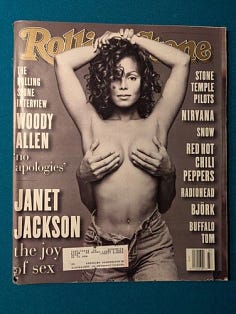

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: It’s been six weeks since I slept more than four hours a night. I slept seven hours last night. That’s a huge upswing. Onward, and upward… I think I’m back… so that begs the question… Remember when this magazine cover was controversial? Who cares… whatever… this article was BEFORE INFLATION TARGETING… I am old… and it’s fine. Let’s get to the week in review… July 20, 2025 A Railroad... Without AmericaWe used to build the railroads and get rich. Now foreign sovereign wealth funds own our toll roads, ports, and parking meters while Americans rent everything and own nothing. From laying tracks to paying tolls—welcome to the $13 trillion garage sale. July 21, 2025 A BRRR Morning in America...The GENIUS Act just passed, forcing stablecoins to back every token with Treasury bills. Translation: crypto bros are about to become Uncle Sam's biggest short-term lenders. What could possibly go wrong when "hot money" meets the safest assets on Earth? July 22, 2025 A Great Headline Question... But Let Me Answer This...Wall Street Journal jokes that nobody knows why stocks hit record highs despite bad news. Plot twist: there's an answer, and it rhymes with "BRRRRRR!" Watch the FNGD, follow the liquidity, and remember—money moves markets, not mystery. July 23, 2025 Congratulations, SoftBank, on the U.S.-Japan "Trade Deal"SoftBank's $500 billion AI project crashes and burns on Monday. Tuesday? Trump announces a $550 billion U.S.-Japan trade deal. What are the odds! Modern bailouts don't require congressional hearings—just remarkably convenient timing and friends in high places. July 24, 2025 Things I Think I Think... (Volume 3,403-B)Want to pitch an AI startup? Hold an extension cord, plug it into itself, throw $500 in the air, and repeat. Meanwhile, today's everything bubble makes 2008 look quaint—we've got more leverage, more debt, and CVS receipts longer than Fed balance sheets. Friday, July 25, 2025 This is Not a Rant... "2008 and Now"Think we learned our lessons from 2008? Think again. While everyone's partying upstairs, there's a slow leak in the basement and termites eating the foundation. Spoiler alert: the smart money isn't buying AI lottery tickets—they're buying the roads we all drive on. July 26, 2025 Is America's "End Game" in This Chart?Foreign investors don't want our debt anymore—they want our assets. While Treasury bills pile up, $17.5 trillion in foreign equity holdings creates a leverage layer cake that could make 2008 look quaint. America isn't just the market—America IS the bubble. All right… Have a great day… time for the pool (but I have to write a 2,000-word report on Tesla)… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "The Week in Review"

Post a Comment