Knowing When Not to Trade By Larry Benedict, editor, Trading With Larry Benedict Gold brutally reversed off its all-time high… Bitcoin and other cryptos are swinging all over the place… And after a sudden pullback just two weeks ago, stocks are fighting to reclaim their highs. Keeping on top of it all can get daunting. You don’t want to miss out on the action… but when markets behave erratically, it can be difficult to know when to trade… And if you scramble to catch every move, you run the risk of suffering a rapid succession of losses. That’s why knowing when to pass on trades is key to being a successful trader. That’s what I want to look at today… | Recommended Links

"I Predict this Will Be the Biggest IPO of the Decade" Last year alone, this Elon Musk private venture doubled its number of customers. History shows this type of growth could deliver massive, transformational gains big enough to fund an entire retirement. For example, in early 2001, Nvidia reported growth of almost 100% in sales. Had you invested $1,000 in Nvidia at that time, you could have turned that small stake into as much as $750,000. While Jeff Brown can't promise gains this high… If you missed that, click here now to get the details on this NEW Elon opportunity.

Profit from Bitcoin whether it goes UP or DOWN There's a way to make money from Bitcoin… without risking a penny in Bitcoin. It's called "Bitcoin Skimming." With Bitcoin Skimming, you don't have to put a single cent of your hard-earned money in Bitcoin. And the best part? If – or when – Bitcoin crashes, you don't have to worry. You could keep making money. You might make even more. In this free video, hedge fund "Market Wizard" Larry Benedict reveals the full details… Including how you can get started with his simple three-step system right away. Watch Now >>>

| Don’t Overtrade Overtrading was something that I struggled with when I started out in the trading pits of the Chicago Board Options Exchange (CBOE) more than 40 years ago… I was eager to trade every move… or chase trades that had already gotten away. I blew up my trading account multiple times. Of course, the size of your trading account plays a part in determining how many trades you can have open at once. But no matter how much capital you have at hand, some key principles will help determine how active you should be. One of the major issues that some folks have is that they simply don’t know what their strategy is. One day, they act like they’re a longer-term trend trader. The next day, they’re trying to jump on a short-term stock reversal. To be clear, both are genuine (and popular) strategies. But trying to do multiple strategies simultaneously can lead to confusion, frustration, and even mix-ups. You can end up second-guessing yourself at every move. So it’s vital to define your strategy before starting to trade. Inherently, that can help you eliminate some potential trades if they don’t fit the profile of the strategy you’re using. If you’re focusing on short-term reversals, for example, you can ignore longer-term setups. That has been one of my secrets to success…

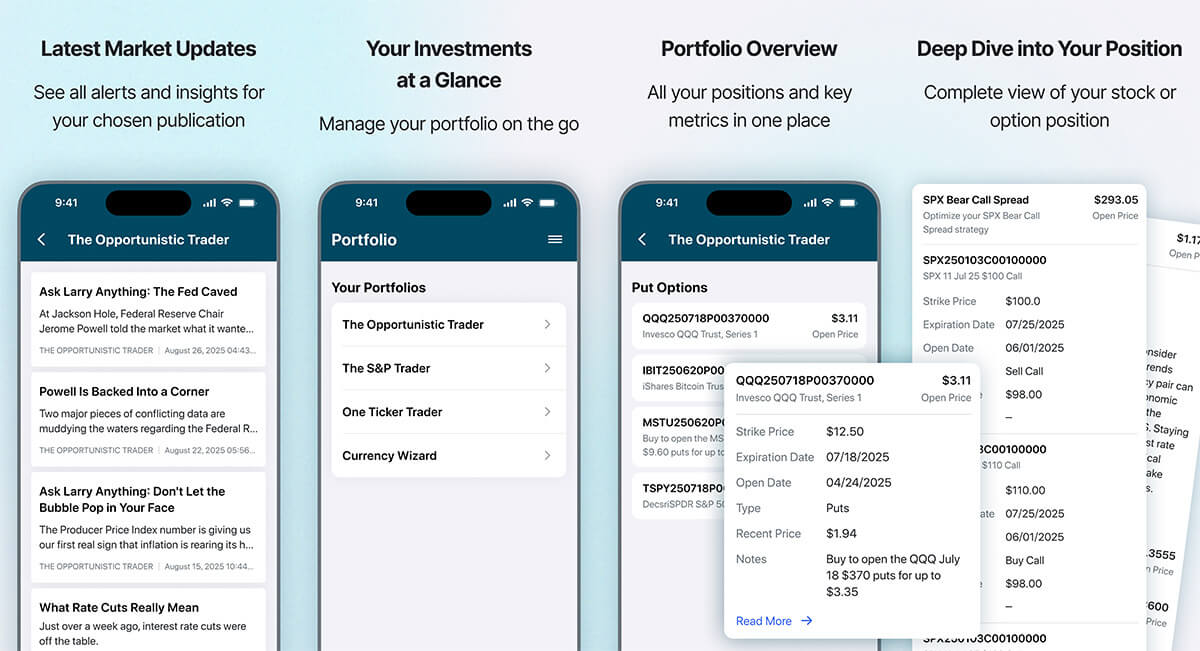

NEW! Instant Trade Alerts Download the NEW Opportunistic Trader app for one-tap access to trade alerts, issues, and model portfolios for all of Larry's services. The old app will no longer be accessible as of November 1. Click the icon below from your mobile device to download it today!

| Be Decisive The strategy that I have used for decades is “mean reversion”… Put simply, I look for stocks or indexes that have overshot in one direction. Overstretched stocks tend to reverse course. I look to profit when they snap back the other way. And because that’s my strategy, I know I can avoid stocks drifting around in “no-man’s land.” That is, stocks that aren’t trending strongly, on the cusp of a major reversal. Instead, I focus on stocks that are trading at extreme overbought or oversold levels and are vulnerable to a reversal. That helps determine the number of potential trades I can do. Market conditions only offer up so many mean reversion trades at a time… That’s more important than how many trades I want to do. And I may restrict my trades even further. I might focus only on the sector seeing the most action… or I might wait until I see several indicators pointing in the right direction rather than just one or two. By being selective, we can preserve our capital for the best, most-promising setups. And we can also pay more attention to the trades we have on with less stress. So rather than feeling like you always need to be active, you need to flip things around… Only enter trades based on your strategy… and focus on finding the best setups that meet your criteria. You don’t have to jump on every possibility you see. That way, the market will determine how often you trade. And that can help alleviate the pressure of feeling like you’ve always got to be active. Happy Trading, Larry Benedict

Editor, Trading With Larry Benedict Get Instant Trade Alerts on Mobile!

Click the icon below from your mobile device to download The Opportunistic Trader app today for one-tap access to trade alerts, issues, and model portfolios for all of Larry's services.

Available in the app store on Android and iPhone. | |

0 Response to "Knowing When Not to Trade"

Post a Comment