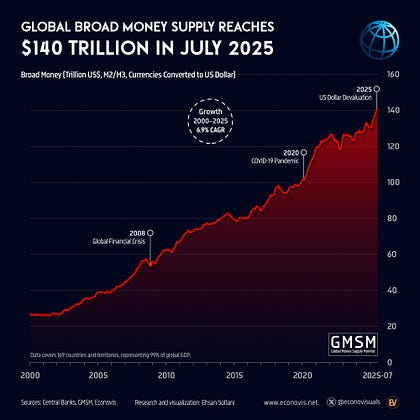

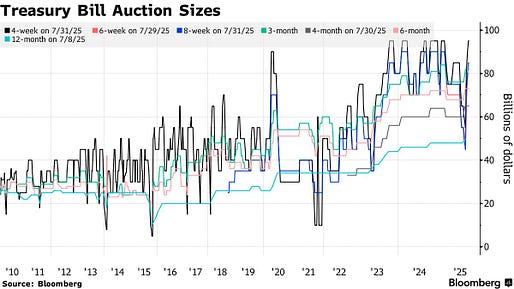

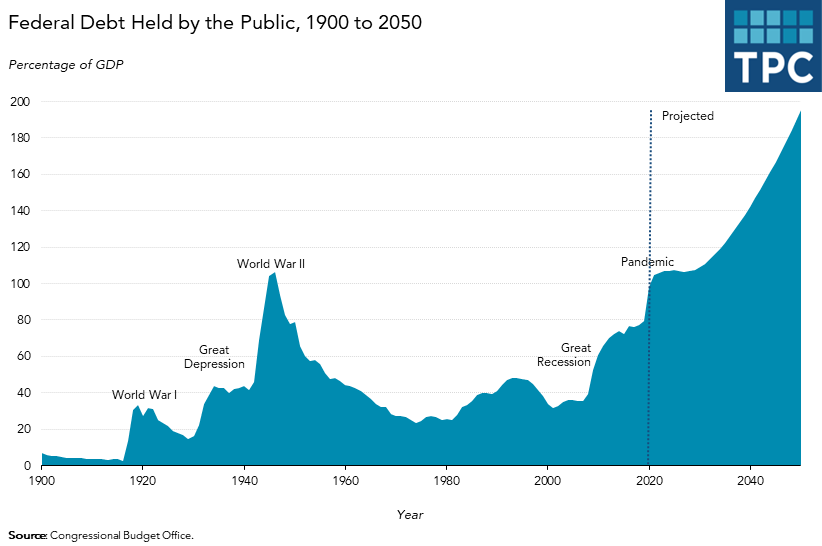

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. It's Not The BRRR?The Congressional Budget Office will have you know that it's the tariffs causing all the inflation... thank you very much.Dear Fellow Traveler: The Congressional Budget Office has just told us, with a straight face, that tariffs are causing inflation. CBO Director Phillip Swagel went on CNBC to explain how Trump's tariffs "pushed inflation higher than expected." Then, a second later, he claimed these tariffs would somehow reduce the deficit by $4 trillion over the next decade. So, let’s see… Tariffs are simultaneously causing inflation AND generating $3.3 trillion in revenue that will fix our deficit? I mean… I must be using the wrong kind of whiskey to do that math… The Boston Fed says tariffs might add 0.5% to inflation. That’s a one-time price bump on specific goods. However, you’ll get a bloody nose trying to understand how tariffs on Chinese goods are driving up the price of a haircut by 20% in a year. Dry cleaning is up 30%… though they’ll tell you that you’re the crazy one as they gaslight you into the ground... These aren’t things that ever touch a shipping container. But yes… Let's go with… The tariffs… Not the surging deficit in the United States… Not the money supply at an all-time high. Not global liquidity exploding to records. Not the Treasury issuing bills like confetti. Nope. Let’s keep the headline focus explicitly on the tariffs… I Will Go to Secret Gardens in My MindThe CBO needs a scapegoat for inflation that doesn't implicate the Fed's money printing or Congress's spending. Tariffs will do. They tried blaming inflation on climate change last year. Remember that? Every price increase was somehow Carbon's fault. But since that term vanished from the narrative after November 2024, we need a new villain. Just like climate change, they're politically divisive, easy to blame, and distract from the real problem. Wall Street analysts aren't seeing meaningful tariff-driven price hikes because tariffs aren't the primary driver. When everything from stocks to Bitcoin to gold hits all-time highs simultaneously, that's not a 10% levy on washing machines. The money supply chart goes vertical. Global liquidity hits records. The Fed's reverse repo drained from $2.6 trillion to nothing. Bank reserves are approaching danger zones. But sure, let's blame the washing machines. The thing that really caught my attention was Swagel admitting the economy has "weakened since January." One would think that weaker economic output and higher interest rates would push inflation DOWN. At least, that's the theory I paid all that money to learn. "So which is it? Are Chinese washing machines driving up your rent? Is a 10% tariff on electronics why your dentist charges $400 for a cleaning? Or is something else? Something that rhymes with 'honey tinting' and flooding the system with liquidity? The CBO's doing what it always does… It’s providing political cover for monetary madness while pointing at shiny objects. Because the projections for debt (and thus inflation) are mind blowing into 2050… We’re going to hit 200% debt-to-GDP at some point… The printer will go BRRR. When you print $8 trillion in just a few years, everything goes up. When everything goes up, you need someone to blame. Tariffs are perfect. They’re foreign, complicated, and nobody really understands them… The CBO knows this. Swagel knows this. They all do… And they’ll keep blaming everything else except the expanding money supply… and instead focus on the things that have far less marginal impact… (and I’m not saying that tariffs aren’t causing some inflationary impact…) So… What’s the next thing they’ll blame? It could be pickleball courts or Taylor Swift concert tickets that drive the next big wave of inflation in the minds of experts… Or whatever else tests best with focus groups. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "It's Not The BRRR?"

Post a Comment