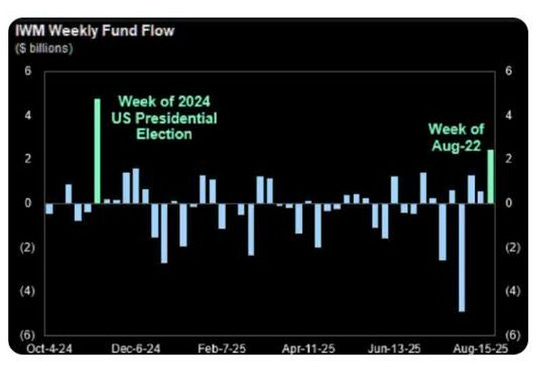

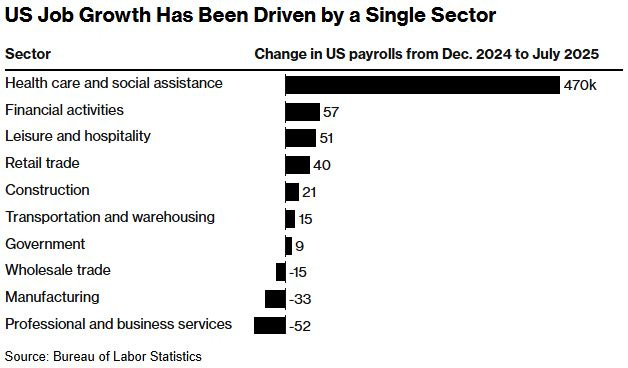

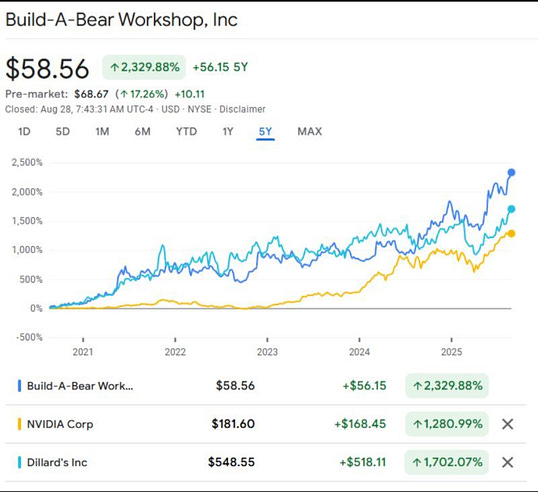

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. It's a Labor Day Chart Party... (Check Out No. 3)This is what I did during the Texas-Ohio State game (not Georgia)... As you'll see, this was more exciting...Good morning: Before we get started… The reason I made this image is simple… As long as the 1% Pattern continues to work, we must buy the dip in crisis to stay ahead of the stagflationary threat on the horizon and the total mismanagement of our debt system, which is leading to ongoing currency debasement. We trade it until it breaks… And it will eventually happen when no one wants or can any longer justify US debt at current levels, and all the financial engineering breaks down. BUT FOR NOW... LET’S DANCE… And get to the CHARTS!!! Chart 1: The Russell Finds New Life…Three weeks ago, I noted that Bank of America had projected an $80 billion annualized outflow on small-cap stocks… which would have been a record. On August 22, our signal for the Russell turned positive (I filmed a video) after Jerome Powell said in Jackson Hole that the Fed would focus on employment over inflation... And then? The Russell 2000 recorded its strongest weekly inflow since the 2024 Presidential Election... Contrarian indeed… Follow our signals and focus… This isn’t complicated… Chart 2: Our Job Market StinksThis Friday, look beyond the headline number in the August jobs report… The reality is that the 75,000 projection is a ruse… We haven't added much of anything to the economy over the last eight months. The single largest source of new jobs is healthcare and social assistance. These are government-by-proxy jobs… Wholesale trade workers are disappearing. Manufacturing continues to decline… Construction is one of the great bellwethers of the US economy… and we only added 21,000 new positions in eight months. Take away the healthcare workers and the social assistants, and we're losing jobs. Chart 3: ESG… Environmental, Social, and Genocide?Hey... this makes perfect sense... right? ESG funds in Europe are loading up on nuclear weapons... as the Ukraine War stalls and Putin threatens Europe… But it’s Green… right? When mass destruction becomes a socially responsible investment, words no longer have meaning. Chart 4: Something is VERY WrongGovernment debt grew five times, while private sector lending credit gets crowded out, according to the massive BIS report that I read. The banking system is broken. Traditional banks are now loan origination machines for private credit vehicles, while hedge funds and stablecoins hold the line on government debt. It’s going to make MUCH LESS sense the further we go down this rabbit hole… Fewer people want to take risks in finance, and that will lead to a greater concentration of power across businesses and tougher conditions for the mid-market. Great work, everyone. Chart 5: Is Gold Still Cheap (Yes…)I’ve given everyone a pretty good little trade. That means selling just under the moving average and then buying two or three dollars below that level. It reduces margin requirements. Here are examples of this type of trade from Friday. We just broke out again on gold… The next leg up for gold is likely to be in the $3,750 range, and there's no sign that monetary inflation is slowing down. I expect this to reach $4,000 within the next 12 months, assuming no major liquidity event occurs that simultaneously affects all asset prices. Plus… the Fed has broken total trust in the dollar’s value today compared to what it will be worth a week from now… Chart 6: I Mocked This Company… I Was Wrong…Just a reminder... NVIDIA isn't the post-COVID champion. The stock everyone should have piled into… the Fundamentals champion? It’s Build-A-Bear Workshop (BBW)…

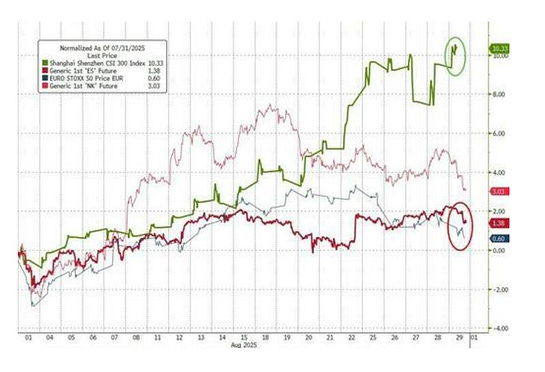

I even made fun of it a few weeks ago… “Hey, Garrett… shut up,” laughs increasingly wealthy CEO, Sharon Price John… The stock was $1 on April 1, 2020… It recently hit an all-time high of $70… And here I am buying pipelines… The money was in stuffed bears the whole time… Chart 7: Probably Nothing…We were talking about gold… and I had something else to say… This chart speaks volumes… And it’s a reminder of what I said yesterday… An event occurred in April 2025 that should have made headlines worldwide. The next time we have a short-term crisis… watch the dollar. If the dollar isn’t seeing significant demand… that’s an issue. Instead, we saw investors in other countries turn to Circle and Tether, which are more or less synthetic dollars. This is called a trend… for a reason… Chart 8: What’s Driving The China Rally?At TheoTrade, one of my colleagues has been very bullish on Chinese stocks and their momentum. One of my favorite stocks to trade is Weibo (WB), a cheap, high-quality Chinese stock that does VERY well when it breaks above its 20-day moving average. Why has Weibo rallied the way it has? Why is China blowing the doors off? A few things… This month, China's finance ministry introduced a policy that subsidizes interest on consumer loans (up to RMB 50,000). It covers 90% of the rate reduction, with local governments covering the remaining 10%. Second, China maintained its one-year Loan Prime Rate (LPR) at 3.0% and its five-year LPR at 3.5%, unchanged for three consecutive months. There are three major global stories that we must continue to monitor from both an opportunity and risk perspective…

Policy and liquidity are driving markets… Full stop… And Finally…It’s not a chart… but it’s a beacon… This morning, someone made me an offer I couldn’t refuse. And I’ve decided to part ways with this baseball card. I was lucky enough to get it a year ago in a Bowman pack. For anyone who doesn’t know, Carson Benge is a top prospect in the New York Mets organization, and I think he’s going to be very good. He’s a lot of fun to watch, and was one of the greats at Oklahoma State, a program I follow every spring… The Mets' future center fielder and maybe a several-time All-Star. This is the FIRST Bowman card that he ever signed… It’s gorgeous… but the offer was too good… I’ve decided to clean house a bit on my cards this fall and consolidate a little. And I will go back to my roots a little. My father has a complete set of 1951 and 1952 Bowman baseball cards… and I want to make sure that I do one thing. Buy a second Mickey Mantle 1951 Bowman card, so that if we ever sell the 1951 set, we will ensure that we keep his card… the one he held as a kid. The Benge card sale is the first step toward that goal… I’ll keep you updated on that journey… I’ll be back tomorrow to talk about the absurdity of stablecoins. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "It's a Labor Day Chart Party... (Check Out No. 3)"

Post a Comment