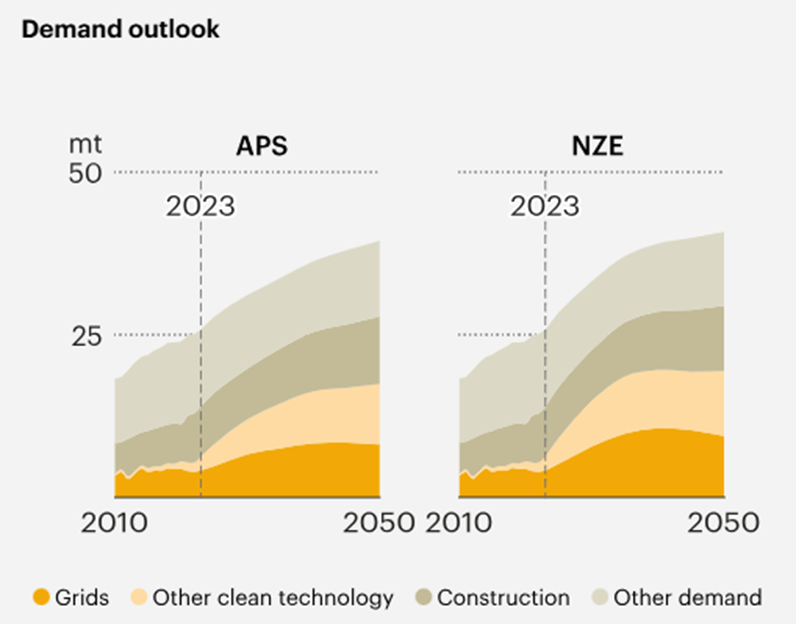

| DAILY ISSUE Copper at $5.50 Could Signal the Start of an AI Metals Explosion VIEW IN BROWSER Tom Yeung here with today’s Smart Money. During the 1980s, traders used “Dr. Copper” to measure the health of the economy. The higher the metal’s price, the rosier the outlook. That’s because copper has a highly cyclical demand. It’s the second-most conductive metal (next to silver), which means virtually every electric wire, motor, and computer chip relies on it. And so, Dr. Copper is one of the first to notice when consumers are opening their wallets to buy new electronics and cars. Copper is also used extensively in the construction industry, particularly in plumbing and roofing. In fact, the world produces enough copper to give every city, town, and village in America 15 Statues of Liberty’s worth of the metal every year. We also benefit from Dr. Copper’s clear signals. Unlike academics with actual PhDs in Economics, Dr. Copper doesn’t mind giving a solid answer. The metal’s prices are either rising or falling. For instance, copper values doubled in 2020 as Covid-19 stimulus began to take hold, and then plummeted 30% in early 2022 as “year of efficiency” cuts kicked in. A recent resurgence in Chinese prices suggests that the country’s real estate market is starting to turn a corner. Now, Dr. Copper is making a new prediction. It’s one that spells great news for the $1 trillion AI industry… and especially a small subsector you don’t want to miss. Let’s take a look… | Recommended Link | | | | A brand new technology is lining up to be more disruptive than the internet or even today’s most advanced artificial intelligence. Those who prepare now could see massive stock gains. Those who don’t could find themselves on the wrong side of history. Click here for 3 steps to take today. |  | | The AI Revolution Boom Dr. Copper’s prediction is that spending on artificial intelligence infrastructure will surge. Since January, U.S. copper prices have crept up from $4 per pound to $5. The conductive metal is essential to the electrical wiring that powers AI data centers, and rising demand has steadily pushed its prices higher. That demand is expected to accelerate in the coming years. Analysts at the International Energy Agency (IEA) expect copper demand to rise another 50% through 2050 in both Announced Pledges Scenario (APS) and Net Zero Emissions (NZE), as shown in the graph below.

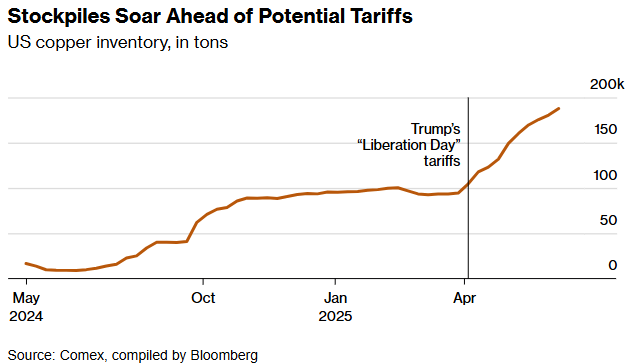

Meanwhile, mining supplies are set to decline. By the time we get to 2040, the IEA believes that current projects might only supply half of the world’s needs. Dr. Copper got another shot in the arm on Tuesday after President Donald Trump announced that 50% tariffs on the metal could start by the end of this month. Prices jumped another 10% to a record $5.50 per pound. In other words, Dr. Copper isn’t worried about demand destruction caused by higher tariffs. Nor is it overly concerned about the government debts created by the latest One Big Beautiful Bill tax package. Instead, it’s suggesting that demand for AI is so red-hot that a new 50% tax on imports will have no lasting impact on the industry. Remarkably, tariffs might even help boost short-term demand as builders rush to stock up on copper. We’ve already seen some action by importers since “Liberation Day” tariffs were announced in April, as shown in the graph below. Markets should expect even more stockpiling over the next several weeks, sending prices even higher.

This has had an incredible effect on mining companies, particularly those that Eric recommends in his premium services. Take Freeport-McMoRan Inc. (FCX), for example. As one of the world's largest publicly traded copper producers, the company is up 23% year-to-date… and has now risen 215% since Eric added the U.S. copper miner in to his portfolio back in 2020. More gains are likely ahead. Freeport-McMoRan operates one of the last two copper smelters in America, and 50% tariffs on imports would mean it no longer must compete against cut-priced imports. Years of overproduction in China have left the country with too much capacity, causing refining charges to turn negative in recent years. “It’s a really hard business,” Freeport CEO Kathleen Quirk said in a recent interview with Bloomberg News. “Unless you’re compelled to build one – unless the government says you have to do it – you’re just going to be economically incentivized to export.” We’re also seeing a surge in other metals thanks to rising tariffs and insatiable infrastructure demand. Shares of another Fry’s Investment Report recommendation – aluminum miner Alcoa Corp. (AA) – have risen 10% in the past month. And members of that service have seen their investment in platinum rise 41%. And Lynas Rare Earths Limited (LYSCF), an Australia-based producer of rare earth materials, has racked up even bigger gains in Eric’s elite service, The Speculator. His subscribers have seen gains of 250% since Eric recommended the mining company in August 2020. The company is the largest producer of rare earth minerals outside of China. And it is building a first-of-its-kind, U.S.-based rare earths facility in Seadrift, Texas. So, Eric expects this stock to continue surging higher. To learn more about The Speculator, click here. Yet, Dr. Copper and its well-known friends aren’t the only commodities that will benefit from AI-triggered demand – and recent related U.S. legislation… The Other AI Metals In January, President Trump issued Executive Order #14179, titled “Removing Barriers to American Leadership in Artificial Intelligence.” In it, the administration laid out plans that could supercharge a new AI trade in a “forgotten” materials sector: the rare earth materials used in AI chips and infrastructure. These minerals are just as important as copper… and far harder to find. In fact, some of rare earth minerals only see 10 tons produced annually – barely the weight of two Tesla Model 3’s. That’s why several companies that aim to produce these rare earth metals have already seen their share prices rise 100%… 200%… 400% this year. America needs these rare earth materials, and China (which supplies most of the world’s needs) is becoming increasingly stingy about exporting them. Shares of one of these firms rose as much as 60% this morning after the Department of Defense announced a “megadeal” to pour $400 million into the firm. This is just the start. Just last night, InvestorPlace Senior Analyst Louis Navellier held a special presentation to discuss why even bigger gains are coming from this “forgotten” subsector of the market tied to critical minerals used in AI. Even after this morning’s news, many oof these “forgotten” stocks are still trading for pocket change… and have the potential see 10X–100X returns. So, be sure to catch the replay of Louis’s free broadcast. In it, he goes into more detail on this new AI trade President Trump is triggering, and the opportunity that includes five “critical mineral” stocks that could fast track your profits. Click here for that broadcast. Until next week, Thomas Yeung, CFA Market Analyst, InvestorPlace |

0 Response to "Copper at $5.50 Could Signal the Start of an AI Metals Explosion"

Post a Comment