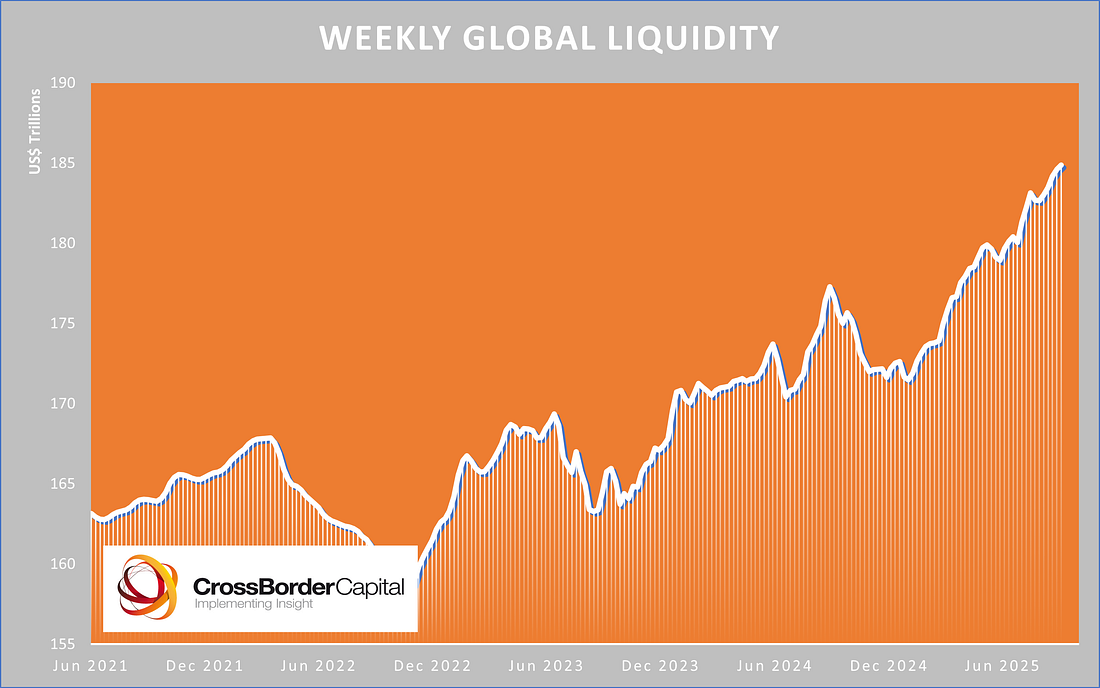

"This Isn't Your Grandfather's Market" (Except Grandpa Had the Gold Standard)I really don't understand why I read anything anymore...Good morning: Someone actually said it. To Yahoo! Finance. With a straight face. "This isn't your grandfather's S&P 500…" That's Jeff Krumpelman from Mariner Wealth Advisors explaining why 23 times forward earnings is totally reasonable because "return on equity and profit margins were far lower in those times." You know what else was lower in grandfather's time? Global liquidity. But Yahoo Finance's 700-word article about record highs doesn't mention liquidity once. Global liquidity just hit new all-time highs. We’ve added $15 trillion since 2024. FIFTEEN TRILLION… Central banks are constantly coordinating, as the BIS admits... The BOJ isn’t tightening like everyone thinks they are. China is still opening the taps. The Fed is draining reverse repos while pretending to tighten. The article mentions what everyone thinks is going on…

Everything except the actual reason stocks are at records… There's more money sloshing around than ever before in human history. Emily Roland calls this a "honeymoon phase" with Fed cuts. No. It's a liquidity tsunami disguised as fundamentals. When global liquidity expands, assets rise. When it contracts, they fall. That's it. It is that simple... But Wall Street and financial journalists need a narrative. So they sell you AI revolution, productivity miracles, and "this time is different" while ignoring that the correlation between global liquidity and the S&P 500 is STRONG. Your grandfather's S&P 500 had one advantage… It had honest price discovery. Our S&P 500 has central banks coordinating global money printing and calling it "policy." We have more ETFs now in the U.S. than actual equities… That's not different. That's Ponzi dynamics with better technology. The bubble isn't in AI. It's in pretending liquidity doesn't drive this market - especially post 2008… Let’s get to the market update… And if you’re not a member of the morning Capital Wave Report, get a trial below… Continue reading this post for free in the Substack app |

Subscribe to:

Post Comments (Atom)

0 Response to ""This Isn't Your Grandfather's Market" (Except Grandpa Had the Gold Standard)"

Post a Comment