What happens next after more market highs … Eric Fry’s latest recommendation … the growth story that underpins the AI Megatrend VIEW IN BROWSER Alaska is the only place you can find fat bears right now. Every year, Katami National Park and Reserve holds an online contest to pick a favorite brown bear. The bears have been gorging on a generous salmon run this year, as they prepare to hibernate for the winter. Members of the public can view pictures and cast a vote for their favorite, NCAA tournament style.

Credit: KenCanning Of course, fat bears are more likely to be successful bears. Winter low temperatures in Alaska range from 0° F to -30° F, so a thick layer of fat is necessary for hibernating bears. Last year, the winner was “128 Grazer” – an adult female that won for the second consecutive year by defeating male bear “32 Chunk” in the final round. While fat bears may be all over Alaska these days, on Wall Street and Main Street, only the bulls have been getting fat as the market has continued to deliver new record highs. With the market hitting all-time highs again this week, are you still feeling bullish, or are you thinking that it might be time for a bearish turn? Analyst Tom Yeung wrote about why you might feel the way you do, and highlighted Eric Fry’s newest recommendation, in the recent weekly update of Fry’s Investment Report. | Recommended Link | | | | To carry out Trump’s Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the “reserve accounts” sitting on trillions of dollars’ worth of untapped natural resources. I’ve spent months digging into this – and I’ve identified three companies that have already been granted “emergency status” and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls forward. |  | | Bulls vs. Bears Tom notes that when stock markets hit fresh record highs, investors tend to separate into two groups: - Bulls: These daring investors see rising markets as a sign of even more gains to come. Time to buy.

- Bears: These cautious investors see record-high prices as inviting a correction. Time to sell.

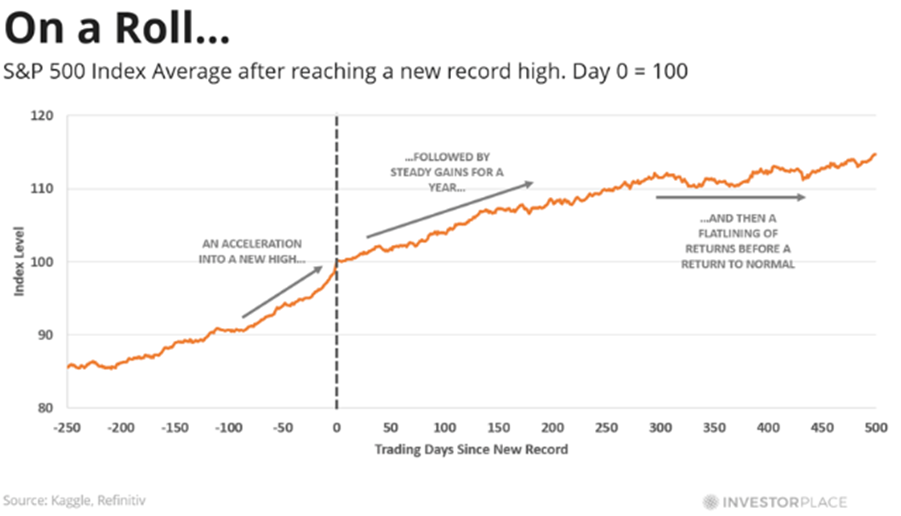

Why investors feel the way they do depends on several factors, such as individual psychology and personal experience. But what do the numbers say about what could happen next? Here is Tom’s summary: To answer this question, I’ve reviewed S&P 500 data since 1927 and recorded each instance where the U.S. index hit a new all-time high. To prevent double-counting, I ignored any record high within 12 months of another one. (So, if the S&P 500 hit a new record on April 4, and then another one on April 5, only the first date is counted.) That leaves us with 35 instances of S&P 500 record highs from the past century. And here’s what the average return looks like over the following two years (roughly 500 trading days).

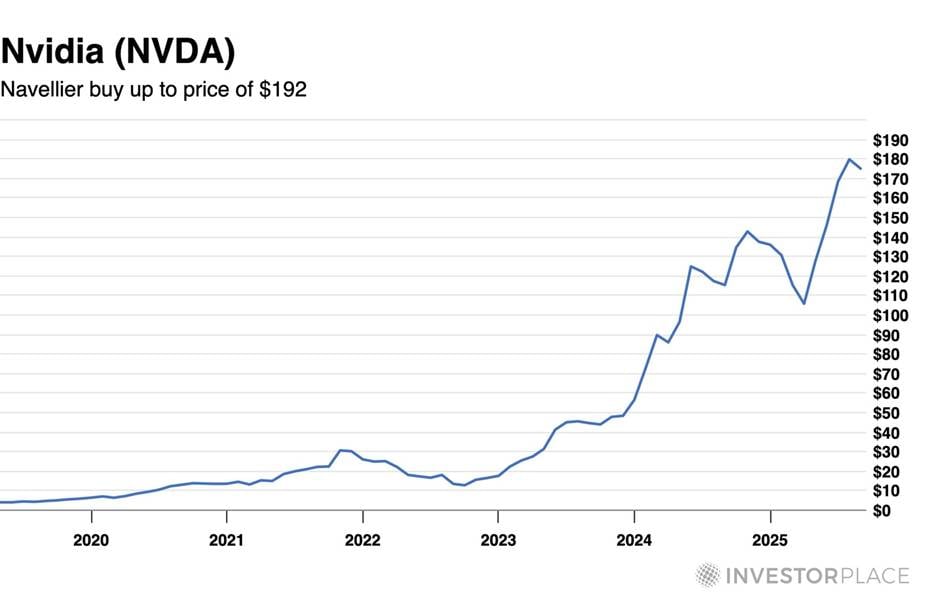

The graph above clearly shows an acceleration into a new record high, followed by a steady one-year return of 9.9% between trading day 0 and 252. Stocks then flatline for a while before returning to normal growth rates. So, on average, buying at fresh record highs is great for your wallet. Earlier this month, Eric recommended that his Investment Report readers take advantage of that momentum by buying Savers Value Village (SVV), the world’s largest for-profit thrift store. Eric noted that the dual trends of more Americans moving “down market” to cheaper retail options and the increasing popularity of “thrifting” as a pastime is driving revenue at SVV. Plus, because it sources nearly all its products from the U.S., it does not have to deal with any of President Trump’s tariff policies. SVV remains a buy below $14.25. Tom ends the weekly update telling readers to stay in the market, own both aggressive and defensive stocks, and avoid high-risk bets. In summary: Our view is that artificial intelligence will continue to pull markets higher. The technology is improving almost daily, and we believe markets are still underestimating its potential. The Sure-Bet AI Play If you’ve been following Louis Navellier, you know that data centers are the cornerstone of the AI revolution. How much will data center capacity grow as AI becomes more prevalent? Here is Louis’ summary: According to McKinsey & Company, global demand for data center capacity is anticipated to grow between 19% and 22% annually between 2023 and 2030. If that’s the case, then annual data center demand would be between 171 gigawatts and 219 gigawatts. To put this into perspective, current demand is around 60 gigawatts. So, global demand for data center capacity is projected to more than triple by 2030. This trend continued to make news recently when AI megatrend leader Nvidia (NVDA) made two major announcements: - A $5 billion investment in Intel (INTC) to co-develop PC and data center chips.

- A $100 billion investment in OpenAI, including “at least 10 gigawatts” of compute capacity from Nvidia’s AI systems to rain and run OpenAI’s next generation AI models.

Here’s Louis’ summary: Simply put, Open AI is investing billion on data centers that will be based on Nvidia’s GPUs. If you’re new to the Digest, Louis recommended NVDA to his subscribers in 2019 when it sold for less than $5 and is currently sitting on open gains of more than 4,000%. In fact, NVDA is still an open buy recommendation up to $192!

Yesterday, Louis published the latest issue of Growth Investor, recommending two more stocks that are in excellent position to ride this trend. If you’re a Growth Investor subscriber, I suggest you go check out those names right now! I hope you’ve been a bull who has grown fat on recent market gains. By all means, go vote for your favorite fat bear, but when it comes to the market, our bullish analysts and their subscribers are the only ones getting fat! Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

0 Response to "Feeling Bullish or Bearish? What the Market Will Do Next"

Post a Comment