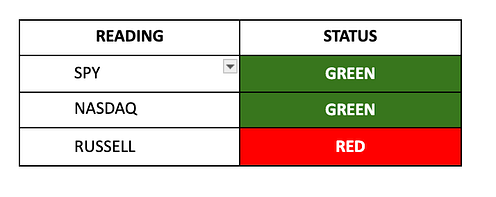

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: I didn’t hear the phrase “it’s okay to screw up” until I was a senior in college… And the professor didn’t use the word “screw.” He was a little more colorful. It was 2004 at Northwestern's Medill School of Journalism. This is a place famous for handing out a Medill F for a serious mistake. The Medill F isn’t a grade so much as a verdict, because you could turn in a well-written feature with perfect prose and devastating quotes, but if you misspelled someone’s name or got a date wrong, you failed the assignment with no partial credit. That happened to me once… Yeah… take that to therapy. Eventually, someone at that school got it. I was in David Protess’ class, working on a reinvestigation of a double homicide from 1983, and this wasn’t a case study or a hypothetical. We were dealing with real victims, real prosecutions, and real errors that had already ruined lives once before. We screwed something up. David told us it's okay to… you know. That was the first time anyone in authority said it plainly… People wonder why I was a perfectionist, and why I failed to understand that a test grade of 93 and 100 are both an A. I got over it after that class and finally understood that you’re going to make mistakes. They’re inevitable. What matters is whether you recognize them, stop compounding them, and take responsibility for fixing what comes next. (Something AI can’t do.) Until then, the unspoken rule had always been that you were supposed to avoid visible failure altogether and keep moving forward as if momentum alone could erase earlier decisions. Fake it till you make it, never let them see you sweat, and project confidence even when you have no idea what you’re doing. Pretend to be an expert at everything, and always have an opinion, even if you don’t know what the hell you’re talking about. That mindset shows up everywhere in markets. People are taught how to buy and how to hold, and they’re taught diamond hands and conviction and “I just like the stock,” but what they’re almost never taught is how to sell without turning it into a verdict on their intelligence, character, or right to call themselves an investor. Selling is framed as weakness, as a loss of faith, as proof that you never really understood what you owned in the first place. The result is that people stay in positions long after the original reason for owning them has played out, not because the math still works, but because exiting feels like confessing something about themselves. Or they FOMO their FOMO. If they make 100%, they think it will go up 200%. So they don’t sell. And if the position starts to go the wrong way, they start chasing the paper gains that they once had. That’s a terrible form of stress… It’s worse than having a bad trade from the start. You were up 200%… now you’re ONLY UP 150%… so you hold out hope for a rebound. And then you’re now up 100%… and you’re mourning your paper losses instead of celebrating the fact that you’re STILL UP 100%. Stocks and commodities don’t care about your feelings. They don’t know you own them, and they’re not going to be disappointed if you leave. Selling is not the same thing as being wrong. It’s recognizing that a process has finished. When a trade works, and price moves in your favor far beyond what you initially risked, taking some off the table isn’t quitting. It’s completing the trade, which is the equivalent of crossing the finish line and then stopping instead of running another lap. I’m Taking A Time OutSprott Silver Miners & Physical Silver ETF (SLVR) has now gone up over 200%… The trade has done its job. I didn’t abandon the long-term case for metals, nor did I eliminate all exposure. I took the win on my SLVR yesterday because that’s what wins are for. The first step after selling was dealing with taxes. I calculated what I owed and set it aside immediately, with no assumptions about future gains, no mental accounting tricks, and no pretending it would somehow take care of itself. Clean accounting leads to clearer decisions, and the IRS isn’t going to forget about you just because you forgot about them. Only then did I ask a more personal question: what is this money for? If every gain is automatically rolled into the next position without pause, then you’re not really building freedom so much as staying on the wheel. You’re the hamster who figured out how to run faster, which is genuinely impressive, but you’re still in the cage. Markets exist to turn risk into optionality, and optionality only matters if you’re willing to exercise it. I know people who have been “about to take some profits” for 15 years. They’re going to enjoy life after the next leg higher, after the position doubles again, after they hit some round number that keeps moving because round numbers are arbitrary and the goalpost has wheels. But here’s what I’m doing with some of those SLVR gains. Swing for the FencesOn March 13, I’m flying to Houston to watch the United States in the World Baseball Classic quarterfinals. I’m not staying at a Holiday Inn Express, either. I’m booking somewhere with a lobby that makes you feel like you should apologize for your luggage… I’ll pay extra for a place where they call you “Sir” without a hint of irony, and the breakfast menu costs roughly what I spent on textbooks my freshman year of college. It’ll be the kind of place where you order orange juice, and it arrives in a glass that weighs more than your phone. After that, I’m flying to Miami for the WBC semifinals and the championship. Then I’m taking a train from Miami to Orlando to meet my wife and daughter, along with my wife’s brother, because we’re going to Epcot. I’ll have one of those absurd Troll drinks that costs $12 and comes in a cup shaped like something from a fever dream. I will have a margarita in Mexico-land. And I’ll go on the Frozen ride with Amelia because she’s at the age where watching her experience something magical is worth more than anything else I could buy with the money. This is what the trade was for. Not to roll into the next position, not to compound into some theoretical future where I finally feel like I have “enough,” but to buy experiences with people I love while we’re all still here to have them. The SLVR position did its job, and now I get to do mine, which is to stop staring at charts long enough to live the life that all this analysis is supposedly in service of. I’m keeping my physical silver because that serves a different purpose, and I still believe in the long-term case for metals in a world where central banks can’t stop printing. But the ETF and the Closed-End Fund trade is done, the gains are real, and some of that money is about to become memories instead of sitting in a brokerage account waiting for the next leg higher that may or may not come. It took me until my early 20s to learn that mistakes don’t define you, but refusing to acknowledge them does. A lot of investors still haven’t learned the parallel lesson… It’s okay to sell. It’s okay to win. Sell some, keep exposure if the long-term case still makes sense, set aside what the IRS is owed, and then go do something that reminds you why financial independence mattered to you in the first place. The goal isn’t to be right forever, and it isn’t to stay invested at all costs. The goal is to know when the work is done and to live well while you still have the chance. Protect the Gain, Reclaim Your TimeThere’s one more piece of this that matters, especially for people who struggle with the idea of selling because they’re afraid of missing what comes next. You don’t have to choose between taking a win and staying exposed, because one of the most underused tools in investing is simply protecting profits in a way that doesn’t require you to watch the screen every day. You shouldn’t have to treat your brokerage account like a bird that dies if you ignore it for a weekend. A stop is nothing more than a pre-set exit that triggers if price moves against you by a defined amount, and a trailing stop adjusts upward as price rises, locking in gains while still allowing the position to run. It’s a way of turning an emotional decision into a mechanical one, where you make the choice once when you’re calm and rational instead of making it later when you’re panicking at 3 AM because futures are red and someone on Twitter said the world is ending. For momentum trades, something as simple as a 20% trailing stop can do the job. If the position keeps moving higher, the stop follows it, and if momentum breaks and price rolls over, you’re automatically out with most of the gain intact. You don’t have to debate it or explain it or write a thread about why you’re “repositioning” when really you just got scared and sold the bottom, because the decision was already made when you were thinking clearly. Another approach is to anchor your stop to a specific structure rather than a percentage, and many investors use the 50-day moving average as a line in the sand. As long as the price stays above it, the trend is intact, and if it breaks decisively, that’s the market telling you something changed. You can argue with the market if you want, but the ma’t be listening. Pick something you can live with, something you understand, and something you can set and forget. The worst stop is the one you move every time you get uncomfortable, because that’s not a stop so much as a suggestion you’re ignoring, which makes it roughly as useful as my gym membership in February. This is how you protect existing profits without turning investing into a second full-time job. Markets will still be there when you get back, because they’ve been doing this longer than you’ve been alive, and they’ll keep doing it long after you’re gone. They don’t need you to watch. Your time, on the other hand, is a limited resource with no trailing stop and no way to buy more at any price. Spend some of it now. And stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "It’s Okay to Sell (That's the Purpose of a Market)"

Post a Comment