You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Financialization and Other Mainly, Manly? Observations...I swear... things don't change... and people are getting worse...Dear Fellow Traveler, The Dolphins didn’t take care of business today - dropping our record to 0-4. I wore my lucky tracksuit… but it didn’t take. The girls are playing infinitely better than at the start of the year, although one of our best players was spinning around in order to get dizzy during the game, and falling and laughing… Same as it ever was… After the game, I went to the gym… I got a call from my wife. She said the handyman that she’d talked to on some app was going to come over. So, I drove 20 minutes west… He walked through… looked at the chalking that needed to be done… He looked at the simple light fixtures that needed to be fixed… The things he could do today… In his very broken, Russian accent, he quoted me on the spot… $950 for the next few hours… I told him, “I don’t know what things cost…” trusting that he wasn’t ripping me off… When I told my wife the cost, she showed me the ad… His ad said he charged $75 an hour… and that included basic materials… I confronted him nicely, but immediately… and tried to get to the core of this disconnection… He thought in Russian and lied in English… Then, he started bartering against himself… and after he was done cutting the price in half, I told him to get out of my house. As he walked out… he said “I’m sorry…” knowing exactly what he’d done… I’m really, really tired of people being assholes… Literally exhausted by it… Listen, I get it… in this society… one based so heavily on extracting from other people… The reality is that as we continue to descend into this attitude of “get the bag while you can…” (A very particular way of looking at the world)… Being expected to constantly be the civil person is exhausting… Let’s get to the market… LOOK… MORE EXTRACTION…Tuttle Capital just launched the Tuttle Capital IBIT 0DTE Covered Call ETF (ticker: BITK). Hold on… back up… back up… An exchange-traded fund (ETF) is a basket of stocks or assets you can buy like a single stock. Think of it like buying a fruit basket instead of individual apples. BlackRock created an ETF (IBIT) that holds Bitcoin for investors (and charges you fees to do so). Simple enough. Now here’s where it gets… I don’t even know what the word is… Tuttle created ANOTHER ETF (BITK) that sells “daily options” on BlackRock’s ETF. Now, options are contracts whose value fluctuates in price depending on whether the underlying asset attached to it (in this case, Bitcoin) increases or decreases in value... Daily options expire the same day - like speculating on whether it’ll rain THIS AFTERNOON, not next week. BITK sells these daily speculations to “traders” who think they can predict Bitcoin’s price movement by 4 PM… In exchange, BITK collects small fees (premiums). But if Bitcoin rockets up, BITK investors miss those gains because they sold away their upside for pennies (because the covered call caps the gains based on the strike price of the expiring option… Confused yet? Good… they have done this shit on purpose… The Absurdity StackWe now have:

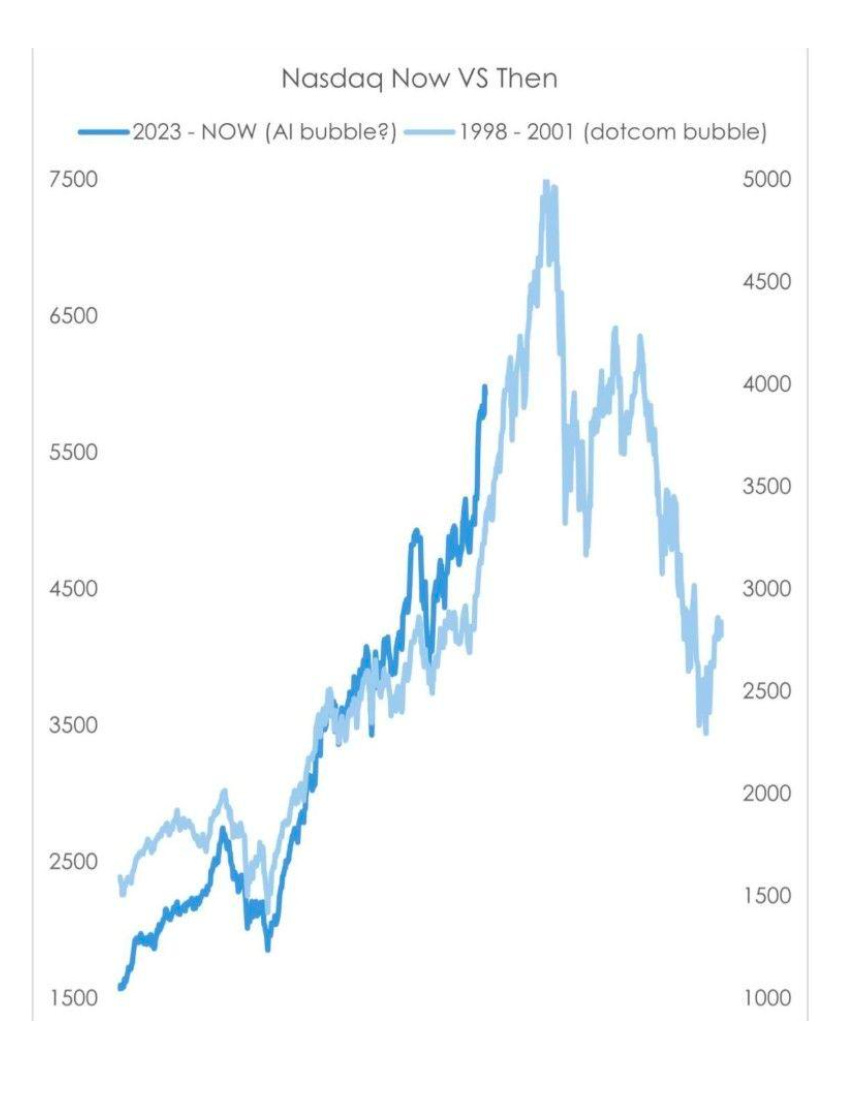

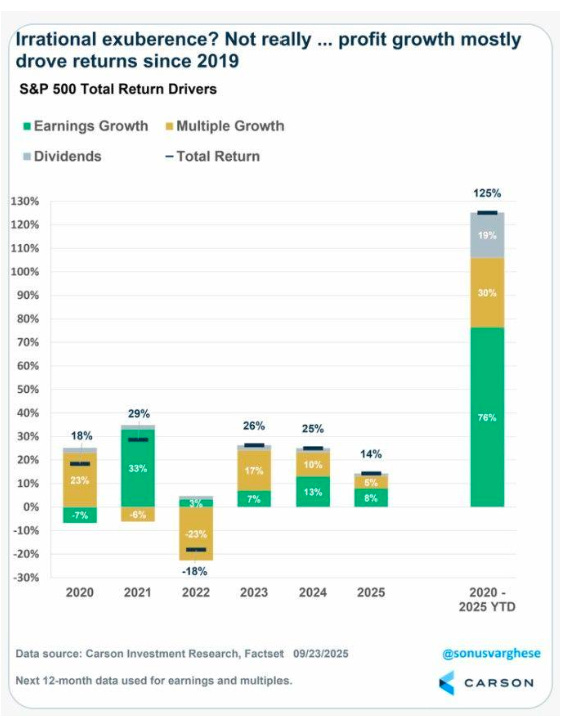

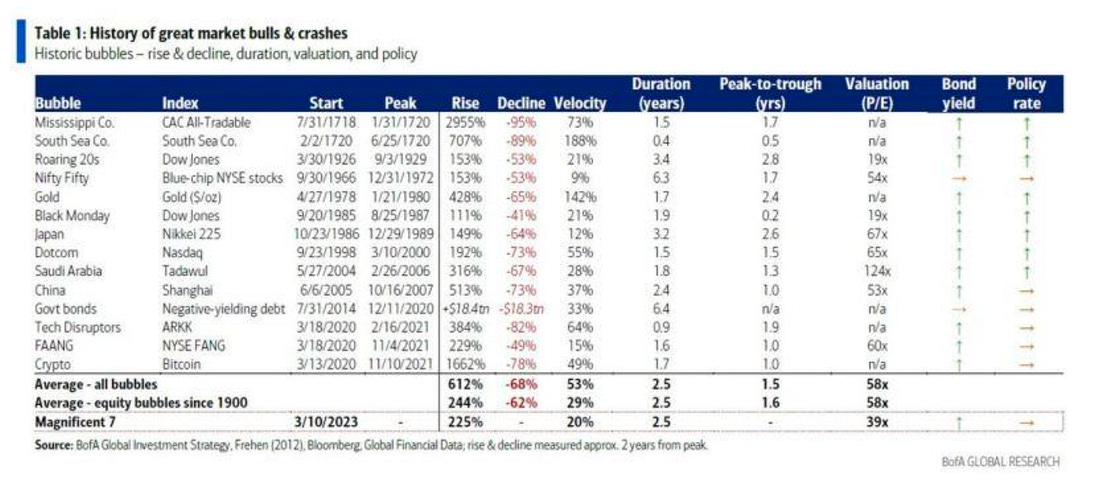

This is what happens when financialization swallows the economy whole… We’ve created an ETF of derivatives of an ETF of digital tokens. Four layers of abstraction from anything productive. Meanwhile, bridges are collapsing, the power grid is stressed, and we can’t manufacture basic medical supplies domestically. But at least we can now trade volatility on volatility on volatility before lunch. Thanks, financialization… Thanks, Treasury Department… Thanks, Federal Reserve… BRRRRRRRRR… The Liquidity ProblemThis product exists because we’re drowning in liquidity with nowhere productive to put it. Global liquidity hit $186 trillion, according to CrossBorder Capital... That money needs returns and needs to go somewhere... However, a significant number of traders, investors, and money managers are unwilling to finance a factory and generate an 8% annual return, which involves creating jobs, managing human capital, and navigating regulatory requirements. Instead of funding infrastructure or manufacturing capacity, it flows into increasingly complex financial instruments. There was $1.9 billion traded on Bitcoin ETF options on the first day they became available. Not in Bitcoin itself - options on an ETF of Bitcoin. That’s $1.9 billion of human energy and capital dedicated to speculating on the daily movements of derivatives of digital tokens. The same engineers who could be designing next-generation nuclear reactors are instead optimizing algorithms to shave microseconds off options trades. Mathematicians who could be solving energy storage problems are building models to price 6-hour call options on crypto ETFs. Incentives… MATTER… We don’t make things anymore. We reach into the next guy’s pocket… We make bets on things. Then we make bets on those bets. Then we make ETFs of those bets. People have never looked at Liar’s Poker or The Big Short as warnings… They’ve looked at them as instruction manuals… then tested the limits of the limits… The Real Economy EvaporatesEvery bright MIT graduate who joins a hedge fund instead of Intel or Boeing is another step toward a world where everything is a trade and nothing is real. This Bitcoin options ETF is the perfect symbol of our priorities. Maximum complexity, zero productivity. It extracts fees from the volatility generated by others extracting fees from volatility. Extraction models are popular these days… That’s the lesson of the post-2008… and… especially… the post-2020 SPAC world… We’ve built the most sophisticated financial system in history to trade claims on claims on claims while our bridges rust and our industrial base evaporates. BITK isn’t just another stupid ETF. It’s a monument to misallocated genius. The smartest people of our generation are building casino games instead of power plants. That’s not innovation or anything to brag about. Let’s just get to the charts, man… No. 1 Past Performance Does Not…The fascination with the AI versus Dot-Com Bubble is an interesting one… I’m gonna go a little contrarian with a few point today… First, liquidity has been a big driver of both. In the 1990s, there was ample speculation around the Dot-Com world. No doubt… It was irrational… But the focus always seems to be on the speculation… and not on the monetary policy… and not on other underlying drivers that remain elusive to a lot of financial historians. This was a period where we incentivized CEOs and managers to really start the process of financial engineering. We started paying people - for the first time - in stocks and options after a government attempt to curb the rise of CEO-to-worker pay levels. Incentivize CEOs to drive their stocks higher - and what happens? Second - and this is the bigger differentiator. One of the issues of the Dot-Com Bubble was the failure of the infrastructure to follow up the hype. The Internet hype started in the early 1990s… but the reality is that the infrastructure build out took at least 15 years, combined with the need for faster internet speeds. An island in Maryland (Smith Island) has FINALLY gotten access to high-speed internet… in 2025. AI is different. It’s an incredibly powerful innovation - but the build out is accelerating at a pace that hasn’t been achieved in human innovation dating back 2,000 years… The question - of course - is how these markets will function in the future… and if we see the real underlying drivers today that aren’t around the technology comparison - but instead focus on the real drivers of markets… Liquidity… and then… liquidity… and then liquidity… and then… IT’S THE MONEY PRINTING… Chart 2: My LordThis chart… Yes… PROFIT GROWTH is the driver of the markets, says… No… NO… NO… NO… Since 2020, they’re trying to argue earnings growth… What could have possibly driven up all that profit growth in 2021? Was it the incredible efficiency of businesses created in the wake of COVID? Or WAS IT THE GOD DAMN MONEY PRINTING… Why are so many people so hopelessly attached to their MBAs and CFAs, when it’s clear that the never-ending liquidity cycles are drying things. You see the multiple growth drops like a stone in 2022? It’s IN THE CHART ABOVE… In 2022, we had the increasing rate cycle, the GILT crisis, and the impact on liquidity. And then… the support came from the central banks to accomodate the shadow banks… I feel like I’m taking crazy pills… No. 3: Last Chart, Amelia’s Bowling…I’m actually bowling right now… so, let me finish with this… They’re still doing it… They’re saying that all good things come to an end… We know. The liquidity cycles tell us this… As I say time and time again, we specialize of getting out of the way when it’s time. We know the moving averages… the mathematical formula that has avoided every major downturn since 2020… And we talk about it every single day in the Capital Wave Report. If you’re ready to protect yourself against any major downturn, let me be your goalie. I play defense… you play offense… We told people on February 21, 2025 to get out of the way… And we’ll tell you when it’s time again… Find out why we became the #1 Rising in Finance voice on Substack this month… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Financialization and Other Mainly, Manly? Observations..."

Post a Comment