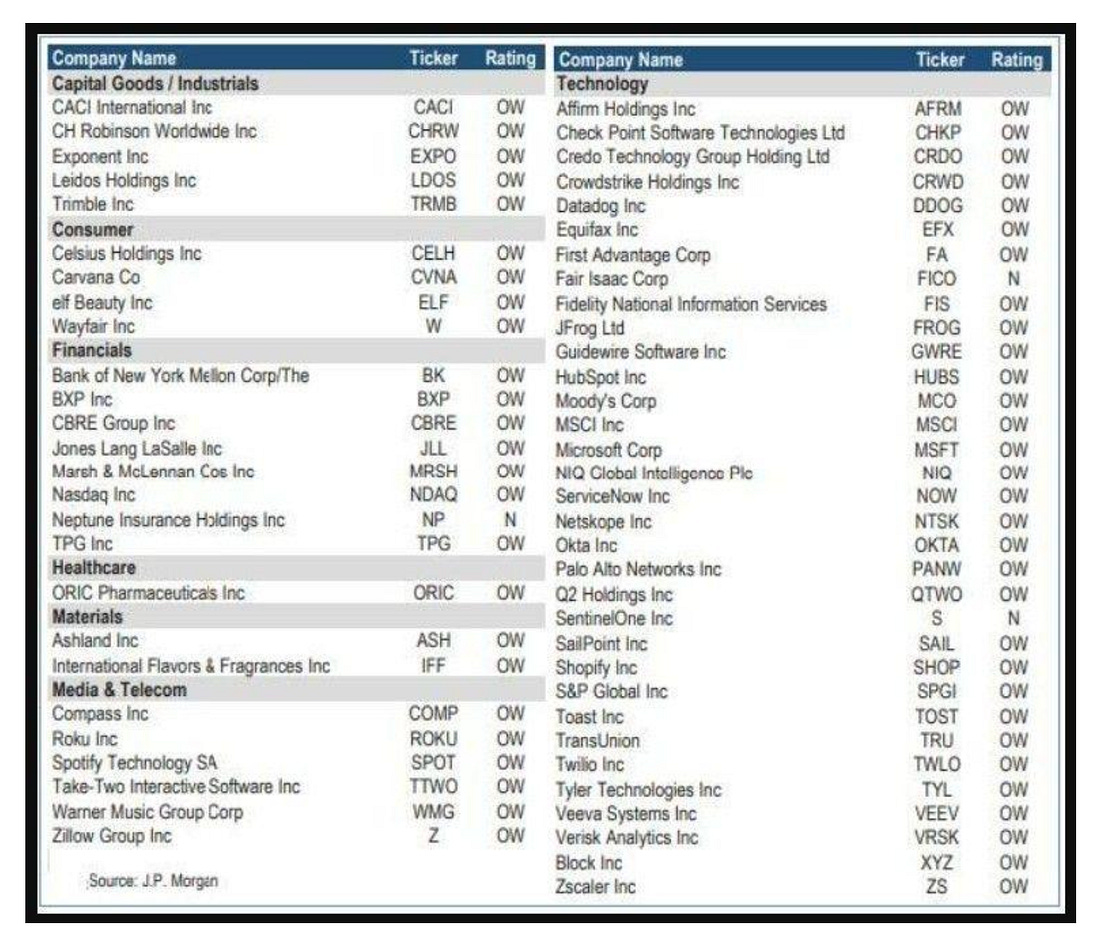

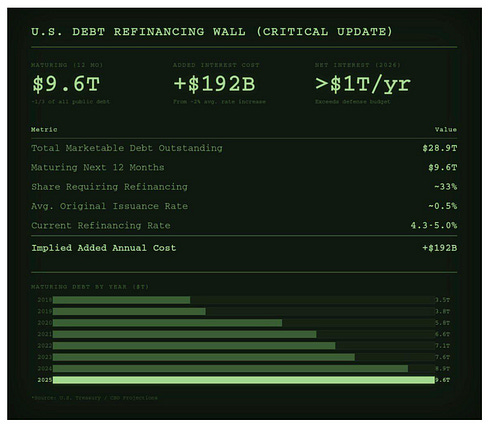

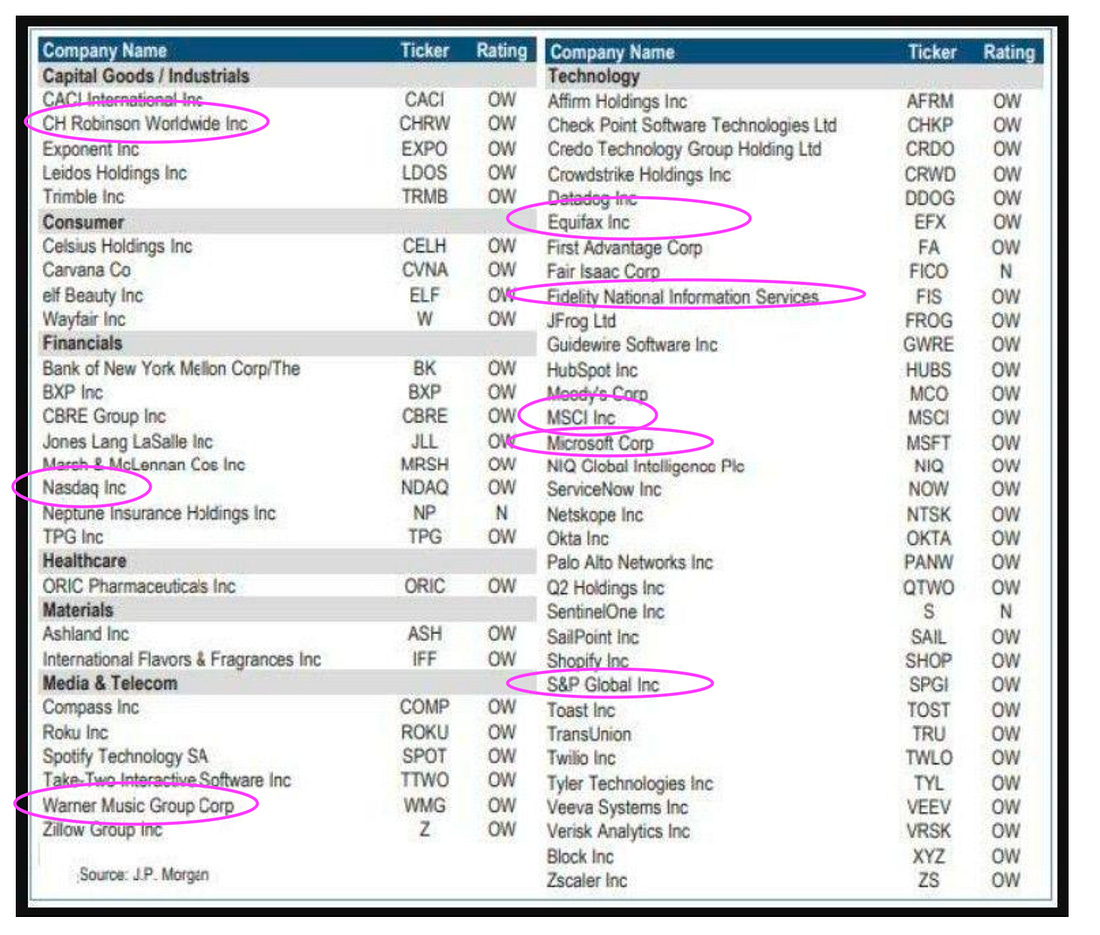

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: I’m coming in a little late in the day… I’ve been writing my next issue of Postcards from the Edge of the World… more or less… this afternoon… So my goal of a Chart Party… Has turned into analysis of one chart… In recent weeks, technology stocks have been under pressure due to ongoing concerns about the impact of AI on brokerages, software-as-a-service (SaaS), law firms, and other industries it might disrupt. Two weeks ago, Goldman’s trade desk called the bottom on that trade… for a hot minute. Then, JPMorgan came out this week with a dedicated research basket of stocks they called “Top Mispriced Stocks Amid AI Disintermediation”. In this chart… the analysts say that prices have outshot fundamentals… This is a big list… where the hell does someone even start with this list of stocks… Yeah… thanks I suppose… Two Things…I want to stress something important. They’re saying that prices have outstripped fundamentals. You know what they didn’t mention? The refinancing challenges on the horizon for the U.S. economy… About $9.6 trillion in U.S. debt will mature in the next 12 months… all at the same time that loads of corporate debt will need to be refinanced… So… U.S. debt (barring some serious monetary expansion) could easily crowd out capital on that technology side… especially the software names… But you know what? Forget all my money printer analysis on liquidity… And let’s look at the thing that I spend more time on during my day than anything… Insider buying… A few years ago, I ran a big analysis of the stocks Cathie Wood kept buying in the face of the 2022 downturn. And what I saw was a little interesting. There were billions of dollars in stock sales in the Top 10 holdings, but only ONE purchase of stock via a direct Form 4 filing over the previous years… The thing I had to ask… If the stocks were cheap… and the fundamentals were so overshot, why would Cathie Wood buy a stock… if the executives weren’t doing it. Yes, they are compensated in stock… but we’re being told by JPMorgan that these stocks are overshooting fundamentals. I would be way more content to hear this from the Chief Financial Officer or the Chief Executive Officer. No one knows the balance sheet and the valuation better than the CFO… No one should know the macro- and micro-worlds better than the CEO… So… I went back and just looked at this list through the lens of insider buying… These are the only names on the list that have seen any insider buys in the last three months… Now… one more addition… let’s only screen for CEO and CFO purchases only…

That’s it… I don’t argue about the fundamentals… but there were times when some of us thought PayPal was cheap… at $150 in 2021, at the height of the liquidity cycle... We just passed the top of that cycle… for now. I’m just asking the same question as I always do when it comes to this… If the CEO and CFO aren’t buying their stock if it’s “so cheap…” why are you? Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "If These People Aren't Buying... Why Are You?"

Post a Comment