Ticker Reports for October 4th

The Outlook for Interest Rate Cuts Got Blown Out of the Water

The September NFP was so smoking hot that it blew the outlook for interest rates out of the water. The headline figure alone was enough to alter the outlook, signaling healthy, resilient labor market conditions, and the revisions sealed the deal. Revisions averaged 72,000 higher monthly in July and August, belying fears that a recession was near. The takeaway for investors is that the FOMC is unlikely to continue with aggressive interest rate cuts and may even pause due to labor market health. Their dual mandate is in balance with labor markets showing strength, inflation trending quickly toward 2%, and the risk of inflationary acceleration back on the table.

Wage Growth Soars in September: Labor Market at an Inflection Point

Not only was job creation strong, but wage growth was robust. The average hourly wage rose by $0.13 with revisions, up 0.4% monthly and 4.0% compared to last year. The data is trending higher, with YoY wage-level inflation back at 4.0%, sufficient to give the FOMC reason to pause. The not-adjusted as-reported data is more compelling, with monthly gains at 0.8% and 4.5% YoY, suggesting sustained consumer health through the holiday season.

As reported by Challenger, Gray & Christmas, hiring intent is also strong. The 403,891 job openings announced in September are seasonally expected and show sustained labor market strength. However, only some of the news is good. The Challenger, Gray & Christmas report also shows the labor market at an inflection point where Senior Vice President Andrew Challenger says it could begin to stall or contract.

The most telling data points are the surge in job cuts, hiring intent, and trends. The 72,821 job cuts announced in September are up 53% compared to September 2023, hiring intent is down compared to last year, and September is the first month 2024 figures surpassed 2023. The 2024 YTD total is only 0.8% above 2023, but it is trending in the wrong direction and could lead to labor market contraction. Regarding the GDP outlook, the Atlanta Fed’s GDPNow tool continues to track in the 2.75% range, well above the analyst consensus and the forecasts for the year.

Overly Optimistic Market Still Expects Two More Cuts By December

The outlook for FOMC interest rate cuts, as forecasted by the CME’s FedWatch Tool, has softened but continues to price at an aggressive pace. The market is pricing in 100% chance for 25 basis points in November and December and another 100 bps by the end of the following year. While cuts will likely continue, the pace will likely be slower than what is currently priced in. The next FOMC meeting is weeks away, with numerous data points still due, including a reading of PCE and the CPI.

Oil has reemerged as a threat to inflation. The oil price is trading near the bottom of its long-term range but showing a clear bottom driven by geopolitical tensions. The market is well-supplied, but there is a significant risk of disruption in the Middle East, and price action in WTI is set to move higher, given the catalyst.

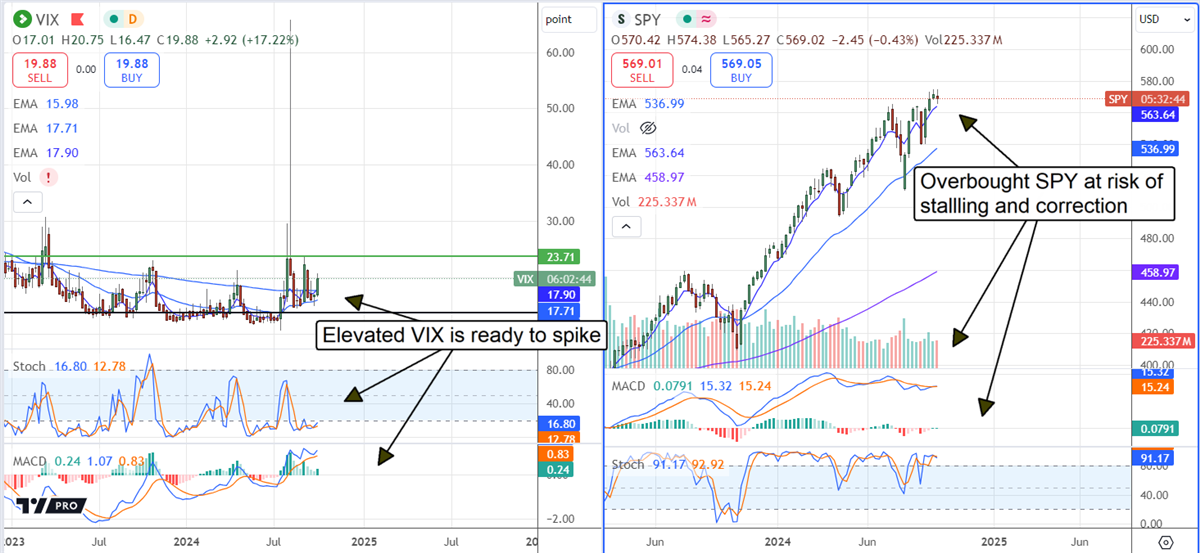

The S&P 500 Stalls Near Record Highs

The S&P 500 (NYSEARCA: SPY) responded favorably to the news, moving higher in early premarket trading, but could not hold the gains. Selling was equally tepid, leaving the market up daily but showing resistance at a critical level, just below the record highs. The takeaway is that market action remains mixed, with no clear indication of direction, and risk is skewed to the downside. As the VIX (CBOE: VIX) indicates, the risk of a major correction remains elevated, with the fear index trading well above the 2024 lows and indicated higher.

2024's Must-Watch Stocks!

Welcome to a year of unparalleled opportunities! Dive into our exclusive guide, "9 Stocks Set to Soar," meticulously selected to elevate your portfolio in 2024. Step into 2024 with confidence and the right assets at your fingertips. Click below to opt-in and receive up to two additional free bonus subscriptions. Unsubscribe at any time.

[Unlock Your Report Now]3 High-Risk, High-Reward Micro-Cap Stocks You Shouldn't Ignore

Micro-cap stocks are typically categorized as companies with market capitalizations between $50 million and $300 million. However, it’s not a hard-and-fast rule. Many small stocks can fluctuate massively in price over a short time. This can put their value inside or outside that range on a given day.

Picking micro-cap stocks can yield massive returns but can also be extremely risky. For example, when NVIDIA (NASDAQ: NVDA) went public in 1999, the company had a market capitalization of $279 million. Holding that investment from then to now would have generated a total return of over 300,000%. In other words, a $10,000 investment in 1999 would have turned into over $31 million.

However, micro-caps can also result in shareholders losing all of their investments. SunPower (NASDAQ: SPWR) is a recent example of this. The company traded in the micro-cap range for several weeks before the NASDAQ delisted it on Aug. 16. It filed for Chapter 11 bankruptcy and is now worth nothing.

Below are three micro-cap stocks with significant potential and significant risk. They sit within or just outside the $50 million to $300 million market capitalization range.

Can Rent the Runway Get Back on Its Feet?

Rent the Runway (NASDAQ: RENT) made a strong name for itself as one of the first entrants into the clothing rental space. The company allows customers to rent uber-expensive designer clothing, costing them much less than buying it outright.

It is improving its financial situation and expects to break even on cash flow this year. However, subscribers to its service are declining as competitors are seeing massive growth.

The rapid expansion in subscribers for competitor Nuuly shows that there is growth to be had in this market. Rent the Runway’s valuation is extremely low, but reinvigorating growth is essential to its long-term success. In August, the company saw a 20% increase in orders in its “reserve” segment, which helped create a flywheel effect to attract more monthly subscribers.

Additionally, the company says the improvements in its website have “almost doubled checkout completion rate compared to the first half of the year.” This means customers are buying products more often rather than leaving them in their cart. Lastly, the company hired a new Chief Marketing Officer in March to reignite customer interest.

374Water’s Hopes Lie in Central Florida

374Water (NASDAQ: SCWO) is a wastewater treatment company that is developing a new technology for this industry. It is currently at a crossroads as it tests its products with the City of Orlando.

If the tests are successful, the city said it intends to purchase multiple units from the company.

These purchases would mark the company's first significant revenue. The firm announced just last week that its systems are up and running in Orlando and should provide periodic updates about the project. The company will also use its Orlando operation to demonstrate the tech to potential federal and industrial customers. So, it may be able to parlay this into many more customers than just the city.

These updates will be key tests of the technology. They should greatly affect 374Water's chances of long-term commercial success.

Skye Bioscience: A Weight Loss Drug Boom or Bust?

Last on the list is Skye Bioscience (NASDAQ: SKYE). Skye is a clinical-stage pharmaceutical company that is developing a different type of weight loss drug. Recently, GLP-1 agonist drugs have seen massive commercial success. Skye’s drug, nimacimab, is a CB1 inhibitor. It is intended to have similar weight loss effects as GLP-1 drugs like Ozempic and Zepbound but works through a different mechanism.

The hope is that the successful development of a CB1 drug could open up a new market of customers who respond better to its mechanism of action compared to GLP-1s. CB1s could also possibly be used together with GLP-1s to compound their effects. However, CB1s have a history of inducing negative psychological effects. Novo Nordisk’s (NYSE: NVO) CB1 inhibitor was shown to have those same problems in recently released results, which caused the company’s shares to fall 5% in one day. However, the drug did show adequate weight-loss effects.

Skye released a statement about Novo’s results, stating that the weight loss results validate Skye’s drug. At the same time, Skye laid out a case for why its drug could mitigate the negative psychological effects. Skye could have a blockbuster drug if nimacimab gets through all Food and Drug Administration trials. But it still has a long way to go, having entered Phase 2 trials in August.

Tim Sykes' Urgent Trade Alert: "Make this move now"

WARNING: 80 Wall Street banks are gearing up for MASSIVE D.C. shock

This $2 trillion D.C. shock is NOT about Trump or Biden dropping out of the race…

3 Bargain Stocks Positioned for Gains After Missing 2024's Rally

By most accounts, the stock market has had a very good 2024. The S&P 500 has provided a total return so far of 20.6%. That significantly outpaces the 11.7% average over the past 30 years. It beats out the returns in 19 of those 30 years, but there are still two months and a presidential election to come.

Although just because the market is going up doesn’t mean every stock is having a great year. Over 300 S&P 500 stocks are underperforming the index; the top names are disproportionately driving its returns. As one might expect, those top names are companies that have something to do directly or indirectly with the rise of AI and data centers. Nuclear power companies, chip designers, and hyperscalers come to mind.

Below are three stocks that have missed out on the rally, are trading at a favorable valuation, and have the ability to recover.

Lam Research Is Projected to Come Out of Its Sales Slump

Lam Research (NASDAQ: LRCX) is one chip stock that hasn’t ridden the success of its industry in 2024. Shares have provided a total return of just 4%, while the PHLX Semiconductor Index has returned nearly 24%. The company is an equipment provider to chip fabrication firms.

Its main U.S. competitor is Applied Materials (NASDAQ: AMAT), which has returned 23% this year. An inventory glut in the chip industry has hurt equipment firms like Lam. Its trailing twelve months sales fell 14% last quarter.

Applied Materials has been able to weather this storm better, with sales slightly positive. However, going forward, analysts expect Lam to see higher revenue and growth in earnings. Analysts expect the company’s revenue to rise by 16% next year, compared to just 2% for AMAT. Earnings per share growth is expected to be 18% versus 6% for AMAT.

Compared to the U.S. technology sector, Lam’s forward price-to-earnings ratio is below the middle of the pack. Additionally, Wall Street analysts see solid potential in the stock. The company’s average price target implies an upside of 24%.

Adobe’s GenAI Investments May Take Time to Pay Off

Adobe (NASDAQ: ADBE) is another technology firm that the market hasn’t liked in 2024. The total return of the company is nearly -16% this year. The company has a suite of software for business and creative use. It includes Photoshop, Premiere Pro, and Adobe Acrobat. Adobe is a leader in this space. It is investing heavily in GenAI via its Firefly tool, which it integrates into its software. It is working to stay on top by integrating these features to avoid losing market share to legacy and startup competitors.

The company has been consistently beating analyst estimates on both revenue and adjusted earnings per share (EPS). But weak forward-looking guidance has overall hurt the share price. Additionally, the company has continued to increase its margins, but the market still isn’t giving it much credit. The company’s forward P/E ratio is right in the middle when it comes to U.S. technology firms, yet its margins are sky-high. Its operating margin beats out 94% of U.S. tech companies.

There is worry about Adobe's ability to compete with other firms that offer similar products at a lower price. But it is still in the driver's seat of its market. As long as it continues investing to stay ahead of the curve, the results should come. I believe we are still in the early innings of people adopting AI, and the company’s offering should help increase revenue growth more in the future. The average analyst's price target currently implies a 22% upside in the stock.

Wall Street Sees the Most Upside in Merck Among Big Pharma

Last is Merck & Co (NYSE: MRK). Merck has provided a total return of just 3% this year, well below the 12% median among its peer group of the 10 largest pharma firms. That’s despite the fact that its net income has risen faster than most of those firms.

Its 13x forward P/E ratio is trading below the median of those firms as well and is nearing historically low levels. At the same time, the company’s operating margin is near the top of the pack.

The market isn’t rewarding Merck largely because its biggest drugs aren’t going quickly, making its strengths go unnoticed. However, Wall Street sees the most upside in Merck stock compared to its peers, with its average price target implying a 26% upside. Cantor Fitzgerald is particularly bullish. It just released its reiterated $155 price target, which indicates shares could rise by 40%.

0 Response to "🌟 3 Bargain Stocks Positioned for Gains After Missing 2024’s Rally"

Post a Comment