You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: A friend from high school sent me a note yesterday… He asked an important question…

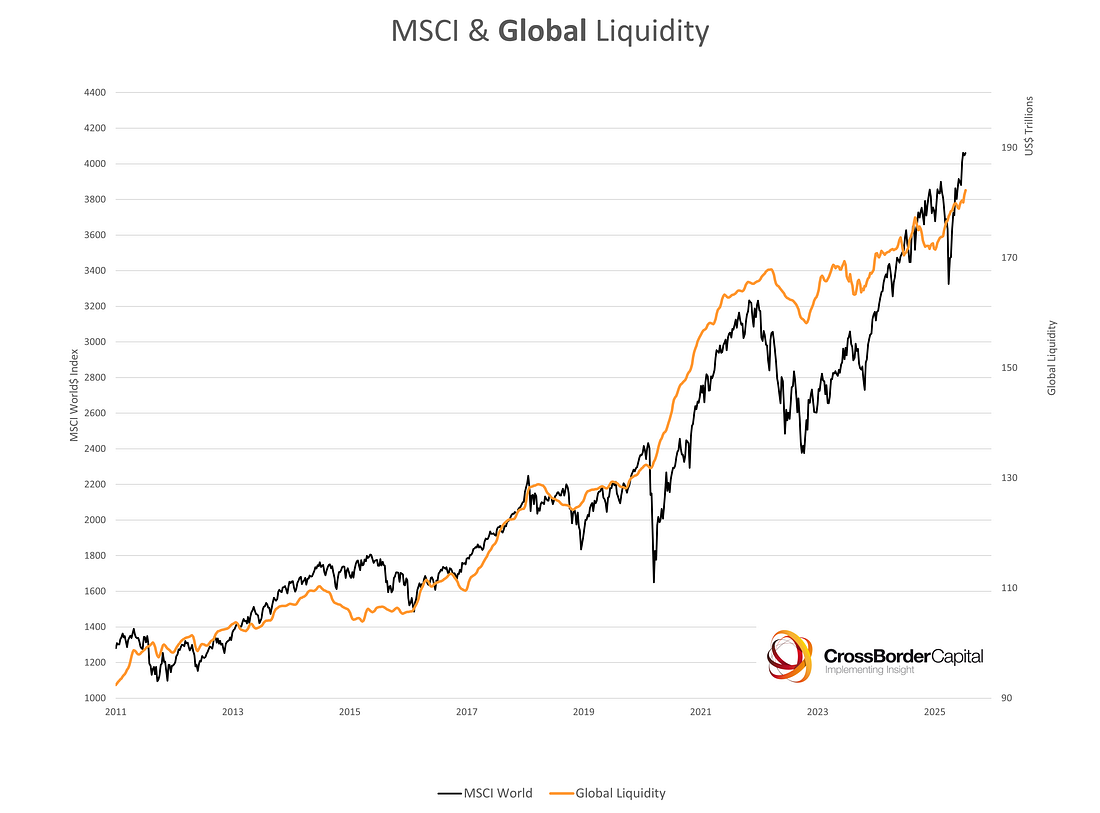

Big question… Back in 2008 is where this whole journey began… So where to start… How about a metaphor? In 2008, the house caught fire, and everyone could see the flames. Today, there's a slow leak in the basement and termites eating into the foundation. Nobody wants to acknowledge these things, as the party upstairs is still in full swing. It's seventeen years later. Capitalism got wrecked… but we're still pretending that it's the real driver of U.S. markets. It's not. Monetary inflation and extraction are. But there's more… A Change in the Financial PlumbingTo understand how the financial system has evolved since 2008, look no further than the structural changes within the system. Around 2008, the shadow banking system (hedge funds, private equity, and things not regulated by the traditional system) had reached around $50 trillion, according to Michael Howell. Then it collapsed. Now, it’s reemerged over the last 17 years as the primary source of liquidity growth in the system… Today, shadow-bank, collateral-based lending represents about 77% of global lending… in a system he values at… $175 trillion… On $300 trillion in global debt. An incredible amount of the global lending system is unregulated… For example, private credit has exploded from around $46 billion in 2000 to over $1.7 trillion by 2023. Morgan Stanley projects it hitting $2.8 trillion by 2028. We didn't eliminate the risk from 2008. We relocated it off the traditional banks’ balance sheets. Banks now hold only about 10% of middle-market loans, down from roughly 70% in 1994. The risk shifted to private equity firms like Apollo and Blackstone, which operate with minimal oversight. Blame the regulations for this. We attempted to make banking safer, but ultimately made it more opaque and worrisome. Great work everyone… And congrats to Larry Fink… The Market Psychology ShiftIn 2008, a housing bubble was built on the fantasy that real estate prices would continue to rise indefinitely. Everyone could get rich flipping houses. Today's bubble is AI… and almost everything else… including America. But AI is the real bubble example… There's a growing belief that AI will revolutionize everything, and traditional valuation metrics may not be applicable. NVIDIA trades at 55x earnings because it's "picks and shovels" for the AI revolution. We had that in 1999. It was called Cisco. They would offer "picks and shovels" for the internet revolution, trading at 200x earnings. Pets.com was going to eliminate pet stores forever, just like today's AI startups claim they'll eliminate entire industries. The psychology is identical… A revolutionary technology is expected to create an infinite addressable market. And that means "this time is different…" Which means - it’s in a bubble. But Bubbles can go on for a long time… if there’s enough capital in the system (and once again, liquidity is expanding at a breakneck pace.) During the Dot-com years, the argument was that the Internet would change everything. It would be infinitely scalable. Therefore, traditional metrics don't matter… Until the crash… In 2007, the prevailing argument was that real estate always appreciates in value. That meant that greater securitization would spread the risk around... And if that's the case, traditional underwriting wouldn't matter… Until the crash. Now, with AI (2024), the argument is that traditional valuation methods are no longer relevant. The next step is… ? The pattern is identical. We have been experiencing “crashes” - even temporary - in 2020, 2022, 2024, and 2025. However, every single time, there's a policy accommodation by central banks or other participants with vast influence in the global financial system. They're pumping more capital into the system… over and over again… There's $300 trillion in debt… and only $175 trillion in liquidity to refinance it all… The point is that it's not just psychology fueling the bubble… More liquidity… drives up the MSCI Global Inded (the Global Stock Market Index) You know… BRRRRRRRRRRRRR! The Rate Environment ReversalIn 2008, the Fed could have slashed rates to zero to address credit problems. Today, we're dealing with the opposite situation. Private credit is predominantly floating-rate lending. When rates surged from near-zero to over 5%, debt service costs exploded for companies already operating on thin margins. Zombie stocks - companies that are saturated with debt and on life support - could no longer rely no constant low interest-rate refinancing. This creates a different vulnerability than in 2008. Instead of a sudden liquidity freeze, we get a slow squeeze as borrowing costs rise faster than cash flows can adjust. The Dollar's Quiet DeclineIn 2008, nobody questioned dollar dominance. Today, IMF data shows the dollar's reserve share has declined from 71% in 2000 to around 55-59% now. Central banks have been steady gold buyers, quietly diversifying away from their dependence on the dollar. It's not collapse… It's erosion. But it means higher funding costs over time for the U.S. Or that the government will find new ways to drive Treasury purchases… Even if that means more leverage… less oversight… and greater exposure to demand that might not have the U.S. interest at heart. All the while, we’re doing all we can to maintain the dollar’s global dominance. That may require some sacrifice that a lot of people haven’t considered… While Americans chase AI stocks, foreign sovereign wealth funds quietly acquire actual infrastructure. This includes ports, toll roads, and data centers. This is basic rent extraction from the world's largest economy. It's a smarter play than speculating on which AI startup will survive. They're buying the roads everyone has to drive on, not betting on which car company wins. The Ownership ConcentrationThis is where today gets more problematic than 2008. Federal Reserve data shows the bottom 50% of Americans today own roughly 2.5% of total wealth. That's more concentrated than pre-2008. Direct stock ownership has fallen from 21% of households in 2001 to 17% today. So when AI stocks soar or the next bubble inflates, fewer Americans participate in the upside. They get the inflation from monetary stimulus but miss the asset price gains. And the people who get the benefits from every bailout? A very small number of people… The funny thing about today is that our banking system is healthier since the integration of Basel III. However, the banks today have stopped lending. Instead, they originate loans and then pass them off to shadow banks with less oversight. The Fed balance sheet never contracted after 2008. Liquidity continues to flow through various channels, supporting asset prices for longer than pure fundamentals would justify. Wealth concentration means fewer Americans own assets that benefit from monetary stimulus. The bubble benefits are more concentrated. The Slow-Motion RealityWe're not building toward a dramatic 2008-style crash. It's more like a gradual, constant wealth transfer —an unintentional economic caste system that is only getting worse with each bailout and each concentration of wealth in one group at the expense of everyone else. This is how and why socialists end up winning in cities today… Capitalism died. Central banks killed it. Which brings me to the real difference between 2008 and now… The key difference is that this time, when the bubble deflates, fewer Americans own enough assets to cushion the blow. Foreign entities will own a greater share of the infrastructure that generates predictable returns, regardless of which technology fad emerges next. The smart money invests in the infrastructure that benefits from the revolution, regardless of which specific companies win. They buy the picks and shovels, not lottery tickets, for individual miners. Meanwhile, the system continues its slow-motion wealth transfer from wage earners to asset owners, from Americans to foreign sovereign funds, from the many to the few. One Last Thing…There’s one last thing… one additional difference between today and 2008? This evening, I was in a parking lot… and saw a Volvo S90… That’s about a $60,000 car. On the back of it was… a “Resist” bumper sticker… That is just insane to me… putting a bumper sticker on a car that is worth basically the average of Americans. Everything… everywhere is politicized… And they’re all missing the big picture… the policies that are really creating this division aren’t coming necessarily from the White House… That’s the thing that’s similar… Just as in 2008 , Americans today still don’t understand that it’s the Fed that has poured fire on the political divide over wealth and American stability. This isn’t a left or right issue… It’s one driven by centralized planning from the sky… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "This is Not a Rant... "2008 and Now""

Post a Comment