ON FEBRUARY 24, PRESIDENT TRUMP IS

EXPECTED TO SIGN HIS FINAL ONE — EVER!

Ian King here with some very big news.

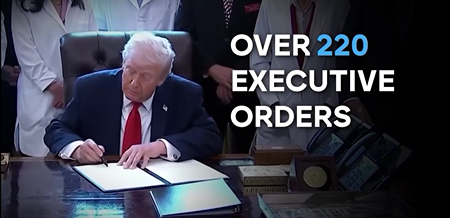

After 220 Executive Orders in one year. And with nearly three full years left in office…

I have learned the unthinkable…

On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order.

I know that sounds crazy …

I didn’t believe it myself.

But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement.

I was able to get the full story for you here.

Regards,

Ian King

Chief Strategist, Strategic Fortunes

Intel Stock Is Priced for Ruin, But the AI Offensive Is Here

Authored by Jeffrey Neal Johnson. Article Published: 2/9/2026.

Quick Look

- The company has launched a unified roadmap targeting the lucrative artificial intelligence inference market with new discrete graphics processors and cooling technology.

- Strategic partnerships with industry leaders and significant government support validate the manufacturing capabilities and ensure a stable capital foundation for growth.

- Management is prioritizing high-margin data center products to navigate temporary supply bottlenecks and rebuild inventory levels for stronger performance later this year.

Intel Corporation (NASDAQ: INTC) is at the center of a high-stakes tug-of-war on Wall Street. Two competing narratives are playing out in real time, creating significant volatility and confusion for retail investors. On one side, the company has launched an aggressive strategic offensive, unveiling a return to the discrete GPU market and a major partnership with SoftBank (OTCMKTS: SOBKY). On the other, operations are flashing warning signs, with confirmed reports of severe supply shortages affecting the important Chinese market.

This tension between a revitalized long-term vision and immediate logistical hurdles has left Intel's stock price hovering in the upper $40s. While delivery delay headlines are alarming, they likely represent temporary headwinds. For investors willing to look beyond the next two quarters, the company's shift from a defensive posture to an offensive artificial intelligence strategy creates a meaningful disconnect between the current share price and potential future value.

The AI Offensive: Brains and Memory

The Silver Strategy Hiding Inside IRAs (Ad)

In 2000, I told Barron's that a popular dot-com stock was headed for trouble. It dropped 90%. Now I'm making the opposite call on that same company: buy it now. This stock has become the lifeblood of AI data centers, yet almost no one has caught the story. While the media focuses on AI chip wars, they've missed this company's essential role in building out data centers. Their hardware is so critical that a single building uses enough of it to stretch around the world eight times. If you own Nvidia, you might want to pivot. If you missed Nvidia, this is your second chance at the AI data center buildout happening worldwide.

See the under-the-radar play fueling AI data centersSince late January, Intel has signaled it is no longer content to serve solely as a manufacturer for other chip designers. Under CEO Lip-Bu Tan, the company is rapidly consolidating a unified roadmap spanning both compute power and memory storage.

The most significant update came in early February with the announcement that Intel is reentering the discrete GPU market. This is not a repeat of prior gaming-focused efforts. Instead, Intel is explicitly targeting the AI inference market. While companies like NVIDIA (NASDAQ: NVDA) dominate AI model training, inference — actually running those models to generate answers — is expected to become the largest segment of the AI industry.

To address this sector, Intel introduced Project Crescent Island. Built on the Xe3P architecture and optimized for inference tasks, this GPU's key differentiator is its thermal design. Unlike some power-hungry competitors that require complex liquid cooling systems, Crescent Island is designed to be air-cooled, making it easier and less expensive for standard data centers to adopt and lowering the barrier to enterprise deployment.

Validating the technical pivot is the hiring of Eric Demers as Chief GPU Architect. Demers, formerly of Qualcomm (NASDAQ: QCOM) and AMD (NASDAQ: AMD), is a heavyweight in the industry. His arrival signals Intel is once again attracting top-tier engineering talent capable of executing complex designs rather than relying solely on legacy management.

At the same time, Intel is tackling one of AI's biggest bottlenecks: memory. The company finalized a partnership with SoftBank to co-develop Z-Angle memory (ZAM). Current AI chips are constrained by the scarcity and cost of High Bandwidth Memory (HBM). This partnership aims to create a new industry standard by 2029 that stacks memory more efficiently, positioning Intel Foundry not just as a factory but as a center of innovation that can influence the entire industry.

The China Problem: A Capacity Crisis

While the strategic vision is clear, the operational reality is challenging. Breaking reports on Feb. 6 confirmed Intel notified customers in China of delivery delays extending up to six months for its Xeon server processors. That news immediately pressured the stock and raised concerns about first-half 2026 revenue.

It's important to understand the root cause: this is not a demand problem; it is a capacity problem. During the fourth-quarter earnings call, CFO David Zinsner said the company's buffer inventory is depleted. In short, Intel sold essentially every chip it had in inventory during 2025.

Intel has entered 2026 in a hand-to-mouth position. Semiconductor manufacturing isn't a dial that can be turned instantly: increasing wafer production today produces finished chips months later. The current six-month delay in China is the tangible result of those lead times. While this creates a revenue air pocket and softer guidance for the first quarter, it confirms a bullish underlying trend: x86 architecture remains critical to global infrastructure. Demand is real and robust; the supply chain simply needs time to catch up. This is a temporary logistical hurdle, not a permanent structural decline.

Priced for Disaster, Built for Success

The friction between strategic growth and supply constraints has pushed Intel's valuation to historically low levels. The stock is trading at roughly 2x price-to-book. For context, high-growth semiconductor peers often trade at multiples in the 7x–10x range. That valuation gap suggests the market is pricing Intel for structural failure — a scenario the financials do not support.

Investors should remember the downside protection that creates a hard floor for the stock:

- Government Backing: The U.S. government now holds an approximately 10% equity stake in the company, effectively designating Intel as a national champion that is strategically important to the country.

- Strategic Investment: Late in 2025, NVIDIA invested $5 billion in Intel, serving as a strong industry endorsement of Intel's manufacturing capabilities and providing additional capital support.

- Cash Fortress: Intel's balance sheet is healthy — the company exited 2025 with $37.4 billion in cash and short-term investments.

That liquidity provides ample runway to navigate current supply shortages without resorting to expensive financing. The company is turning away orders because demand outstripped supply, not because its products are obsolete.

Patience Pays: Looking Past the Noise

The recent volatility in Intel stock reflects two different timelines colliding. The supply shortages in China are a short-term weather event — painful but transient. The GPU pivot and SoftBank partnership represent a permanent climate change for the company, positioning it to capture the next wave of AI spending.

For traders seeking a quick profit over the next few weeks, the supply-chain headlines present real risk. For investors with a longer horizon — beyond the next two quarters — the current share price looks like a discounted entry point. Intel is rapidly consolidating a cohesive roadmap across manufacturing, memory, and compute. As manufacturing yields improve and inventory buffers rebuild later this year, the market will likely re-evaluate the stock based on its strategic future rather than its immediate logistical challenges.

This message is a sponsored message for Banyan Hill Publishing, a third-party advertiser of DividendStocks.com and MarketBeat.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here.

If you need assistance with your account, feel free to email our South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from DividendStocks.com, you can unsubscribe.

© 2006-2026 MarketBeat Media, LLC. All rights reserved.

345 N Reid Place, Sixth Floor, Sioux Falls, SD 57103. United States of America..

0 Response to "Is Trump Done? Shocking leak…"

Post a Comment