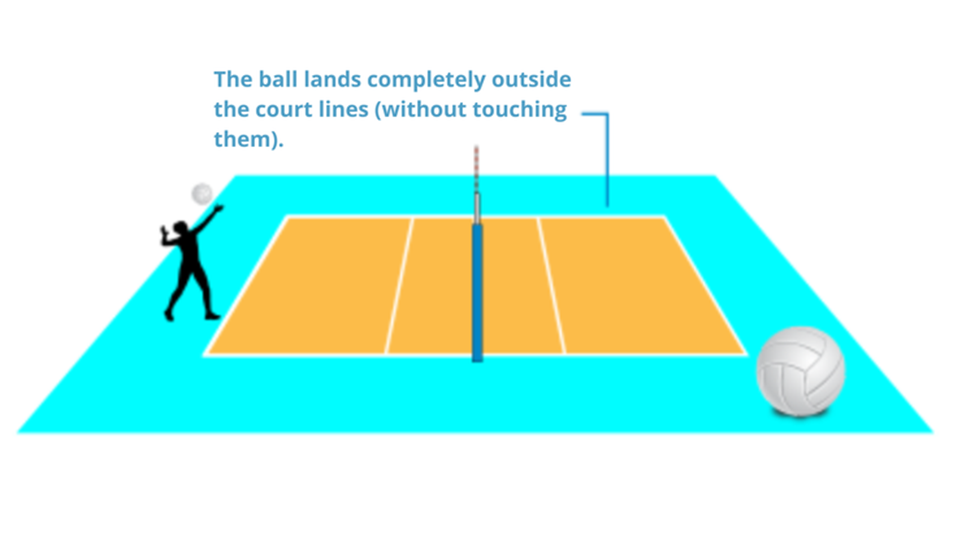

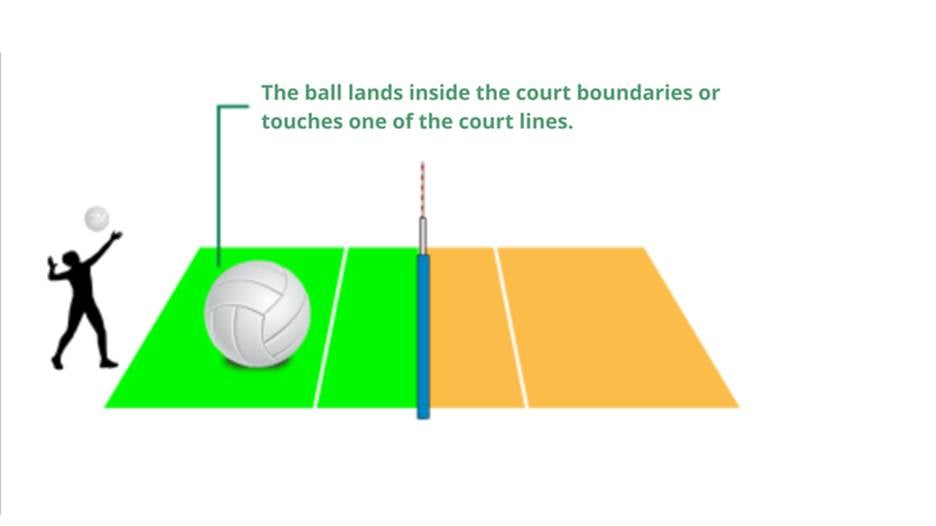

| WEEKLY ROUNDUP Three Ways a Rally Ends – Only One Makes You Money VIEW IN BROWSER Hello, Reader. I’m a native Southern Californian, so it probably won’t surprise you to hear that I’m an avid beach volleyball player. In fact, I’ve been playing for decades, and spent my “crazy youth” of the 1980s at the volleyball nets of California’s beaches. Although I have jokingly referred to the sport as my “real job,” the truth is that playing volleyball has similarities to playing the market, especially during a rally. Like the one we’re experiencing right now. On Friday, the S&P 500 and Nasdaq Composite indexes both hit record highs during intraday trading. They started out even higher today largely due to optimism surrounding yesterday’s trade agreement between the United States and European Union. This upward trend may continue this week, as several big tech companies deliver earnings. While the “fear of missing out” may have you wanting to participate in this rally, you should still do so cautiously. Here’s what my time at the net has taught me about smart investing… Beach volleyball, like the markets, also consists of rallies. In the sandy game, though, a rally is the sequence of hits back and forth between teams during any given point. A volleyball rally always starts with a serve – and it ends in only one of three ways… - The ball lands out of bounds.

From an investing angle, you can think of this as companies with sky-high valuations. While these firms may seem attractive to investors, like Nvidia Corp. (NVDA), the truth is that their valuations are overshot, landing them in the stratosphere. For instance, Nvidia’s market cap sits at $4.23 trillion, the highest in the world. It is currently trading for 56X its trailing price-to-earnings (P/E) ratio, or about double the market average. I recommend avoiding out-of-bounds stocks like these because their high valuations yield to low valuations… eventually. Instead, you’ll want to focus on companies that land squarely within the winning parameters of the court. That is why I look for companies that have a promising runway built by strong fundamentals – attractive valuations. In fact, I recommend one such company over Nvidia. And it is set to report its second quarter earnings for 2025 tomorrow, July 29. Analysts expect this company to beat estimates with over 20% year-over-year earnings growth and nearly 7% year-over-year revenue growth. You can learn how to access all of the details about this company – before its earnings call – by clicking here. This brings me to the second way a volleyball rally… - A team commits a fault, like failing to return the ball over the net.

You can think of this as companies that miss the mark. Like Tesla Inc. (TSLA), as we talked about in Saturday’s Smart Money. The company announced last week that it missed both top and bottom lines for the second quarter of 2025. This is largely due to declining vehicle sales. CEO Elon Musk said that the company “probably could have a few rough quarters” ahead. What’s more, Tesla is well behind the pace needed to meet its stated goal of producing at least 5,000 Optimus robots this year. The company has so far only produced a few hundred. Tesla is failing to return and is, therefore, not a stock that we want in our portfolios. I’ve got my eye instead on a company that is successfully sailing over the net. It’s a robotics company that is a direct competitor to Tesla, and its current backlog means there’s another $23 billion in future sales already baked in the cake. You can learn the name of this company, for free, here. I’ll share the third, final, and most advantageous way to end a rally below. But first, let’s take a look back at what we covered here at Smart Money last week… |

0 Response to "Three Ways a Rally Ends – Only One Makes You Money"

Post a Comment