Complacency Is Rearing Its Head Again By Larry Benedict, editor, Trading With Larry Benedict Two weeks ago, investors suffered their first real fright since stocks tanked back in April. The October 10 sell-off hit due to Donald Trump’s threats to impose an additional 100% tariff on Chinese goods. The S&P 500 lost around 2.7% on the day. An uncomfortable drop, for sure. Folks started to panic and kept my phone ringing all day. Yet compare that sell-off to the recent fall in gold. At one point, it was down around 8.5% in just two days. But while I’m not necessarily seeing a similar move for stocks soon, people are getting way too complacent… again. Investors could be in for a rude shock if something unexpected sweeps through the markets… Volatility Collapses Again The 2.7% fall in the S&P coincided with volatility breaking out of its lackluster pattern. The CBOE Volatility Index (VIX) rallied from around 16.2 to 22.4 – a 37% rise. And just a week later (October 17), the VIX opened up around 28.4 and was on track to break up through 29 – its highest level in six months. Yet it all reversed just as sharply when President Trump reassured markets that a deal with China wasn’t far away and that soon everything “would be fine.” That sent the VIX tracking back around 16. And last Friday, the major indexes were back again, pushing out all-time highs… Apart from hopes for a U.S.-China trade deal, that move came off “positive” inflation news. The month-over-month Consumer Price Index (CPI) inflation print came in at 0.3% (0.1% below forecasts). Yet year-over-year CPI is tracking at 3%. So it’s still a long way to the Fed’s 2% target and well above the 2.3% back in April. Clearly, inflation’s fall from its June 2022 peak (at 9.1%) has stopped and looks to be trending higher. And that’s not good for the economy or markets longer term…

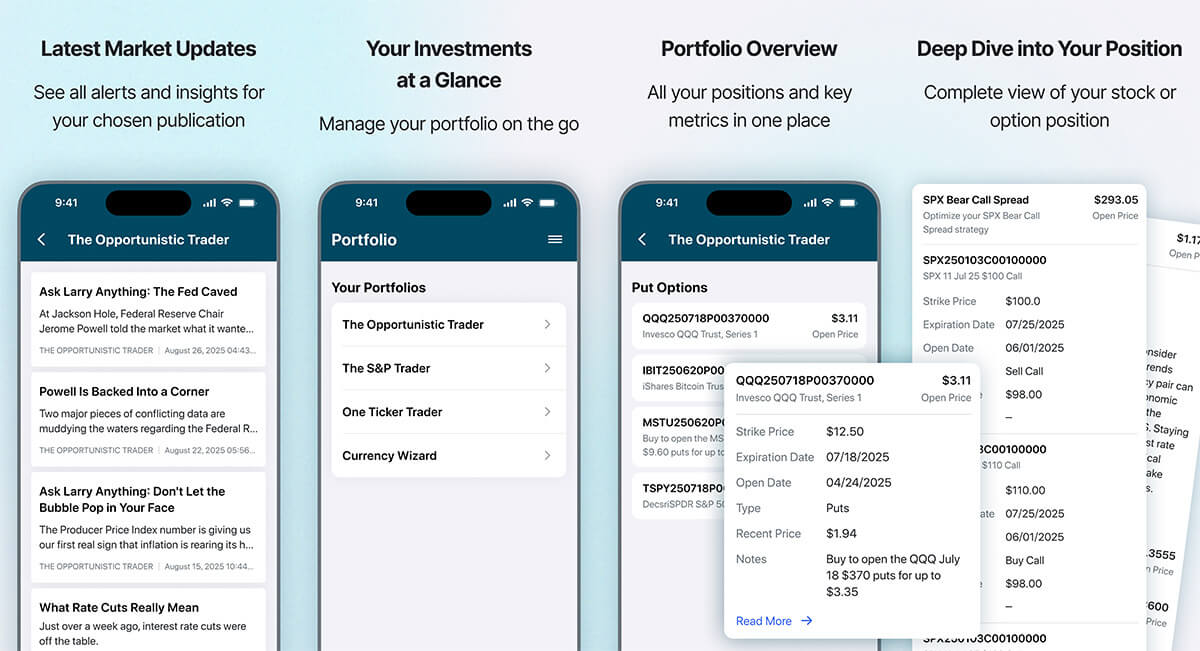

NEW! Instant Trade Alerts Download the NEW Opportunistic Trader app for one-tap access to trade alerts, issues, and model portfolios for all of Larry's services. The old app will no longer be accessible as of November 1. Click the icon below from your mobile device to download it today!

| A Truce? Positive sentiment about a potential breakthrough between China and the U.S. buoyed markets. And there has been much talk about “constructive” discussions and “promising” progress. There’s an agreed-upon “framework” from which Trump and Xi and their respective teams can thrash out a suitable deal. But even if a deal has been agreed on, there is no guarantee that it will come into fruition. Despite how some might spin it, a proper deal can’t be negotiated in just a matter of days. So even if Trump and Xi can agree to something – access to rare earths and critical minerals in exchange for software or selling more agricultural products, for example – it could evaporate into thin air. Recall that at China’s recent conclave (where it maps out its five-year plan), the Chinese government reiterated its desire to dominate science and tech – in particular, AI. Whatever’s agreed, that could put a cap on rare earths and critical minerals… and reignite the trade wars… So, despite the reawakening of the bulls, you need to remain vigilant. Don’t get caught up in the complacency that’s once again setting in. A rate cut later this week is sure to steady the market. However, if the Fed starts to walk back expectations of additional rate cuts, there could be trouble. (Markets are factoring in a 97% chance of a 0.25% cut in December.) And if the touted trade deal between China and the U.S. suddenly falls apart, markets could just as quickly roll over. Overly complacent investors could be in for another shock… but we’ll work hard to ensure we’re not in the same boat. Choppier markets have the potential to hand us some of our best gains of the year. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict Get Instant Trade Alerts on Mobile!

Click the icon below from your mobile device to download The Opportunistic Trader app today for one-tap access to trade alerts, issues, and model portfolios for all of Larry's services.

Available in the app store on Android and iPhone. | |

0 Response to "Complacency Is Rearing Its Head Again"

Post a Comment