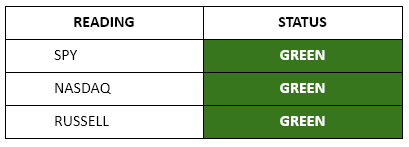

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Good morning: Today’s the MOST IMPORTANT FED MEETING EVER… Or something like that… As you expect, today’s Fed presser at 2:30 PM ET will generate a lot of attention. We know that the Fed’s not chopping rates this week. The real question will center on Fed Chair Jerome Powell’s ongoing spat with President Trump. Markets will be busy today. Names like Tesla and NVIDIA will be VERY active directionally after the bell… But I ask that you pay very close attention to the 2:35 trade that I’ve discussed in the past. For the last two Fed meetings, we haven’t had a large “Post Powell” squeeze. But we have seen large directional moves. The markets are still stretched… and there remains a search for a catalyst to fuel a selloff. I am not completely convinced that today’s Fed meeting is that catalyst simply because markets already know what to expect. Liquidity remains strong… Like… REALLY strong. According to a new measure by Michael Howell, global liquidity is put at above $183 trillion, and an expansion of accommodative conditions is above a 10% annualized pace. A decline in bond volatility has created tailwinds for these conditions, in addition to a weaker U.S. dollar. Policies around the globe have been supportive of monetary inflation, which has helped support global equities and cryptocurrencies. This has also helped push gold to recent highs and encouraged more risk-taking in emerging market stocks that have been ignored in recent years by investors. What’s going to reverse all this? A shift in policy and coordination… and the only major threat that I foresee is some odd change that comes in August during the Fed’s symposium in Jackson Hole. For now… it remains “Risk On.” As stretched as these markets are… Trader’s FocusThe Fed man cometh. Markets are drifting ahead of today’s 2 PM Fed decision and Powell’s press conference 30 minutes later. Add in a heavy earnings calendar with Meta, Microsoft, Robinhood, and more, and we’re looking at one of the busiest sessions of the summer. Intraday momentum is opening around negative four this morning. Nothing alarming yet, but enough to keep us cautious at the open. Futures bounced after hitting yesterday’s low on SPY near 634.50, and have yet to break back above the midday level from around lunchtime. Until that happens, we’re trading under a slight caution flag. VIX futures remain under 18, bond volatility sits at multi-year lows, and the Magnificent 7 ETF (MAGS) is testing all-time highs. The market remains bullish for now, with rotation continuing through defensives, energy, then likely back to high-beta names. It’s hard to see anything coming out of this Fed meeting that meaningfully changes market direction. The focus has been on headlines around trade, policy shifts, and big tech earnings. Powell isn’t expected to deliver any surprises today. The meeting will spark a rush of midday volatility and give market makers some quick action, but the real driver comes after the bell with Microsoft and Meta when they report earnings. If there’s anything that can knock this market off its perch, it will likely come from a tech miss or changes in forward guidance, not the Fed. We’ll break it all down live at 8:45 AM ET and map out the setups heading into what could be the most important trading window of the week. If you’re not in the room this morning, you’ll be flying blind into the most important stretch of the week. Click here to join the morning session Market ViewMarket outlook:

Momentum - Cooling Off Tuesday broke the market’s six-day streak. The S&P slipped 0.3%, the Nasdaq 0.4%, and the Russell 0.6% as traders finally eased up on the high-flyers. The Mag-7 opened strong but faded, with only Alphabet holding green while Meta, Apple, Tesla, and Amazon drifted lower. Defensive names helped keep things from looking worse. Energy popped more than 4% with oil back over $69, and utilities and staples found buyers. Even so, intraday momentum ended negative at minus 5 on the S&P, minus 2 on QQQ, and minus 8 on the Russell. Momentum is still positive, but stretched. Where we head next likely comes down to the Fed this afternoon and Microsoft and Meta earnings after the bell. Insider Buying: Some Midstream Buying…

Liquidity Treasury yields eased Tuesday, with the 10-year near 4.36% as investors absorbed heavy supply expectations and shifting policy signals. Primary dealers see coupon sizes staying unchanged through October, leaving short-term bills to carry most of the government’s $1 trillion borrowing this quarter. That keeps near-term funding stable but increases rollover risk if market conditions change. The dollar remains firm after announcing trade deals with Europe and Japan, with wider tariffs on other partners set to take effect Friday. Japan’s bond market is still under strain, with long-end yields near multi-decade highs and foreign demand for Treasuries looking thin beyond the short end. Global liquidity is holding together but feels increasingly fragile. Any slip in auction demand, a stronger dollar squeeze, or a hawkish Fed tone could quickly ripple through risk markets. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Ladies and Gentlemen... Jerome Powell"

Post a Comment