This Stock Nearly Doubled From Washington’s Latest Big Move – What’s Next? VIEW IN BROWSER First, the Trump administration invested in MP Materials (MP). Then, it took a stake in Intel Corporation (INTC). Now, the Trump administration is making another splash. This time? Lithium Americas (LAC). On Tuesday evening, reports emerged that the Trump administration is negotiating for up to a 10% equity stake in the company. The stock soared “bigly” on Wednesday as a result – up more than 90%. This is the most dramatic example yet of Washington’s new playbook of making strategic investments in companies that supply products, components and resources that are deemed critical to national security. This playbook is being revealed in real time. Rare earth magnets. Chips. And now lithium. But if you are a regular reader of mine, you know I have been previewing this playbook for months. In fact, I gave my premium readers a heads-up about MP Materials before the Trump administration’s deal was announced – and they had the chance to make as much as 130%. So, in today’s Market 360, I will explain the deal between the government and Lithium Americas. I’ll also share how this investment will help the U.S. gain access to more lithium, what this means for America’s electric vehicle (EV) supply chain and how investors can profit from government-backed investments like this. The Trump Administration’s Latest Investment First, let’s address the big question of why the Trump administration is interested in this company. Lithium Americas is building the Thacker Pass mine in Nevada – a site that is set to become the largest lithium project in the Western Hemisphere.

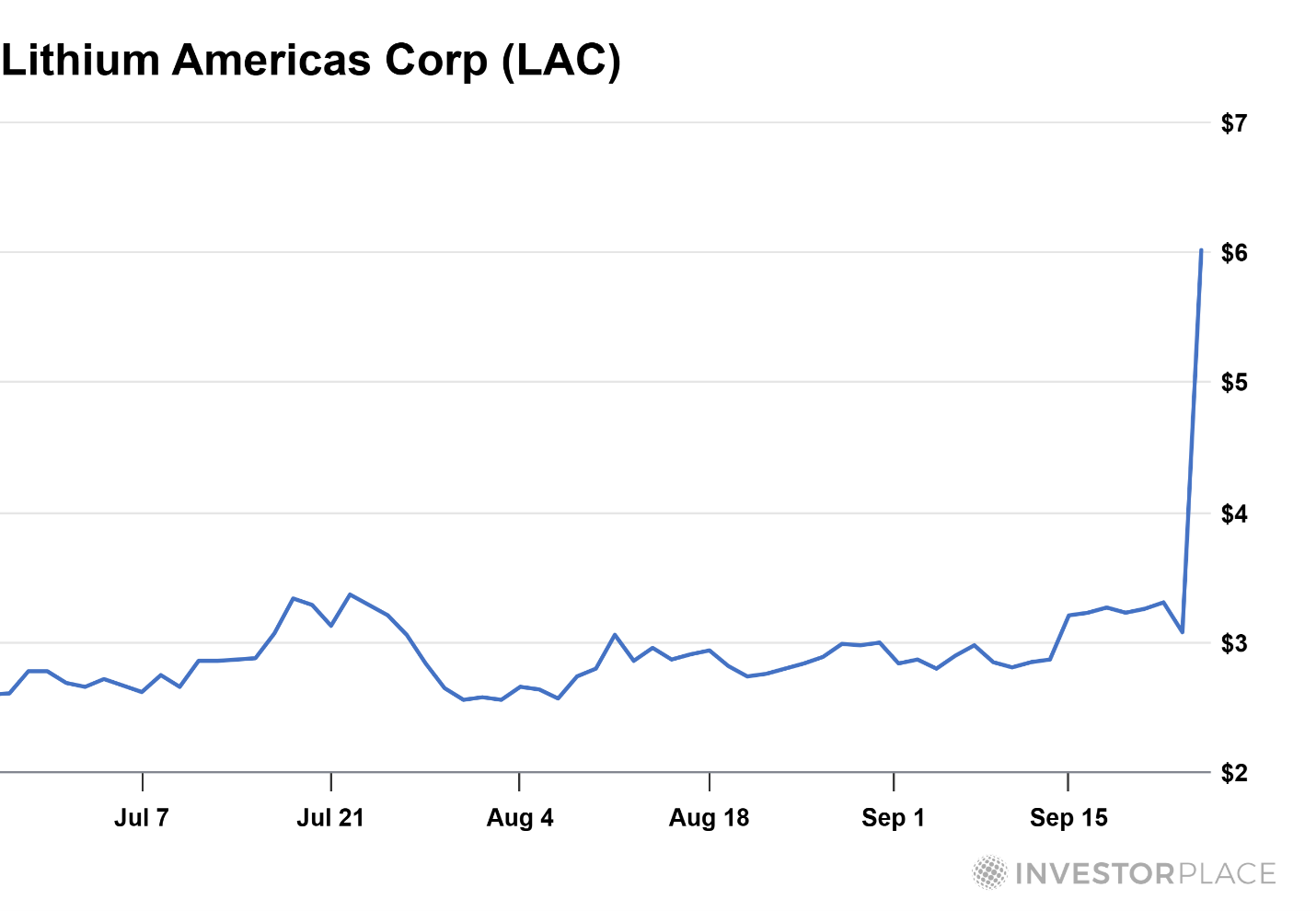

Source: Lithium Americas To finance construction, Lithium Americas previously received a $2.26 billion loan from the Department of Energy. The current talks are part of a renegotiation of that loan. As part of the deal, Lithium Americas has offered Washington no-cost warrants on up to 10% of its common shares. The administration is also pressing for purchase guarantees from General Motors (GM), which already has $625 million invested in the project and owns a 38% stake. The market’s reaction was swift. As I mentioned, shares of Lithium Americas exploded more than 90% higher on the news.

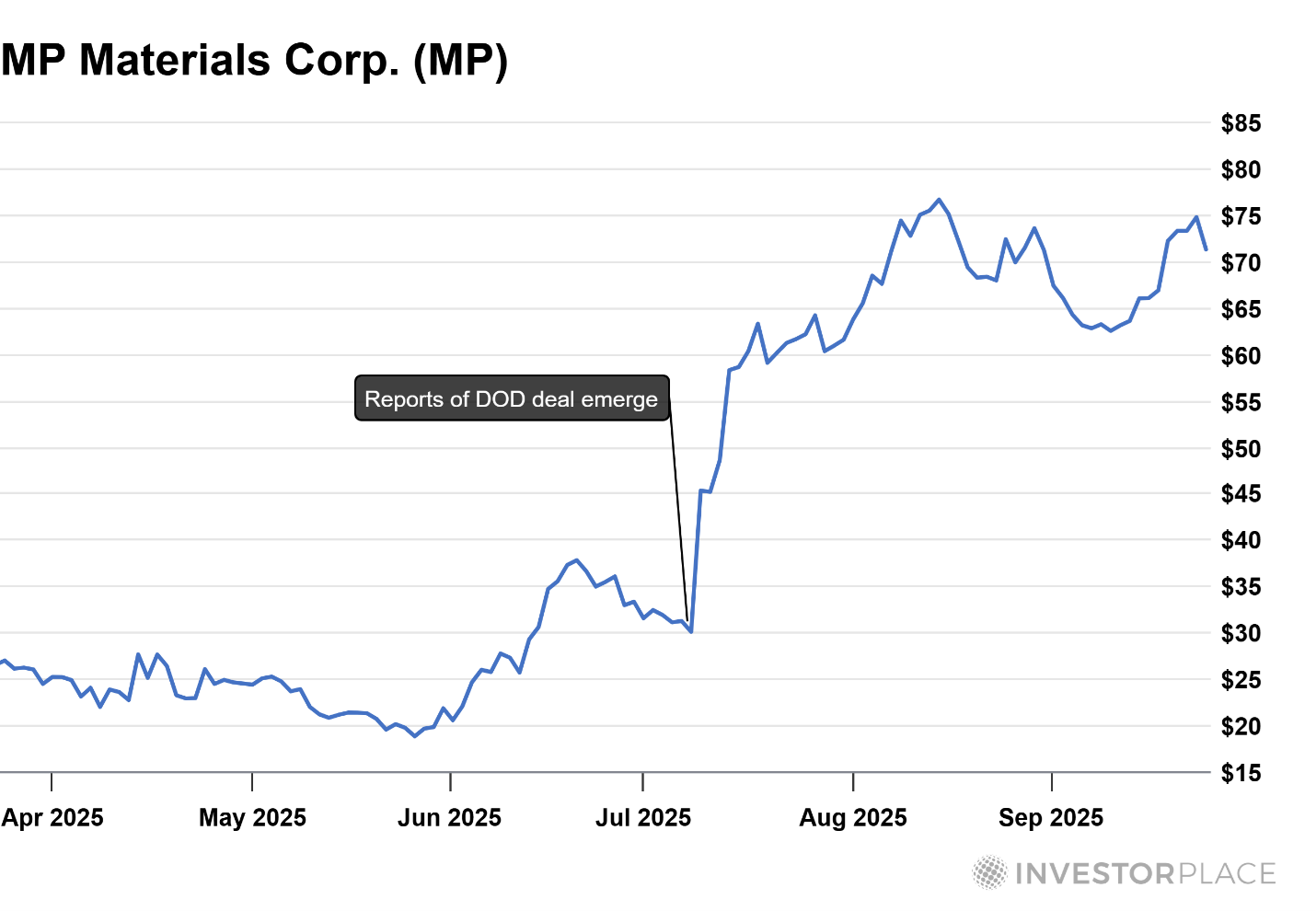

That is the power of government money – and it is why this new industrial policy is shaking up markets in real time. Why Lithium? Simply put, lithium is one of the most critical resources for the future of America’s economy, and the government is doing everything it can to ensure the U.S. is not left behind. You see, currently China dominates the global lithium market. It is the world’s third-largest producer, but it controls more than 65% of the world’s lithium refining. The U.S. is heavily dependent on foreign countries for the raw materials that power everything from our electric car batteries to advanced military technology. The Thacker Pass project is poised to become the largest lithium mine in the Western Hemisphere, producing more than 40,000 metric tons of lithium carbonate in its first phase alone, which is expected to come online in 2028. That is enough lithium to power 800,000 electric vehicles – but it’s just the beginning. When it’s all said and done, the project could produce 160,000 tons of battery-quality lithium per year. What’s more, the company projects a lifespan of 85 years for the mine. By backing Lithium Americas, the U.S. is signaling its intent to break free from this reliance on China – especially when it comes to key materials that will shape the future of both our economy and national security. | Recommended Link | | | | On July 18th, Trump approved a new digital U.S. dollar that’s already used for $27 trillion in payments a year — more than Visa and Mastercard combined. It’s not Bitcoin or a Federal Reserve scheme, but a free-market solution to restore the dollar’s supremacy. See Louis Navellier’s new analysis of Trump’s 21st-century dollar. |  | | What’s Happened So Far – and What Could Come Next Lithium Americas is the latest chapter in a growing story – but it won’t be the last chapter. Back in July, the Trump administration moved into MP Materials, the only U.S. company mining and processing rare earth minerals at scale. I flagged it as a “hidden AI trade” in advance, and the stock doubled within a week of the news. (You can read a recap of my coverage in this Market 360.)

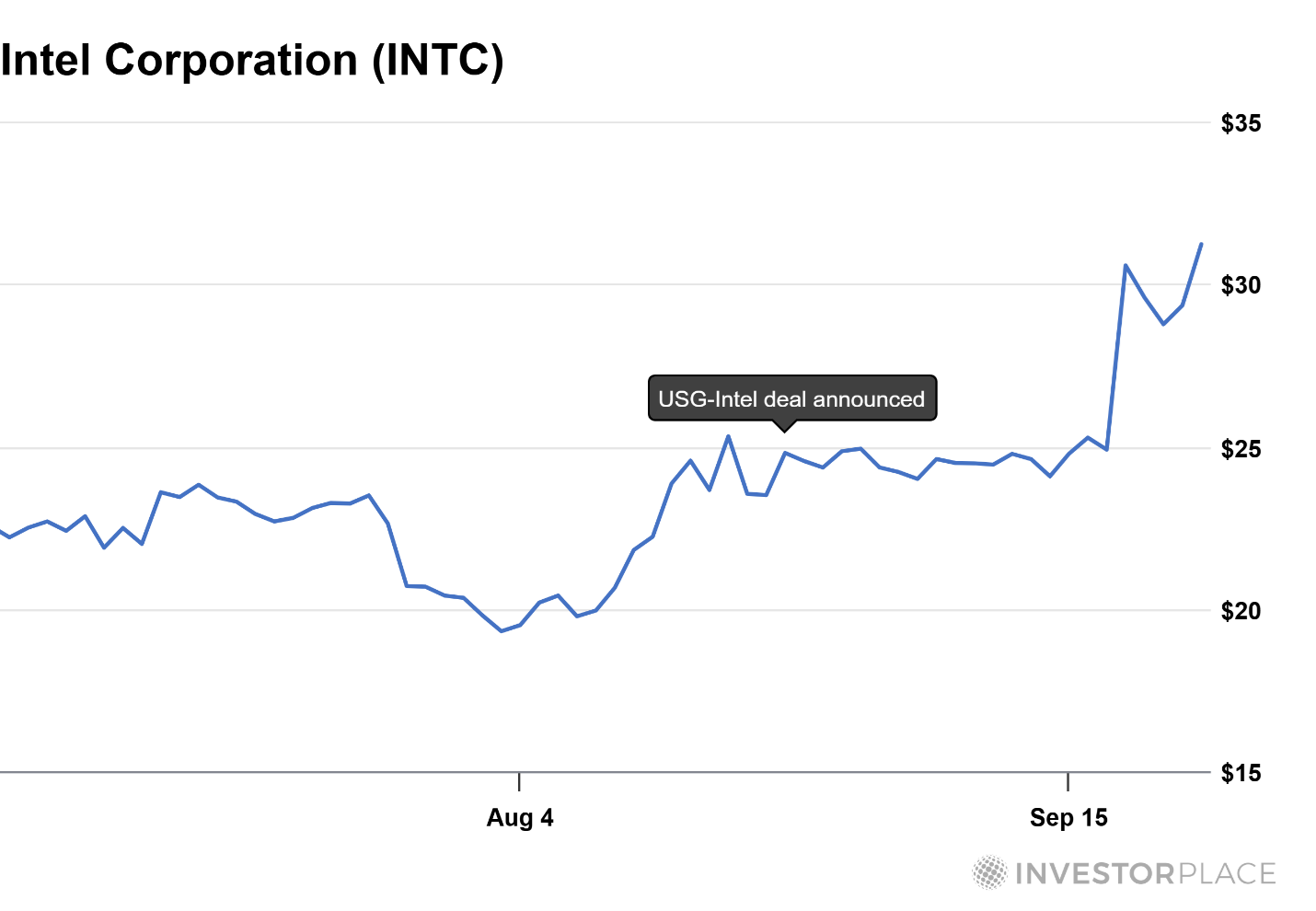

Then came Intel, where Washington invested $8.9 billion for a 10% equity stake to secure domestic semiconductor manufacturing (we covered that news here). You can see how much INTC jumped following the news.

Now we have Lithium Americas. Clearly, these moves are not happening in isolation. They’re part of a coordinated effort. And Washington is already flexing its muscle in other strategic areas, too: - Quantum computing: The Texas Quantum Initiative, passed in 2025, will provide a funding vehicle (among other things) to award grants and matching funds for quantum projects. Meanwhile, the Defense Advanced Research Projects Agency (DARPA) has selected 18 companies for the first stage of its Quantum Benchmarking Initiative (QBI) to evaluate their ability to build a utility-scale, fault-tolerant quantum computer by 2033.

- Nuclear energy:NuScale Power (SMR) secured a $500 million Department of Energy grant for small modular reactors – another critical area for U.S. energy security. More funding – or perhaps even an equity deal – could be on the way for players in this space…

- Cloud computing:Oracle Corporation (ORCL) landed a government cloud deal that provides a 75% federal discount, cementing its position as a strategic partner in data infrastructure.

- Defense: Recently, Commerce Secretary Howard Lutnick has suggested that the Pentagon could take direct stakes in defense contractors such as Lockheed Martin Corporation (LMT).

- Critical minerals: A host of other companies with access to critical minerals like copper, cobalt, uranium, silver, antimony (and more) could be on the table for a deal.

The bottom line: Washington is moving beyond grants and subsidies. It is stepping into the market as a shareholder. What This Means for Investors All of these investments tie back to Executive Order #14196, which allowed President Trump to direct the creation of America’s first sovereign wealth fund – what I call the MAGA Fund. Its purpose is to unlock hidden “reserve accounts” and funnel that capital into a select group of U.S. companies critical to our national security and long-term prosperity. Make no mistake, we are talking about trillions of dollars in potential wealth. The companies tied to this agenda will have something no other firms can claim – the full weight of the U.S. government behind them. I have identified a handful of under-the-radar companies I believe are in line to benefit. And because they are smaller names that most investors have not heard about, I believe their stocks could skyrocket as the money starts flowing – just like it did with MP Materials and now Lithium Americas. Click here now to learn how to position yourself before the next round of MAGA Fund investments hits the market… and sends select stocks soaring. Sincerely, |

0 Response to "Must Read: This Stock Nearly Doubled From Washington’s Latest Big Move – What’s Next?"

Post a Comment