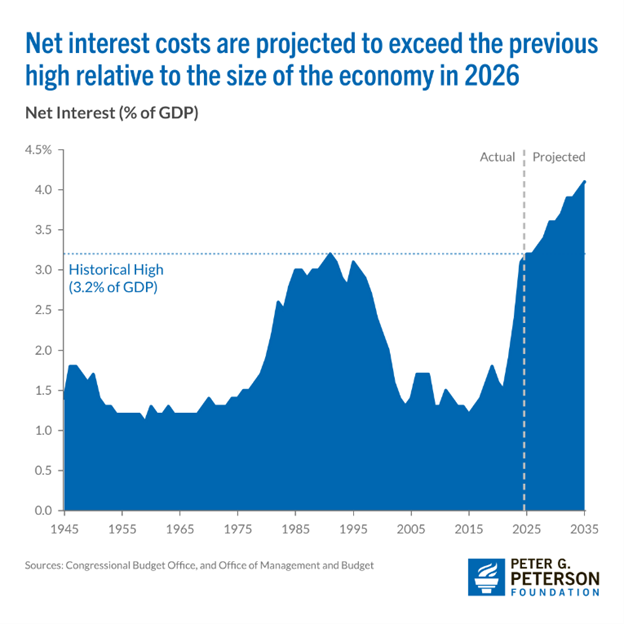

The Latest Inflation Numbers – and the Financial Revolution No One Is Talking About VIEW IN BROWSER We spend a lot of time here in Market 360 covering topics like the latest inflation reports. The same goes for Federal Reserve policy. And for good reason. These aren’t just numbers on a page. They move the stock market, they impact your retirement account, your mortgage payment and the price of groceries in your cart. That is why, in just a moment, we will cover this morning’s Personal Consumption Expenditures (PCE) report for August. The short version is that inflation is still sticky, but, as I have been saying for months, the heavy lifting is already behind us – and it’s time for the Fed to shift its focus. The bigger challenge now is the job market. Growth is slowing, and cracks are starting to show in employment. That is why the Fed made its first rate cut of the year last week. Still, policymakers remain cautious. They do not want to cut too fast and repeat the mistakes of the 1970s, when inflation came roaring back after the Fed eased too soon. I understand their concerns, but here’s the thing… There is a much bigger issue that does not get enough attention. One with far greater implications for your wealth, your savings and America’s standing in the world. I am talking about the sorry state of U.S. fiscal policy and the imminent threat to the dollar’s dominance. Washington’s massive debt load and exploding interest costs are threatening the U.S. dollar itself. Foreign governments are dumping Treasuries. The dollar’s share of global reserves has dropped to multi-decade lows. And if we don’t do something about it, it could turn into a dangerous spiral of inflation, higher rates and mounting debt that could end in a full-blown crisis. So, in today’s Market 360, I will not only cover the August PCE report and what it means for the Fed’s chances of cutting rates. I will also zoom out to show you the bigger picture and why a bold plan out of Washington may be the only way to break this cycle and restore the dollar’s strength. What the Numbers Say The latest data shows the PCE rose 0.3% in August, up from a 0.2% gain in July. On a year-over-year basis, headline inflation ticked up to 2.7%, compared to 2.6% the month before. Both readings matched what economists were expecting. Core PCE, which strips out food and energy, increased 0.2% for the month, unchanged from July, and held steady at 2.9% on an annual basis. Looking deeper, food prices rose 0.5% while services climbed 0.3%. Wages and salaries gained 0.3% in August, a bit softer than July’s 0.5% pace, while overall income rose 0.4%. Consumer spending also increased 0.4%, with most of the strength coming from goods, while travel and dining inched up 0.2%. The takeaway is that households are still spending, even in the face of tariffs and higher borrowing costs. That resilience has strengthened the case for another Fed cut in the months ahead. In fact, futures markets are now pricing in better than an 85% chance of a 25-basis-point cut at the October meeting. The Dollar Spiral Now, the deeper problem that doesn’t get discussed enough is the $37.43 trillion national debt (and counting). Interest payments alone now exceed Medicare and defense spending, making it the third-largest line item in the federal budget. They’ve quadrupled since 2015 and are on pace to hit $1.8 trillion annually by 2035.

That’s why, although it may sound counterintuitive, the Fed could actually do a lot to help the situation. The Trump administration has been pushing for rate cuts for a long time, arguing that inflation is largely under control – and that the administration’s tariffs wouldn’t meaningfully add to the problem. And while they won’t say it out loud, they are probably praying for lower rates to help lighten the load with America’s fiscal obligations. The point is, for decades, Americans trusted the dollar as the foundation of retirement savings and the world’s reserve currency. It was seen as untouchable – one thing Washington couldn’t break. | Recommended Link | | | | Tim Cook was spotted in Kentucky with this little-known company’s CEO in what was deemed a scene “worth marveling over.” UBS also caught on and just upgraded this “overlooked AI play” to BUY. But here’s what matters most: If you get in before September 28th, you’ll collect a cash payout the very next day. Eric Fry says it’s time to sell Nvidia and bet on THIS stock instead. Since his July 23rd call, it’s delivered nearly 20X Nvidia’s gains. Get the ticker symbol and secure your Sep 28th payout before time runs out. Watch Eric’s time-sensitive video now. |  | | But that foundation is cracking. Inflation has eaten away at nest eggs for years. The dollar itself has fallen as much as 10% this year, its worst start since 1973. Foreign governments and central banks are dumping U.S. assets and shifting to alternatives. A weaker dollar means higher prices at home and lower confidence abroad. It fuels a vicious cycle where inflation, rising rates and exploding debt feed on one another. Legendary investors like Ray Dalio and economists like Ken Rogoff have warned that America could face a debt crisis within just a few years. This is the reality we face. But President Trump has a plan on the table to reverse it… Trump’s Dollar Upgrade On July 18, 2025, President Trump signed the GENIUS Act into law. It authorizes a new class of digital U.S. dollars, called stablecoins, which are fully backed by Treasuries. I call them “Trump Dollars” – because I believe they’re part of a bigger plan to shore up the U.S. dollar and restore confidence to the monetary system. That’s because these are not volatile cryptocurrencies. They are not central bank experiments. Each one is backed by a real dollar or Treasury bill. Which means every Trump Dollar created is tied directly to new demand for U.S. debt. That new demand could be the key to breaking the debt spiral. It could lower rates naturally, fight inflation and restore the dollar’s global supremacy. Institutions are already moving billions into this upgrade. Visa, PayPal, JPMorgan, BlackRock and Fidelity are all racing to build infrastructure for Trump Dollars. This is not just politics. It is the early stages of a generational investment boom. And it is happening right now. What Investors Should Do The bottom line: The PCE shows inflation is cooling, but the dollar crisis is far from over. Rate cuts alone will not save us. The real solution is already in motion, and investors who act early will be the ones best positioned to benefit. Trump’s Dollar Upgrade is not just a policy wonk’s dream. Nor is it a “get rich quick” scheme. We’re talking about a financial revolution. By tying new digital dollars to Treasuries, it could generate trillions in demand for U.S. debt, lower rates and restore the dollar’s global leadership. Institutions are already moving billions. But most individual investors are still in the dark. That is why I have prepared a special research briefing that explains what’s going on. It also reveals the details on a full list of companies positioned to soar from this trend, including my number-one Trump Dollar stock. It could turn a small stake into life-changing wealth. You can access it here. Sincerely, |

0 Response to "Must Read: The Latest Inflation Numbers – and the Financial Revolution No One Is Talking About"

Post a Comment