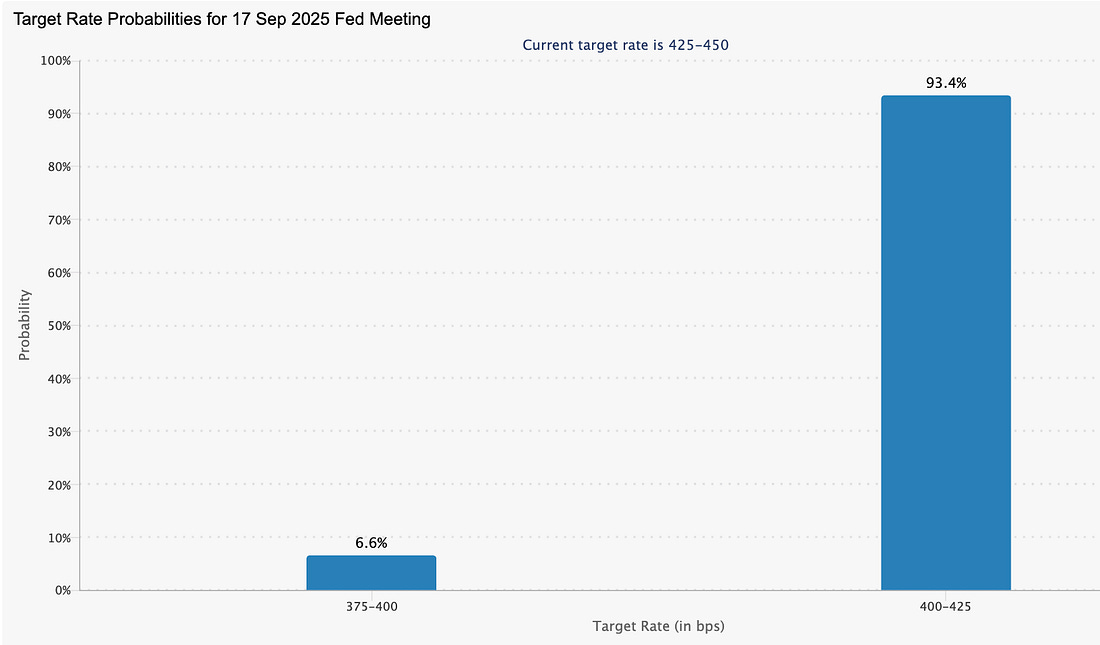

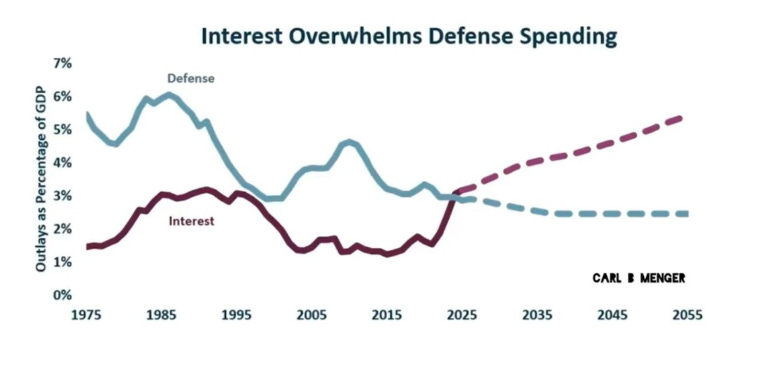

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Yeah, I'll Chart Party...With the markets at all-time highs, the debt-game continues... Stay positive...Dear Fellow Traveler: We’re back from soccer… And we did better… with a 2-0 loss… Amelia had a very good shot, and we definitely played against the league’s best team. So, we hold out hope for next week. Today, we spend the day assessing the new house and ways to enjoy the process before the land around us becomes increasingly expensive due to the dollar's continued decline. What a world… This all goes back to March 2024… That’s when we released a report called “The Hedge of Tomorrow.” The entire premise was an accelerated look at the wave of capital flowing around the globe, ongoing currency debasement expectations, and how to invest and protect yourself from the non-stop delusions of this financial system. Gold was at $2,100. Silver was at $25. The S&P 500 was around 5,150… Fast forward to today - despite the nonstop crash calls and certainty that fundamentals still drive markets - and we’re at all-time highs across the board… With services inflation at 3.8%… and the Fed on the verge of rate cuts… Stocks. Gold. Silver. Bitcoin. They’re all hitting highs together… What does that tell you? That we’re “Rich?” No… It’s that the dollar is weakening and currency debasement is real… America is now paying more in debt interest than on defense…. But we have to keep this debt shell game going - all while preventing deflationary spirals… And given the possible stress we could see in liquidity… we may print (accomodate) sooner than later… The reality is we’re not “getting rich…” We’re keeping our head above the water… and protecting what we have from whatever does come next… All the while - we’re looking to exploit any significant sell-offs that come when liquidity channels break and momentum cracks… When do those opportunities come? Glad you asked…. The Liquidity Squeeze Coming September 15th?Is a short-term repo schism underway? The Fed's Reverse Repo facility has collapsed from $2.6 trillion to $29 billion. Bank reserves sit at $3.2 trillion, approaching the $3 trillion level where things historically break, according to Michael Howell. Below that threshold, repo markets have frozen historically... The Treasury's been issuing bills like crazy since the debt ceiling lifted in July, sucking liquidity from the system. As Howell noted, when bank reserves drop below minimum thresholds, repo rates spike. That's what's under the hood here… Reuters reports SOFR hit 4.42% last Friday, the highest in two months.

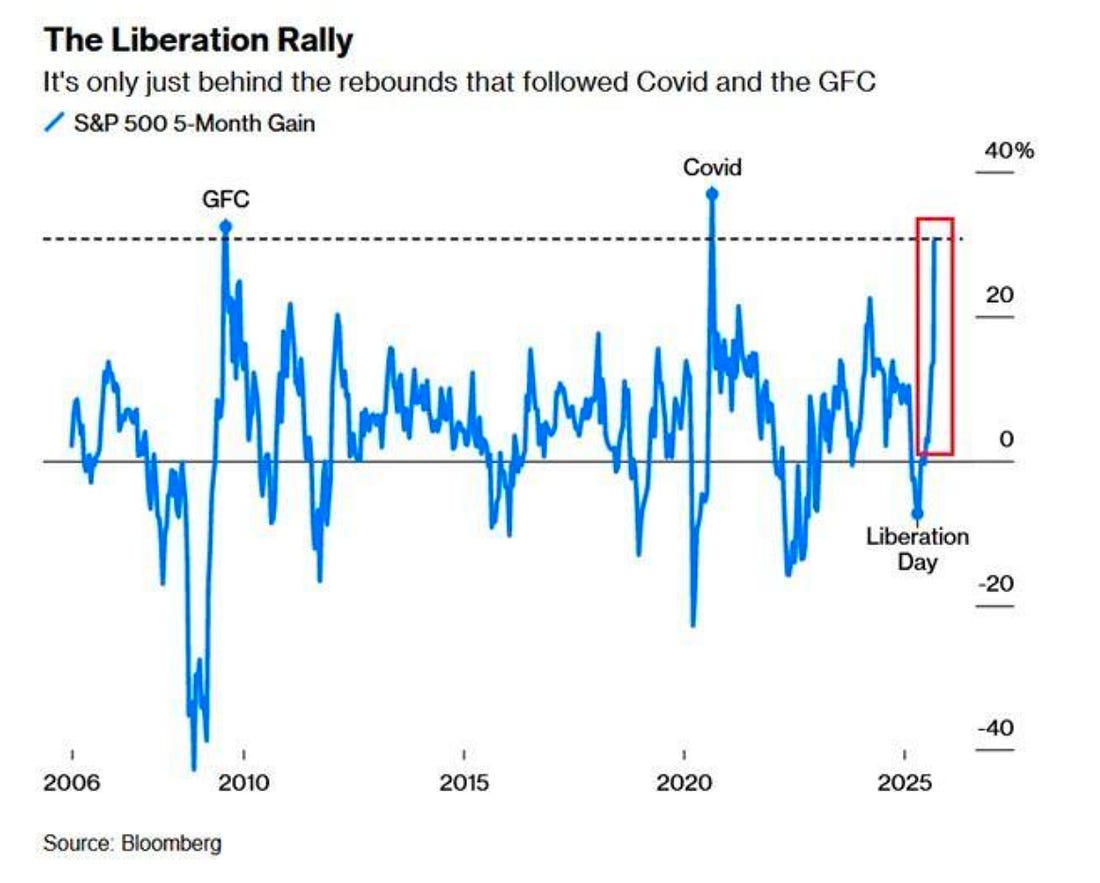

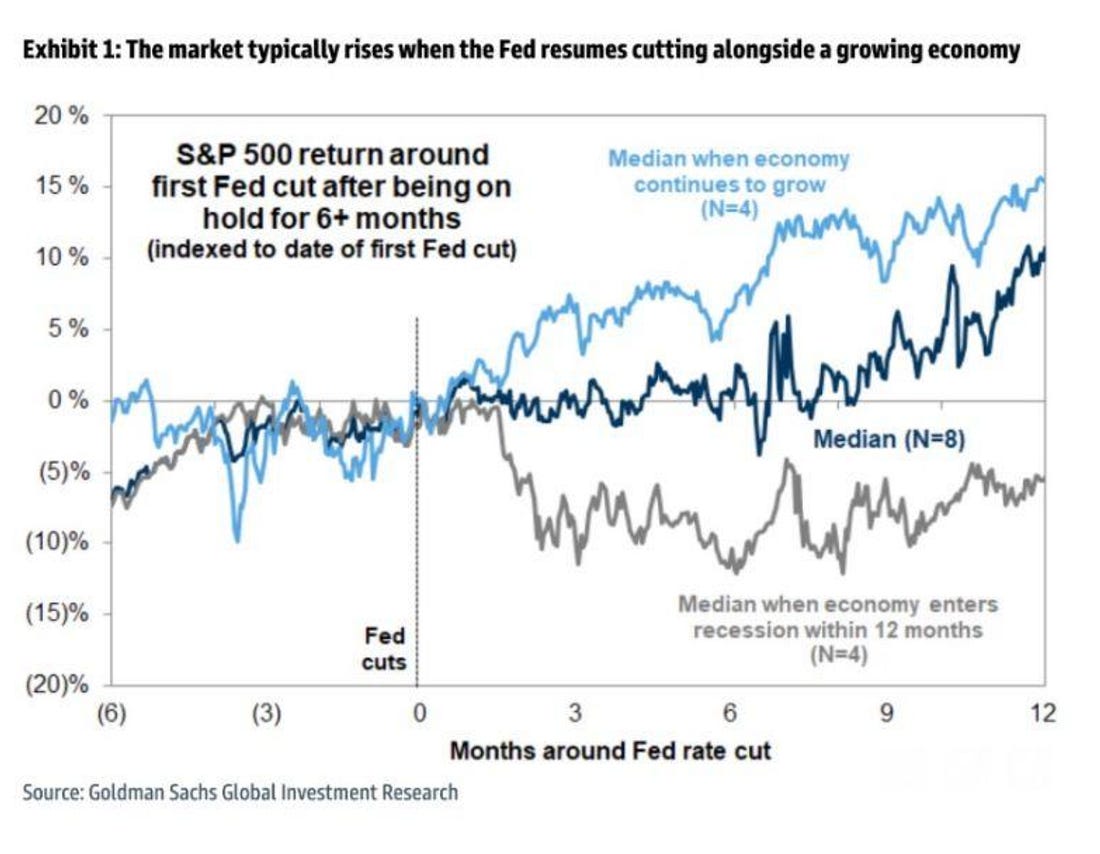

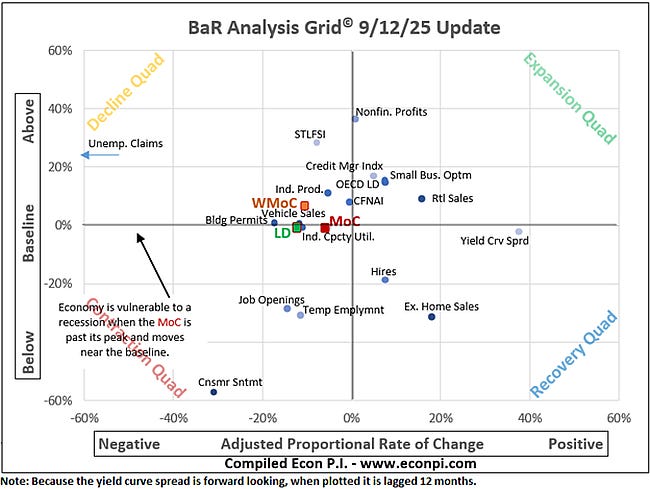

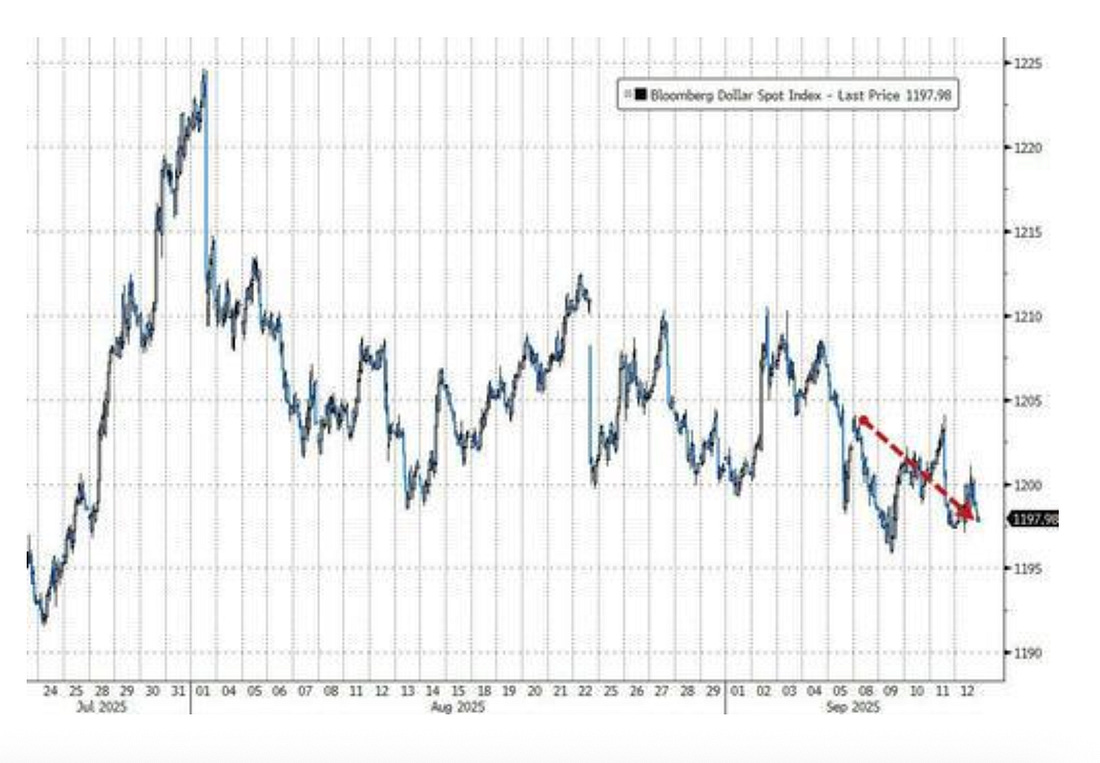

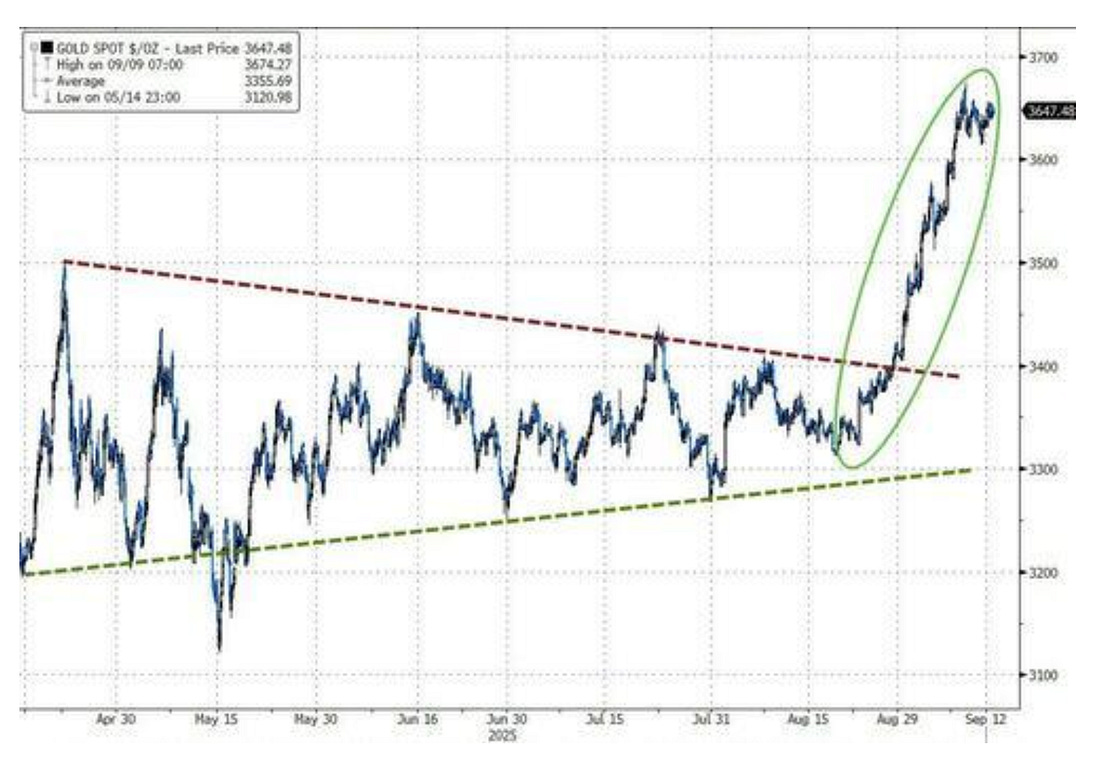

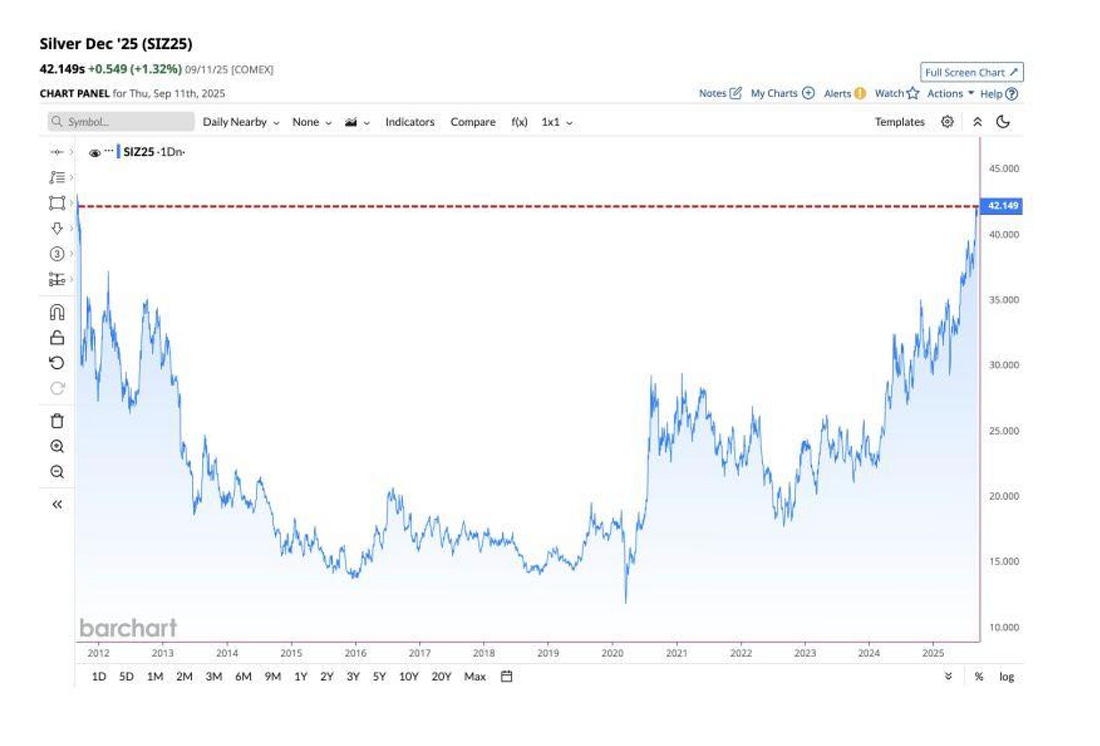

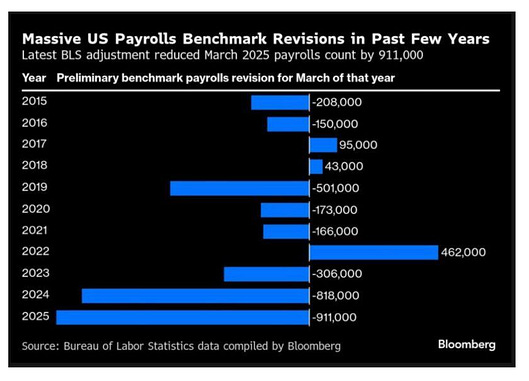

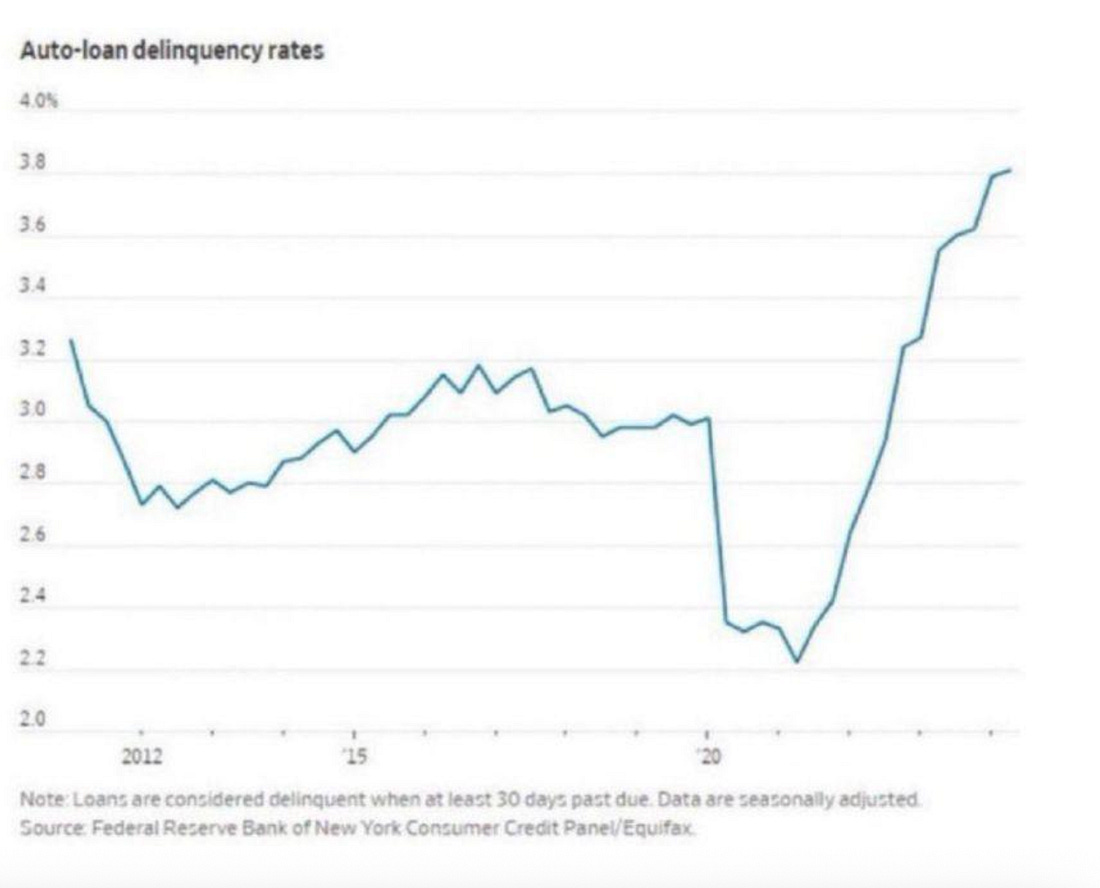

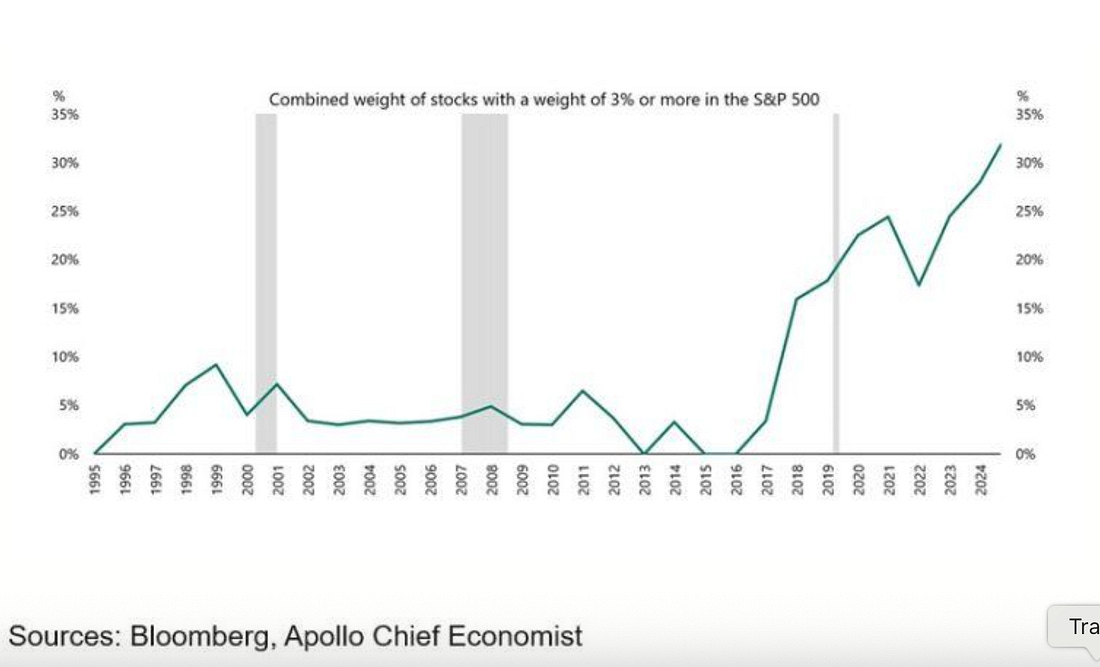

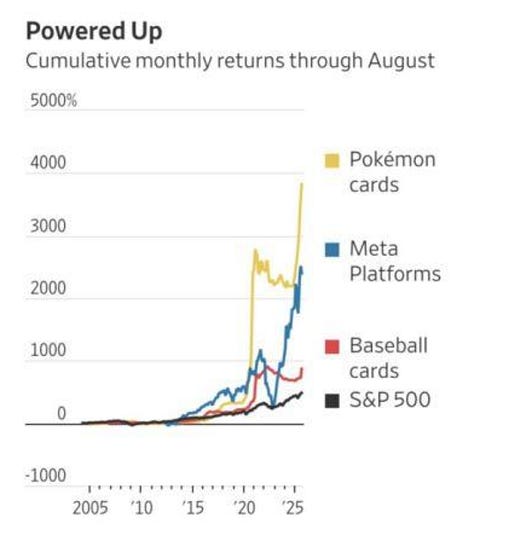

This could be a sign that funding stress is building. Which brings us to Monday… September 15 brings a triple whammy… We have simultaneous corporate tax payments, quarter-end positioning, and massive Treasury settlements. So… everyone needs cash at once. J.P. Morgan's Teresa Ho (who heads short duration strategy at the investment bank) told Reuters we could see a repeat of September 2019, when repo rates exploded and the Fed had to inject liquidity... The Fed's backup plan is its Standing Repo Facility… That’s just an emergency cash window for banks (but totally NOT QUANTITATIVE EASING... just QE-like outcome pursuits in stability). Wrightson ICAP says banks may borrow up to $50 billion through it by month-end, versus $11 billion last quarter. The liquidity that pushed everything to records is draining. However, when liquidity reverses, these assets plummet. The market thinks that because everyone sees it coming, it won't happen. That's what they said in 2019 as well. Watch repo rates. If they spike on Monday… and problems pick up into Third Friday, don’t be shocked if the Fed intervenes again. That subject could dominate the FOMC meeting this week… And, as always, we’ll see more printing, more debasement, more inflation down the road. The cycle continues until something actually breaks… But here’s what you need to know about dip buying… Because it’s leading to more insane recoveries and wins for the insiders… S&P 500 Up 31% in 5 MonthsEveryone’s an investing genius when a chart looks like this… The move, following the cancellation of Liberation Day on April 8 (a day after people became experts on the next Great Depression), has given us a jaw-dropping return… Markets added $16.6 trillion in five months. That’s more capital than any country's entire stock market except ours. But it’s not value creation… It’s the nature of the beast. Loose policies (yes… LOOSE) have sucked capital into American markets over the last decade, and investors around the globe are chasing returns… Monetary expansion and global liquidity - combined with policy accommodations (fiscal, monetary, and/or other accomodations)… fuel V-shaped (but really K-shaped) rallies. Insiders loaded up on the bottom on April 8… This was the third-biggest rally in 20 years, and like the others, it followed the same pattern… The Consensus - Cuts Without RecessionWe’re going to avoid economic turmoil, says Goldman Sachs. They expect rate cuts with growth continuing (how can we not grow when we borrow 7% of GDP a year?). But here’s the issue… The economic numbers don’t look that great. And the Fed and Treasury have been manipulating our economic numbers for a solid three years… To prevent natural and healthy recessions, these policies have juiced the markets at the optimal time to avoid two consecutive quarters of negative economic growth. We even changed the definition of a recession at one point to protect bureaucrats… Be cautious - with Leading Indicators are in the Contraction Quad of Econ Pi… This economy might look good with all the government spending and borrowing… but we know what it looks like under the surface - and inflation isn’t going away. Dollar Down 5 of 6 WeeksThe dollar's down 10% this year while everything priced in dollars hits "records." That's not a coincidence, it's math. When your measuring stick shrinks, everything measured looks bigger. The world's reserve currency is in freefalL… But THE MARKET IS UP… SO YOLO!!! We need to call it what it is… debasement. Remember - the dollar didn’t go up in April during the selloff… which is rather stunning… That means the Reserve Currency isn’t doing what it should. It also means we’re not getting richer… we’re getting diluted. Gold's Record RunGold broke out from a two-year consolidation and hasn't looked back. Central banks' annual purchases of 950 tons tell you everything… They're dumping paper on the people… and buying rocks. Next stop $4,000, and it won't stop there. Meanwhile, Silver's 14-Year HighSilver just hit $42, its highest level since 2011. It's both a monetary metal and an industrial commodity, which doubles its benefit from inflation and green energy delusion. It’s more volatile than gold, but it has the same underlying drivers. When silver runs, it runs violently. If you missed gold at $2,100, this is your second chance at the debasement trade. 911K Jobs Revised AwayLet’s go back to the jobs report… They erased 911,000 jobs, the worst revision since 2009. That's 1.7 million phantom jobs in two years. This isn't an error; it's systematic lying. This is Soviet level nonsense… Powell buried the jobs revision warning in a Jackson Hole footnote: "payrolls will be revised down materially…" He knew 911,000 jobs were fake while markets rallied on false data. It's not incompetence, it's complicity in the lie. They pump fake numbers for headlines, then quietly confess months later when nobody's watching. Every year since 2019 (sans 2022) has shown massive downward revisions. That's statistically impossible unless the methodology is broken or intentionally rigged. They overstate to maintain narrative, then revise when it doesn't matter. The labor market's been weak for years; they just stopped hiding it. Auto Loan Delinquencies 14-Year HighProbably nothing, right? Auto loans are defaulting at the highest rate since 2011. People can't afford their cars at 10% rates. This is your "strong consumer…” The one who misses payments on depreciating assets that they need to get to work at a 10% loan rate... When transportation loans fail, the economy's in trouble… What’s worse? The people reporting on it want… THE GOVERNMENT TO FIX IT… S&P 500 Concentration ExtremeAll the while, stocks with 3%+ weighting now control 35% of S&P 500… That figure is the highest ever. Five companies ARE the market. This isn't capitalism, it's central planning via passive indexing. One stumble from any giant and the whole index collapses. One liquidity scare, and we’re looking at a March 2020, August 2024, or April 2025 event again. And Finally… Your Top Performing Asset Is?What’s been the real opportunity over the last two decades? It’s not the AI trade… and it’s not Build-A-Bear… Pokemon cards are up 3,821% since 2004. That figure outperforms the S&P 500's 483%. And hooray for baseball cards… When collectibles beat productive assets, you're not investing, you're fleeing currency. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Yeah, I'll Chart Party..."

Post a Comment