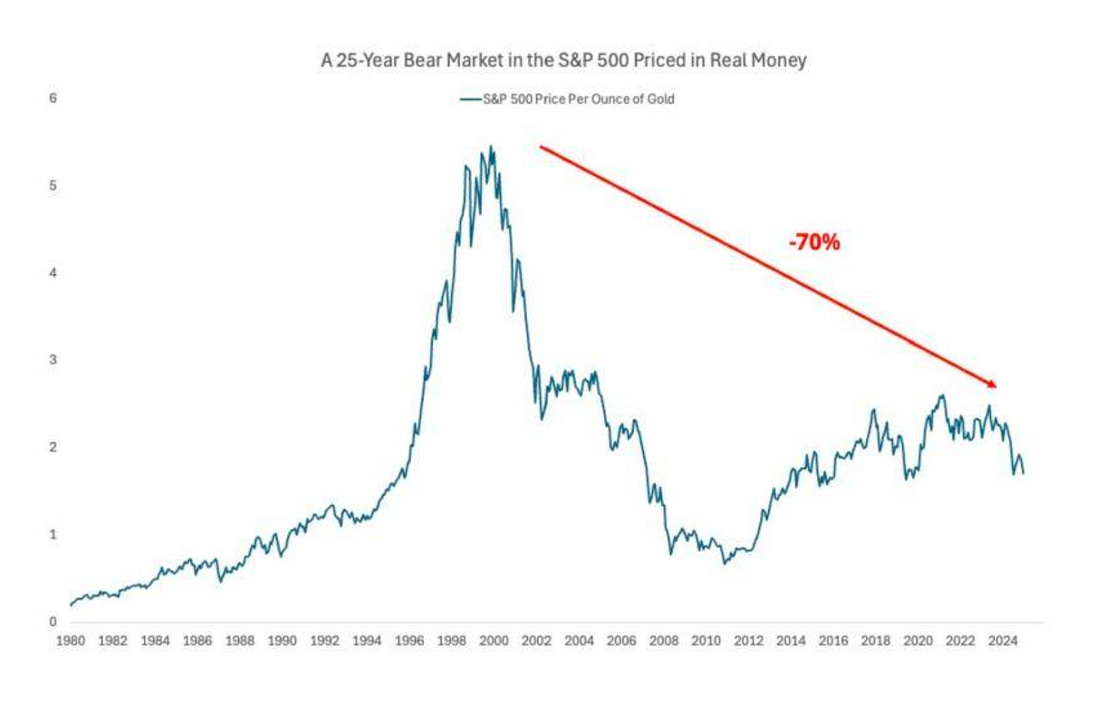

You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Editor’s Note: This is high-level analysis from my couch at 6:45 AM on a Saturday. I’m not defending a graduate thesis or getting into specific presidential decisions. This is a 30,000-foot view for anyone trying to understand what the hell is happening between America and China. There might be some omissions, but they don’t change the trajectory. I’m giving you the big picture patterns that led us here. Dear Fellow Traveler, The headlines sound like economic warfare… Reuters: “China expands rare earths restrictions, targets defense and chips users” New York Times: “Trump says he’ll impose new 100% tariff on China ‘over and above’ current rates, massively escalating trade war” But somewhere in Beijing, a Chinese official is probably thinking… “Took you long enough to notice.” The Capital Wars between the United States and China have now shifted into a new phase… one that could not just drag the U.S. markets lower, and also drastically impact our national security and economic stability… The U.S. response to this @#$% show for now? Headlines like this… Oh… Now’s the time? After Friday’s selloff? [Sidenote: If that’s the case… when, why the hell was Jim Cramer recommending DraftKings (DKNG), a speculative stock with little earnings, last Friday? Thanks, bud.] Let’s step back on China and the United States… This blowup didn’t start last week or last decade. Historical disasters brew for years through accumulating pressures that seem manageable until they suddenly aren’t. Small policy decisions compound over time into existential threats, like the 2008 crisis that began with reasonable 1980s deregulation decisions, or how World War I started with decades of accumulated tensions that one assassination finally triggered. This is the story of how America chose finance while China chose steel… And why that difference now threatens everything. The Fork in the Road: 2008Yes, a lot happened before 2008. In 2006, China announced absolute state control of seven industries (two months after the U.S. midterm elections). They were shipping armaments, power generation/distribution, oil and chemicals, telecommunications, coal, and aviation. You know… tangible assets. This would set the tone for what came next… After the 2008 Great Financial Crisis, both countries had to choose their economic futures. It was like a fork in the road, except the American path led to a casino and the Chinese path led to a steel mill. When Lehman Brothers collapsed, America’s response was swift.. The government chose to reflate the financial system at any cost. That’s been the pattern ever since. The Federal Reserve slashed rates to zero and pumped trillions into markets through quantitative easing (QE). It worked brilliantly for Wall Street. Everyone else? Well… The S&P 500 tripled from its 2009 lows. But money flowed into financial assets instead of productive investments. It’s a reminder that incentives matter… Companies found it cheaper to buy back stock than build factories. Entrepreneurs focused on apps instead of steel. Investors put money into triple-leveraged ETFs instead of a new factory that might create jobs and generate a steady 8% annual return… America became incredibly good at moving money around while becoming dependent on other countries for manufacturing goods. We maintained leadership in technology and high-end services, but our production capacity steadily eroded. We mastered getting rich by shuffling paper around… while forgetting how to make the paper. By 2020, the U.S. economy leaned heavily on services and finance, with manufacturing accounting for around 10% to 11% GDP, while the broader FIRE (Finance, Insurance, Real Estate) category was near 20 percent. We’ve endured, for 17 years since the crisis, complete financialization. We saw “wealth” grow through financial engineering rather than producing goods people actually need. And even then, it’s all largely been a mirage… An illusion… thanks to currency debasement in the process. On a ratio basis, the S&P 500 has given back a large chunk of its 2000 outperformance versus gold. The S&P-to-gold ratio is now a fraction of its 2000 peak. Hey Jerome Powell… take a lap, bud. China’s Choice: The Materials PathChina looked at 2008 and drew opposite conclusions. While America was making money from money, China doubled down on its industrial policies. Beijing launched massive infrastructure projects and systematically targeted industries it wanted to dominate. The “Made in China 2025” plan wasn’t subtle… The goal was to control 70% of advanced materials markets, dominate renewable energy, lead in AI and robotics, and secure semiconductor supply chains. State banks provided cheap loans. The government offered subsidies and guaranteed purchases. Local officials were rewarded for industrial targets, not stock performance. While America mastered moving money, China mastered moving materials. It turns out you can’t eat a derivative or drive a credit default swap… China’s strategy was part of something bigger… U.S. policymakers have been fighting over power for three decades with a bloodlust, missing the broader picture and how quickly the world has changed in less than two decades. Since 2008, the BRICS nations (Brazil, Russia, India, China, and South Africa) have increased control over raw materials that make civilization possible. While America celebrated the “knowledge economy,” these countries procured everything you need to actually live: BRICS countries hold critical positions in materials that make modern life possible. South Africa and Russia dominate platinum-group metals, Brazil is a giant in iron ore and agriculture, and China controls most rare-earth processing and a large share of battery inputs. India has significant mineral potential and is expanding its reserves through international partnerships and domestic exploration. Some of these places are politically unstable… but they still have the resources… Combined, BRICS controls physical inputs for everything from smartphones to fighter jets. China’s Systematic Industrial Takeover: The BlueprintChina’s dominance didn’t happen by accident. They followed a methodical pattern, and American policymakers spent infinitely more time on wealth transfers and subsidies... Take shipbuilding… seemingly boring but strategically crucial. It’s utterly impossible to build ships in the United States anymore. That’s been an issue for decades. By the 1990s, South Korea and Japan dominated global shipbuilding. China was building mostly dinghies. But Beijing identified shipbuilding as strategic. They knew that ships carry 90% of global trade, require advanced steel and engineering, and create spillover benefits. China’s approach was patient. State banks provided cheap loans, and the government guaranteed orders from state-owned shipping companies. Foreign builders had to transfer technology for market access, while local governments provided subsidized infrastructure. By 2020, China was building 40% of global shipping capacity while former competitors wondered what the hell happened. China delivered roughly 53% of global shipyard output in 2024 and controls a majority of the orderbook. It was like watching your quiet neighbor gradually take over the entire block while you were day-trading. This exact playbook was applied systematically across many industries… China today controls:

Each industry followed the same pattern. They identified strategic importance, flooded the sector with state capital, undercut competitors, dominated the market, and controlled entire supply chains. So basically… Amazon… but at the sovereign level… And Now Raw MaterialsNow… why is the rare earth story so important? China doesn’t just mine rare earths… They built the entire ecosystem around them. Raw neodymium from Africa gets processed in China into magnets, assembled into motors, and installed in wind turbines. China exports globally. This vertical integration means even countries with mineral deposits depend on Chinese processing. You might own the mine, but China controls everything from raw ore to finished products. It’s like owning a cow but having to send the milk to China to get cheese. America’s financial dominance worked for decades because everyone had to play by U.S. rules. Need oil? Use dollars. Want capital markets? Come to Wall Street. It was like being the only casino in town. But 2008 and 2020 exposed the risks. When American banks froze, credit dried up everywhere. When the Fed printed trillions, commodity prices spiked globally. Countries realized dependence on American financial systems meant their economies could be destroyed by American mistakes they couldn’t control. BRICS nations started asking… Why should we depend on a system that prioritizes America’s needs? They began trading in their own currencies, created alternative development banks, and launched the Belt and Road Initiative. These were seeds of a multipolar world where Washington wouldn’t call every shot. The Crisis Warning SignsThe crisis warning signs were everywhere, but seemed manageable individually:

When a Trade War Became a Tech WarBy 2016, policymakers realized China wasn’t just cheap manufacturing - it was a technological competitor challenging U.S. dominance in semiconductors, AI, renewable energy, and advanced materials. The 2018 tariffs began a new approach, but something significant happened… It shifted from being about trade to being about technological control, like starting an argument about dishes and ending up in a nuclear standoff over who controls the kitchen. America banned semiconductor exports to Chinese companies, pressured allies to exclude Chinese 5G equipment, and restricted AI access. China tightened materials controls, restricted gallium and germanium exports, and stockpiled rare earths. Administrations doubled down with the CHIPS Act and export controls. Trade disputes became technological warfare over industries defining the 21st century. China’s new rare earth export controls represent a significant escalation. These 17 metallic elements make modern technology possible: neodymium for EV motors, europium for LED screens, terbium for lasers, and dysprosium for extreme-heat magnets. China’s new rules resemble the U.S. “foreign direct product” approach in chips, creating a symmetrical escalation where both sides use export controls as strategic weapons. China dominates every processing step. Even rare earths mined elsewhere get shipped to China for refining. It’s like owning all the flour mills in a world full of bakers. The controls potentially extend to any product made anywhere using Chinese materials or processing technology. China could restrict exports of EV components made in Mexico, wind turbines made in Europe, or defense equipment made by allies. That’s what you call a chokepoint. America’s Remaining LeverageAmerica still dominates systems, making the global economy function. This includes:

Trump’s 100% tariff threat also uses America’s $430 billion import market as leverage. But tariffs are blunt instruments that raise consumer costs while accelerating China’s search for alternative markets. Mexico passed China as America’s top goods supplier in 2023, which shows the supply-chain rethink is real, but China's exposure remains large. The Real Stakes: Control of the FutureThis is about technological dominance in industries defining the next century… The big investments and big trends… they’re all on the table. They include:

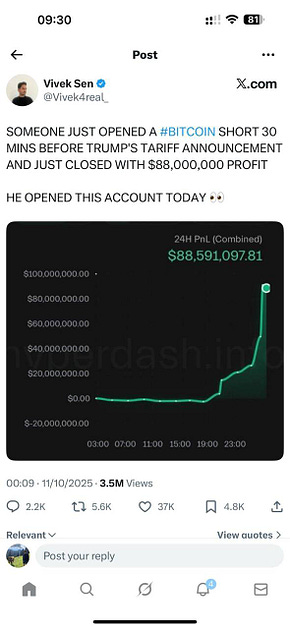

Meanwhile, the Chinese leadership needs export growth for employment and stability, but also faces domestic pressure to show strength against American pressure. Failure to achieve could put pressure on the Communist Party. Both sides painted themselves into corners where backing down looks weak. This isn’t just trade disputes - it’s a new global rivalry defined by supply chains and technological standards rather than military bases. America emphasizes innovation, financial markets, and alliance networks. China emphasizes state planning, industrial capacity, and materials control. These are fundamentally incompatible approaches that will determine the next century’s rules. The Money Printer’s RoleAmerica’s financialization was enabled by printing the world’s reserve currency. When you create money everyone needs, you can trade deficits indefinitely, import goods while exporting dollars, and maintain living standards despite declining production. But this only works if everyone accepts your currency. BRICS payment alternatives, commodity currencies, and Bitcoin adoption could end the money printing advantage. China’s resource controls directly challenge dollar dominance. Countries controlling physical materials may have more leverage than those controlling financial systems. The money printer created conditions for this disaster. Easy money encouraged financialization over production, consumption over savings, and financial engineering over industrial capacity. We got drunk on cheap money and forgot how to make things. Seriously… how many people in this nation can even build a birdhouse? What Now…Assuming this spat goes on for a while, Americans will see higher costs for electronics, EVs, and solar panels. There should be expected economic volatility for companies exposed to China. Then, there might be potential manufacturing job creation, but it requires significant training. All the while, people will continue to bet on printed money outcomes, with some clearly having informational advantages over others. Consider this story below, where someone just made $88 million betting against Bitcoin 30 minutes before Trump’s announcement yesterday… It would be awesome if our regulators and our media investigated these stories… but they won’t… I digress… The most serious issue is the national security implications if we remain dependent on Chinese supply chains for critical technologies. This represents decades of accumulated strategic choices reaching a tipping point. America chose finance over manufacturing, and consumption over production. China chose the opposite. The technologies being fought over… AI, clean energy, advanced materials, and quantum computing… will determine which countries prosper for the next century. The money printer won’t save us. You can’t print semiconductors, rare earths, or industrial capacity. These require a patient, systematic building of real economic power, which America abandoned for financial engineering. We need more farms… more food… a complete rethinking of things… in a nation of people who probably don’t want to do the work… or worse… lack the knowledge… Stay positive, Garrett Baldwin About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "How We Got Here: The New Cold War Most Americas Never Saw Coming"

Post a Comment