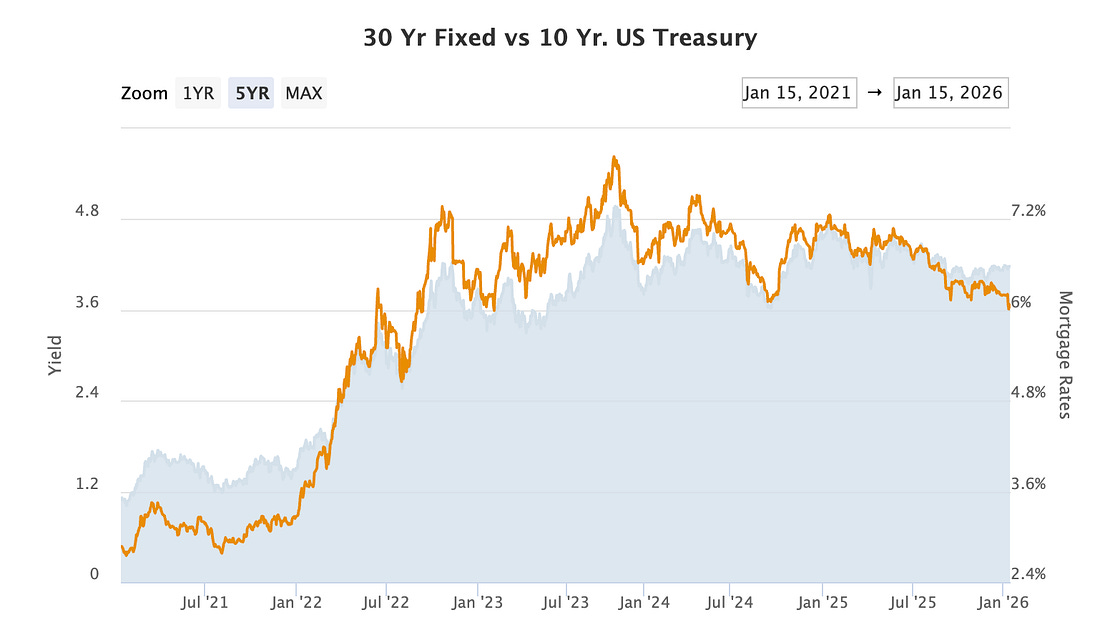

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: Mortgage rates are falling… That sentence feels weird, doesn’t it? The odds of interest rate cuts this month or in March have been falling. A lot more economists are telling us that we might not get a rate cut until June now… Powell never announced victory over inflation… has he? I mean, aside from that “Good Ship Transitory” comment that fell flat. The 10-year bond… is holding around 4.2%. But, interestingly, America’s most rate-sensitive market has loosened… What the what? (Mortgage rates on the right axis, 10-year yields on the left) Well… let’s take a look at what’s going on real fast with mortgage bonds. First… when banks issue mortgages, it typically won’t sit on that loan for the full 30 years. It will typically bundle thousands of mortgages into a wonderful little product called a mortgage bond. Institutional investors and others can buy that bond for yield, again a reflection of increased financialization of assets in the United States. Those bonds are critical to the plumbing in the housing market. If investors want them, mortgage rates will drop. If investors avoid them (think 2008), rates rise, and things can get intense for the market. It’s a simple way of thinking about it. Now, mortgage rates don’t completely depend on action by the Federal Reserve. They do depend on how easy it is for lenders to sell the mortgages they create and package. So… something happened here, right? It followed President Trump's announcement that he wanted U.S. housing agencies to purchase $200 billion in mortgage bonds. FHFA Director Bill Pulte confirmed on X that Fannie Mae and Freddie Mac would execute those purchases. It doesn’t matter if you support the actions or not… the outcome was inevitable. Here’s What Happens…The federal government told the market it intends to boost its efforts as one of the largest buyers of mortgage bonds. And when a giant buyer shows up, prices jump before they even start shopping. Traders try to get ahead of the order flow because it’s stupid not to trade this… Mortgage bond prices rise in anticipation. Mortgage rates dip amid expectations of a shift in mortgage bond prices... The announcement moved the needle. In the days following Trump’s directive, the 30-year fixed rate fell to 6.06%, the lowest in over three years. Again, that’s curious given the expectation that the Fed controls those rates, right? So, what happened after the announcement… Mortgage applications rallied over 28% in the next week. Refinancing activity surged by 40%. For one day, top-tier borrowers saw rates drop under 6% for the first time since 2022. Now, remember, this is not a Fed policy shift. It’s not quantitative easing (QE)… that’s a process in which the Fed creates new money and buys mortgage bonds and other assets. These Government Sponsored Enterprises (GSEs) are using the cash reserves they’ve built over the years during their years under conservatorship. Treasury Secretary Scott Bessent framed it as an offset… The Fed is letting about $15 billion in mortgage bonds roll off its balance sheet every month as part of quantitative tightening (QT). The GSE purchases are designed to neutralize that pressure. As Bessent put it, the idea is to “roughly match the Fed, which has been pushing the other way.” It’s the President using two government-controlled mortgage companies to push down borrowing costs amid a housing affordability crisis. You can argue about whether it’s wise and about what it does. It makes mortgages cheaper to fund, and cheaper mortgages mean lower monthly payments. But… it could also invite more buyers into the market and create greater demand for homes… We’ll find out if housing prices go up as a result (though it’s fair to estimate that they probably will) But the thing that isn’t what’s on my mind… We Need to Build…None of this solves the real issue. America doesn’t have enough homes for all these potential new buyers. Heck, my house had six offers… and that was in the middle of 6.5% rates… The country needs somewhere between 3 and 5 million additional units just to restore affordability, depending on whose estimate you trust. Lower rates don’t magically build new houses or convince people to give up the 3% mortgages they locked in years ago. (Ugh, I was at 2.6% in Florida…) What they do is keep demand alive. They keep home prices supported. They also keep shelter costs sticky in the inflation data. Banks will also have some breathing room on the mortgage portfolios that have been underwater since rates spiked. I think that’s the real issue at hand - a lot of banks need cash - and this alleviates some of that pressure if they did need to sell MBS. This is why the housing market continues to behave like it has its own private monetary policy. The Fed can keep rates elevated, and the 10-year can stay stubborn. But if the mortgage bond market heats up, and if the White House drops a $200 billion anchor into that pool, mortgage rates will drift lower regardless of what the central bank does. It looks like a rate cut, and it feels like one. But it didn’t come from the Fed. It came from the plumbing. Looking ahead, I don’t think MBS purchases will solve the supply-side issues. It will either need to come from one of two places. Significant reductions in zoning red tape (there are 25,000 agencies in America - though I’m using agency loosely as a term - that oversee housing zoning…) and I don’t foresee a bunch of people with a small amount of power to give up that control on where people can and can’t live… Or we port the mortgages - and allow people to transfer their rates over to new homes - which picks winners and losers… and theoretically would create more churn in the housing markets. There are many pros and cons to that idea… (it would likely create more competition and negatively impact MBS origination.) I’ll share how that would work and both sides next week. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Rate Cut... Shmate Cut"

Post a Comment