Uncle Sam Sends Another Small Stock Soaring – Here’s How You Could Find Their Next Target VIEW IN BROWSER When people think about the Manhattan Project, the first name that comes to mind is usually J. Robert Oppenheimer. That’s understandable. But they should also give credit to another important figure. See, the Manhattan Project wasn’t just a triumph of science. It was a triumph of engineering, logistics and execution. The person who made it all work? That would be U.S. Army Corps of Engineers Lieutenant General Leslie Groves.

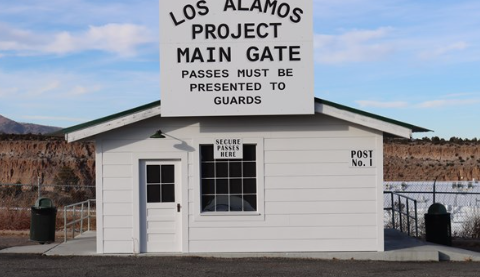

Source: U.S. National Park Service Fresh off building the Pentagon, Groves was a no-nonsense Army engineer. He didn’t invent the science behind the atomic bomb. But he knew how to marshal people, money and materials on an unprecedented scale to make sure it actually got built. More than 80 years later, the United States finds itself in another high-stakes race – the race to achieve artificial intelligence supremacy. The AI breakthroughs are already happening. The real challenge now is execution. That means manufacturing advanced chips. Building massive data centers. Securing enough energy. And locking down the critical materials that make it all possible. That’s where the Genesis Mission comes in. Over the past few days, my colleague Luke Lango has been laying out how the U.S. government is once again stepping in to coordinate capital, resources and timelines to make sure this next technological leap actually happens. And in today’s Market 360, we’ll go over how the latest move by Washington is just another step in the race. (It was a move that sent a tiny stock skyrocketing. This isn’t the last time that will happen, so we’ll unpack that some, too.) I’ll also tell you more about what the Genesis Mission is, why it matters right now… And how investors can’t afford to ignore what’s next. It’s All About Execution At its peak, the Manhattan Project employed more than 130,000 people, spanned dozens of facilities across the country and cost the equivalent of tens of billions of dollars in today’s money. Purpose-built government towns like Oak Ridge, Tennessee, and Los Alamos, New Mexico, were constructed almost overnight.

Source: U.S. National Park Service Supply chains were created from scratch. Everything moved under intense time pressure, with a clear mandate from the top: Get it done. That kind of mobilization isn’t confined to history books. In fact, if you look at what’s happening today, the parallels are striking. The science behind AI already exists. The algorithms are improving by the day. The real constraint is physical. Advanced chips must be manufactured at scale. Massive data centers must be built. Power generation has to expand. And the raw materials that feed it all must be secured. In other words, this isn’t just a technology race. It’s an industrial one. That brings us to the latest headline this week. | Recommended Link | | | | This isn’t a boom where everyone wins. It’s a transfer from one group to another – like railroads (1800s) and internet (1990s). Louis Navellier, who spent 46 yrs on Wall St., built the grading system institutions paid $24,000/yr for him to evaluate stocks with. Now, his system shows exactly where the $7 trillion is flowing. And it’s not AI. Click here for the full story. |  | | Washington’s Latest Move This week, USA Rare Earth Inc. (USAR) announced that the Department of Commerce intends to take an equity stake in the company, alongside a major financing package designed to accelerate its growth. Under the proposed deal, Commerce would provide a $1.3 billion loan and $277 million in federal funding. In return, the U.S. government would receive a meaningful ownership stake through common shares and warrants, potentially ranging from 8% to 16%. The market reacted immediately. Shares of USA Rare Earth surged more than 20% on the news. And for good reason. This is not a grant or a one-off subsidy. It is the federal government putting capital behind execution, with clear expectations attached. The funding is meant to fast-track two critical projects: a rare earth magnet manufacturing plant in Oklahoma and a rare earth mine in Texas. The magnet facility is expected to come online in early 2026, with mining operations targeted for later in the decade. Those timelines matter because rare earth magnets are one of the biggest choke points in the race to secure domestic supply chains and compete with China in the AI era. Rare earth magnets are among the most powerful permanent magnets ever developed. They are small, lightweight, and extraordinarily strong, which makes them indispensable in modern technology. They sit inside electric motors, generators and precision control systems. You’ll find them in fighter jets, missile guidance systems, drones, radar equipment and advanced communications gear. They’re also embedded throughout electric vehicles, industrial robots, semiconductor manufacturing tools and the cooling and power systems inside AI data centers. Bottom line: If something needs to move, spin or operate with extreme precision and efficiency, there is a good chance a rare earth magnet is involved. For years, the United States has relied heavily on China not just for rare earth processing, but for magnet manufacturing itself. Beijing dominates the refining and magnet-making stages of the rare earth supply chain, which gives it enormous leverage. Mining alone doesn’t solve that problem. Processing and magnet production are the real bottlenecks. This Is Just Getting Started… By backing USA Rare Earth’s magnet facility and tying capital to clear milestones, Washington is attempting to secure an end-to-end domestic supply chain for one of the most strategically important components in modern defense systems and AI infrastructure. If this all feels familiar, it should. Over the past year, the U.S. government has repeatedly stepped in when it believes a sector is too important to leave entirely to the open market. And each time it has done so, stocks tied to those moves have reacted fast. In July, the Pentagon took a roughly 15% stake in MP Materials Corp. (MP) to secure rare earth minerals used in defense systems. The stock surged 111% in the week following the announcement. In August, the U.S. government committed nearly $9 billion to Intel Corporation (INTC) to rebuild domestic semiconductor manufacturing. Shares nearly doubled over the next three months as investors reassessed Intel’s strategic importance. Then in September, Washington revealed it was seeking a 10% equity stake in Lithium Americas Corp. (LAC), the company behind what is set to become the largest lithium mine in the Western Hemisphere. The stock jumped 194% in the two weeks that followed. And in October, the White House announced it was exploring a 10% stake in Trilogy Metals Inc. (TMQ), unlocking access to domestic copper and cobalt resources. Shares exploded more than 200% in a single day. Each time, the pattern was the same. A government announcement signaled urgency. Capital rushed in. And the market repriced these companies almost overnight. USA Rare Earth is simply the next chapter in that same story. But it won’t be the last. The federal government is no longer just encouraging private companies to act and hoping for the best. It is actively shaping outcomes and accelerating timelines. That’s an important shift. During the Manhattan Project, the government didn’t wait for the market to decide whether building nuclear facilities made sense. The stakes were too high. If the U.S. didn’t crack the nuclear code first, then the Germans might. And if not them, then the Russians. Instead, it defined the mission, aligned resources and executed. This is where my InvestorPlace colleague Luke Lango’s work comes in. What Genesis Mission Means for Investors Launched by President Trump in November 2025, the goal of the Genesis Mission is simple: Bring together the public and private sectors to win the AI race. Luke has been tracking the technologies, timelines and policy moves that point to where this next wave of investment is heading – and he’s identified what he thinks are the eight best opportunities for investors right now. If the past year has taught us anything, it’s that these moves don’t stay under the radar for long. And once they’re obvious to everyone, much of the upside has already been captured. That’s why understanding the Genesis Mission now matters. Because according to Luke’s research, the government could publish a detailed list of funding priorities of the Genesis Mission by February 22nd. (Maybe we’ll find out who the Leslie Groves of the Genesis Mission is around that time as well.) That means the window to act is now – before the rest of the crowd catches on. That’s also why Luke has put together a special free briefing that explains how this mission is taking shape and what it could mean for the markets ahead. Go here to watch it now. Sincerely, |

0 Response to "Must Read: Uncle Sam Sends Another Small Stock Soaring – Here’s How You Could Find Their Next Target"

Post a Comment