Japan's Problems About to Become Ours... Again?(Why Momentum is Red)We've been talking about this transmission issue since August 2024. Now Citi wants we should brace for $130 billion in Treasury selling.Dear Fellow Traveler: Well… you can’t say I haven’t been going on and on about this for 16 months. But… on Tuesday, Japan’s bond market imploded. And yes, that is the right word, given the statistics behind the statement. US Treasury Secretary Scott Bessent had this to say yesterday: "Markets are going down because Japan's bond market just suffered a six-standard-deviation move in ten-year bonds over the past two days." That’s not an academic calculation. It’s a macro trader’s way of saying the models stopped working. That’s statistically an event that should happen roughly once every 1.4 million years. In Japan, the nation’s 40-year government bond yield surged 40 basis points in two sessions. The 30-year bond hit record highs, and its 20-year auction was so bad that dealers reported pretty much no buyers showed up. Said a Nomura portfolio manager: “There’s no buyers on the level of the market.” That has spread quickly through global bond markets… and Bessent encouraged Japan to stablize its system. When you don’t have any buyers in the market, there’s only one buyer of last resort, the Bank of Japan. And its willingness to absorb unlimited duration risk is fading. But this isn’t just Japan’s problem. Without some quick thinking, it’s about to become all of ours very quickly... The Transmission Mechanism I’ve Been Warning AboutBack in August 2025, I did something most people would consider a form of self-harm. I read the entire 2025 Annual Report of the Bank for International Settlements. On page 63, buried in the bureaucratic prose, sits a sentence that should have been front-page news. But it goes largely ignored because it sounds so complicated.

And then… Page 65 confirms just how deeply this issue extends…

What does it mean? If Japan sneezes, America can catch pneumonia. I described it like this at the time… Imagine you used to control your home’s temperature with a thermostat. But years later, your neighbor’s thermostat now affects your house temperature almost as much as your own. You still have some control, but you’re no longer fully independent. That’s our central banking (and thus financial) system today. When the carry trade unwound in August 2024, the Nikkei had its worst one-day sell-off since 1987. US markets felt it immediately—the S&P 500 cratered. Our signal went red on August 1st, and four days later, Tokyo’s market seized up. Most people blamed China’s export curbs. But Japan’s top currency diplomat had warned of possible “rapid” FX moves in the yen a month earlier. The stress was already building in the plumbing. The same thing happened yesterday. Greenland became the headline. Japan was already the stress point. Japan had responded by selling first on Monday. Yes, President Trump is sucking up a lot of oxygen in the room… But markets don’t run on headlines and oxygen. They operate in plumbing and capital. Japan has already been teetering, and one more reason to sell bonds pushed the situation over the edge. We’ve been hammering away over this because it’s been the single biggest (obvious) threat to the financial system since that August 2024 event. I don’t take victory laps over this stuff… I point the camera and hope I’m wrong or that the inevitable is delayed. But we wrote about this, warned about it, and explained why it mattered. Now it’s happening… again. But bigger. What Just Happened in TokyoI need to explain that this isn’t about Greenland… It’s about Japan’s financial situation, and this recent market blowup is EXTREMELY familiar with history repeating itself. Prime Minister Sanae Takaichi called a snap election on Monday. Politicians are being politicians and showing that they don’t understand the challenges of their positions. Her platform for the snap election? More spending and tax cuts… in a nation where its national debt is well over 250% of GDP, and its demographics are collapsing. They don’t actually need more spending and tax cuts… but the Prime Minister wants stimulus to drive a return to inflation and growth. The specific proposal that likely broke the market was a two-year suspension of the food levy. That would create a 5 trillion yen hole in the budget. That’s $32 billion in annual revenue, in US dollars, gone, with no funding mechanism in place. So, no one wants to touch their long-term debt, all while other instutions that bought bonds at much lower interest rates are selling them to raise cash in a hurry. If all of this sounds familiar, it’s because we just had the same scenario play out about 40 months ago. In 2022, UK Prime Minister Liz Truss proposed unfunded tax cuts. The gilt market collapsed, and she was out within weeks. State Street’s Masahiko Loo called Tuesday’s selloffselloffarket pricing in Japan’s Truss Moment.” That might be underselling it. England’s situation was bad… Japan’s is worse. Its debt-to-GDP ratio is 263%. The UK’s was 101% when Truss blew it up. Japan has been borrowing at effectively zero percent for decades. Its entire economic model depends on cheap money. Now, 40-year yields have breached 4%. The borrowers who’ve been getting free money for a generation are about to discover what real interest rates feel like. Why This Hits Your PortfolioCiti’s Mohammed Apabhai published a note on Tuesday that should have everyone’s attention. Risk parity funds may need to sell up to one-third of their current risk exposure. That could trigger up to $130 billion in bond sales in the US alone. That would be $130 billion in forced Treasury selling, and it’s really not because of anything happening in America. It’s because of a political stunt in Tokyo. This is the transmission mechanism in action. When JGB volatility spikes, global portfolio managers must rebalance positions across all durations. Japanese life insurers, which hold enormous positions in US Treasuries, will need to sell to meet domestic obligations. Hedge funds running leveraged basis trades in both markets will face margin calls simultaneously. As I wrote back in December:

They’re selling Japan… and combining all this with Greenland… and foreign investors appear to be selling America too, after a massive swell of capital flowing back into the US last year. The FX Plumbing ProblemThis week, I wrote Money Printer 202: The Price of What Matters. The core argument… Interest rates aren’t the real price of money… access via FX markets is. The Fed Funds rate is the sticker price, and FX funding spreads are what clear the checkout when the crowd gets nervous. When Japanese banks need dollars, and they need a lot of them, they get them through the FX swap market. They effectively rent dollars by trading yen today with an agreement to swap back later at a fixed rate. That rental premium is the real marginal cost of dollar funding for globally leveraged balance sheets. When that premium spikes, the system de-risks. Fast. Here’s the problem: Japan’s bond market chaos is putting extraordinary stress on the yen. It’s pinned near intervention territory at four-decade lows. When the currency weakens, Japanese institutions holding dollar-denominated assets face a choice… They can hedge aggressively and pay the premium, or sell the assets. Many will sell. That’s how Tokyo’s bond rout becomes your 401(k) ‘s problem. The Structural Buyer VacuumThere’s a quote from Fidelity’s Ian Samson in the Reuters coverage that gets to the heart of this:

This is the question I’ve been asking about theUS. Treasury market, too. Japanese life insurers sold a record amount of super-long bonds in December. The Bank of Japan, which used to hoover up everything with a coupon, has been stepping back. And now politicians are competing to see who can promise to spend more. For most investors, Japanese government bonds were unattractive on Friday. Now, there is very little to no natural market demand for Japanese debt.” And when there’s no natural buyer, you need an unnatural one. That means central bank intervention. Governor Ueda has been reluctant to use the tools his predecessor invented. But as Macquarie’s Gareth Berry noted, “Soon, he may have no choice.” Here that sound… BRRRRRRRRRR…. Yeah, I hear it too… The opposition leader, Yuichiro Tamaki, is already calling for the government to buy back bonds or reduce issuance of super-long notes. That’s financial repression. It’s what theUS. has been doing… and a large number of other central banks around the globe. The practice buys time, but it doesn’t address the underlying problem. Back in December, I wrote:

Japan is the canary. It’s been the canary since August 2024. The world’s third-largest economy, with the developed world’s heaviest debt burden, just had its bond market reject the fiscal plans of its political class. The transmission mechanism I identified in the BIS report is live. The FX funding stress I warned about is building. The structural buyer vacuum we’ve discussed is now on full display. Bessent knows it. He’s a former macro trader. When he calls something a six-sigma event, he’s not being hyperbolic. He’s signaling that the models are breaking. This is what happens when decades of easy money meet political reality. And now that momentum cracked yesterday, we’re facing greater uncertainty about how they will put it all together. The big challenge right now is the temptation to short. But when we get these bigger events, we’re always on standby for greater central bank intervention, money printing, and the expectation of rebounds by algos and market participants who have seen this pattern for 17 years. I argue it’s really the time to use any support by central banks to exit positions that you don’t need. If you can’t explain why you own a stock without referencing multiple expansions, rotate it into fortress balance sheets, short-duration exposure, or real assets with pricing power. Continue to focus on hard assets. This isn’t a Japan crisis. It’s a funding crisis revealing itself first in Japan. This might not be the big one, but it’s a constant preview of the inevitable monetary endgame in our lifetime. We just have to keep playing the game and dancing near the door Now, let’s get to the market preview… The Market UpdateTrump’s plane had some issues overnight, so he’s running a few hours behind on his Davos address. That’s a shame, I was going to tailgate that… One would think that would mean a quiet morning, but the selling has already started to pick up. S&P and NASDAQ futures are now pulling below yesterday’s lows. The Russell is pulling back, too, but hasn’t broken under yet. Little change overnight as far as our momentum numbers go. A bit more weakening in the Russell, but the S&P and NASDAQ are mostly unchanged. It doesn't look like the selling is through yet. If you’re new here and haven’t experienced a negative momentum downtrend, this is how we handle it. When our indicator goes red, that’s when I get in position. As the panic kicks up and people start crowding for the exits, selling indiscriminately, we want to be buyers. You don’t want to be the guy or gal scrambling to sell in these moments. You want to be the one with cash in hand when the rest of the crowd runs out screaming. I’ll take that. I’ll take that. I’ll take that. Make your list. The stuff you’ve wanted to buy but was just too expensive. That’s where we’re at, and that’s why we follow these rules. You only get one or two of these a year if you’re lucky. You have to be in position, or you’re on the losing end. You can read more about this in the article I wrote about the 1% pattern. The more you see these moments, the more conviction you have to take advantage. Six Rules of Negative Momentum Rule 1: Cash is your friend. When momentum turns negative, I build more cash (that’s been the trend of the last few weeks). Out of long positions, protecting capital. This is how I position myself to buy when opportunities show up. Rule 2: Avoid selling puts unless you see Rule 6. This is not the time to open new put spreads. If you’re already in and you’re up, take the profit. If you’re down, decide whether you’re willing to sell at an even lower strike. When momentum goes negative, selling can be indiscriminate. Rule 3: Know implied volatility rank. IVR tells you whether options are cheap or expensive relative to the last year. Under 25 means the options are cheap to buy. Over 30 means you might want to be selling premium. Rule 4: Sell credit spreads in negative momentum. If a stock is expensive to short with a long put, sell vertical call spreads instead. You benefit if the stock trades sideways or declines. Rule 5: Watch for oversold levels on SPY and IWM. Markets sell off fast in negative momentum environments. When RSI drops under 30, that’s oversold. Nobody wants to buy there, but that’s exactly when the algorithms start scooping up shares. Rule 6: Sell puts in very specific conditions. Oversold territory is where you can sell puts on stocks you actually want to own. If RSI is around 25 on a quality name, use the fear to sell puts 15% to 20% below the current price. If it falls there, you’ve got a bargain. If it bounces, you can repurchase the option at a lower price. Taking a quick look at what’s moving this morning. Gold is up another 2% and hit new highs again. Silver touched new highs as well. The metals trade continues to work even as equities struggle. Natural gas is squeezing hard on the back of this cold snap. Keep an eye on it. Wait until it draws all of retail in, and once everybody and their mother starts talking about natural gas prices, and we hit overbought, that’s the moment to take a shot the other way. I’ll be looking for a trade on that as the week goes on. The problem is we have a big snowstorm coming this weekend, so it may keep this trade in the news a little longer than usual. VIX is back at that 20 level. A move higher from here tells you more trouble is ahead. If you’ve been watching the FNGD, none of this should come as a surprise. We’re creeping back towards Liberation Day levels. What we’re looking for is an overreaction followed by a policy shift that puts this market back on course. How will we know that’s happening? Momentum pressure will spike. Our signals will flip back green. And the S&P will need to break back above some of these breakdown levels. The first significant level to watch is 6900 on ES. Get back above that, and we start talking about breaking this downtrend. On the SPY, that level is around 685. Below 676.5,0 and people are still heading for the exits. Market outlook

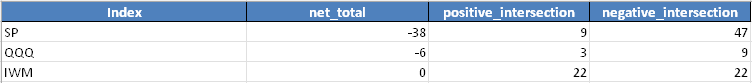

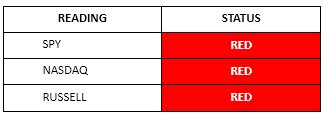

Momentum - Back to Red Tuesday closed red across the board. The S&P and NASDAQ were both down over 2%, and the Russell finished down 1.2%. All three indices are now negative on the broad momentum signal. Intraday pressure weakened throughout the session. We opened around minus 24 on the S&P and ended the day at minus 38. ... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "Japan's Problems About to Become Ours... Again?(Why Momentum is Red)"

Post a Comment