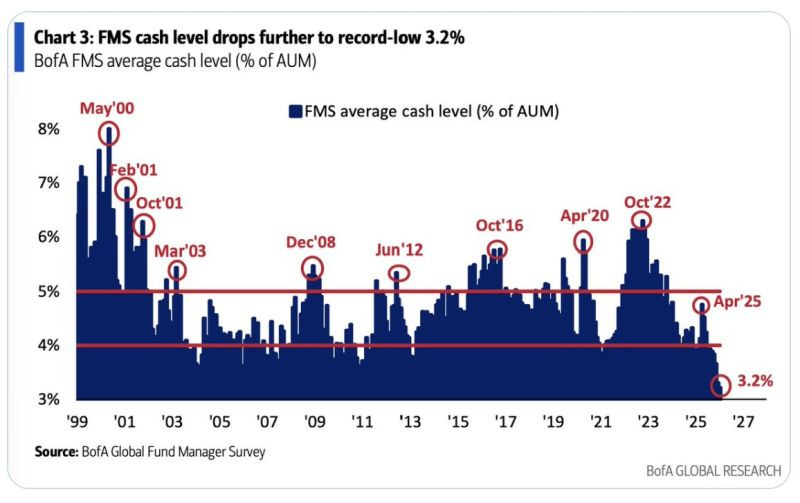

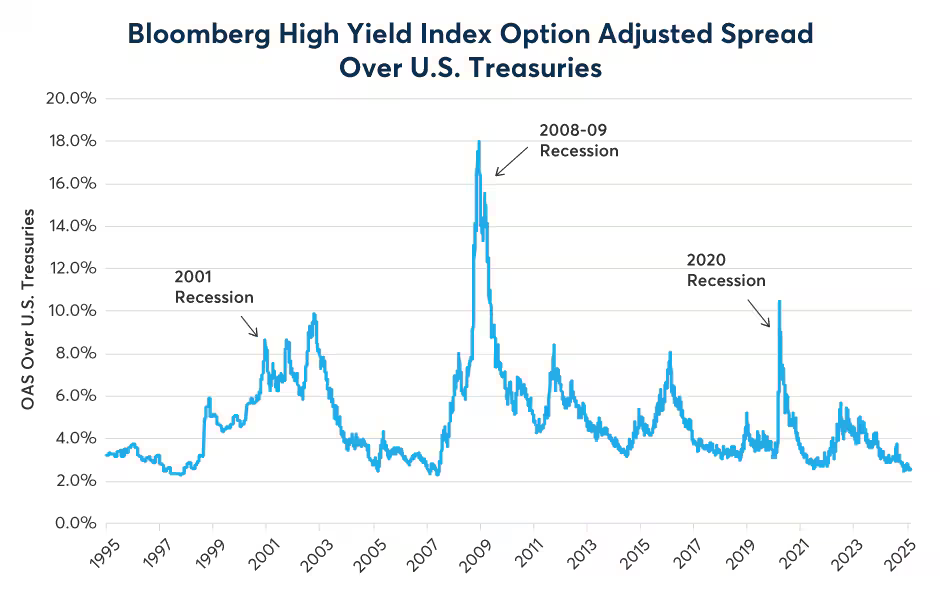

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Small Selling Pressure Builds, We're Heading RED on the S&P 500Oh great... it's been there the whole time...The number of stocks now down 7% in the week and down on the month on the S&P 500 has exploded… and it came just a week after we saw the biggest reversal signal since October. All the while. we just learned that cash levels were at record lows, as everyone has been all-in on equities. And yieleds had collapsed as well… We’re under critical moving averages and technical levels. Our intraday readings continue to weaken, and our pressure on tech names like ORCL and NVDA, and consumer cyclicals like RCLH and CCL, are telling us that momentum is cracking… Combine the Japan issues with the fact that the Fed just pumped a few billion into the system… and if you follow the big narrative - we’re back in the “Sell America” mode. Trump’s speech in Davos, Switzerland, could be a bag of bananas tomorrow… We’re at the point where my full attention turns to this line in the sand… The ProShares S&P 500 Short ETF (SH) and its 50-day EMA of $36.25. We’re seeing leverage unwinding elsewhere in the Mega cap stocks… And… the larger banks are still under pressure… It seems that regular injections from the Federal Reserve may be the only thing holding the regional banking sector up at the moment… and they’re reporting… Hey… this was supposed to be a short, fun week… right? Well… funding squeezes are showing up. A few things… Here’s your latest chance to go through all those assets that you bought on a speculative recommendation… maybe it’s some crazy advanced computing company that doesn’t make money… maybe it’s a business you don’t understand… Maybe you bought something because you heard that Eric Trump might be involved… But these are the moments you have to look at your portfolio and say… we’re standing on the edge right now… and if this market wants to sell… and capital starts to flow back out of the United States after such a huge wave of foreign flows… You might want to protect yourself now. Remember, it’s early in the year, and taking gains won’t hurt you now. But what comes if you’re trying to play catch-up later in the year is where you might fall into some traps. So… look at that portfolio. Is this a real business or not? Does it have real earnings and cash flow or not? Would you be willing to hold this for 36 months? How about this… why do you own it? You have to be able to answer these questions… Meanwhile, if you’re willing to let something go that you really like… sell covered calls or In the Money Calls instead of just dumping indiscriminately… Now then… I’ll keep monitoring all this… but this market is really dizzying, even for me. Japan’s bond sale yesterday is the latest sign that there’s going to be more pressure on bonds (it was a weak auction). Bitcoin continues to sell today… raising questions about liquidity. Recall what my thesis is on Bitcoin - it’s a canary… not a commodity. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Small Selling Pressure Builds, We're Heading RED on the S&P 500"

Post a Comment