodity Trade for 2026 By Larry Benedict, editor, Trading With Larry Benedict When it comes to commodities, metals stole the show in 2025. Gold prices rallied to record highs and topped over $4,300 per ounce in October. They remain near that all-time high. Silver is setting records as well. Silver prices jumped over the $65 per ounce level this week, and they are surging past the prior record highs seen in 1980 and 2011. These are major records in the making. Copper is also moving to all-time highs after breaking above $11,000 per tonne in November. That level has been tested several times since 2021 and is now being broken to the upside. Now we’re watching to see if there’s more in store for the commodity trade. But just like the stock market, you should be on the lookout for signs of rotating leadership. I believe another major commodity uptrend is in the making, and the opportunity to add a position could be right now… | TONIGHT, December 18, at 8 p.m. ET:

America Unleashed 2026

Five Years of Economic Growth in the Next 12 Months Jeff Brown believes a new, much more powerful AI – dubbed the "Holy Grail" by insiders – will make ChatGPT obsolete and trigger an economic "big bang" in 2026. Some are predicting 20% to 30% GDP growth (around 10 times the typical growth rate). When this happened before on a smaller scale, individual stocks soared 1,000%-plus. Tonight, December 18, at 8 p.m. ET, Jeff's sharing the details. Just for attending, you'll get the name of one of his top picks. Register with one click here >>>

(When you click the link, your email address will automatically be added to Jeff's guest list)

Two BIG AI Events Set to Rock the Markets Early in 2026. The Oxford Club team is calling an “All-Hands” meeting on December 22 at 1 p.m. ET to prepare you for market-altering AI news coming out of the White House. Reserve your spot here today >>>

| The Energy to Power Everything Multiple catalysts are converging at the same time to boost natural gas demand and prices. Natural gas has long been sought as a “bridge fuel” in the transition to cleaner energy. Natural gas carbon emissions are about 50% less than coal, and gas is a reliable baseload fuel. (That means it can power the constant, minimum electricity demand on a grid.) That’s one reason why domestic natural gas production has jumped by 105% over the past 20 years, making the U.S. the largest producer in the world. But new sources of demand are emerging as well. That includes energy demand from data centers running artificial intelligence (AI) applications. Data center capacity has expanded by an estimated 10 gigawatts in 2025, which is comparable to peak daily electric demand in New York City. And the International Energy Agency is projecting that energy demand from data centers will double by 2030. Natural gas supplied over 40% of U.S. data center electricity in 2024 and is projected to continue supplying the largest share of data center energy demand through 2030. But it’s not just domestic sources of demand for natural gas that are increasing. International demand for U.S. gas is soaring as well. Liquified natural gas (LNG) refers to gas that is cooled to extremely low temperatures for transport abroad on specialized ships. LNG exports are hitting record levels in 2025 and are up 25% compared to last year. Those catalysts are pushing natural gas prices higher. Prices have nearly doubled from the lows seen this year. I believe natural gas is still in the early stages of an uptrend, and a recent pullback could present a trading opportunity… Tune in to Trading With Larry Live

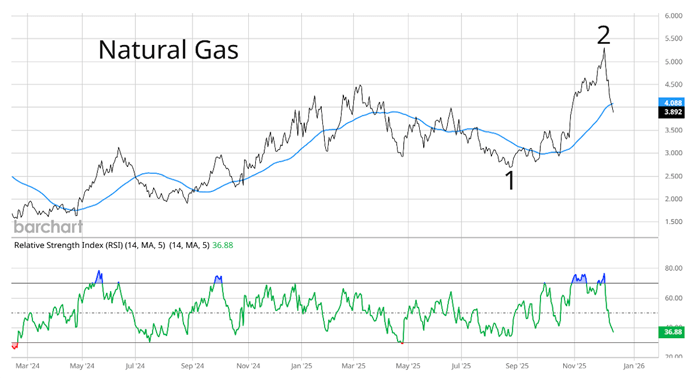

Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. | A New Commodity Trading Opportunity Natural gas started 2025 in a downtrend. Gas prices entered the year at $3.63 per million British thermal units (Btu) and then fell as much as 26% to hit $2.69 in late August. Prices hovered near that level for the next month and then went on a huge run. Here’s the chart below:

(Click here to expand image) Natural gas gained as much as 97% from this year’s low at “1” to the highs at “2” in early December. That move left gas prices extremely extended to the upside and susceptible to a mean reversion lower. Forecasts for milder winter weather arrived at the same time, and gas prices are now making a quick pullback. But that pullback is sending natural gas to key support levels while momentum is now extended to the downside. Take another look at the chart:

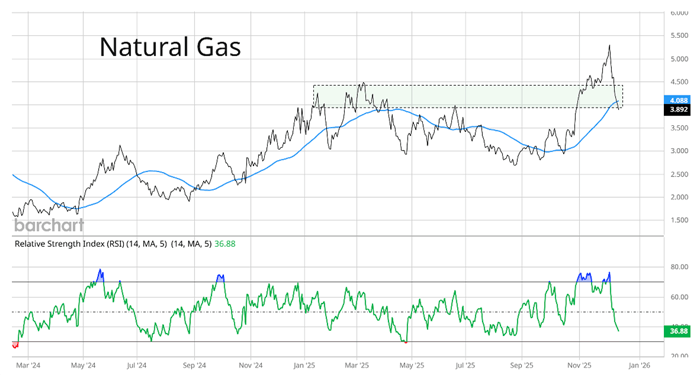

(Click here to expand image) Natural gas is testing support at the 50-day moving average (blue line). At the same time, price support in the $3.90 to $4.50 zone is coming into play (shaded area in the dashed box). During the run that started in August, that area served as resistance. After breaking above that level, that zone now serves as support. The Relative Strength Index (RSI) is also extending below the 40 level. That has served as an oversold reading on multiple occasions over the past two years. There are plenty of catalysts supporting natural gas prices, which is why I’m viewing the recent pullback as a mean-reverting move lower in an overall uptrend. If you missed out on the run that started in August, this could be another chance to profit from the bullish momentum behind natural gas… Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. | |

0 Response to "The Top Commodity Trade for 2026"

Post a Comment