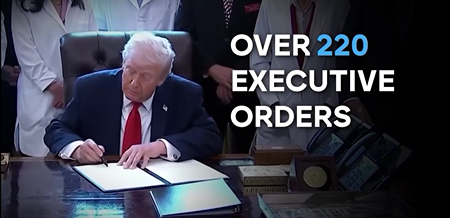

ON FEBRUARY 24, PRESIDENT TRUMP IS

EXPECTED TO SIGN HIS FINAL ONE — EVER! Ian King here with some very big news. After 220 Executive Orders in one year. And with nearly three full years left in office… I have learned the unthinkable… On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order. I know that sounds crazy … I didn’t believe it myself. But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement. I was able to get the full story for you here. Regards,

Ian King

Chief Strategist, Strategic Fortunes

Further Reading from MarketBeat.com Offshore Titans: Transocean Buys Valaris for $5.8BBy Jeffrey Neal Johnson. Article Published: 2/12/2026.

Key Takeaways- This transformative combination creates a clear market leader with a massive and diverse fleet of ultra-deepwater drillships and high-specification jackups.

- The all-stock transaction strengthens the financial profile of the combined entity through significant operational cost savings and improved balance-sheet flexibility.

- Consolidating these two industry giants positions the new organization to capture pricing power and maximize returns during the expected market recovery.

Transocean Ltd. (NYSE: RIG) has taken a decisive step to cement its position as the leader in offshore drilling. By agreeing to acquire Valaris Limited (NYSE: VAL) in an all-stock transaction valued at approximately $5.8 billion, Transocean is not just expanding — it is reshaping the scale of the energy services sector. The market's reaction was immediate and broadly positive. Valaris shares rose about 34% on the news, moving the stock price toward the acquisition premium. Three Nobel Prize Winners expose this once-in-a-generation wealth shift:

"Don't Say I Didn't Warn You"

Porter Stansberry exposes how the convergence of three immense forces is about to rewrite everything about the American way of life: how you work, save, invest… it's all about to change. Don't be left behind. Click here now. Transocean shares also climbed, lifting year-to-date performance to roughly 30% and pushing the stock to 52-week highs. This enthusiasm suggests a shift in investor sentiment. After years of caution around traditional energy, investors appear increasingly willing to back long-cycle offshore projects. Despite the global focus on energy transition, the physical reality of declining onshore reservoirs requires large-scale investment in deepwater basins. By consolidating now, Transocean is securing the capacity and pricing power needed to lead the expected multi-year upcycle. The Blueprint: Deal Mechanics and Immediate ValueThe structure of the deal is straightforward but transformative. Valaris shareholders will receive 15.235 Transocean shares for each Valaris share they own. That exchange ratio conveys a premium for Valaris' assets and recognizes the company's operational turnaround since 2021. When the transaction closes — expected in the second half of 2026 — existing Transocean shareholders are projected to own about 53% of the combined company, with Valaris shareholders holding 47%. The combined company will be a substantial player in the sector. Key metrics include: - Enterprise Value: Approximately $17 billion.

- Fleet Size: 73 total rigs, including 33 ultra-deepwater drillships, 9 semisubmersibles, and 31 jackups.

- Revenue Backlog: About $10 billion in secured future work.

That backlog gives investors clearer visibility into future cash flows. Management also expects more than $200 million in annual cost savings from streamlined corporate overhead and optimized supply chains. Those savings should immediately expand profit margins, even before day rates recover. The Perfect Marriage: High-Spec Assets and Clean BooksThe merger pairs complementary strengths. Operationally, Transocean brings one of the industry's most advanced ultra-deepwater fleets, including the Deepwater Titan and Deepwater Atlas — the only two drillships globally outfitted with 20,000 psi blowout preventers. Those capabilities are essential for high-pressure, high-temperature reservoirs in the U.S. Gulf of Mexico, projects many competitors cannot access. Valaris adds a versatile floater fleet and the world's largest high-specification jackup fleet, plus the ARO Drilling joint venture with Saudi Aramco. That JV provides a steady, long-term foothold in the Middle East shallow-water market, balancing Transocean's higher-risk deepwater exposure. Financially, the deal is also sound. Transocean has historically carried significant debt, a frequent concern for investors. Valaris, having reorganized in 2021, entered the market with a clean balance sheet, net cash and modest leverage. Combining the two dilutes Transocean's debt concentration across a larger asset base and stronger cash flow. Management has targeted a leverage ratio near 1.5x within 24 months of closing, effectively shifting Transocean toward a more stable, blue-chip energy services profile. The Oligopoly Era: Why Consolidation Drives PricingThe timing suggests management believes the industry is near a cyclical inflection point. The offshore drilling market is stabilizing in 2025, with dayrates softening slightly as oil majors exercise temporary budget discipline. Transocean is using this lull to buy capacity at what it sees as the bottom of the cycle, positioning itself for an expected demand surge in 2027. Importantly, the deal reinforces a supply oligopoly. After Noble Corp.'s acquisition of Diamond Offshore, the U.S.-listed offshore drilling market is now dominated by two large players: Transocean and Noble Corp. With fewer competitors, the remaining firms can exert better pricing discipline, reducing the likelihood of a race to the bottom in dayrates that has hampered previous cycles. Recent activity supports this bullish view. Major oil companies are sanctioning complex projects in Brazil, Guyana and West Africa for 2027–2028. Third-quarter 2025 results underscored the sector's resilience: Transocean reported Adjusted EBITDA of $397 million, while Valaris delivered EPS of $2.65. Even in a quieter market, both firms continue to win work — Transocean secured the Deepwater Skyros in Australia, and Valaris added a DS-12 contract in Egypt. The New Standard for Offshore EnergyThe Transocean–Valaris merger presents a compelling risk-reward case. It addresses Transocean's chief weakness — leverage — while maximizing exposure to an anticipated deepwater recovery. By combining industry-leading deepwater assets with a much stronger balance sheet, the new company is well positioned to capture a large share of global offshore capital expenditure. With offshore breakeven costs often below $50 per barrel, deepwater projects remain competitive with onshore shale. That cost advantage helps insulate the combined company from moderate oil-price swings and keeps deepwater investment a priority for producers. As a one-stop provider for global drilling needs, the merged company looks poised to lead the offshore sector for years to come, supporting the stocks' recent upward momentum.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here. |

0 Response to "Is Trump Done? Shocking leak..."

Post a Comment