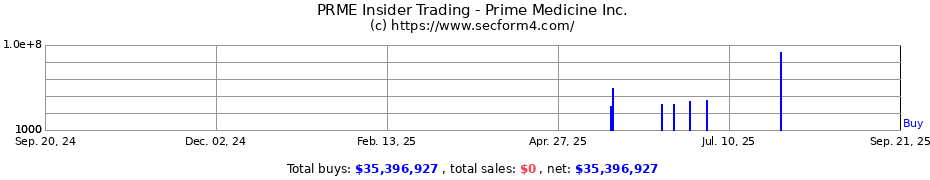

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. What an Under-8 Girls Soccer Team Can Teach You About Trading and InvestingThe Dolphins flew too close to the Sun on Saturday... and there's a lesson for us all...Dear Fellow Expat: There was a great moment yesterday… Amelia scored her first goal of the season, and we soon went up 2-0. The girl who had told me about her cat and “Hydrogen” 15 times kicked an incredible goal over everyone’s head, bouncing off the top crossbar, into the goal… We went into the fourth quarter with a lead… Our other coach was hyper optimistic… But I’m a man of my surroundings… I couldn’t help but notice… The Blue team had just added two strikers from their bench… At first, I thought these girls were the older sisters of other players on their team. They were not. In fact, one of the girls was the daughter of a friend from college whom I hadn’t seen since we moved back to Maryland. Her mother (his wife) was a former Division I women’s soccer player, as I would remember shortly after the game... The following minutes felt like the basketball wager in Season One from The Wire - in the East-West Game - or a moment in White Men Can’t Jump where they select Woody Harrelson to play on Wesley Snipes’ team… The ringers came off the bench… With that, the game was over. My friend’s daughter scored four goals against us in the fourth quarter… and the Dolphins lost 5-2. One of the things that is so interesting about coaching is how it tests your ability to manage the emotions of players. Every child reacts differently… But because she was the goalie of the first two goals let in to start the fourth quarter, Amelia blamed herself… She was a ball of emotion… It was 2-2 and she didn’t want to play goalie anymore… I had to loudly ask her if she was okay from across the field. She wasn’t. She was 7 years old… Eyes welling… I walked across the field while the ref nodded and gave me permission, lifted her, hugged her as hard as I could, carried her off, and told her it was “just a game” in front of a hundred spectators as time stood completely still… I didn’t even realize at the time what was happening… It feels now like it didn’t even happen… It was a tough moment, but that's why I’m a father… The loss took a lot out of her… When they went down 3-2, she was frozen… I kept cheering, but it was a lot… slow motion… The other team scored two more from there… And that was that… Amelia and I went to Dunkin’ Donuts after the game - then to the bowling alley arcade… We played air hockey, had lemonade, and then drove over to the new house. No one talked about the game for the rest of the day… As it should be… All that matters is she’s smiling this morning and she’s excited for the next game… There’s always next week… You Have to Play DefenseAs we move into October soon, I would like to offer a simple observation about trading… One of the key areas we focus on here is utilizing various metrics to help identify opportunities. These include high F-scores and low Price-to-Graham figures, Tim Melvin’s strategy around strong F-scores and Z-scores, high short-interest momentum, and insider buying. One of the key factors in helping you manage your trades and investments is being aware of the technical averages. If you’re ahead - figure out a way to play defense… The market is merciless… especially when you’re winning… So, the technicals MUST become your defensive levels. Particularly, the exponential moving averages (EMA)… Take this stock - Prime Therapeutics (PRME)… As I noted recently, executives at PRME have been loading up on stock… Over the last three months, insiders and 10% owners bought over $35 million in stock. But there’s an important part of understanding how to trade momentum on insider buying… You don’t just blindly buy the stock. As I’ve mentioned before, there are various ways to trade insider buying. You can sell spreads at levels UNDER where the insiders bought the stock… (In this case, it was August 1 at the $3.30 level… Since there aren’t ample options chains, you have to look for an alternative way to trade… So, what was the trade? Well, you buy as the 8-day exponential moving average (EMA) breaks above the 20-day moving average. That happened (after a pullback) during the first week of September… As the stock climbs, it’s not the 20-day moving average that becomes your stop (where you sell)… It’s if the stock closes the day under the 8-day moving average again. Strong momentum propelled this stock from $3.50 to $5.00 in under three weeks… Now, you may want to consider using the 50-day moving average as your entry point and the 20-day moving average as your stop-loss point. It doesn’t matter how you do it… Find what works best for you… You’re just parking the bus and protecting your lead. That way… there’s no surprises… We’ll get ‘em next week… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "What an Under-8 Girls Soccer Team Can Teach You About Trading and Investing"

Post a Comment