You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler: My wife has a very simple way of pointing out the things I’m doing that are quietly driving her nuts. She’ll walk past wherever I’m writing… and say… “We need to get better at…”

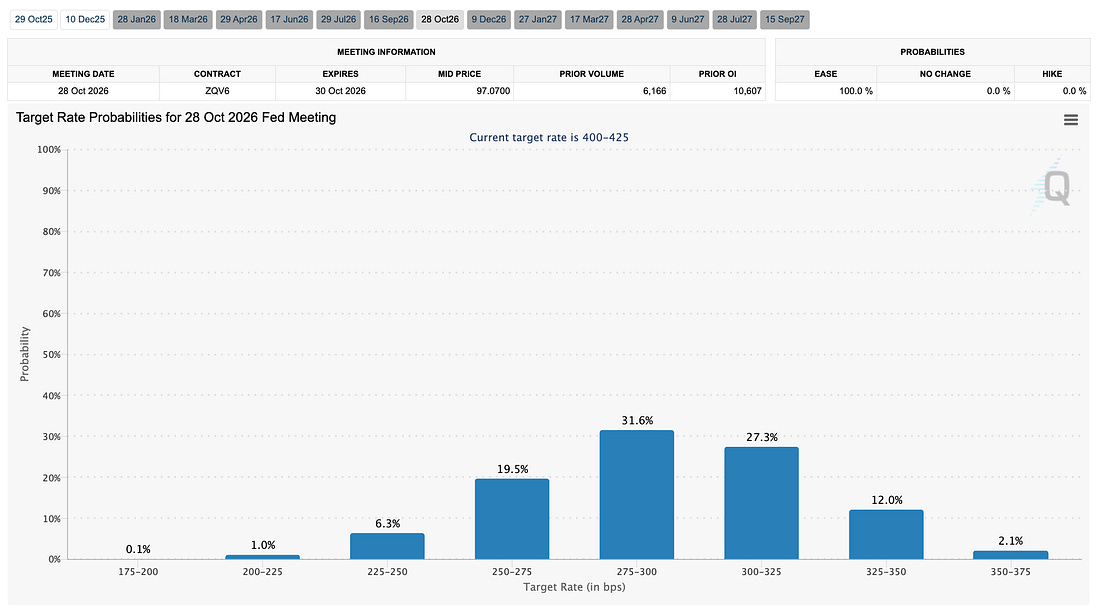

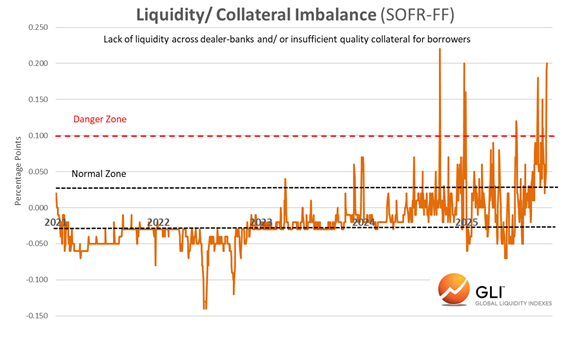

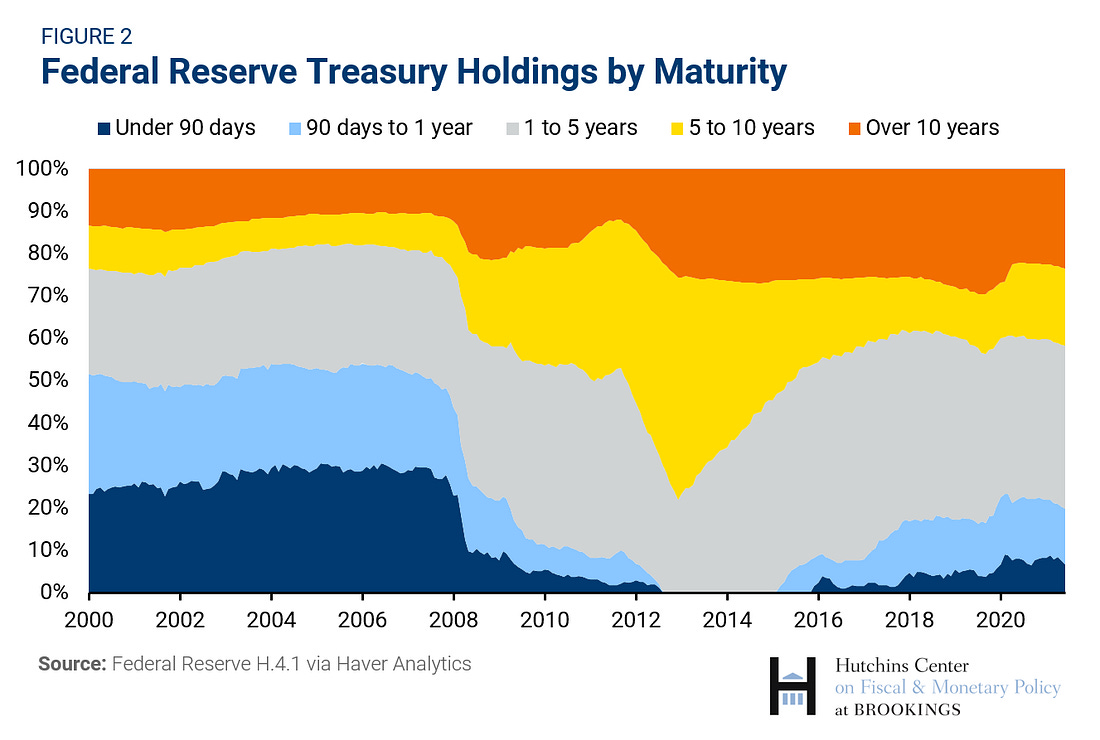

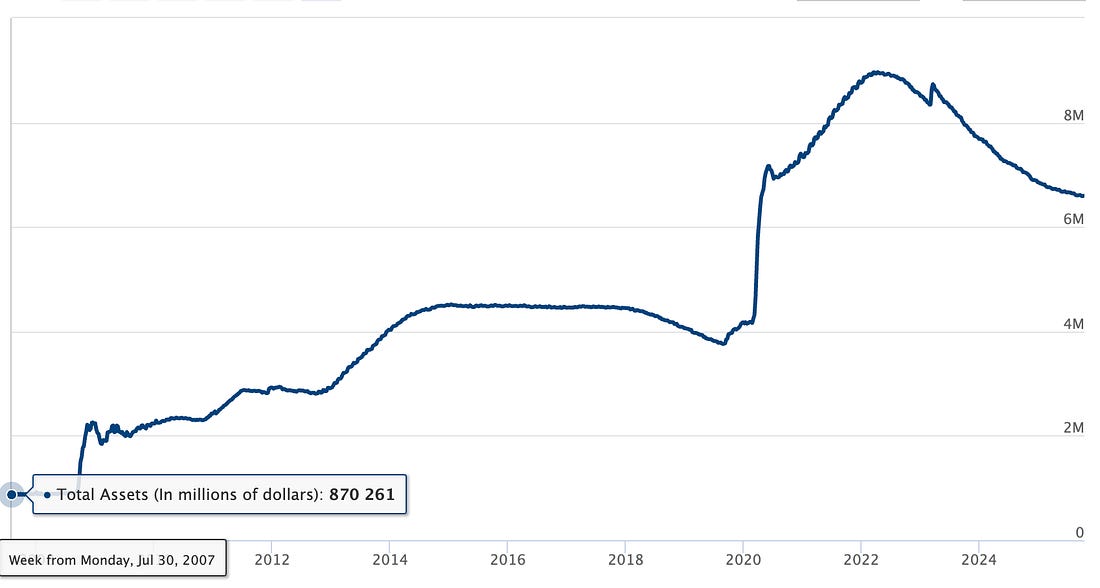

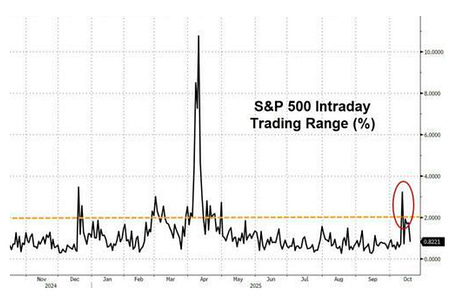

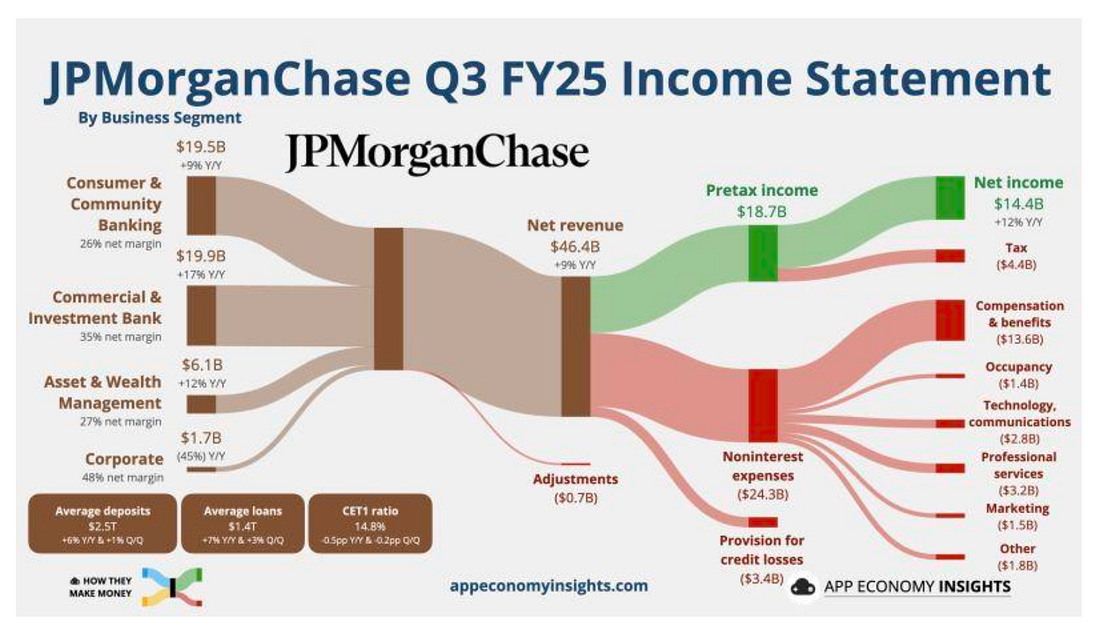

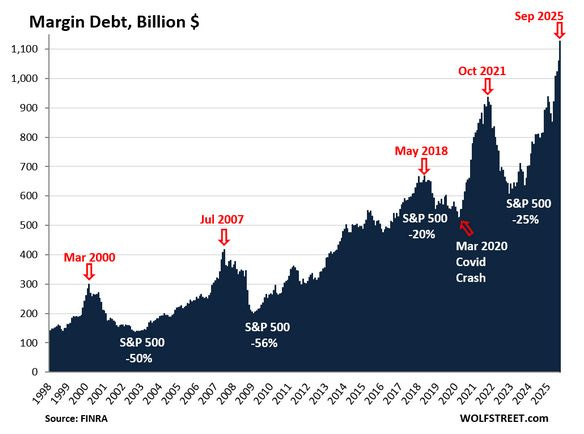

Okay… I made up the last one (with a nod to a Conan O’Brien joke…) We is a Royal We… as it really means… “You…” You need to get better at… But the collective approach isn’t as direct… or stabby… It’s her commitment to the process… to taking partial blame in the process… even though she doesn’t need to. I am 100% sure that she - as a Kindergarten teacher - uses this same approach with the kids in her class. “We need to stop breaking crayons…” And the kid nods… but the kid will certainly be watching into perpetuity into whether she breaks the crayon so he can say… “We need to get better at not breaking crayons.” Which begs the question… How long has my wife been using early education behavioral techniques on me… and to what level? Meanwhile…My wife and daughter fell asleep early last night, which put me into full chart mode. I’m not much of a college football fan, and there was no baseball on television. The New York Rangers played earlier and won (but consistently break my heart…) So, I turned on John Candy: I Like Me (a documentary by Colin Hanks, son of Candy’s co-star Tom in Splash.) I’ll tell you now, you must watch this documentary. Not just because it’s a star-studded cast of brilliant comedians and actors like Conan O’Brien, Katherine O'Hara, Dave Thomas, Martin Short (my favorite entertainer ever), and Eugene Levy… Or for the incredible moment of Maculley Culkin talking about how Candy treated him with respect as a kid when his own parents did not… But because when you watch this film… and hear the praise of the man… you’re going to want to live a better life. It is a calling… an absolute beacon of hope and friendship and honesty and perfection in a world so full of cynicism. It was incredibly moving. If you shut your computer now and didn’t read the rest of this column - and instead went and watched this documentary… I wouldn’t be upset. It is the perfect story at the perfect time. But if not… proceed with caution… The evening became a chart party… Chart PartyFor those who don’t know - here’s the basic breakdown of a Chart Party… One man enters… that man leaves. He goes and gets two large cans of Modelo while everyone is asleep… He returns and reenters the arena. He then has to analyze charts until either he’s exhausted or the Modelos are gone… Let’s get started… Chart 1: QE Soon? Or Just Rate Cut Madness…My subject line is pretty simple… Is a 50-basis-point cut in the cards this month for the Federal Reserve? The Fed Funds rate now sits between 4.0% and 4.25% - and there are WILD expectations on where markets believe the Fed funds rate will be come NEXT October… But when it comes to this month… with no clear insight into inflation… new Fed Governor Stephen Miran and Trump ally is pushing for a big cut now… and a total of 75 basis points by December… (One basis point equals 0.01%.) Miran was outvoted 11-1 on a 50-point cut in September. Believe it or not… I think that this week’s problems in the regional banking sector FIRMLY justify the size of the cut. The reality is that we are going to cut by 50 basis points come December. What the hell does it matter if they do it now or in 45 days? They think that inflation is suddenly going to move up quickly because of an additional 25 basis points? That’s not what is driving inflation. The massive government deficit is… the money printing is… the leverage is… Cutting 50 points this month would point to the obvious. The Fed is behind the curve - and has been so consistently for so long as I can remember. A 50-point cut would be an admission of defeat. It would become political. It would be a reminder that our jobs data was cartoonishly off for years… and that people are really struggling… So… they probably won’t do it. But they should. Rip the Band-Aid. That’s competence. But we don’t have competence. Regional banks, private credit, and alternatives are taking a bath right now. We’re one more bad, crazy event away from a panic in the overnight lending markets… As I’ve noted… the Fed Funds rate isn’t what matters in a world of leverage, liquidity, and crowding. The Secured Overnight Financing Rate (SOFR) is… and when it gets detached from the Fed Funds rate… problems start. This chart from Michael Howell showcases that we are in the danger zone… Refinancing risks are a problem… And when we are in the danger zone… that’s when all the banks that have significant exposure to volatility need to reassess their risk management… These problems lead to a moment like this somewhere in Manhattan or Tokyo.  Chart 2: This is Insane…Here’s a chart from Brookings that makes me wish I’d bought more Modelos. It’s the holdings of the Federal Reserve by maturity. As in… the bonds that the Fed purchases… when do they mature (effectively… when can they roll off the balance sheet…) You’ll notice that the Fed is holding more long-duration bonds - over 10 years… a clear sign that it’s incredibly hard to get people to own this debt. So… they printed money… then bought long-term bonds out past 10 years… this is money printing… But what bugs me… really bugs me… is the Fed’s ownership of SHORT-duration - everything from under 90 days up to a year. They’re trying to keep the front-end of the yield curve - rates on things under a year - lower. This is Fiscal Repression - even though we are STILL pushing all the stablecoin companies to hold more and more U.S. short-term debt. Now, you might look at this chart and say - Well, the percentages of these holdings are way different compared to pre-2008. Don’t look at that. The Fed’s balance sheet before 2008 was very limited… They use “millions” in the chart… to fool you… These figures are in the trillions. Today, the Fed Balance sheet is $6.6 trillion… and it’s going to have to rise over the long term… because our debt is unmanageable… They are working overtime to contain BOTH ends of the yield curve… short duration AND long duration… And - as I’ll argue - they’re GOING TO HAVE TO DO MORE QE. I expect that the Fed’s balance sheet will roar to $10 trillion by 2030. The funny thing about it? That’s bullish as hell for equities. Get ready to BRRR… Chart 3: Volatility WakensI’ve been worried about the markets for the last couple of weeks. And it’s when our signal turns negative that we start to see these intraday ranges pick up. We just had our first 2% day since April… The thing that matters here is that we’ve had more 2% days up and down this year than we had in 2023 and 2024 combined. That’s because of the ever-increasing increase in global liquidity (capital). Next year, Michael Howell and CrossBorder Capital predict that the liquidity cycle will peak. And then? Get ready for fireworks… Chart 4: The Only Bank to OwnI’m not a guy who spends a lot of time in the banking sector… That’s reserved for my father-in-law, who has a great strategy to take advantage of banking M&A. So… I own one bank… and one bank only. JPMorgan (JPM)… And why not? It’s literally the backstop of the financial system. Every time there’s a problem in a regional bank, the Fed sells it to them for the price of a hot dog. Yes, it will go up and down - but it’s largely a reflection of global liquidity conditions. The stock front-runs credit expectations… so - yeah… still long. If I were more cynical, I’d just tell you that there will come a day that you’ll have six banking options for your accounts - and JPM will be the top choice… I’m half joking. Probably… Chart 5: The Leverage GameFinally… this is the leverage in the system… over the years… ongoing increases in liquidity (capital in the system) popped to new highs - and when the cycle stopped… the markets got beaten up. We have been on a straight move up since the late 2022 period when the GILT Crisis happened and the Treasury Department got more aggressive with short-term debt issuance… Yes… There will be another period where we see markets come back down… and it will accompany a few things… the drainage of excess liquidity… which we track… A series of momentum swings into negative territory… which we track… And ultimately… a period where the Federal Reserve and policymakers end up crying uncle… injecting capital back into the system… and keeping the game going. In other words: The money printer rides again… Stay positive… Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "A 50 Basis Point Cut in October? And Charts Galore..."

Post a Comment