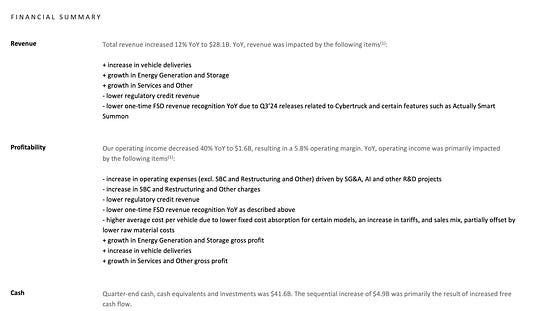

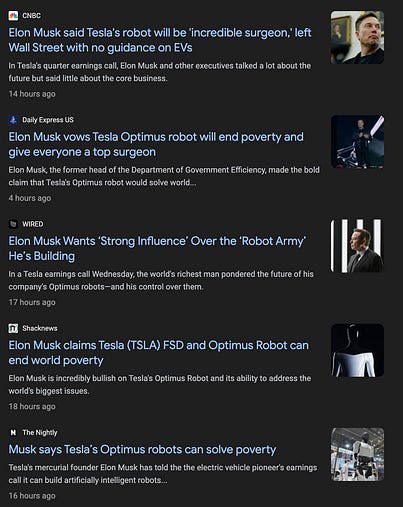

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Dear Fellow Traveler, Earnings season… I don’t like it… the same way that Garfield hates Mondays… You see… this is a few solid weeks of people failing to look under the hood… Need proof? The media offered yet another masterclass in how to completely miss the story while chasing clicks and access to the world’s wealthiest people. After the bell, Tesla reported a scary decline in operating margins. Operating margin sank from 10.8% to 5.8%… all while Tesla achieved record deliveries. Operating income collapsed 40% despite revenue growth. The company depleted its inventory, hit record delivery numbers, and did so all while burning cash on speculative projects. That should be the headline for investors and analysts. What did CNBC lead with? “Musk says robots will be incredible surgeons.” A Puff Piece PlaybookCNBC delivered an 800+ word piece about Musk’s robotaxi promises, surgical robots, and “world without poverty” fantasies while burying the actual profit compression in throwaway lines. The author mentioned that earnings “missed estimates” without explaining that operating expenses exploded 50% while margins collapsed by half. The article says the stock fell 4%, but it spent more time on Musk’s trillion-dollar pay package drama than on the fundamental challenges. This is financial journalism in 2025: It was a press release with a byline. Here’s the Media Focus on the Last 24 Hours…

Here’s the Buried Reality:

Now… that’s what I picked up from just the investor presentation… What happens if we read the filings with the SEC? Something called… secondary source analysis in basic journalism. What Else Did They Miss - From the 10-Q?While reporters chased robot surgery soundbites, here’s what was buried in the actual filing that people should be reading:

The 10-Q Nobody ReadWhile reporters live-tweeted Musk’s robot surgeon comments, the actual filing revealed a company in trouble. Tesla is burning money on AI infrastructure (81,000 H100 GPUs worth $2 to $3 billion) while their core business deteriorates. The company briefly addressed EV affordability with new Model 3 and Y pricing after the tax credit expiration and mentioned Cybertruck capacity targets. But these got buried under robot surgery fantasies in most coverage. The media loves Tesla “reboot” stories because they generate engagement. Robots! Surgery! Ending poverty! It’s more exciting than explaining why a company selling record vehicles is making less money than ever. But this isn’t a reboot. It’s an ugly business period disguised as innovation. When your CEO spends earnings calls discussing robot armies instead of explaining a 40% profit decline, that’s not visionary leadership. That’s distraction on an industrial scale. Why This Matters Beyond TeslaThis stuff represents everything wrong with modern financial journalism… It’s a constant focus on access over accuracy: Reporters prioritize maintaining relationships with management over asking hard questions about the numbers. It’s a constant story of narrative over numbers. The reality is that future promises get more coverage than present reality because stories about robot surgeons drive more clicks than operating margin analysis. It’s always a headline race to the bottom. You see, getting the first headline matters more than reading the actual filing and understanding what the numbers mean. Tesla achieved their best delivery quarter ever and their worst profitability in years simultaneously. That’s not a story about innovation or market leadership… It’s a story about management trying to distract everyone from what’s happening. The financial press largely missed this because they were too busy transcribing Musk’s robot fantasies, actually, to read the financial statements. They treated an earnings call like a product launch instead of a financial accountability session. Tesla’s margins compressed by 501 basis points while the media wrote about ending world poverty through robots. Operating expenses exploded 50% while reporters focused on proxy-advisor drama. Production declined while deliveries increased, and most coverage missed the inventory depletion story. When the next crisis hits, remember that the people responsible for warning you were too busy chasing robot surgery soundbites to notice the fundamentals falling apart. Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Financial Media is Bad at Finance: Evidence 3435-B"

Post a Comment