Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

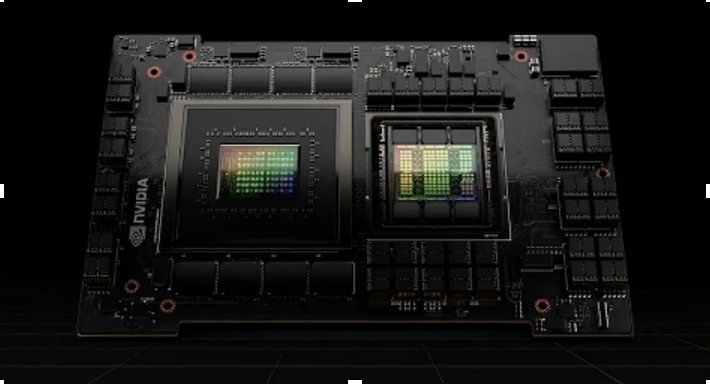

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

Navitas Soars 78% on NVIDIA Update: Is This Rally Sustainable?

Written by Leo Miller. Published 10/21/2025.

Key Points

- Navitas's "NVIDIA bump" has led shares to rise well north of 700% in half a year.

- Shares just gained nearly 80% in one trading week as the company provided more details about its NVIDIA-linked products.

- However, with the company now valued at over $3 billion, what is the outlook on this high-flying name?

Navitas Semiconductor (NASDAQ: NVTS) has been one of the market's hottest stocks thanks to its newly established relationship with NVIDIA (NASDAQ: NVDA).

Navitas's "NVIDIA bump" has been dramatic: shares are up nearly 750% over the past six months. In May, NVIDIA included Navitas on a list of suppliers it would use to reshape power utilization in data centers, causing shares to spike 164% in one day.

Your Bank Account Is No Longer Safe (Ad)

What If Washington Declared That: YOUR Money ISN'T Actually Yours?

Sounds insane, but that's exactly what the Department of Justice just admitted in court—claiming cash isn't legally your property.

What does that mean? It means Washington thinks they can seize, freeze, or drain your accounts—whenever they want.

In mid-October, Navitas got another NVIDIA-induced lift. In the trading week beginning Oct. 13, NVTS stock catapulted another 78% after Navitas released additional details about its NVIDIA tie-up. But is this rally sustainable—or has speculation outrun fundamentals?

Navitas Spikes on Product Update and Manufacturing Readiness

On Oct. 13, Navitas unveiled products it calls "purpose-built" for NVIDIA's 800-volt direct-current (VDC) AI factory architecture. That architecture changes how electricity enters and moves through data centers: by eliminating several power conversions, it reduces energy loss and enables denser deployment of computing power.

To support this architecture, Navitas highlighted a new 100-volt Gallium Nitride (GaN) field-effect transistor (FET) portfolio. The company says these devices deliver "superior efficiency, power density, and thermal performance," all of which matter for NVIDIA's new design. Navitas also announced a key manufacturing partnership with Power Chip, enabling scalable, high-volume production.

That Navitas has developed the product and lined up manufacturing excited investors: it signals tangible progress toward generating revenue from the NVIDIA partnership.

Why Navitas Could Keep Gaining

Looking at past price action helps explain why shares might continue higher.

The stock's initial 164% surge on May 22 pushed the price to $5.05. After a one-day pullback to $4.41, shares never closed below $5.05 again and climbed steadily afterward. By Oct. 10—just before the latest NVIDIA-related announcement—shares reached $8.23, roughly a 63% increase from the May level. Even after a 47% gain on May 27, the stock rose another ~27% through Oct. 10.

That pattern suggests many investors are reluctant to bet against Navitas and its NVIDIA linkage. The persistent demand provides some confidence that the stock could absorb further positive news and move higher following recent developments.

Analysts Caution: NVTS Valuation May Be Getting Stretched

Other indicators, however, suggest caution.

The MarketBeat-tracked consensus price target for Navitas sits at $5.65, implying substantial downside from current levels—around 61% by that measure. Even a bullish $8 target implies significant downside. Wall Street analysts have not widely updated targets since Navitas's Oct. 13 announcement.

That may simply reflect timing: Navitas is still a relatively small $3.1 billion chip stock that might not be a top priority for many analysts. But it could also indicate analysts view the new disclosures as incremental rather than transformational.

Markets already knew Navitas and NVIDIA had a relationship, and the Oct. 13 details were limited in scope. While the announcement confirmed progress and a manufacturing partner, Navitas did not release a production ramp, revenue figures, or sales guidance—milestones investors typically want to see.

For that reason, it's reasonable to question whether the 78% jump was warranted. In the near term, the stock's trajectory may be more likely to pull back than to continue straight up absent clearer commercial milestones.

High Risk, High Reward Ahead

Several signs point to an overbought stock driven more by potential than by current performance. Still, a confirmed relationship with NVIDIA is valuable in today's market and could translate into substantial rewards if Navitas executes.

Navitas is set to report earnings on Nov. 3, which could be the next major catalyst. Investors will watch for guidance tied to the NVIDIA partnership—revenue projections, production timelines, or design-win confirmations. Strong details could lift the stock further; disappointing disclosures could send it sharply lower.

Ultimately, Navitas remains a high-risk, high-reward investment: compelling upside if execution and commercialization materialize, but significant downside if progress proves slower than investors expect.

This email is a paid sponsorship sent on behalf of Paradigm Press, a third-party advertiser of MarketBeat. Why was I sent this message?.

If you have questions or concerns about your subscription, please don't hesitate to email our South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 North Reid Place, Suite 620, Sioux Falls, SD 57103. United States..

0 Response to "Nvidia’s Holy Grail"

Post a Comment