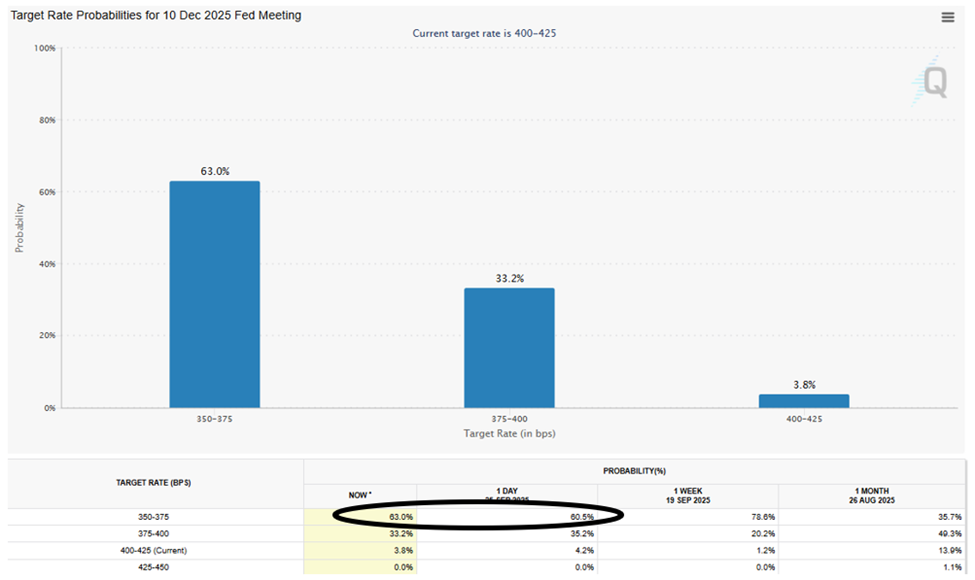

PCE inflation comes in as expected… Fed cuts still expected… a step forward in practical use for quantum… how to invest… AI buying agents are nearly here… VIEW IN BROWSER This morning brought the Federal Reserve’s favorite inflation barometer, the Personal Consumption Expenditures (PCE) Price Index. Although the numbers didn’t present any major curveballs, they showed that inflation remains a challenge. Headline PCE rose by 0.3% month-over-month, lifting the year-over-year figure to 2.7%. Excluding volatile food and energy, core PCE (what the Fed watches most closely) climbed just 0.2% on the month, bringing the 12-month core rate to 2.9%. Importantly, all these numbers matched the Dow Jones consensus forecast. Here’s more from CNBC on where we saw the inflation: Goods prices increased 0.1% while services rose 0.3%. Food showed a gain of 0.5% while energy goods and services jumped 0.8%. Housing costs posted a 0.4% rise. Meanwhile, personal consumption expenditures rose at a 0.6% pace – higher than forecasted, supporting the “resilience” of the U.S. shopper. The personal saving rate also increased, edging up 0.2 percentage points to 4.6%. The Fed is likely to find this report mildly soothing – but not entirely comforting While headline inflation isn’t running away, core inflation remains stubbornly above target – nearly 50% higher than the Fed’s 2% goal. Under normal circumstances, the Fed wouldn’t be cutting rates. But cracks are forming in the labor market: wage growth is cooling, job creation has softened, and layoffs are inching higher in certain sectors. The Fed is walking a tightrope – trying to bring inflation back to 2% without tipping the labor market into distress. It can’t fine-tune both simultaneously, so it prioritizes whichever mandate – maximum employment or price stability – is farthest from target and moving in the wrong direction. Today’s PCE numbers weren’t great, but they were still “less bad” than recent labor market readings. So, it seems unlikely the Fed will abandon its current projected rate-cut path. On that note, the CME Group’s FedWatch Tool shows that bets on where interest rates will end the year didn’t materially change following this morning’s data release. In fact, the expectation for two quarter-point cuts – where the heaviest odds were yesterday – grew stronger. We climbed from 60.5% yesterday to 63% as I write.

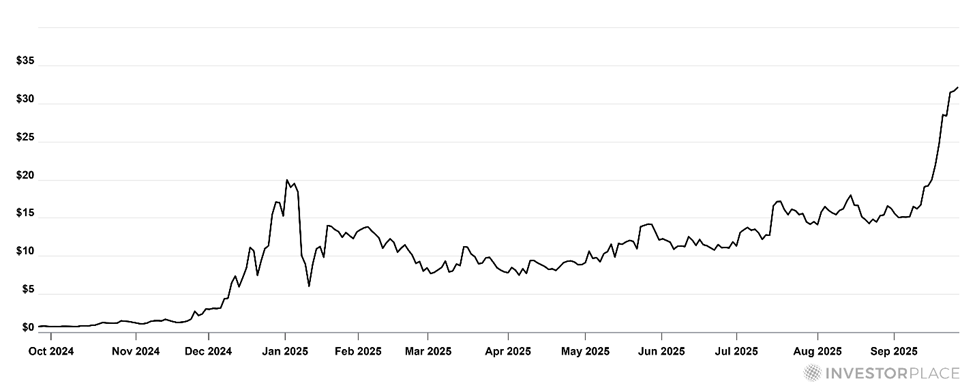

We’ll get more color on this one week from today when the BLS releases its latest jobs report. If the numbers come in weaker than expected, prepare for more rate cuts despite today’s lingering inflation. We’ll report back. | Recommended Link | | | | Never bet against Elon Musk. When he went all-in on PayPal… it created a wave of new millionaires. When he went all-in on Tesla… early investors walked away with fortunes. And now… Elon has just bet $1 BILLION of his own money on what I believe is the launch of the Optimus robot… An AI-powered robot Elon believes will be “the biggest product ever of any kind.” The profit potential is enormous. That’s why I’ve identified a high-upside “backdoor” way for regular Americans to profit from it before its launch as soon as October 23rd. Without buying Tesla shares… After all, at a $1 trillion market cap, Tesla is already far to 10X from here. Click here to see the backdoor way to play it. |  | | A preview of what’s coming tomorrow – and how to invest in it today With any new technology, one of the largest thresholds to cross is from “theoretical” to “real-world application.” Quantum computing is one of the most exciting, potential-filled technologies out there, but real-world application has remained distant. There have been amazing breakthroughs – like the Sycamore quantum computer that solved a complex mathematical problem in seconds, while it would have taken the Frontier supercomputer, the most powerful computer in the world, 47 years. But practical uses have been limited. That’s beginning to change… Here’s MarketWatch from yesterday: What if [investors] could use quantum computing to actually make their bets, well, better? Banking giant HSBC says they have done just that, claiming that quantum computing tools can make its algorithmic corporate bond trading more efficient. Working with a team from IBM, Europe’s biggest lender said that in tests using quantum and classical computing resources it saw a 34% improvement in predicting how likely a trade would be filled at a quoted price, compared with common classical techniques used in the industry. The article quoted the head of HSBC Quantum Technologies who said: This is a groundbreaking world-first in bond trading. It means we now have a tangible example of how today’s quantum computers could solve a real-world business problem at scale and offer a competitive edge, which will only continue to grow as quantum computers advance. How to invest now… Quantum computing is a long-horizon trend with extraordinary potential. If the technology develops as we believe it will, the upside for early investors will be enormous. But the risks are real. The technology might not pan out as hoped. And even if it does, we could be years away from practical implementation despite recent advancements. Meanwhile, today, most quantum companies show no profit, and some are only beginning to generate meaningful revenue. That means stock prices will swing wildly, in both directions. Take Rigetti (RGTI), one of quantum’s current darlings… It’s up more than 4,000% over the last year. But within that explosion there was a brutal 70% collapse in January. That was immediately followed by a brief 100%+ rally, then a slow bleed that destroyed 45% of investor wealth between late January and early April.

This level of volatility is the price of admission when you’re betting on early-stage, transformative technologies that could redefine entire industries. In this situation, your best bet is to stick with the handful of quantum companies that have fundamental strength – not the moonshots that are running purely on hype and hope. This is what legendary investor Louis Navellier has been doing. Here’s his quick take: Rather than snap up shares of any company that incorporates quantum computing into its business, you need to consider its fundamentals first. After all, if a company has weak fundamentals, it doesn’t matter how involved it is in quantum computing; its stock will eventually fall flat after the hype inevitably dies down. So, you need to make sure that a direct quantum play or quantum computing-related stock has strong fundamentals to support its long-term growth. For more on the select few quantum stocks making Louis’ cut, he just put together a free report that you can check out right here. As we’ve said before, this is a huge growth story. The difference today is that its application is coming to life. Bottom line: Be careful how you play it, and make sure you’re ready for volatility, but this trend is worth your consideration. Continuing with our “preview of what’s coming” As we’ve highlighted in the Digest, the next fast-approaching evolution of AI is “agentic AI.” These are AI systems that can reason, make decisions, and perform multi-step tasks without human micromanagement. Rather than just answering questions like ChatGPT, agentic AIs take initiative, handle ambiguity, and operate more like digital employees. One near-term use case: AI shopping agents. Let’s go to Louis’ favorite economist, Ed Yardeni: In the near future, consumers may tell AI shopping agents what they’d like to buy, and the AI agent will scour the Internet to find the perfect item and purchase it. To make this future a reality, Google introduced last week Agent Payments Protocol (AP2), a new set of rules to govern online purchase transactions. In short, these rules seek to provide a way to document how a human will authorize an AI agent to purchase an item – basically a bread-crumb trail to avoid an errant purchase. Back to Yardeni for an example of the application: Shopping for and purchasing concert tickets is entirely delegated to an AI shopping agent. An Intent Mandate is created when the human asks the AI agent to shop for concert tickets, specifying price limits, timing, or other conditions. Once the conditions are met, the AI agent automatically generates a Cart Mandate… After the Cart Mandate is created, the merchandise can be paid for using the human’s desired payment method. How do you invest in Agentic AI? Think of the opportunity in three main buckets. First, there are the platform owners building the standards and user gateways. Alphabet is the obvious name here. It will control much of the discovery, routing, and commerce data if AI agents become a mainstream way to shop. Next, you have the payments rails that will move the money once an AI agent fills a cart. Visa (V), Mastercard (MA), and American Express (AXP) remain the Big Dogs for transaction processing (though in a future Digest, we’ll need to dive into the existential threat posed by stable coins). No matter how smart the agent, the actual purchase still needs familiar card or bank networks. So, the major players will earn a fee on every swipe, click, or mandate. Finally, there’s the infrastructure layer. Cloud giants like Amazon (AMZN) and Microsoft (MSFT) will provide the compute and cryptographic key management to support all those agentic transactions. Meanwhile, payment processors like PayPal (PYPL) and Adyen (ADYEN) could benefit as gateways for agent-initiated checkouts. And we’ll also need cybersecurity and identity-verification specialists like Fiserv (FI) to prevent fraud. Each of these buckets will evolve differently, but all provide exposure to the same underlying trend: AI agents executing real-world transactions on our behalf. We’ll keep tracking this. As powerful as agentic commerce could become, it’s only one slice of the broader AI opportunity The same advances enabling digital shopping agents are also driving breakthroughs in physical AI – robots that don’t just think, but act. We’re talking about machines that don’t just process data but sense, move, and adapt in the real world. Louis, along with our technology expert Luke Lango and our global macro expert Eric Fry have zeroed in on a select group of companies at the heart of this transformation. These aren’t generic “AI plays,” but carefully chosen companies positioned to capture the next wave of growth as robotics and artificial intelligence converge. You can learn more and get a preview right here. We’ll keep you updated on all these stories here in the Digest. Have a good evening, Jeff Remsburg |

0 Response to "No Curveballs in the PCE Report – But Here’s What’s Next"

Post a Comment