Pegasystems shares ballooned once again after reporting earnings. It's not too late to get in on this $10 billion stock capitalizing... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ |

| | Written by Leo Miller

For the second quarter in a row, artificial intelligence (AI) tech stock Pegasystems (NASDAQ: PEGA) crushed expectations. Shares soared 14% on July 22 as the company eclipsed Wall Street analyst forecasts. The company’s GenAI Blueprint product is gaining serious traction, putting the firm in a position to be a huge winner as AI evolves. Let’s examine Pegasystems’ latest results and explain why investors should pay attention to this stock. Accelerating ACV Growth: A Great Sign For PEGA In Q2, Pega posted sales of just under $385 million for a growth rate of 9.5%. This surpassed estimates by nearly $40 million. Adjusted earnings per share (EPS) of $0.28 equated to a growth rate of 7.7%. Analysts predicted the figure would instead decline by 7.7%. The company’s growth rate may seem modest until investors consider Pega’s annual contract value (ACV) growth rate of 14%. ACV calculates the revenue growth that the company can expect to receive on an annual basis through its subscription model. Because it measures the revenue Pega can expect going forward, ACV growth provides a better assessment of the company’s growth trajectory than revenue. The AVC growth rate of the company’s Pega Cloud offering is even more impressive at 25%. The company is switching customers from managing their software themselves (Client Cloud) to Pega managing it (Pega Cloud). This allows for higher margins as customers share the same cloud infrastructure, making it easier to deploy new features that the company can upsell. This ongoing shift helps create more value down the road for shareholders. Overall, Pega’s business is growing much faster now than it was in 2024. The company’s net new AVC adds hit $99 million in the first half of 2025, up 60% compared to H1 2024. So, what’s driving Pega to have all this success? Pega GenAI Blueprint Is Driving Momentum Pega is making it known that its GenAI Blueprint tool is a key driver of success for the company. Blueprint allows users to describe a business problem in simple language, and within minutes, it generates a blueprint for an application that can solve it. Users can then refine this initial blueprint to better meet their needs, with minimal coding required. They can use it to enhance an existing company solution or develop a completely new one for a different problem. Overall, the tool aims to use GenAI to drastically reduce the time a company takes to build an application. That is a compelling proposition, as businesses need to evolve quickly in an ever-changing world. Pega’s sales teams use Blueprint themselves to show prospects customer-specific examples of how it can solve their problems in their first meeting. That makes it much easier for salespeople to secure more meetings and ultimately close the deal. This is why Pega says its growth reflects how “Pega GenAI Blueprint is transforming” its process of gaining customers. It notes that Blueprint is being talked about in every one of its sales campaigns. Pega believes Blueprint’s implementation of GenAI in the application design phase provides a key advantage over other agentic AI competitors. PEGA: Untapped Near-Term Upside, Even Greater Long-Term Potential Analysts broadly raised their price targets on Pega after the Q2 results. The MarketBeat consensus price target on Pega is just under $58, nearly equal to the stock’s July 24 closing price. However, the average price target among analysts who updated their forecasts after the July 22 report is $65.60. That number implies around 13% upside in shares. This may not seem groundbreaking, but it is important to remember that the company is in the early stages of its Blueprint rollout. Given the product's success thus far, the longer-term upside opportunity for Pega is likely much larger. Pega notes that research firm Forrester (NASDAQ: FORR) estimates that two-thirds of global tech spending will go toward legacy systems in 2025. As Blueprint works to transform legacy systems, this shows the huge opportunity that Pega has to capture a percentage of this spending in the long term. GenAI Blueprint is now proving to be more than just a highly interesting product. It is clearly resonating with customers and driving growth for the company. This creates an opportunity for investors to gain a strong upside in Pegasystems' shares.  Read This Story Online Read This Story Online |  |

| Written by Gabriel Osorio-Mazilli

It’s no secret that the retail sector is now one of the most forgotten areas of the market, whether it is because artificial intelligence (AI) names have taken the bulk of the attention—and capital—in the entire industry, or whether ongoing trade tariff negotiations have pushed investors away from this space in fear of further volatility and uncertainty. The truth is, there are some hidden opportunities with the potential to create the sort of wealth-compounding effects that every investor would love to have in their portfolio, especially considering how inflation and valuation uncertainty have affected the market and economy. Best Buy Inc. (NYSE: BBY), Lululemon Athletica Inc. (NASDAQ: LULU), and Bath & Body Works Inc. (NYSE: BBWI) are ideal candidates for multi-year runs and expansion in market capitalization. Why? They each boast strong profitability and the ability to reinvest earnings at high rates. Best Buy: A Brick-and-Mortar Winner Many consumers—and investors—would likely pass on Best Buy in favor of Amazon.com Inc. (NASDAQ: AMZN) and other online retailers that offer a wider selection of products and often better prices. Best Buy knows this, and it is one reason why it is quickly pivoting its inventory exposure to include items that customers wouldn’t usually buy online. The company hopes to capitalize on the value of an in-person with appliances, high-end electronics, and smart home devices that consumers want to see, touch, and understand before purchasing. In-store staff provide hands-on education, and showrooms allow consumers to test products, enhancing customer satisfaction and protecting pricing power and brand loyalty. This strategy should enable Best Buy to remain one of the few standing brick-and-mortar retailers still generating sufficient profits. The company's ROIC is hovering around 20%, well above the company’s cost of capital. This matters because annual stock price performance tends to align with the long-term ROIC rate over time, meaning there is sufficient market share and pricing power in the company’s brand to sustain business profitability for the foreseeable future. All this considered, Best Buy is positioned to continue delivering strong performance, especially as many of its peers struggle to adapt. Lululemon: A Tariff-Induced Buying Opportunity Lululemon's story is one of short-term pain but long-term potential. After President Trump announced a wave of tariffs targeting most of the Asian countries from which the United States sources its apparel materials, Lululemon shares sold off significantly, trading at a dismal 53% of their 52-week high levels. This created a massive gap to be filled on the upside. While the headlines spooked retail investors, institutional sentiment tells a different story: the risk-to-reward ratio now favors the buyers. Over the past month, Lululemon’s short interest has declined by over 4%, showing some signs of bearish capitulation and a new path for higher prices. Major institutional investors have already taken action on this setup opportunity. For example, Robeco Institutional Asset Management significantly increased its holdings by as much as 55%, bringing its position to nearly $60 million. This aligns with Wall Street analysts issuing a consensus price target of $335.9 for LULU stock, implying the company can rally by as much as 50% from its current trading price. And that is not even assuming it will retest its previous 52-week highs. At the core of this buy-the-dip thesis is the company’s ROIC, which sits around 29%, confirming Lululemon's ability to maintain high margins and strong brand value, even during challenging macro periods. For long-term investors, the recent sell-off may be a gift. Bath & Body Works: Earnings Power Meets Capital Efficiency Wall Street analysts forecast that Bath & Body Works could generate up to $2.08 in earnings per share (EPS) for the fourth quarter of 2025, a massive jump from today’s reported 49-cent EPS. As most investors already know, stock price action typically follows EPS growth, but the story goes deeper than that. Bath & Body Works also generates up to 29.5% in ROIC, meaning that this brand recognition and market share could allow the company to compound on its value and deliver outsized returns, following the Best Buy model of capitalizing on the in-person shopping experience. Bath & Body Works thrives on sensory-based shopping, selling products customers want to see, smell, and feel before buying. The brand has cultivated deep consumer loyalty and continues to drive innovation in fragrance, skincare, and home products. Institutional buyers have taken note, with OLD National Bancorp recently boosting its stake by 8.5%, bringing its total holding to over $11 million. This quiet vote of confidence is worth paying attention to, especially with the stock trading at relatively low multiples compared to its historical averages. In addition, the recent appointment of Daniel Heaf, a former Nike executive, as CEO further signals a shift toward operational excellence and modern retail strategy and could drive future profitability even higher.  Read This Story Online Read This Story Online |  Porter Stansberry and Jeff Brown say a new U.S. national emergency is already underway — and it could trigger the biggest forced rotation of capital since World War II.

They reveal why Trump is mobilizing America's tech giants… and name the two stocks most likely to soar as trillions shift behind the scenes. Watch the National Emergency broadcast here |

| Written by Dan Schmidt

The S&P 500 has experienced a broad rally over the last three months, but not every sector has participated in the uptrend. In fact, some sectors have been struggling in the face of stiff headwinds from regulators and macroenvironmental factors. Homebuilders have yet to join the market rally because the housing market remains stifled by high mortgage rates, rising construction costs, and a price growth contagion emanating out of previously hot markets. Today, we’ll examine the myriad factors putting pressure on housing stocks and three companies investors might want to avoid while their margins are being threatened. Multiple Factors Putting Pressure on Homebuilder Margins - Tariffs on Construction Materials: Steel, copper, and lumber tariffs continue to weigh heavily on homebuilders, and President Trump’s latest tariff on copper hasn’t even gone into effect yet (although that didn’t stop copper prices from jumping 2.5% on the announcement). Rising input costs exacerbate the affordability crisis, keeping prospective homebuyers in their rentals for longer as prices continue to increase. Some notable year-over-year (YOY) cost increases include fabricated steel plates (13.6%), metal molding and trim (15.1%), softwood lumber (18.9%), and machinery equipment and parts (24.2%). With home prices already near all-time highs and mortgage rates showing no signs of abating, homebuilders must either pass on these expenses and risk fueling even higher prices or absorb them and face margin reductions. Neither option is currently desirable for this sector.

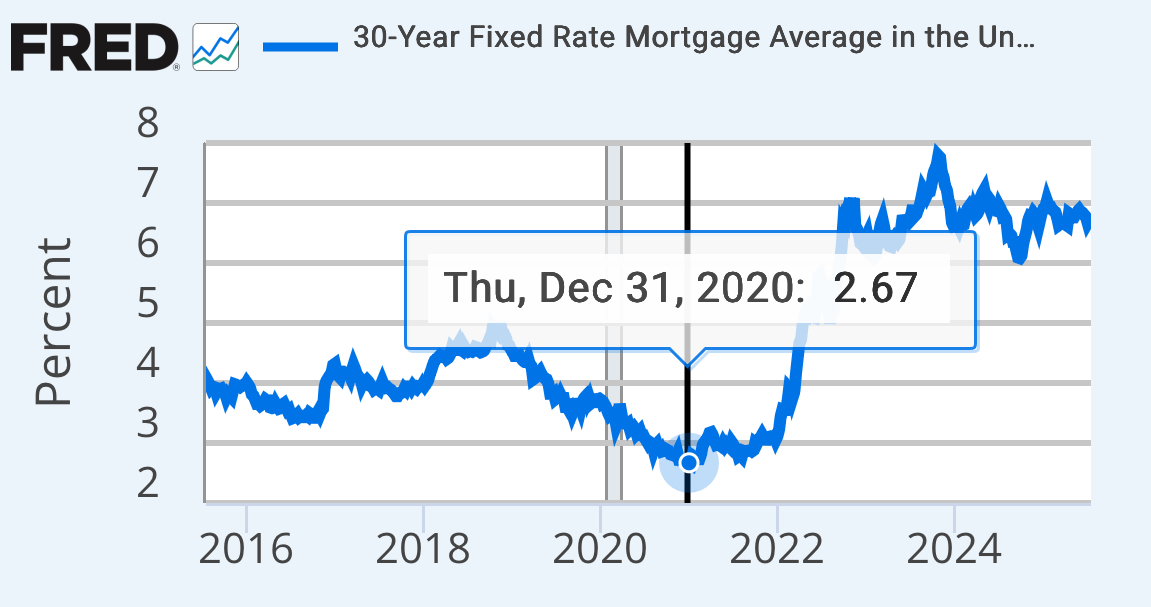

- Persistently High Mortgage Rates: The 30-year fixed-rate mortgage has remained stubbornly elevated, fluctuating between 6.5% and 7% for the better part of two years. This number is a far cry from the 2.67% rate homebuyers saw in December 2020, when the COVID-19 pandemic was at its peak and the Fed had dropped rates to near zero to protect the economy. The Federal Reserve’s Housing Affordability Index (HAI) sits at 97.5, meaning that median household income is below the threshold required to afford a median-sized home with a 20% down payment. Don’t count on the Fed coming to the rescue here either; mortgage rates are higher today than when the cutting cycle began.

- Immigration Crackdown: The Trump administration’s aggressive immigration crackdown could have a chilling effect on the construction labor market, especially in the South and Midwest, where undocumented immigrants make up a large portion of the workforce. In states close to the border like California and Texas, immigrant employees often comprise more than 40% of the workforce. A labor shortage can hinder homebuilders by delaying projects and increasing costs, as employers are compelled to pay higher wages to attract workers.

- Declining Home Prices in Several Major Markets: Home prices grew by 2.7% in April, marking the slowest month for housing price growth since the summer of 2023. In June, home prices retracted 0.1% month-over-month, with several formerly booming markets like Austin, Dallas, Tampa, Orlando, Phoenix, and San Diego. The Northeast isn’t immune, as Washington, D.C., saw declining home prices in June.

3 Stocks That Could Suffer in These Market Conditions You might have read that last section and thought, “Well, other than that, Mrs. Lincoln, how was the play?” However, homebuilder headwinds continue to intensify as consumers expect high prices and elevated mortgage rates to persist longer than initially anticipated. D.R. Horton Inc. (NYSE: DHI) boosted the sector this week by beating top and bottom line earnings expectations, but the numbers still shrank year over year, and this brief bump could be a good exit point for the following three companies. NVR: Apprehension Ahead of Earnings NVR Inc. (NYSE: NVR) comprises three brands: Ryan Homes, NVHomes, and Heartland Homes, which focus on detached homes, condominiums, and townhouses. It operates in 18 states, including the Midwest and Southeast, where prices have recently shown weakness. It also has a significant presence in D.C., which experienced a slowdown in June. NVR runs an asset-light business model by outsourcing land development, but it also remains at the mercy of developers passing on tariffs. New immigration restrictions will also affect NVR’s subcontractors, and the company will likely need to increase wages to compensate. NVR posted a significant EPS miss in its Q1 2025 earnings report, and analysts are expecting more YOY declines in this week’s Q2 report. Lennar: High-Volume Strategy Under the Microscope Lennar Corp. (NYSE: LEN) focuses on a high-volume operation, which leaves it vulnerable to macro and regulatory pressures. Since Lennar’s strategy requires a high number of homes to be built and sold each year, any type of disruption can severely hurt margins and cause a cascade of delays. Tariffs can be especially damaging to high-volume sellers like Lennar, as the company‘s ability to fully pass these costs onto buyers is limited by splintered demand. LEN shares soared 8% following the DHI earnings release, but this sympathy rally could be short-lived as Lennar’s Q2 earnings report showed a 4.4% drop in YOY revenue, and the stock is still down nearly 13% in 2025. KB Homes: Clientele Most Vulnerable to Price Pressure KB Home Inc. (NYSE: KBH) specializes in land development and housing for first-time buyers or first-time move-up buyers, which is, unfortunately, the customer base most likely to feel the sting from high prices and mortgage rates. The company’s Built To Order strategy offers unique customization and a personalized experience; however, this model may struggle with the HAI under 100, as customization matters less to buyers than affordability. KBH has also already reported Q2 earnings, and saw revenue drop an eye-popping 10.5% YOY. Several analysts dropped their price targets following the June release, including Wells Fargo and Barclays, which cut their price estimates below the current market price.  Read This Story Online Read This Story Online |  The original Magnificent Seven returned 16,894%—turning $7K into $1.18 million.

Now, the man who called Nvidia at $1.10 reveals AI's Next Magnificent Seven… including one stock he says could become America's next trillion-dollar giant. See his full breakdown of the seven stocks to own now |

|

| |

|

|

0 Response to "🦉 The Night Owl Newsletter for July 27th"

Post a Comment