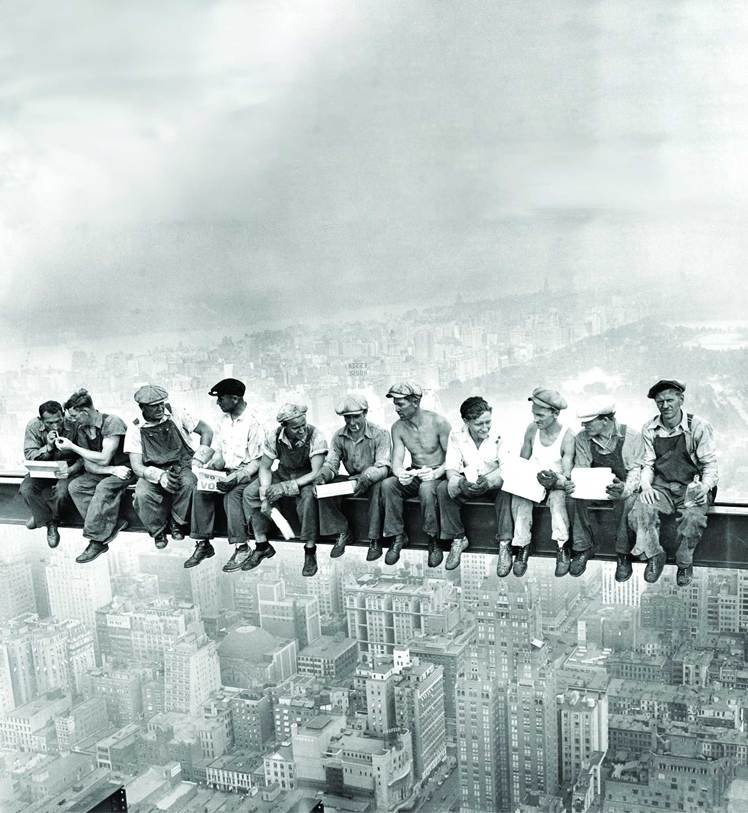

| DAILY ISSUE The Rise of the “New Market Aristocrats”… and How to Join Them VIEW IN BROWSER Hello, Reader. “Lunch Atop a Skyscraper” is among the most iconic photographs of the 20th century. On September 20, 1932 – exactly 93 years ago – 11 ironworkers ate their lunch at 850 feet in the air, scuffed shoes dangling, gloved hands opening lunch boxes.

This makeshift lunchtime view is now the Top of the Rock Observation Deck, the primary attraction at Rockefeller Center. It features 360-degree views of the New York skyline. The iconic photograph shows just a small group of workers who helped construct the skyscraper, which was commissioned by the eldest son and heir of John D. Rockefeller, founder of the Standard Oil Co. and one of the wealthiest tycoons of the Gilded Age. Rockefeller’s fortune was estimated at $1.4 billion at the time of his death in 1937. That enormous fortune accounted for 1.5% of the entire nation’s wealth, and a whopping 16% of the wealth of “Manhattan Island,” according to the Census Bureau. By contrast, average household savings in 1937 were less than $200! That means Rockefeller’s fortune was seven million times greater than the typical savings of folks like the ironworkers who built the skyscraper bearing his family’s name. The immense wealth divide in the U.S. is as old the American oil industry itself (and as old as steel, railroads, and shipping, for that matter). But the thing is… it’s growing wider. Now, thanks to AI, the financial chasm between folks is expanding by the day and creating a growing roster of new market aristocrats, along with extreme social and economic imbalances. So, in today’s Smart Money, let’s take a look at the rise of a new “market aristocrat.” Then, I’ll share five specific tactics you can use to join them. Let’s dive in… | Recommended Link | | | | One company to replace Amazon… another to rival Tesla… and a third to upset Nvidia. These little-known stocks are poised to overtake the three reigning tech darlings in a move that could completely reorder the top dogs of the stock market. Eric Fry gives away names, tickers and full analysis in this first-ever free broadcast. Watch now… |  | | The Gilded Age, 2.0 The American economy of 2025 is both dazzling and disturbing. In 2025, billionaires have never been more numerous. There are more than 3,000 of these global elite. Take Oracle Corp. (ORCL) founder Larry Ellison. He first became one of fewer than 200 billionaires in 1993. He is now a multi-billionaire, many times over, as Oracle has become a dynamic AI play. Ellison even briefly eclipsed Elon Musk as the richest person in the world last week, after the tech company announced stellar quarterly earnings. Like the “robber barons” of the 20th century, Ellison’s fortune dwarfs that of the average American. The chart below shows Larry Ellison’s stock wealth, expressed not in dollars but as multiples of the median U.S. household’s net worth. In 2005, Ellison’s fortune was already staggering, amounting to several hundred thousand times that of the typical American family. But since 2020, the trajectory has turned vertical. Today, Ellison is 2 million times wealthier than the median household.

This comparison does not merely tell the tale of one multibillionaire. It demonstrates how the “capital class” is flourishing in the age of AI, relative to the “labor class.” The owners of intellectual property, stock options, and equity stakes in technology firms are watching their wealth skyrocket, while median household net worth is growing modestly, if at all, eroded by inflation, housing costs, and debt burdens. In other words, for every Ellison, there are millions of households who find themselves priced out of housing, squeezed by medical bills, or stuck with stagnant wages. But despite this growing wealth division, we individual investors are not powerless in the face of these forces. To the contrary, the most effective response to today’s socioeconomic challenges may be as old as America itself… even surpassing the monolithic monopolies of the Rockefeller era. And that is… The 5 Tactics to Becoming a “New Market Aristocrat” Self-determination. A self-determined investor is one who honestly evaluates both risk and reward, and then sets a long-term course toward wealth creation. This is also the kind of investor who may eventually become a billionaire, joining the ranks of the “new market aristocrats.” While not all will become billionaires, of course, most billionaires started as self-determined investors who refused to accept the status quo. Admittedly, AI complicates this journey because it introduces new and frightening risks. But a complicated journey is not an impossible one. If we keep our eyes on the prize, we can hitch our financial future to the engines of progress, rather than being run over by them. In practical terms, self-determination embraces and applies five tactics… 1. Own Businesses, Not “Tickers” – Self-determined investors insist on buying businesses with formidable competitive moats, not “story stocks” that are trying to dig a moat with a garden trowel. 2. Respect Both Promise and Peril – The prudent investor must acknowledge both sides of AI’s split personality – like driving innovation… and then hollowing out certain jobs – and then craft their investment strategy accordingly. The intelligent course is neither blind enthusiasm, nor blanket rejection. 3. Think in Years, Not Days – The self-determined investor looks past the noise and insists on a longer timeframe. Wealth is not built in days or weeks. It is built in years, even decades. 4. Diversify Without Diluting – In an AI-driven age, diversification might mean balancing high-growth innovators with stalwarts in energy, infrastructure, or healthcare. 5. Refuse the Seduction of Fads – The range of compelling investment opportunities extends far beyond the current fad of the technology sector. Self-determined investors can, and should, hunt for opportunity in the four AI categories that I’ve identified: Builders, Enablers, Appliers, Survivors. The contradiction between abundance and anxiety is not a new feature of the American economy. Obviously, we investors cannot block the path of progress, but we can prepare for it… at least to some extent. That preparation begins by applying self-determination. And it continues by knowing exactly which stocks to buy, which to sell, and when. That is why, in my free “Sell This, Buy That” broadcast, I share the names of four companies to sell before they crater, including some that might shock you. These aren't fly-by-night operations. These are companies that have been market darlings for years – and are still overweight in many investors’ accounts. More importantly, I also share the names of four companies that could multiply your money in the coming months. For instance, while everyone is focused on Nvidia Corp. (NVDA), I've identified a stock that's now become a key supplier to AI data centers everywhere. And while investors keep piling into Amazon.com Inc. (AMZN), I reveal a virtually unknown online retailer that could be like buying Amazon in 2005 — but with an even bigger competitive advantage. I am sharing all of this with you today, free of charge. All you have to do is click here to access my special broadcast… and bring along your spirit of self-determination. Good investing! Regards, |

0 Response to "The Rise of the “New Market Aristocrats”… and How to Join Them"

Post a Comment