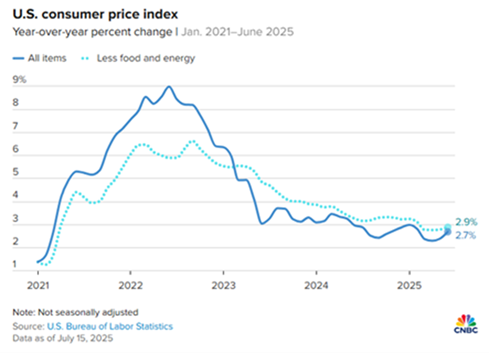

The Fed's Got It Wrong – And This Week's Data Proves It VIEW IN BROWSER For a moment, it looked like the gloves were about to come off this week. See, ever since taking office in January, President Trump hasn’t been quiet about his feelings on Federal Reserve Chair Jerome Powell. That’s because the Fed has kept key interest rates steady since December of last year. President Trump hasn’t been a fan of that policy stance. He’s been openly criticizing the Fed boss all year long, even calling him “Mr. Too Late.” Then on Wednesday, things nearly boiled over. That’s when word got out that Trump had asked lawmakers if he could fire Powell.. Legally, it’s unlikely. But the White House had been floating the word that a $2.5 billion remodel of the Fed’s headquarters is reportedly way over budget. That could make for a convenient excuse if Trump decides to pull the trigger. But, late Wednesday, Trump backed off. He said, “We’re not planning on doing it. I don’t rule out anything, but I think it’s highly unlikely, unless he has to leave for fraud.” Still – the pressure is intensifying. Several Fed officials now say inflation has cooled enough to cut rates at the next meeting. That includes Governor Christopher Waller and Vice Chair Michelle Bowman. Waller has been especially blunt. He says the labor market needs support – and the whole tariff-inflation panic is overblown. Some folks say they’re angling for Powell’s job when his term ends this year. Other Fed members, meanwhile, are still in “wait-and-see” mode. Luckily, we don’t have to wait. We’ve already seen the numbers, and they’re telling a very clear story. So, in today’s Market 360, let’s review this week’s Consumer Price Index (CPI), Producer Price Index (PPI) and U.S. retail sales reports. Then, we’ll examine whether the tariffs actually made an impact and discuss whether Powell will change his tune and cut rates. And finally, while we avoided the shock of President Trump firing Powell (for now), I’ll tell you about another shock that’s set to rock the market – and tell you why it’s an incredible opportunity for investors who are prepared... What the Data Says We’ll start with the CPI. On Tuesday, I went on Mornings With Maria to walk through the CPI numbers in real time. In fact, President Trump even shared our segment on Truth Social – that’s how important this data has become.  Consumer Price Index As I explained on air, inflation remains tame. Tuesday’s CPI report showed headline CPI rose 0.3% in June and is now up 2.7% in the past 12 months. Core CPI, which excludes food and energy, increased 0.2% and is up 2.9% in the past 12 months. Both reports were in line with economists’ expectations.  Shelter costs – or owners’ equivalent rent – continues to be the biggest driver, up 3.8% over the past year. But the biggest surprise might be vehicle prices. They actually fell 0.3%, while used cars dropped 0.7%. In other words, tariffs – specifically, the 25% tariff on all cars built outside of the U.S and on certain car parts – simply are not showing up in vehicle inflation. In fact, we’re seeing the opposite. Digging further into the details, food prices were up 0.3%, and energy prices surged a full 1%. This is because utility bills are up from the hot weather, and gas prices firmed up in the summer months. | Recommended Link | | | | America lost 90,000 factories and became a nation of consumers, not producers. But Trump’s reshoring initiative is changing everything fast. Investing legend Louis Navellier has identified specific companies positioned to benefit — and 20 to avoid. Click here for his complete research. |  | | Producer Price Index Now, let’s turn to the PPI. On Wednesday, we learned that wholesale prices were flat on a monthly basis in June. Economists expected a 0.2% increase. On a yearly basis, PPI rose 2.3%. That’s below the 2.7% seen in May and lower than the 2.5% increase economists had projected. “Core” prices, which exclude food, energy and trade margins, were flat in June, below the 0.2% increase economists had expected and the 0.3% gain seen last month. They rose 2.6% year-over-year, below the 3.2% annual rate in May. Economists were expecting an increase of 2.7%. When you look further into the report, wholesale service costs actually declined 0.1%. Goods prices rose 0.3%, energy prices went up 0.6% and food prices were up 0.2%. In other words, another swing-and-a-miss for the economists on wholesale prices. This report was a lot better than expected, and it’s continued proof that the tariffs aren’t impacting wholesale prices. U.S. Retail Sales Finally, let’s look at the retail sales report. On Thursday, the Commerce Department reported that retail sales increased 0.6% in June, crushing economists’ projections for only a 0.2% rise. This is a big deal, since sales decreased 0.9% in May, after declining two months in a row for the first time since late 2023. Now, all categories experienced an increase in spending, but surprisingly, car dealership sales were up 1.2% last month. Sales at restaurants and bars also grew 0.6%, revealing that Americans haven’t cut back on eating out. This was a solid report and a nice improvement. It tells me that people aren’t panicking about tariffs... they’re out and about on their summer vacations, spending more money and feeling more confident. So What Is the Fed Waiting For? So, what have we learned from the latest economic data? Simply put, tariffs have not caused the inflation bogeyman to appear. They haven’t dramatically impacted consumer spending, either. You may recall that Powell even stated that rates would have been cut by now if not for Trump’s tariffs. Still, despite favorable inflation data and a resilient consumer, the Fed isn’t expected to cut key interest rates when it meets on July 30. Clearly, that’s not what President Trump wants to hear. And whether you like Trump’s trash talk or not, he does have a point. The Fed’s benchmark rate has been stuck between 4.25% and 4.5% for months. And it’s hurting regular Americans. Here’s how: - Mortgage rates are near 7% – pricing out first-time homebuyers

- Average car payments just topped $750 a month – a record

- Credit card APRs are now over 20% – making it brutal to carry a balance

That’s not just an economic issue. It’s a political one, too. Trump’s got midterms coming. The fact is, we could be on the verge of “economic nirvana” if the Fed would simply cooperate. Hopefully, this week’s data will be enough to get Powell to change his tune. But no matter what happens, the Federal Open Market Committee (FOMC) statement is anticipated to signal that a key interest rate cut will be on the way at the September policy meeting. The Bottom Line Here’s the point. Powell needs to give some kind of guidance next week – not only to save face, but to calm markets and restore confidence. Not only may it save his job, but it will likely bolster the market, and investors will breathe a sigh of relief. Because while Trump may have backed off his threat to fire Powell… imagine if he hadn’t. It would have been the biggest financial headline of the year. A complete market shock. But here’s the thing… There’s another shock brewing right now – and almost no one is talking about it. It has nothing to do with interest rates, tariffs or Powell’s job. It has to do with a completely new approach to the market. One that could hand prepared investors a serious edge and a shot at real gains – no matter what the Fed does next. And on Tuesday at 10 a.m. Eastern, my friend and colleague Keith Kaplan, CEO of TradeSmith, is going to host a special event to reveal what this breakthrough is – and why I believe it could trigger one of the most lucrative trading windows we’ll see all year. Click here to RSVP for free now. Sincerely, |

0 Response to "Must Read: The Fed’s Got It Wrong – And This Week’s Data Proves It"

Post a Comment