You are a free subscriber to Me and the Money Printer. To upgrade to paid and receive the daily Capital Wave Report - which features our Red-Green market signals, subscribe here. Private Equity Landlords... Ric Flair... Charts... and the Week in Review...Blackstone was my landlord... and they made me pay an arm and a leg to fix their rental up nice for them..Dear Fellow Traveler: We moved to Maryland last year for my job… and we had to move in haste… So, we rented one of the first places we could find and hit the road. In what’s been a mess, we conclude the rental agreement with the following fun… It costs two months’ rent to break the lease… and a laundry list from Blackstone Real Estate (via Tricon Residential) to fix the place up before we leave.

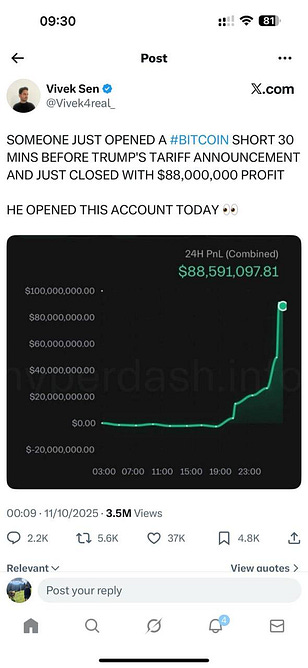

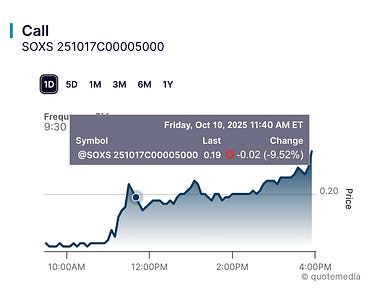

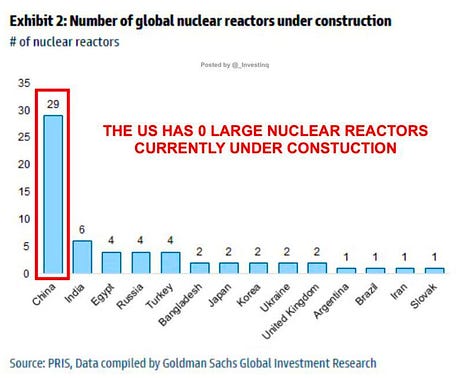

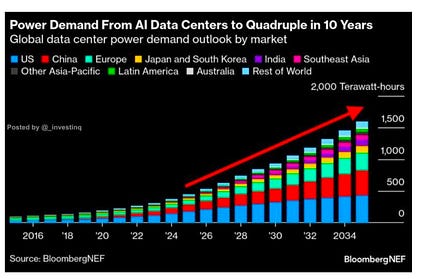

By the time I’m done, I’ll have spent $2,000 in time and money to make their place look fantastic (then hand over two months' rent), on the fingers-crossed hope that they’ll give me my $3,000 security deposit back. I’ll tell you right now… given that I’m finding it harder and harder to trust strangers… I’m not holding out hope. If I break even… as in they only give me $2,000 back… expect the rant of a lifetime… and a possible speaking tour. Now then… speaking of rants… Let’s look at some charts. Chart No. 1: No Coincidences With Trade PolicyIt’s always interesting to look back a few days or a week and start to piece together events as they unwind. We were with Jitters on Wednesday when bets started adding up against Technology stocks - as the sector turned yellow that day. So… money was already moving out on tech… I’d been unusually bearish over the last week - which really isn’t me… I’m not a perma-bull either. I just look at capital in and capital out - and then keep an eye on the momentum readings… Something has felt off since the banking reserves slipped under $3 trillion in the last two weeks… But that’s just boring old Garrett… Here’s where the journalism and the Blue Label kick in… On Friday, someone opened a short Bitcoin account 30 minutes before Trump's announcement and made $88 million, according to various media outlets… Now… I clearly don’t believe in coincidence. Someone had to have known… Just like the April 8 insider purchases and the record TQQQ buys at the time. I’m telling you right now - unusual options, unusual buying, unusual anything related to high beta or anything linked to natural resources is a sign of something coming. There are NO COINCIDENCES in this environment. But again - looking back… Technology stocks turned yellow on Wednesday… Energy flipped on Friday morning… and Devon Energy (DVN) became a prime short target… Devon Energy fell 5% on Friday, immediately after that signal flipped… Eight sectors were negative on Friday at noon… Meanwhile, the SOXS $5 call, which I called a lottery ticket right after our signal flipped Friday around 11:35 am, popped 50% in about four hours. Bet small when the signals flip. We’ll see what happens… But there hasn’t been any bullish news this weekend… And the TASE - the Israeli Stock Market - is up today. I expect that we’ll either pop at the open tomorrow and immediately fade as funds sell back into strength, or we gap down because the narrative builds around trade in premarket. Either way… PLAY DEFENSE NOW. Chart No. 2: We Need EnergyI got an electric bill the other day from BGE. It was for $100. But they wanted to put me on a billing plan that smoothed out expected costs for the coming year… $300 a month… That’s great for their cash flow… but it signaled I can expect $300 to $400 bills in the coming months - for a 2,200 square foot house. What?!? Anyway… this chart tells you everything you need to know about the ongoing AI and capital battles between China and the United States. This tells you what you need to know about financialization, the environmental efforts to shut down the energy we need, and much, much more… What… in the living hell… are we doing? 29 to 0. We aren’t serious… We need electricity NOW. And two more things on this… First… electricity is about to get more expensive… And second… our economy is way too reliant on this stuff that needs electricity… Chart No. 3: An IdeaThis came out of nowhere… didn’t it? The top ETF in the world is now… “VOO.” This is the Vanguard S&P 500 ETF (VOO)… surpassing the O.G. S&P 500 SPDR ETF (SPY) that launched in 1993… with consequences… More passive money… more capital that’s just buying stocks without any concern at all about the underlying fundamentals… just tracking the performance of the S&P… There are now more ETFs in the U.S. than actual stocks… which is insane… I’m going to start trying to embrace this… and launch my own ETFs… that collect 1% or 2% a year. But I want my ETFs to matter… to mean something… So, I’m going to start here… Not thematic… but focused on one person. One person honored in ETF form… And I could only start with one man… And that man is Ric Flair - The Nature Boy ETF… And the ticker? “WOO.” I propose this ETF - please make some calls. It would be pure… Ric Flair… Tickers would include…

This portfolio would be more volatile than crypto but twice as entertaining. The SEC would have questions, but it would be legendary. An annual shareholder meeting would take place at Caesar’s Palace… even though it’s an ETF… just so Ric Flair can start doing monologues in a $5,000 suit… eventually shouting, “To be the ETF, you gotta beat the ETF! WOOOOO!” A man can dream in a sea of other nonsense… The Week In ReviewMonday, October 6: Finally... I Non-Frothy, Non-Insane, Investment Trend... Tuesday, October 7: The Market Myth That’s Fooling Everyone Wednesday, October 8: How to Beat The Great American and Great Ancient Extraction Methods... Thursday, October 9: Hallelujah! The Wall Street Journal Finally Gets It Friday, October 10: Things I Think I Think… Saturday, October 11: How We Got Here: The New Cold War Most Americans Never Saw Coming Paid Subscriber PostsMonday: How To Use Capital Wave Report... And Your Daily Market Commentary Wednesday: Jitters (Capital Wave Report Update) Thursday: An Earnings Season Preview (And The Capital Wave Report for Thursday) Thursday: Late Night Fed Theater (A.K.A. Policy in the Dark...) About Me and the Money Printer Me and the Money Printer is a daily publication covering the financial markets through three critical equations. We track liquidity (money in the financial system), momentum (where money is moving in the system), and insider buying (where Smart Money at companies is moving their money). Combining these elements with a deep understanding of central banking and how the global system works has allowed us to navigate financial cycles and boost our probability of success as investors and traders. This insight is based on roughly 17 years of intensive academic work at four universities, extensive collaboration with market experts, and the joy of trial and error in research. You can take a free look at our worldview and thesis right here. Disclaimer Nothing in this email should be considered personalized financial advice. While we may answer your general customer questions, we are not licensed under securities laws to guide your investment situation. Do not consider any communication between you and Florida Republic employees as financial advice. The communication in this letter is for information and educational purposes unless otherwise strictly worded as a recommendation. Model portfolios are tracked to showcase a variety of academic, fundamental, and technical tools, and insight is provided to help readers gain knowledge and experience. Readers should not trade if they cannot handle a loss and should not trade more than they can afford to lose. There are large amounts of risk in the equity markets. Consider consulting with a professional before making decisions with your money. |

Subscribe to:

Post Comments (Atom)

0 Response to "Private Equity Landlords... Ric Flair... Charts... and the Week in Review..."

Post a Comment