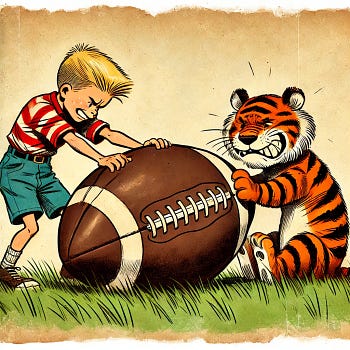

How the Fed Turned the Market into a Lop-Sided Sports League (Capital Wave)If you thought Deflategate was a scandal... get a load of this...Good morning: As we prepare for the CPI number and we find ourselves right in the middle of NFL training camp… a quick analogy of what’s happening in this market… Imagine the NFL suddenly made footballs twice as heavy. This should make it harder for every team to throw and score, right? That's basically what happened when the Federal Reserve raised interest rates… They made money "heavier"… or in simple terms, more expensive to borrow. But somehow… seven superstar teams, Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Google (GOOGL), Amazon (AMZN), Meta (META), and Tesla (TSLA), keep scoring touchdowns like nothing changed. Why? Because they're so rich, they bought their own lightweight footballs. They don't need to borrow the league's heavy ones. Rich Teams Don't Need Loans Most teams rent their equipment, pay their players, and build their stadiums using borrowed money. When interest rates went from 0.25% to over 5%, it's like their equipment rental costs went up 5x overnight. Suddenly, they can't afford good players or new facilities. But Apple has $50 billion in cash reserves. Microsoft has $79 billion. And those figures were incredibly higher back in 2023… They're like teams that own everything outright… the stadium, the equipment, even their own TV networks. When borrowing became expensive, they didn't care. They weren't borrowing anyway. Everyone Else Is Getting Crushed Meanwhile, smaller companies are like high school teams trying to compete with duct-taped equipment. Regional banks, real estate companies, and small retailers can barely field a team anymore. Consumer staples stocks like Conagra (CAG) are getting smoked. They're losing games 45-0 every week because they can't afford to compete with such high costs. Think about your local mall stores or that small factory in town… they need loans to buy inventory, pay workers, and keep the lights on. When those loans jumped from 2% to 7%, it's like trying to run plays while carrying sandbags. The Score Is Getting More Lopsided These seven "teams" now represent 70% of the entire stock market's wins. It's as if seven NFL teams scored 70% of all touchdowns across the entire league last season. When your 401(k) buys "the stock market," it's really just buying more shares of these seven giants because they're so massive. Then NVIDIA discovered a concept similar to the forward pass in the times of the film School Ties… except it's AI chips. Their profits are growing so fast it's like going from scoring 7 points a game to 70 points a game. Investors don't care about expensive interest rates when they see that kind of explosive growth. Why This Matters to You The Federal Reserve raised rates to slow down the economy and fight inflation, like adding weight to footballs to make games lower-scoring. But instead of slowing everyone down equally, they accidentally created a league where only the richest teams can win. The strong got stronger, the weak got weaker… And the gap between them has never been bigger. These seven companies are basically playing a different sport now. And every crash should produce another massive buy-the-dip moment… Can you tolerate it? Let’s get to the rest of our morning commentary…... Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to "How the Fed Turned the Market into a Lop-Sided Sports League (Capital Wave)"

Post a Comment