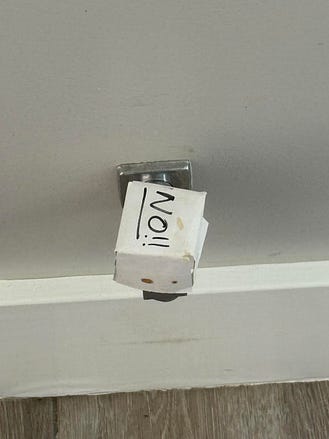

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Good afternoon: Well, the good news is that I’ve got two acres to grow food on again… The bad news is that I had to withdraw some capital to do so for a while, which has made my property a bank asset for now. One of the primary frustrations of a place like Maryland, in addition to the income taxes and real estate taxes, is that everything was a lot easier in Florida. But you can’t look back. And the dogs are running around again like maniacs. The real question we have is not what to grow first… (since the first vegetable is typically broccoli planting in March…) No… What the hell do these things mean? “Don’t touch?” “No!” Naturally… my wife touched that switch. We’ll find out if the house blasts into space in the next few hours… If you don’t hear from me… at least you got to see the week in review… Sunday, September 7 Fear and Loathing at the Maryland State Fair...We went back to the Maryland State Fair… And we got some Bazooka Joe Gum…  The lesson is… never go back to the Maryland State Fair. Monday, September 8 Nope on "Capitalism"... (Here's Why)A new Gallup poll says only 54% of Americans view capitalism favorably, down from 60% in 2021. They're asking the wrong question. I remind you… What’s the saying? This is not a rant? Monday, September 8 Say Thank You To Frank Wycheck...How did we get here? How did this idea of the Money Printer and the 1% Pattern come to be? It’s all the result of a terrible football outcome that happened in 2000… It’s funny how all roads lead back to this moment… and what it means to all of us… Tuesday, September 9 We Know, Jamie...Jamie Dimon just discovered the economy is weakening. In related news, the Titanic's captain once noticed the deck was wet. I don’t understand how this is even a headline. The largest bank CEO in America, with access to more economic data than the Fed, just appeared on CNBC to say, "I don't know" about a recession… Wednesday, September 10 All the Debts I OweSome days can be difficult… But sometimes a good song will help you overcome them… Friday, September 12 Things I Think I Think...Well, the dogs are nervous. That’s because we closed on the new house… about 15 minutes west. It wasn’t an easy process… But here we are… and we’re on the way to a place with farmland and a place for the dogs to run… That’s a great time… What else do I think? Saturday, September 13 Yeah, I'll Chart Party...Every week… We have a chart party… Feels like a great time for another one… What’s a chart party? That’s why you need to click the link… And Finally…We have a busy week coming up with the Fed meeting and Third Friday. Also, please be aware of what I wrote this week about the state of the money markets…

If any cracks are in the system - we’ll see them first at The Capital Wave Report - which goes live tomorrow at 8:00 am… Additionally, I’ll be writing about the New American OPEC and some curious things I’m seeing in the Utah Desert (it’s not geothermal… it’s bigger…) this week. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Dogs Running Around Yards Very Freely (And the Week In Review)"

Post a Comment