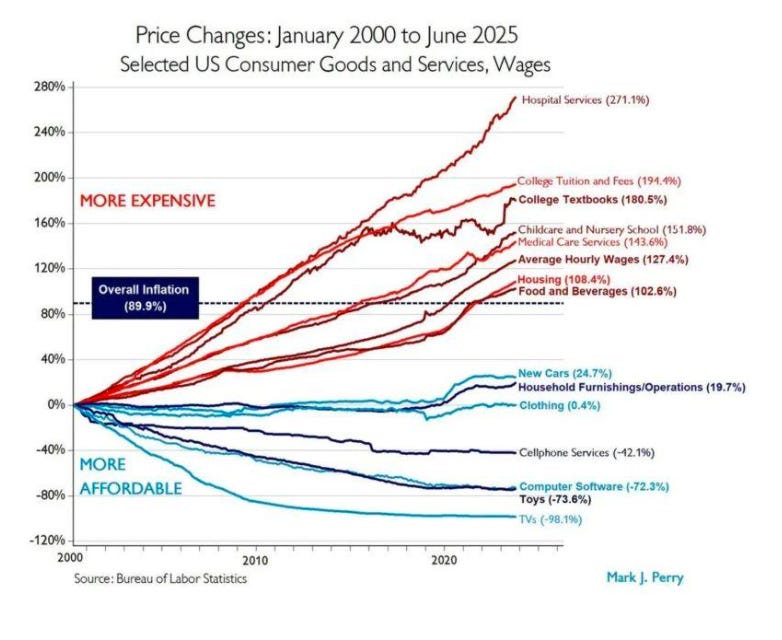

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. How to Make Housing More Expensive...Look, I don't like taxes... but this is not good for America...Dear Fellow Traveler: Wondering why socialist mayors keep winning elections across America? Here's your answer: economics. Not that they understand economics… neither do their voters. But when rent eats 50% of your paycheck, anything labeled "free" sounds like a dream compared to watching your landlord buy a third investment property with your monthly payments. We’ve had three decades of money printing, inflation targeting, quantitative easing, foreign swaps, bailouts, and six straight years of "accommodation" in our post-COVID wonderland. The result? Housing prices have exploded by over 108% since 2000. Look… I don’t like taxes. However, cutting taxes on housing sales… will not solve the housing issue… It will make housing more expensive. And bring along… more socialist mayors… and potentially worse. A new FDR… Britain Tried This. It Was a Disaster.Before we hand out more tax breaks to the CEO of Citadel, let's check the instant replay from across the pond. In July 2020, Britain eliminated stamp duty taxes on homes under £500,000. The goal was to help buyers save up to £15,000. Sounds great. The politicians promised it would make housing "more affordable." What actually happened? Housing prices shot up like a rocket. Buyers ended up paying the same total cost. The “savings” just went to the sellers instead of the government. Imagine you get a $100 restaurant gift card… And then you find out the restaurant doubled its prices. The economic principle here is as predictable as a shitty Marvel movie. If you reduce transaction costs on supply-constrained assets, you increase demand. When demand increases faster than supply, prices go up. I thought we knew all this… even on the Stephen Moore side of the economic spectrum. Who Really Benefits (Hint: Not You)Most American homeowners already pay zero capital gains tax when they sell their primary residence. Single filers can exclude up to $250,000 in profit. Married couples get $500,000. So who would actually benefit from eliminating the tax entirely?

Congratulations! You just made U.S. residential real estate significantly more attractive to foreign capital. Multi-family REIT stocks would surge… like… SURGE… Congratulations to shareholders in AvalonBay Communities (AVB), Equity Residential (EQR) and Camden Property Trust (CPT) Sure… calling it a full "tax haven" overstates things given FIRPTA rules, local taxes, and property taxes still apply. However, the broader point remains: tax-favored treatment attracts international capital like moths to a flame. The Investor Feeding FrenzyEliminating capital gains taxes wouldn't just benefit current homeowners. It would also fuel a massive surge in investment demand that would significantly distort an already strained market. Imagine private equity firms that can pay cash and close in 10 days, now with tax-free appreciation as a cherry on top. Foreign investors from countries with capital controls, suddenly finding U.S. residential real estate irresistible. Both groups would be bidding against a dozen 28-year-old baristas for the same limited housing stock. The baristas don’t win… and their rents go up… But guess which of these bidders votes? And guess which ones find “free” more attractive when it comes from a crazy man with no economics background but a willingness to make insanely bold promises… all while blaming capitalism for the problem… The politician's logic is: "people will sell their homes and buy new ones. This misses like every Storm Trooper in a Star Wars movie… Some existing homeowners will trade up. However, you're also attracting entirely new categories of buyers who weren't previously in the market. More demand. Same supply. Higher prices. The Real Problem (That Nobody Wants to Fix)The real issue isn't taxes. It's supply. America has 25,000 different jurisdictions controlling housing zoning, most of which are dominated by NIMBY attitudes. Wealthy neighborhoods fight new construction like it's an invading army. They'll block affordable single-family homes and multi-family housing with equal enthusiasm. They people wonder why their kids can't afford to live nearby. But fixing zoning restrictions doesn't generate campaign contributions from real estate investors. Tax cuts! Now that's a policy platform! Follow the Money (It's Always About the Money)Let's be honest about what this proposal really does:

It's like trying to solve traffic by giving everyone a Ferrari. Sounds great until you realize the roads are still the same size. The Solutions Nobody Wants to HearIf we actually wanted to help American families achieve homeownership, the solutions are sitting right there:

THIS… IS… NOT… HARD… If you're looking for actual solutions to the housing crisis, they involve building more houses. Wild concept, I know. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "How to Make Housing More Expensive..."

Post a Comment