How a Hedge Fund Legend’s Unfinished Work Could Rewrite Your Trading Playbook VIEW IN BROWSER

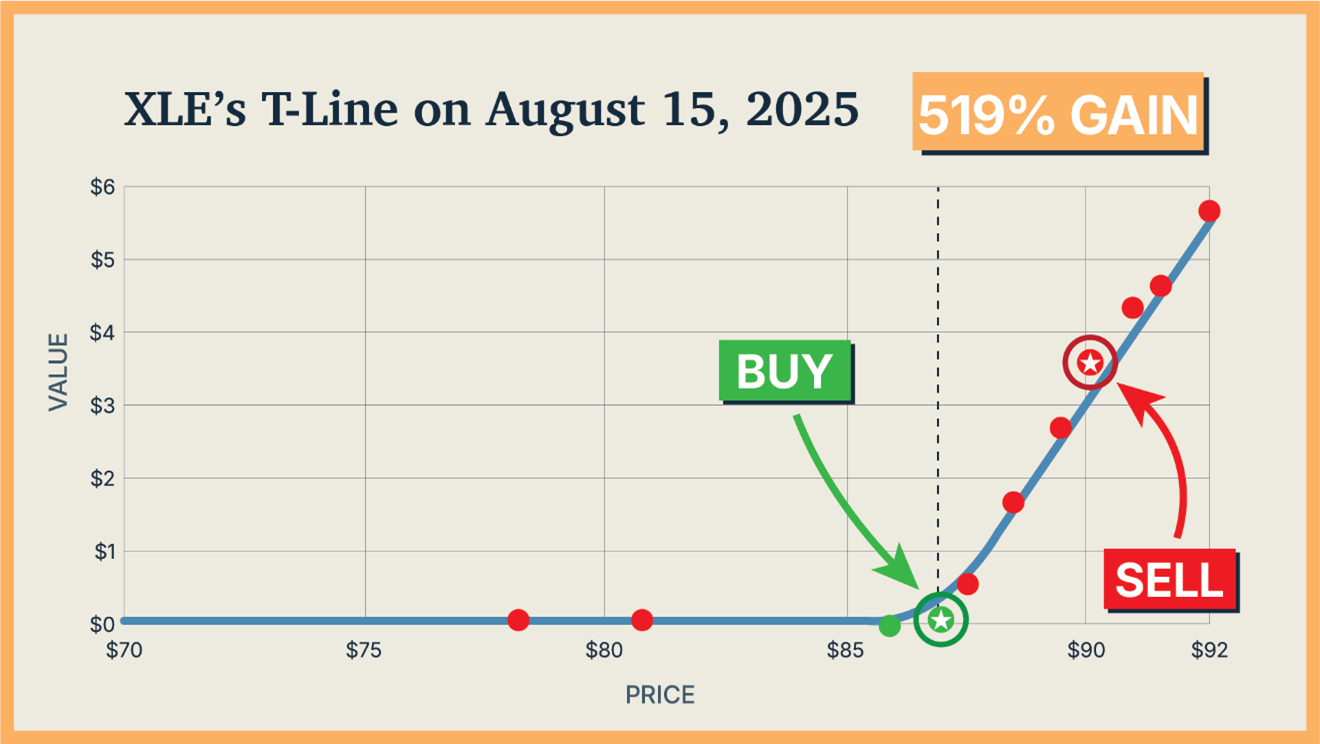

On a mountain road on his way from Las Vegas to his home in Las Cruces, New Mexico, Ed Thorp’s accelerator pedal suddenly jammed. On the steep downhill, it was too much for his brakes. The car sped past 80 miles an hour, and he began to lose control. Thorp yanked the emergency brake lever and killed the ignition. Finally, the car shuddered to a halt in a gravel turnout. A passerby who knew about cars popped the hood. A piece of the throttle assembly had worked loose from its long, threaded rod. The passerby had never seen anything like it. Thorp’s mind went cold. The casinos might not just want his money back. They might want him dead. It was easy to see why. Thorp had cracked blackjack. With probability theory and a stack of index cards, he’d turned the house’s unbeatable game into one a player could win. His book Beat the Dealer became a national sensation. Every time he sat down at a blackjack table, pit bosses watched with clenched jaws. But Thorp wasn’t a hustler or a gangster – he was a math professor. And the same brain that rattled Vegas would soon shake Wall Street. After he beat the dealer, Thorp started a hedge fund, Princeton Newport Partners. And over three decades, he delivered five-fold higher gains than the S&P 500, turning every $10,000 into $283,400. Even more impressive, his fund only had three down months in 20 years —and each was less than a 1% loss. But some of Thorp’s best work was left undone when he retired. His notebooks and ideas hinted at deeper ways of identifying value in financial instruments that the broader public never got to see. That’s where TradeSmith comes in. Our team of data scientists, quants, and coders picked up where Thorp left off … And we created the Thorp Line, or “T-Line,” for short. It’s a software tool that cuts through market noise to reveal mispricings in the market. And after months of development and testing, we’re putting it in the hands of everyday investors – giving you the same hedge fund-quality edge that made Thorp a legend. In this column, we’re going to go over how the T-Line uncovers mispriced trades Wall Street doesn’t want you to see. Plus, I’ll reveal how regular investors are already using this tool to generate steady income and triple-digit wins. And we’ll get into why this innovation could make “buy, hold, and hope” obsolete — and what to do instead… | Recommended Link | | | | To carry out Trump’s Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the “reserve accounts” sitting on trillions of dollars’ worth of untapped natural resources. I’ve spent months digging into this – and I’ve identified three companies that have already been granted “emergency status” and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls forward. |  | | Wall Street Wants This Edge to Itself For years, the “smart money” has thrived on mispricing. Hedge funds spend billions a year on models that sniff out small gaps between a stock’s market price and its fair value. Multiply that edge across thousands of trades, and you see how Wall Street racks up billions in profits. And Wall Street’s edge isn’t theory – you can see it in the numbers. Last year, the S&P 500 returned 25%. But leading hedge funds crushed that return. For instance, Discovery Capital returned 52%. Light Street’s long-short tech fund closed the year up 59%. And D.E. Shaw’s Oculus fund delivered 36%. Meanwhile, the average retail investor made 16.5%. That’s going by figures from DALBAR, an independent research firm that has tracked investor behavior since 1994. Oxford University finance professor Bige Kahraman explains this phenomenon. In 2021, for example, small investors “were exploited not only because big investors are exploitative, but also because, even in a perfect market, they cannot compete with informed, sophisticated traders.” Wall Street firms employ armies of Ph.D.s, supercomputers, and oceans of data to give them signals most investors can’t see. They know when volatility has pushed prices too far in either direction – and the exact moment to strike. The best most everyday investors can manage is a free Yahoo or Google stock chart. So, Main Street investors are told a different story: Don’t worry about mispricing. Don’t worry about edge. Just buy, hold, and hope. It’s a nice story – for Wall Street. While everyday investors are left guessing, the insiders keep the edge to themselves. That’s the gap we set out to close with the T-Line. Picking Up Where Thorp Left Off Our mission at TradeSmith is to take the kind of tools Wall Street guards for itself and put them in the hands of everyday investors. In a world where more than 70% of trades are done algorithmically, this is one way to level the playing field. Our story began in 2005 with TradeStops, a risk-management algorithm. Since then, more than 100,000 investors have used it to lock in gains and avoid catastrophic losses. Over the years, we’ve added more breakthroughs – from algorithms that spot hidden seasonal patterns… to stock-ranking software… to AI-powered trading tools. Now, we’re picking up where Edward O. Thorp left off. Remember that I said his genius was spotting when the market mispriced trades? That’s exactly what our new T-Line indicator does — it spots when the market is mispricing trades and shows you, at a glance, what to buy and what to sell. The chart below lays out an example of two trades the T-Line showed us: when to buy (then when to sell) options on the Energy Select Sector SPDR Fund (XLE), the popular energy stock fund. The green dots show trades that are undervalued… and the red dots show trades that are overvalued. The blue line between them shows the “fair value” of that asset – using Thorp’s mathematics. You buy anything below the line… and you sell anything above the line:

Now look at the dot the green “Buy” arrow is pointing to. The T-Line showed it was a highly undervalued trade. Had you got into our particular XLE options trade at $160, you could have sold at market close for $990 — or more than six times your money. And this software suite doesn’t just spot undervalued directional trades. You can use it to generate income as a trader. “Constant Money Generator” We first launched an automated strategy to help readers generate income in the markets in 2011. And it’s already been a huge success. Here’s what one user named Mark wrote: I set a low monthly target of $5,000 gain based on my past two years’ trading experience and learnings. For the first seven weeks in 2025, I was fortunate to harvest $15,000. Or take this piece of feedback from Ron, a surgeon from Ventura, California: [This] is the greatest thing I’ve ever seen or used. The last 22 weeks of the year has made me $1,137,488. And here’s a note from a more conservative trader, Mike: I am 80 years old, so I am not looking for moonshots. I want to increase my portfolio consistently for my heirs. I do 30+ trades per month with nearly 100% wins and a 25% ROE. I don’t like to lose. This product is what it says: a constant money generator. Those are fantastic returns. And we’ve gotten in a bunch of other positive feedback like this from our users. And these are the results our users achieved with our software before we developed the T-Line. This new indicator promises to completely upend the way regular folks make money in the markets. It shows you exactly what to buy and what to sell — in real-time. You can use it to generate constant cash flows like Mark, Ron, and Mike have been doing. You can use it for making profits on directional trades as high as 112% … 172% … and 519% – in a single afternoon. You’ve got to see it with your own eyes to fully comprehend how much this changes the game for you from here forward. And next Tuesday, September 30, you finally get your chance. That’s when I’ll be holding my T-Day Summit (save your spot by going here). I’ll be demonstrating, on camera, how the T-Line lets you systematically slash the kinds of risks that are keeping too many folks treading water with traditional buy-and-hold… while giving you massive upside potential in a lucrative niche of the trading world. You’ll be among the first to see exactly how this innovation could shrink decades of gains into a matter of hours — all while slashing the risks you face with buy-and-hold. Go here now to reserve your free spot for TradeSmith’s T-Day Summit. It’s time to get ready for a whole new world of trading possibilities. All the best,

Keith Kaplan

CEO, TradeSmith |

0 Response to "How a Hedge Fund Legend’s Unfinished Work Could Rewrite Your Trading Playbook"

Post a Comment