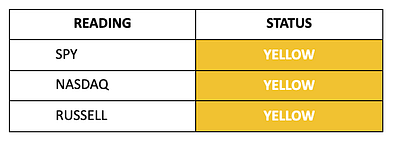

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. We’ll be live at 8:45 a.m. on Market Masters with the full breakdown and premarket setups. You can join me by clicking here. Good morning: The real event is on Tuesday. That’s where I put on a tracksuit. I tap on a headband. I walk down the hill with a giant boombox… and then surround myself with ten eight-year-old soccer players all looking at me for guidance. Coach “Out of His” Prime will take over my daughter’s second soccer season. Some may recall the Lutherville Strawberries U-7 team went to the finals last year, ending the season in overtime heartbreak. I don’t know if we’ll make it that far… But we’re prepared… I bought a lot of tracksuits… I spent a lot of time looking up drills for girls who are new to soccer. My daughter will probably sit on the sideline listening to Taylor Swift and making bracelets for her teammates instead of… practicing… We’re Team Number 6, the Blue Team for now. I will be asking the girls for names… Ideas include… Blue Crabs, Blue Wave, Blueberries, and Blueys… Part of me hopes I end up with a smart-ass kid who snarkily says… “Let’s just be Team Six: The Blue Team.” What’s This Go to Do With Anything?I tell you this because you already know Jerome Powell is speaking. You already have every armchair economist telling you what tie color to look for… what hand he’s holding in his briefcase. What words to listen to… And I remind you… It’s all theater. It’s all a setup for what is inevitable… The return of the Money Printer, more monetary easing… Our signals are as even as they can be heading into 11 am. All we can do is react. I remind you that right now is the time to assess your portfolio… understand what you own. Think about why you own it. Ask yourself - in the event of a downturn, would I still hold this through thick and thin? And if so… WHY? I will be back a little later with video commentary on Powell’s speech - as I gather it will take me more time to analyze his speech than it will to break it down… Let’s Get to the Commentary Trader’s Focus We made it. Powell speaks at 10 a.m., and once that is behind us, positioning for year-end can begin. Futures are modestly higher this morning after an overnight selloff pushed S&P contracts into a third standard deviation VWAP touch before reversing. The rebound appears tied to strength out of China. The Hang Seng and Shanghai both closed higher, with reports that Beijing may back yuan-linked stablecoins. That shift is giving a premarket boost to Chinese tech names and related ETFs, including CQQQ, BABA, and PDD. While Powell’s remarks will dominate headlines, Nvidia (NVDA) is the other story to watch. The company told suppliers to halt H20 production after Beijing raised security concerns, and the stock gapped lower overnight. With the MAGS already below their 20-day moving averages, further weakness in Nvidia weighs heavily on momentum. FNGD sits between the 20- and 50-day. A move toward the 50 would spell serious trouble for leveraged tech exposure and the broader market. It is a busy day stacked with headline risk. Powell sets the tone this morning, and Trump follows at noon, possibly taking aim at the Fed or hinting at a successor. That mix could spark sharp swings. Even so, the backdrop still favors the bulls. Liquidity remains ample, central banks are leaning accommodative, and fiscal support like the Genius Act adds to the tailwinds. The doom and gloom belong to the dollar, not equities, because the money printing never stops. Market outlook:

Momentum - Leaning Negative, Energy Looking Up The pressure hasn’t let up. Thursday was the S&P’s fifth straight red close, down 0.4%, and the Nasdaq is on track for its worst week since May. Our live look on momentum for the S&P closed at minus 10 with 12 breakdowns and just two breakouts. Breadth is thin. Retail took a beating. Walmart fell 4.5% and dragged Costco and Target lower. Big-cap tech was heavy again, with money still rotating out of the MAGS. The bright spots came from energy and basic materials. OILU broke above its 20-day, and the Russell managed to finish green while the bigger indexes stayed red. Technically, SPY is sitting right beneath its 20-day. As are the MAGS, and FNGD has moved higher. None of that says buyers are stepping back in just yet. Now it’s all about Powell. If he holds the cautious line, momentum grinds lower and the downside opens up. If he even hints at cuts, money floods bac,k and the relief rally starts fast. One way or another, the next move is his. Insider Buying: Some REIT Buying

Top Insider Buys of Last 10 Days - Form 4 Documents Market LiquidityLiquidity still looks supportive, but the tone is shifting. The dollar has firmed, JGB yields are creeping higher, and long-end Treasuries are under pressure as deficits mount. None of this has broken markets, but it’s clear conditions aren’t as forgiving as they were earlier this summer. The deeper issue is that today’s buyers are different. Traditional demand has thinned, leaving hedge funds, money funds, and even stablecoin operators to carry more of the load. That helps keep auctions moving, but it also makes the system more fragile when volatility picks up. Liquidity looks ample right up until it isn’t. Heading into Jackson Hole, the focus isn’t on speeches but on whether the U.S. can keep financing record issuance without disruption. As long as demand holds, risk stays supported. If it falters, the cushion under this market gets thin very quickly. Stay positive. Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Something to Take Powell Off Your Mind"

Post a Comment