Silicon Valley Was Built by Washington, Not the Market – and It's Happening Again

Most people think Silicon Valley was built by entrepreneurs. By garage tinkerers, venture capitalists, and risk-taking founders chasing consumer demand. Take Jeff Bezos. In 1994, he noticed something most people did not: The internet wasn’t just “a passing fad”… it was the future of computing. By that point, the web had grown more than 2,000% in a single year … which made Bezos sit up straight. Bezos was a vice president at the D.E. Shaw hedge fund. So he did what numbers people do: He made a list… What could you sell online that the world already wanted … and that a single digital “store” could scale to everyone, everywhere?

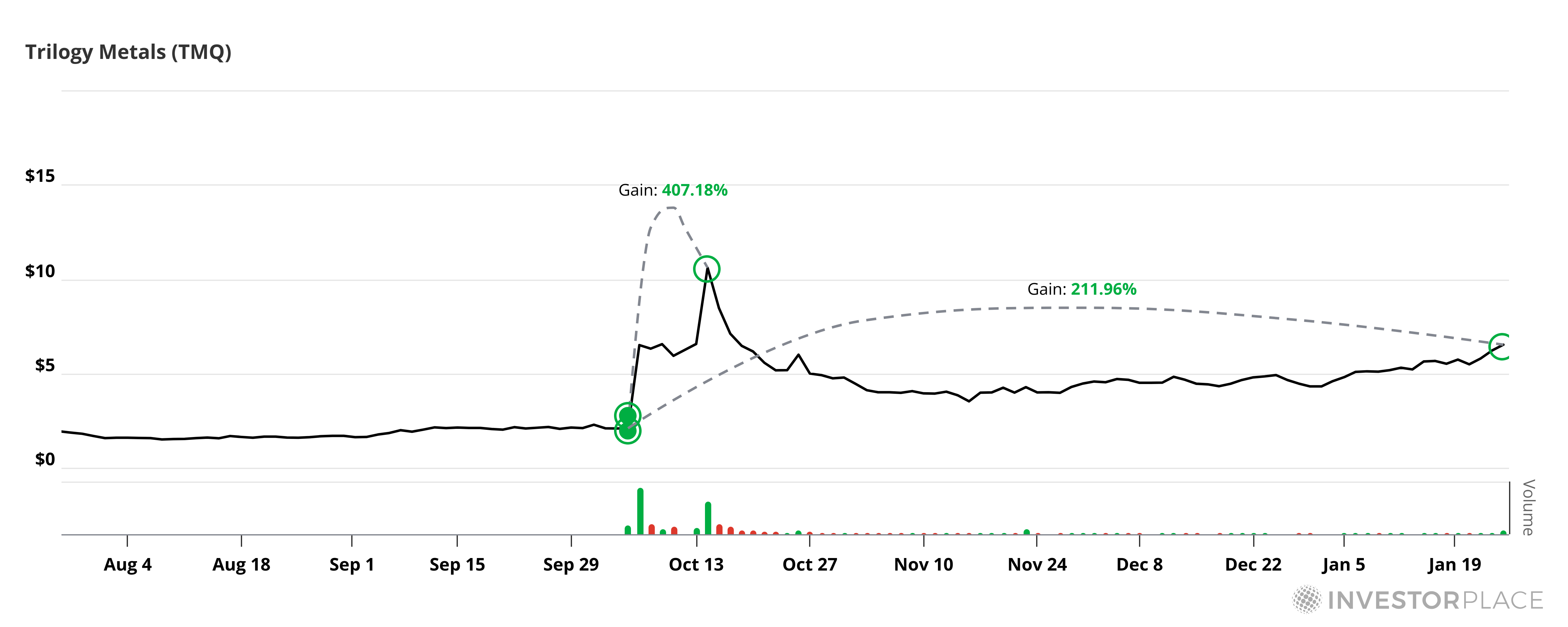

The first headquarters of Amazon, a single-family home at 10704 Northeast 28th Street in Bellevue, Washington, near Seattle That’s how Amazon was born… And that’s the version of Silicon Valley we love to tell. It’s a comforting story… because it makes our greatest tech boom feel within reach. If only you have enough ambition, enough industrial insight, then you too could become an American icon. But the truth is more useful for investors. So below, I’ll reveal more about the secret real driver behind Silicon Valley… And I’ll show you how it proves that you don’t have to be an entrepreneur to get rich on innovation… The Real Story Behind Silicon Valley During the Cold War, Washington couldn’t “wait for markets” to produce the electronics, computing power, and communications systems national security required. So it stepped in… not as a regulator on the sidelines, but as the first customer, the largest check writer, and the ultimate accelerator. Defense and space agencies funded research, creating demand. They paid companies to build unproven technologies that had no civilian market yet, like integrated circuits, early computers, satellite communications, and networking protocols. Fairchild Semiconductor became a semiconductor powerhouse because the government needed missile guidance systemsbecause the U.S. government needed guidance systems for missiles. Intel Corp. (INTC) didn’t scale because PCs were flying off shelves. It scaled because Washington needed reliable chips, at scale, and was willing to underwrite the cost. Federal demand created a loop of guaranteed revenue, talent concentration, scaled manufacturing, and falling costs — which then unlocked civilian markets. Entire industries were born this way. And a handful of early investors didn’t need to guess which stocks would skyrocket. They simply followed the flow of government capital. Now the same playbook is back. Enter the Genesis Mission Now Washington is launching the Genesis Mission – a push to fuse America’s top supercomputers, scientific data, and research labs into a unified AI platform. The signal is unmistakable. We've already seen the White House make strategic equity investments in Intel, MP Materials Corp. (MP), Trilogy Metals Inc. (TMQ), Lithium Americas Corp. (LAC) and xLight. Just have a look at Trilogy Metals before and after the Trump administration invested $35.6 million in the company:

Even if you missed that initial surge, TMQ is still up 200%-plus since. Industrial policy has become industrial warfare. And it's shining a spotlight on an industry set to dominate Wall Street in 2026. Because here's what they're not saying out loud… AI without robots is just ChatGPT. Control of supply chains, physical production, and the technologies that turn software intelligence into real-world power – that's the endgame. When you map these investments onto the Genesis Mission's strategic pillars, the government's grand plan becomes undeniable. Robotics Is the Real Endgame Robots without AI are just basic machines. But AI plus robots equals production dominance. Robots turn AI into physical output — manufacturing, logistics, defense. Indeed, according to recent reporting from Politico , the administration is considering an executive order to support the U.S. robotics industry in 2026. The Genesis Mission centers on six core industries: - Semiconductors

- Energy (nuclear + grid + storage)

- Critical minerals

- Advanced manufacturing

- AI

- Robotics/physical automation

If you'll notice, robotics is an integration of the other five. Robots need chips, energy, magnets, copper, lithium. They automate manufacturing. AI is their brains. That’s why the idea of a robotics executive order matters so much now. It would be a declaration that Washington wants the U.S. to lead the world in robotics… and is willing to help us get there. Here's where the upside consolidates and the robotics stocks to keep your eye on… The Flagship Narrative Name - Tesla Inc. (TSLA) sits at the intersection of AI, manufacturing, robotics, and America itself. Its Optimus humanoid robot is designed to work in U.S. factories, built by a company already reshoring aggressively.

Warehouse & Logistics Automation: - Symbotic Inc.’s (SYM) AI-driven warehouse automation is already scaled, deployed, and saving labor. If Washington wants to harden domestic supply chains without blowing up inflation, this will be the tech that gets subsidized and accelerated.

- Teradyne Inc. (TER) dominates collaborative robots (cobots), which manufacturers can deploy without rebuilding entire factories. If the goal is broad-based adoption, cobots are the fastest way there.

Service & Labor-Substitution Robots - Serve Robotics Inc. (SERV) creates last-mile delivery robots solving real economic problems: labor shortages, urban congestion, service-sector inefficiency.

- Richtech Robotics Inc. (RR) is developing hospitality and service robots to deploy in hotels, restaurants, casinos, and senior living facilities.'

Security & Infrastructure Robots - Knightscope Inc. (KSCP) builds autonomous security for malls, warehouses, transit hubs, infrastructure, etc. If robotics starts flowing through federal infrastructure budgets, this category could benefit big-time.

The Picks-and-Shovels Layer - The smart money often flows to providers of critical supplies and materials. Robots need sensors, cameras, actuators, control and safety systems, and more. So, companies like Cognex Corp. (CGNX), Keyence Corp. (KYCCF), and Rockwell Automation Inc. (ROK) will ride the wave when robot counts rise.

2026 Is the Inflection Point for America's Robotics Industry AI is powerful and widespread. Hardware costs are falling. Labor is scarce and expensive. And the White House is done waiting for markets to self-correct. It's realized that if America doesn't shape the next industrial era, someone else (China) will. So, 2026 looks like the year robotics breaks out. American power, productivity, and geopolitical leverage demand it. The smart money won’t wait for any official announcement. It positions before the market reprices the entire sector. The Genesis Mission is reshaping the American economy behind the scenes … directing capital, accelerating timelines, and backing the companies that matter most to national strategy. That’s why my team and I have put together a free Genesis Mission broadcast, where I break down how this buildout is unfolding, where the real constraints are, and how investors can position before Wall Street fully prices in what’s happening. Silicon Valley was not an accident. And the next great technology ecosystem won’t be either. Watch the free Genesis Mission broadcast here. |

0 Response to "Silicon Valley Was Built by Washington, Not the Market – and It’s Happening Again"

Post a Comment