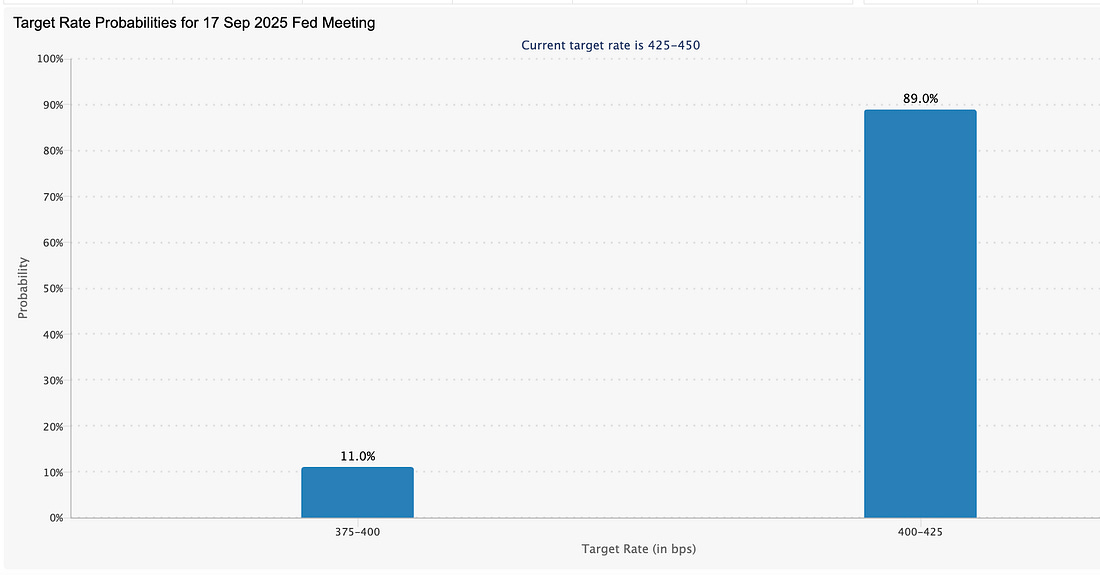

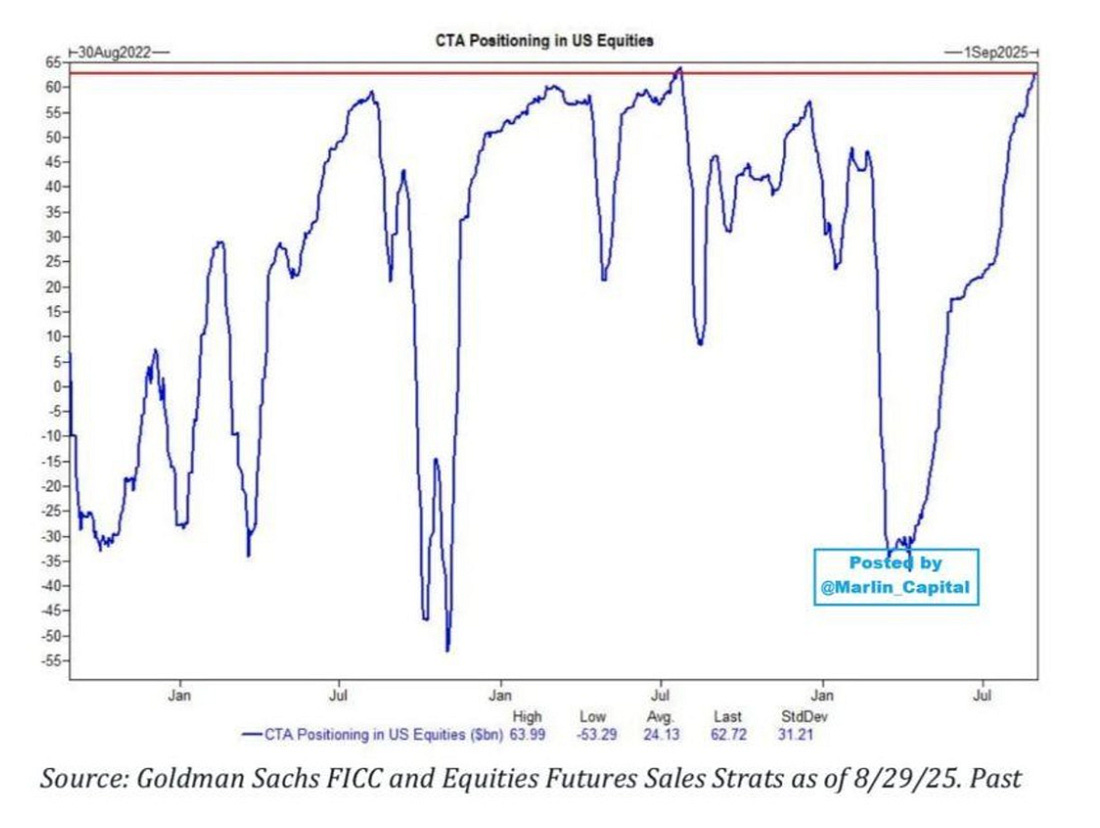

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: The campaign begins this morning… At 11:30, Coach Baldwin and Coach Zoulis lead the Blue Dolphins onto the field for the first game of the season. I would hope we have a puncher’s chance. Last year, I covered the playoffs of the Under 7 soccer season, igniting passion and enthusiasm for the “Strawberries” as they fell short in the championship in overtime. The kids didn’t care. The parents were saddened. But we picked up fans here in the Money Printer from New Zealand to Belgium. This year, your team is the Dolphins. We will see how the team performs today… I’ve told Amelia (in jest) that she needs to score five goals. She just nodded… prepared… I won’t be surprised if she scores a few… She starts at forward today… on her demand. Given that she doesn’t care for me coaching other kids (she’s admitted that she’s jealous)… I’ll see if we can channel that energy into Wayne Rooney form. Afterward, there’s ice cream… No. 2: Howell’s Warning Bugs MeI am a constant reader of liquidity experts like Michael Howell here on Substack… With regional banks and cyclicals climbing higher on expected rate cuts, I was a little surprised to read his latest commentary. It seems something is coming… and it might not be very good for the markets. In his latest commentary, Howell stated that the Fed is withdrawing money from financial markets by shrinking its balance sheet (quantitative tightening) and the Treasury is replenishing its cash account (TGA). Why does this matter… this double trouble scenario leads to a drain on liquidity. Bank reserves at the Fed have dropped $207 billion since July. This is already causing stress - repo rates (overnight lending costs) are spiking because banks lack sufficient cash to lend. Meanwhile, global liquidity is hitting new highs, creating a weird disconnect. Howell thinks this is incredibly bad timing - tightening financial conditions when the economy is weak, job numbers look terrible, and companies need to refinance trillions in debt over the next few years. If they continue to drain liquidity, it could cause problems soon... So - pay attention to our signals - and keep an eye on the FNGD… Something significant may arrive this fall… and people won’t know why… THIS IS WHY… No 3. I’m Not Laying Off GoldmanSome people asked why I was "attacking" the Goldman-T. Rowe deal. No problem… Let’s talk about what happens when Wall Street "democratizes" alternative investments for retail investors. They lose money… Yieldstreet just blew up $370 million of regular people's money. They promised "institutional" real estate access for the masses. Out of 30 deals, 4 had total losses, 23 are on deathwatch, and there’s been $78 million in official defaults. One man in Miami lost $400,000. Others lost their entire retirements. The pitch aligns with Goldman's recipe here… You know, guys… sophisticated investments were previously reserved for the ultra-rich… BUT NOW THEY’RE now available to YOU! Ugh… When rates rose… reality hit… Retail investors soon discovered they owned illiquid garbage with no exit. The underwriting was lazy. The deals weren’t as good as those offered to top-tier clients. But the institutions? They got their fees upfront. So when I see Goldman wants to stuff private equity into 401(k)s with the same "democratization" rhetoric, I'm going to call it out. Because someone needs to say it BEFORE teachers and firefighters lose their retirements… not after. No. 4. This is the Number to WatchOver the last month, everyone has been discussing interest rates. Will the Fed cut rates? After Friday’s dismal jobs numbers… the conversation has accelerated. For a month, we watched expectations shift for a 25-basis-point cut, with the probability ranging between 87% and 99%. However, yesterday’s jobs report was so bad that markets started to price in the possibility of a 50-basis-point cut… Just as I projected about three weeks ago. Do I think they will cut by 50 basis points? That doesn’t really matter. The Fed is now behind the jobs market. Without healthcare jobs, we’d already be in negative territory, and our “productive” parts of the economy are already reeling. They’re behind… as always. The market can run higher in the short term BECAUSE the odds of a 50-point cut could accelerate. But two things happen… First, if they only cut by 25 basis points, the markets could quickly tank after the Fed meeting because EVERYONE else knows that the Fed is too late… And second, the market could face increased volatility at 50 basis points because everyone now realizes that the Fed is behind the curve… yet again… Combine all this with weakening liquidity, and I start to worry about the end of the year and the lead into 2026. If you ran a roofing company… and your math was as off as the Federal Reserve’s… You’d still be sitting courtside waiting for your trial… This has to be one of the few jobs in the world that carries such influence, power, and consequences, yet there is zero accountability. Must be nice… No. 5: And Finally…Commodity Trading Advisers (CTA) are maxxed to the max on equity expsosure… As in… there’s not cash from them sitting on the sidline… As you can see… this doesn’t tend to last long… and any sideways slip could lead to a pretty sizeable amount of selling. Combine this with possible liquidity missteps and questions about leverage… and you’ve got some tricky conditions. As always, I’ll be guiding you through the weeks ahead… For anyone who hasn’t signed up for The Capital Wave Report, this chart above is the reason to do so… If markets go sideways and our signals turn negative… you’ll be first to know… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Things I Think, I Think... (Am I Any Good at Coaching Youth Soccer?)"

Post a Comment