You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Kevin Durant... The World's (Accidentally) Greatest Investor?The basketball star can't access his Coinbase account... and now he's richer than ever...

Dear Fellow Traveler: One of the greatest speeches in sports was delivered on May 6, 2014. Basketball superstar Kevin Durant delivered his MVP speech, in which he thanked his mother for everything. I’ll never forget this quote…

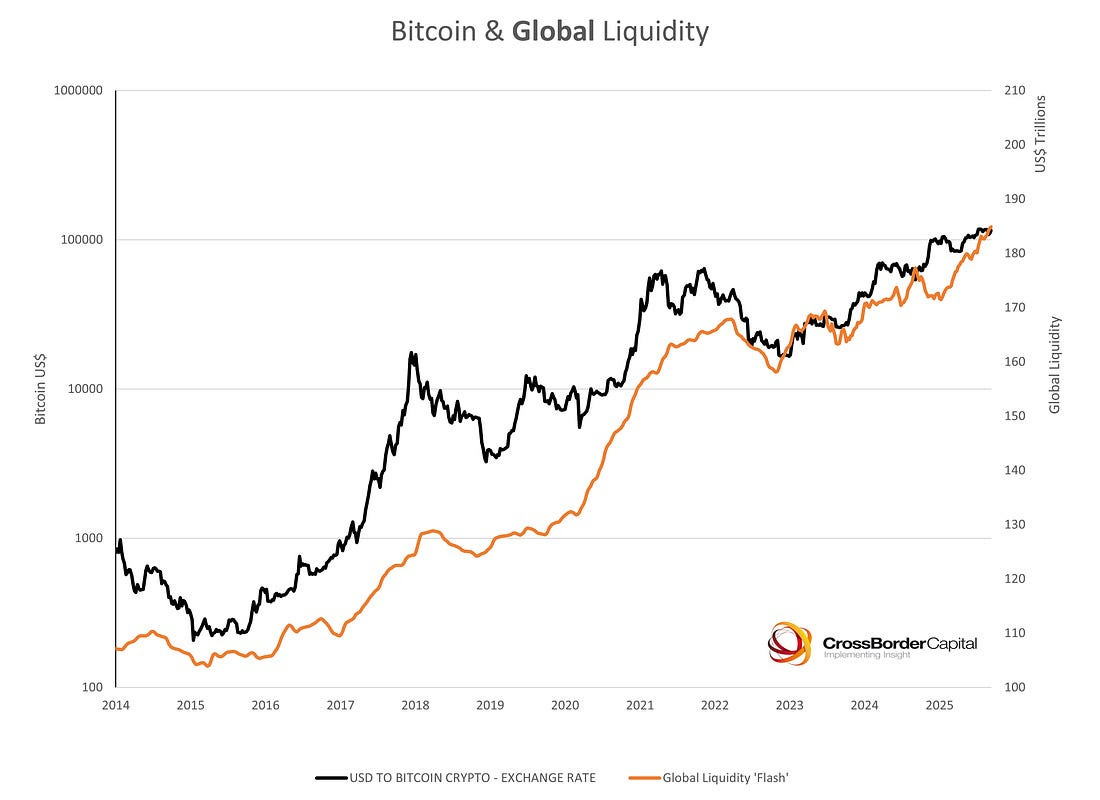

He told his mother that she was the real MVP… Now, 12 years later, Durant has a net worth easily over $300 million… But it could be much higher. And there’s a reason for that… He can’t get access to his Coinbase account… Welcome to the “Everything Trouble”Durant can't access his Bitcoin fortune because he lost his Coinbase password. And that might be the best thing that ever happened to him. Durant started buying Bitcoin in 2016 after a team dinner where his Golden State Warriors teammates wouldn't shut up about crypto. Bitcoin then traded between $360 and $1,000. Today it's at $117,600. His agent, Rich Kleiman, admits they haven't been able to access the account for "a few years" due to "user error on our end." Translation: they probably didn't write down the recovery phrase, and they can’t remember what email or phone number he used… An Accidental Diamond Hands StrategyDurant's error created the perfect investment strategy. He couldn't panic sell during the multiple 80% crashes since 2016. When Bitcoin crashed from $20,000 to $3,000 in 2018, Durant was unable to sell. When it collapsed during COVID, he couldn’t sell… When it crashed from $69,000 to $15,000 in 2022, Durant couldn't sell. Every crypto winter that would have shaken out weak hands, Durant was forced to hold because he had no choice. His password problem turned him into the ultimate HODLer. The Chart Tells the StoryBitcoin and global liquidity reveal the pattern. This is from Michael Howell’s analysis… You can see the causal relationship here… Bitcoin tracks global liquidity almost perfectly… with a correlation that gets tighter over time. When liquidity expands at a rapid pace… Bitcoin rises. When it tightens, BTC crashes. Then, central banks panic and pump again, and Bitcoin explodes higher. Durant bought and held through the 2018 crash. He held through COVID. He held through the 2022 crash. He’s still holding (even by accident)… If he'd had his password, he probably would have sold at $20,000 in 2017 and felt like a genius. Now, he's sitting in a position that's up at least 11,000%. But it gets better… The irony is that Durant has a partnership with Coinbase (Durant's Thirty Five Ventures has a promotional deal with them), yet he can't access his account. Tells you everything about crypto's "be your own bank" philosophy. Even the bank can't help you if you lose your keys. The Liquidity LessonThat chart illustrates why Durant's forced holding was effective. Global liquidity expanded from roughly $110 trillion in 2016 to $185 trillion today. Bitcoin captured that expansion, going from a few hundred bucks to six figures. Durant couldn't trade the volatility. He couldn't get scared out during crashes. He couldn't take profits "responsibly." He was forced to ride the entire liquidity wave, and it made him a fortune he can't access. Durant's locked Bitcoin is the perfect metaphor for this entire market. Everyone's getting rich on paper from assets inflated by money printing, but trying actually to access that wealth makes things complicated. It's Schrödinger's wealth - you're both rich and poor until you try to sell. Durant's Bitcoin exists in this quantum state, where he potentially owns $100 million or more, but can't buy a coffee with it. The lesson isn't to lose your passwords. It's that in a liquidity supercycle, the best strategy is often to do nothing. Every clever trade, every risk management decision, every "smart" move probably costs you money versus just buying and forgetting. Durant turned a lost password into millions. The Fed turned money printing into "price stability." Coinbase turned "not your keys, not your coins" into "not even your keys help sometimes." Welcome to the everything bubble… …Where even your mistakes make money. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Kevin Durant... The World's (Accidentally) Greatest Investor?"

Post a Comment