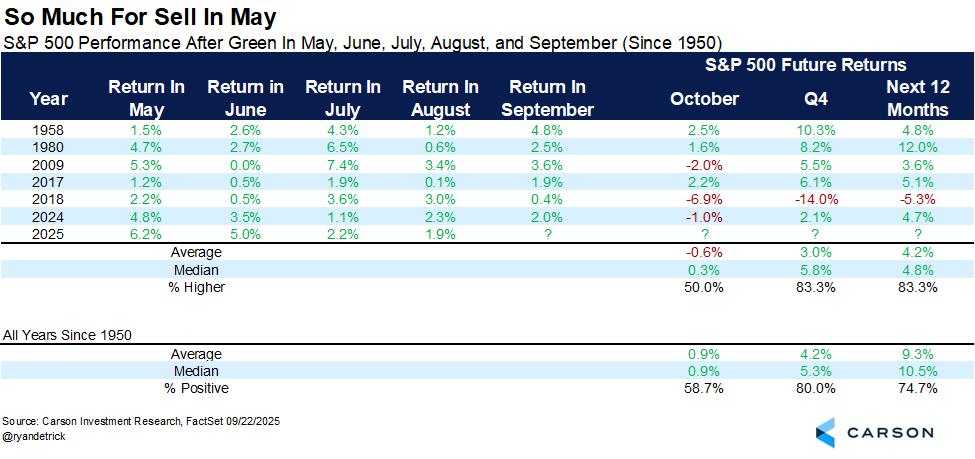

The S&P has bucked the trend in September… how will we finish out the year?… China keeps slow-playing rare earths… is MP Materials still a “Buy”?… how to invest in the broader AI rollout… Jonathan Rose’s NB trade VIEW IN BROWSER While this week is bringing some selling pressure, September has been surprisingly strong for stocks. At the beginning of the month, we profiled the average performance of September – historically, the worst month of the year for the S&P 500. Since 1945, it has fallen by an average of 0.6%. We’re on pace to buck the trend this year. As I write, the S&P is up 2.3% on the month. And if legendary investor Louis Navellier is right, this is just the start: It’s been quite the September to remember. And the good news is, this rally is not over yet. You see, we’re on the verge of what could be a phenomenal few months for the stock market, as several positive events are set to propel stocks higher. A bullish roadmap for Q4 Looking forward from here, the investment legend believes we’ll finish September on a high note due to “quarter-end window dressing.” Here he is explaining: Essentially, quarter-end window dressing occurs when institutional fund managers and investors shore up their portfolios and make them “pretty” for their clients before the end of the quarter. To do this, they sell the underperformers and scoop up the best-performing, most fundamentally superior stocks. Following window dressing, we go into Q3 earning season. Early forecasts point toward a solid performance. Back to Louis: Current estimates call for 7.7% average earnings growth and 6.3% average sales growth for the third quarter. But I look for wave after wave of positive earnings surprises to not only drive the S&P 500’s actual earnings results higher but also propel stocks higher when the season commences in October. Here’s additional color from FactSet, the go-to earnings data analytics group used by the pros: If 7.7% is the actual growth rate for the quarter, it will mark the ninth consecutive quarter of earnings growth for the index… Analysts and companies have been more optimistic than normal in their earnings outlooks for the third quarter. As a result, estimated earnings for the S&P 500 for the third quarter are higher today compared to expectations at the start of the quarter. In terms of guidance, both the number and percentage of S&P 500 companies issuing positive EPS guidance for Q3 2025 are higher than average… For Q4 2025 through Q2 2026, analysts are calling for earnings growth rates of 7.3%, 11.6%, and 12.6%, respectively. That ramp-up of earnings growth is exactly what we want to see. If this holds as earnings season continues, it should help provide a floor under the market. Following Q3 earnings, Louis says we’ll have an early “January Effect” to support stocks: This phenomenon typically occurs when folks pour money into their retirement accounts, employers contribute to their employees’ retirement savings, and financial gifts are made prior to the end of the year. These contributions can significantly boost small- and mid-cap stocks. | Recommended Link | | | | The AI trade is running full throttle. But it won’t last forever. It’s not time to abandon AI stocks completely, but it IS time to prepare for the inevitable slowdown. Futurist Eric Fry is showing people how to test each step before plunging into the “AI Tiger Pit” of overvalued and faulty companies. In Eric’s “Sell This, Buy That” research package, he reveals which market moves you must make today (starting with getting rid of Nvidia stock.) Access 7 free trade ideas here. |  | | Put it all together and how much might the S&P climb into year end? Ryan Detrick, Chief Market Strategist at Carson Group, crunched the numbers based on this unusually strong September (following higher S&P returns for each consecutive month beginning in May). The quick takeaway: expect some brief giveback in October, followed by a strong rally to end the year. If you have trouble seeing the data below, the average October performance in this environment is a -0.6% pullback followed by a 3% gain in Q4.

Source: @ryandetrick And note that those are the average figures. If we look at the median performance, things get even better. We stay positive in October, then jump 5.8% in Q4. One final wildcard tailwind to boost stocks Trump. I’ll let Louis give you the quick overview: After nearly five decades in this business, I can tell you when the pieces start to line up… when the money starts to move… and when the opportunity in front of us is simply too great to ignore. That’s exactly where we are right now. On September 30, a floodgate is going to open and $7 trillion is going to pour in from the sidelines. I call it the Trump Shock, and I believe it will send a very small group of stocks soaring – while leaving the rest of the market behind. Louis’ Stock Grader system has flagged five companies best positioned to benefit from Trump’s actions. Each one carries Louis’ highest rating. You can access more details – as well as the name of one of Louis’ favorite stocks today, totally free – in his full briefing right here. The interplay between public policy and private markets… One week ago, Representative John Moolenaar, chair of a U.S. House of Representatives committee on China, called for the Trump administration to restrict or suspend Chinese airline landing rights in the U.S. Why? Because Beijing is slow-walking its promise to give us access to rare earths and magnets. As we’ve covered extensively in the Digest, rare earth elements (REEs) are critical for our nation’s AI buildout, next-gen weaponry systems, and advanced robotics. China has a stranglehold on global mining, refining, and processing. Our Liberation-Day trade framework with China was supposed to guarantee reliable access to REEs, but Beijing has dragged its feet. The Financial Times reports that China has repeatedly delayed export licenses for key rare earth products despite pledges to keep supply stable. Cue a frustrated John Moolenaar recently saying: Beijing’s stranglehold on critical minerals is a direct threat to America’s technological future. How do we leverage this situation? The kneejerk way to play this is with MP Materials (MP), the premier pure-play U.S. producer of REEs. The government’s equity stake (established back in July) underscores its strategic value. Louis’ quant system flagged MP the day before the Pentagon announced its $400 million deal. The stock has surged 169% since (and is up 14% today as I write). But is MP still a “buy” today after this run-up? Though it is certainly pricier, yes. If Beijing really begins to weaponize rare-earth exports, the U.S. has little choice but to build alternatives – and quickly. Unfortunately, building out domestic infrastructure will take years. That’s why MP Materials’ “Mountain Pass” mine” – the only active rare-earth mine in the U.S. – now matters in a way it didn’t a few years ago. And the Pentagon’s deal changes the traditional calculus – as does Apple’s equity stake in MP that came a few weeks after the Pentagon’s. These multi-billion-dollar investments take a lot of risk out of MP’s big spending plans, including its new “10X” magnet plant. It also locks in steady demand before the factory even opens. So, instead of being just a raw-materials miner, MP is on track to become a full magnet maker with long-term customers and far more predictable cash flow. Bottom line: MP remains one of the few ways to play U.S.-backed REE supply – and it still has a bright future despite the recent price gains. But MP is just one piece of a much larger puzzle Securing rare earths is essential for the chips, data centers, and robotics that will drive the next wave of AI innovation, but that’s just a start. That’s why Louis, Luke Lango and Eric Fry joined forces to build the Day Zero Portfolio – a hand-picked collection of seven companies they believe represent the very best in AI-driven robotics. Now, full disclosure – MP Materials is one of them since it’s a critical part of this story. Consider yourself in the know. But MP is just the beginning. The portfolio also holds top-tier stocks in robotic sensors… drones… factory robotic automation… and 3D sensing for navigation, to name a handful. To be clear, this isn’t just another list of tech stocks – it’s a focused roadmap to the companies poised to capture the next surge of AI-powered growth in robotics. If you’re interested, Louis, Eric, and Luke put together a preview you can review here. Finally, master trader Jonathan Rose says it’s time to book profits in his rare earth trade, NB Louis wasn’t InvestorPlace’s only analyst who nailed the MP Materials trade. Jonathan got his subscribers into position using options, with one tranche returning 700%. But Jonathan also recommended a second REE play: NioCorp Developments Ltd. (NB). We gave away this trade for free in the Digest and have been tracking it since. Our latest update from Jonathan came on Monday: We jumped into NB around $3.50 — now it’s trading near $6. I’m taking profits on half while letting the rest ride. Well, here we are just a few days later, and Jonathan has updated his thinking. He just recommended his Masters in Trading All Access subscribers close out their position, making about 70% on the trade. Yesterday, Jonathan emailed me his thinking and plan going forward: I closed to lock in profits – market feels frothy… it’s ok to lock in profits and reassess. We are buyers of any of the Deep Sea Mining companies on pull-backs: MP, TMC, USAR, NB. Jonathan just gave you a look at his picks so, once again, consider yourself in the know. If you’re not following Jonathan… I’ll let a few of his legions of trading fans make the case why you might consider it. Here are just a handful of the latest investor/trader accolades for Jonathan: - 98%. Thanks @Jonathan

- Great trade – thanks, JR!

- You really have become a hero of mine!

- So far, I have executed 121 trades by using the UOA tool along with trade ideas discussed in the Discord community… Of the 121 trades, I have 107 closed trades with a 73.8% win rate, and a 25.6% overall return on all trades. I have more than paid for my subscription, just 3 months in and I am looking forward to continuing to grow my trading account.

We’re thrilled that investors/traders are responding so enthusiastically to Jonathan, but we’re not surprised. He’s one of the best teachers in the business. To begin learning his approach to trading – and how he uses options safely – check out his Masters in Trade Options Challenge. Don’t worry if you know nothing about options – and if you’re skeptical of them, even better! The course is all about learning, with Jonathan holding your hand through the concepts until they become like second nature. Here he is with more: You’ve got nothing to prove. You’ve just got to be willing to learn. And once you see how simple it can be, you’ll never look at options the same way again. If you’re ready to learn the right way — with zero pressure, fixed risk, and a community that supports you — I’d love to see you inside the Challenge. We’ll keep you updated on all these stories here in the Digest. Have a good evening, Jeff Remsburg |

0 Response to "A Market Roadmap to Round Out the Year"

Post a Comment